Embattled construction giant Fletcher Building [FBU] is signalling yet more significant writedowns, which point toward another substantial loss for the financial year about to end.

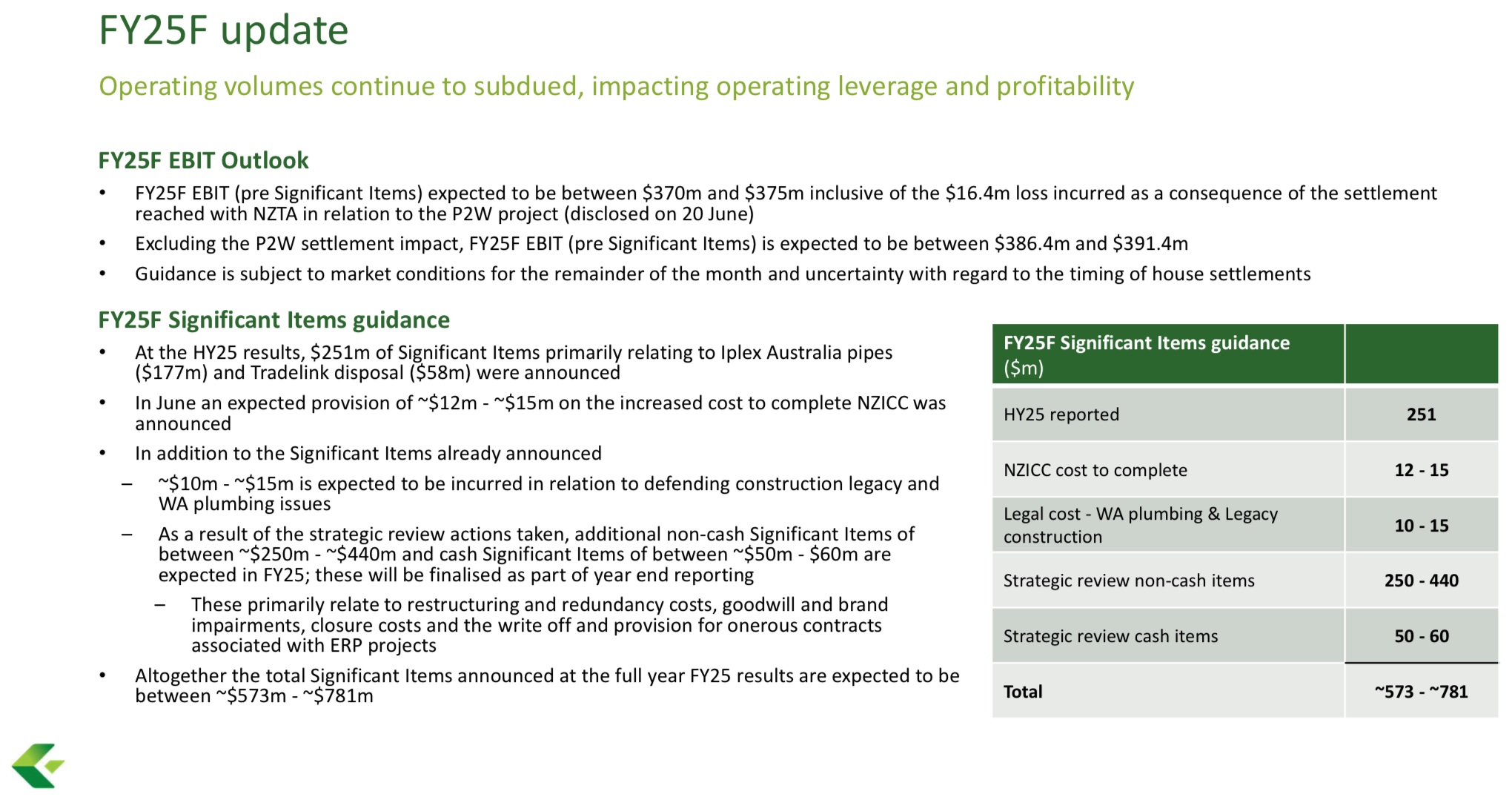

The company says in an investor day update posted to NZX that on top of writedowns of $251 million previously indicated at the half-year result announcement, the company is forecasting further provisions in the second half that will see total 'significant items' for the full year of between $573 million and $781 million.

Whatever the final provisions figure, it will dwarf the expected operating earnings (before interest and tax) of between $370 million to $375 million and suggests the final loss could be larger than the $227 million loss reported last year. The company's not currently paying dividends and won't be in future till it gets its net debt levels lower, with the target level being between $400 to $900 million. At the half-year mark the net debt figure was $1.1 billion and the Investor Day presentation released on Tuesday indicated the nebt debt will be at about the same level on the June 30 end of the 2025 financial year.

By mid-Tuesday the Fletcher Building share price had dropped around 5% after the latest news.

Two weeks ago Fletcher Building told the NZX that, following the announcement of its strategic review, it had "received ongoing inbound inquiries from parties interested in its businesses, including the Construction Division amongst others. The Company advises that no decisions have been made to sell any of its businesses."

There was no update on this statement in the latest investor presentation.

Last year the company had indicated it was seeking partners for its residential development business, but there's been no apparent developments on this either.

For Fletcher Building, the woes have been many over recent years, including the agonising building of Auckland's New Zealand International Convention Centre, where the problems have included, but haven't been limited to, a substantial fire that extensively damaged the building and caused years-long delays. It's due to be finished in the second half of this year. Convention centre operator SkyCity Entertainment Group has instigated legal action action against Fletcher Building, though analysts doubt its chances of success.

There's also been a leaky pipes issue in Western Australia.

In the past year there's been extensive changes to both the board composition and to senior management at the company.

Fletcher Building managing director and CEO Andrew Reding said that in addition to the 'significant Items' already announced, about $10 million to $15 million is expected to be incurred in relation to defending "construction legacy and Western Australia plumbing issues".

"As a result of the strategic review actions taken, additional non-cash significant Items of between ~$250 million and ~$440 millon and cash significant Items of between ~$50 million and ~$60 million are expected in FY25, which will be finalised as part of year end reporting," he said.

"These will primarily relate to restructuring and redundancy costs, goodwill and brand impairments, closure costs and the write off and provision for onerous contracts associated with ERP [software system] projects."

6 Comments

Too big to fail?

Too bigger fish in a too smaller pond. Massive octopus like structure with tentacles gripping and dominating all facets of the building and construction industry accompanied by inborn complacency, arrogance and quite obviously unaccountability. Series of large financial reversals issuing forth is the writing of all of that, on the wall.

Had a mate who was at corporate level there years ago. Said it was a great place originally a family type feel to it. Then the corporate leadership changed to overseas import who proceeded to import his other British compatriots. In his view they destroyed the original kiwi culture and it was all down hill.

Or something like that - was a long time ago we chatted about it.

We had the misfortune of staying at a hotel one night that coincided with some sort of seminar the company was conducting there. That day also coincided with the announcement of the huge loss and notice of Ralph Norris resigning. But as far as the executive in that hotel it was all about free drinks and good times aplenty. Overfilled the bar and couldn’t have given a toss about any other guest. Not a pleasant encounter.

How many unsold apartments and townhouses are they hanging onto for better days? There must be some intersection point where continual holding costs are higher than selling at a loss. perhaps they can't do that sort of calc.

FBU: a instrument of mass shareholder value destruction.

Best we could hope for is a buyout by someone who knows what they're doing and has real buying power (Home Depot??) - and could change the corporate culture of failure.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.