Construction giant Fletcher Building [FBU] might not resume paying dividends till the 2028 financial year, according to calculations by analysts from financial services firm Forsyth Barr.

Fletcher Building stopped paying dividends in 2024 in order to reduce debt levels in the face of a number of problems for the business and a general slowdown in activity. The company lost $227 million in the 2024 financial year and the result for the full year to June 30, 2025 will likely be worse than that, after the company this week, in an investor day update, forecast further writedowns of between $573 million and $781 million.

The company said it would not start paying dividends again till it gets its net debt levels lower, with the target level being between $400 to $900 million.

Forsyth Barr senior analyst Rohan Koreman-Smit and analyst Paul Laxton Koraua said that Fletcher Building's assumed net debt at the end of the 2025 financial year of around $1.05 billion to $1.15 billion "must halve".

"FBU has options: it should start generating cash with legacy projects and major capex nearly complete; excess land will be sold; and non-core assets divested," they said.

"Dividends will not be paid until net debt nears the midpoint of the target—on our modelling (assuming no asset sales) in FY28."

The analysts have dropped their 12-month target share price for Fletcher Building from $3.80 to $3.55 and maintain a 'neutral' rating on the stock. The stock's closing price on the NZX on Wednesday was $2.91.

They said while no asset sales were announced by Fletcher Building this wee, "the Residential and Construction divisions do not align with FBU’s medium-term manufacturing and distribution focus and were conspicuously absent from the update".

The analysts said disappointments from the update included:

- another round of large significant items;

- limited confidence in a near-term NZ recovery; and

- little detail on self-help at the business unit level—"we suspect these are still being finalised".

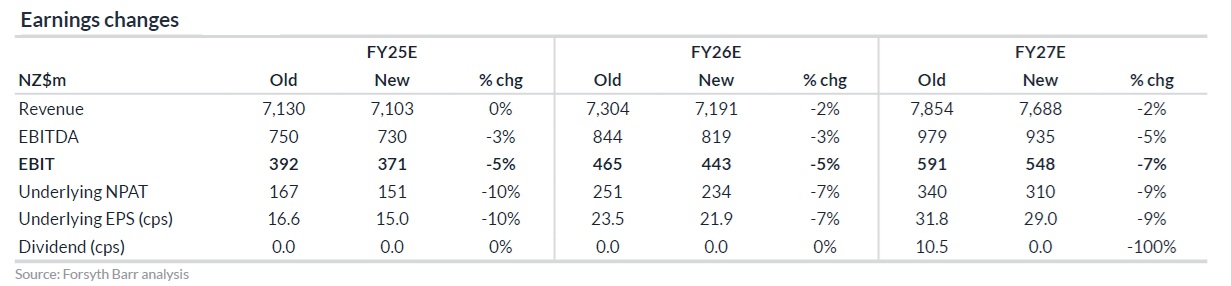

The analysts have trimmed their forecasts for the 2025-2027 financial years by 5%, 5% and 7% "reflecting FY25 guidance and a slower recovery in NZ activity".

2 Comments

Fixed dollar debt level band is a sensible change, rather than a multiple of EBITDA. As seen before, when the EBITDA drops off on the downcycle, the debt/ EBITDA multiples gets out of band very quickly.

Once in band, can management restrain themselves from empire building again however...

Question is then how much does the NZ government and/or its agencies have invested in this company’s shares as obviously a deadweight come inert use of the public purse

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.