BNZ sees "encouraging signals" businesses are preparing to move beyond survival mode, but says those who want to thrive need to think more strategically.

Brandon Jackson, BNZ's GM Growth Sectors, said a study of six high-growth companies shows they combine operational excellence with more strategic decision-making.

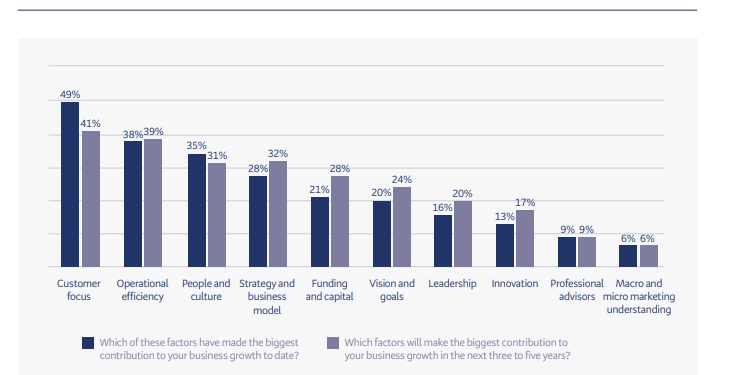

A broader survey, of more than 1,000 businesses across the country, asked respondents which of 10 "growth levers" had contributed most to their success so far, and which they believed would matter most in the next three- to five-years.

Around 10% of those surveyed had turnover of $100,000 to $250,000 and 11% had revenue of $10 million+, with the remainder spread evenly between.

BNZ's first Growth Levers Insight Report shows customer focus was cited as the top critical success factor, at 49%, followed by operational efficiency at 38%.

Jackson says those two were "genuine strengths" that had served companies well through challenging times.

Less encouraging were low ratings for innovation (13%), use of professional advisors (9%), and macro and micro market understanding (6%).

"The fundamentals are strong, but sustaining resilient growth requires broader capabilities," Jackson says.

Many business owners are getting caught up in daily management and firefighting, working 'in' the business instead of 'on' it.

This operational focus might help explain New Zealand's poor record of productivity growth, which has averaged 0.2% a year for the last decade. Owners need to "break free" to focus on strategy, innovation and long-term planning.

"While our businesses may run efficiently by local standards, we're competing globally against companies with access to deeper pools of capital and larger market scale," Jackson says.

"We need to be more strategic about innovation, which increasingly means technology and automation investment, to compete on the global stage."

One of the advantages of a small country like New Zealand is that we can access and share information "with only two or three calls," Jackson says.

Some of the best growth companies he'd seen - including those among the six companies studied for the report - gave high priority to researching markets.

Kiwi companies could also be reluctant to use advisers because they saw them as a cost rather than as an investment.

While "microbusinesses" might get by no more advice than they can get from their accountant, those wanting to scale and grow quickly could find specialists and consultants of all kinds.

"The investment's worth doing."

Jackson says "significant underinvestment" in innovation is a national-level "cultural thing."

Where it takes place, it can take many forms; new business models, breakthrough products, smarter processes, or fresh ways to engage customers.

But what set the six case study businesses apart from the general survey was that they saw it as an important part of their business plan.

The survey shows "funding and capital" moving up as a critical lever from 21% "to date" to 28% over the next 3-5 years.

That's one of the "encouraging signals" BNZ sees that businesses are starting to move out of their survival bunkers.

"It reflects the economy," says Jackson. "As people build plans, it will move up."

"The bigger businesses are thinking about it, the smaller ones less so."

13 Comments

Jackson says "significant underinvestment" in innovation is a national-level "cultural thing."

Wonder if Brandon Jackson includes himself and his employer in this observation. Given that the incentives to innovate barely exist for the majority, it shouldn't come as any surprise. Wonder how he would deal with the accusation that BNZ is part of the problem, not a solution.

Given that the incentives to innovate barely exist for the majority

I'd argue the opposite (for a change), the only way most of us are going to punch above our weight is to be as innovative as possible, because the status quo barely pays.

The point being the status quo is and has paid bloody well for BNZ.

Perhaps even they are aware the status quo is a bit of a dead end.

We're riding on coat tails, thinking we can continue yesterday's approach and have it deliver indefinitely.

I get to integrate with some fairly large corporates. The amount of energy expended by decision makers just to stand still leaves very little room for innovation.

I had a relly recently taken a job with one of the big 4. Shocked by some of the computing done using things that predate their existence on this earth. They're not that young.

Banks need to do a better job of understanding your business vs just asking how much your house is worth. House price bloat within inflation fueling vapor created money has made them lazy.

Strategy is right call though...if you do that right you don't need your bank.

Banks need to do a better job of understanding your business vs just asking how much your house is worth. House price bloat within Flatiron fueling vapor created money has made them lazy.

Well expressed.

Strategy is right call though...if you do that right you don't need your bank.

If we associate innovation with start-ups, banks are rarely involved. When Fonterra develops a new product for food service, the banks don't really have skin in the game, even if they think they do.

The company that uses debt slavery as its business model accuses its customers of poor strategic thinking.

Sounds like a headline for an Onion article - satire to the extreme.

Isn't debt slavery like the apex of strategic thinking?

One could argue debt is simply wool over everyone's eyes, in that if someone promises to pay, we operate society on faith that they will pay it back and (hopefully) do our best to gauge the risk and likelihood of such. On a small local scale this is feasible but given the introduction of layers upon layers of bets (derivatives), we are simply on a merry go round and playing the game until the whistle goes and the stands crumble beneath us.

Depends upon what end of the intelligence spectrum you sit.

I just went to check my BNZ balance and their app was down. It's got to be the most unreliable flimsy piece of software going around.

https://www.waikatotimes.co.nz/nz-news/360779690/robo-ccino-anyone-robo…

And just like that, 10,000 more people on the dole queue

Some will say they prefer human made, but there's an indifference curve for everything. What's your price for a robot latte before it starts tasting pretty good - $1 less? 2, 3?

I saw one of these at Hong Kong airport but it was mixing cocktails in a duty free shop.

Some restaurants at Auckland at the moment have robot waiters.

If AI starts taking the office jobs and robots start replacing the manual stuff then the middle's gonna get squeezed pretty quick

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.