Building industry giant Fletcher Building [FBU] has given the clearest hint yet that it's going to sell its residential and development business, as it reports a $419 million after-tax loss for the year to June 30, 2025.

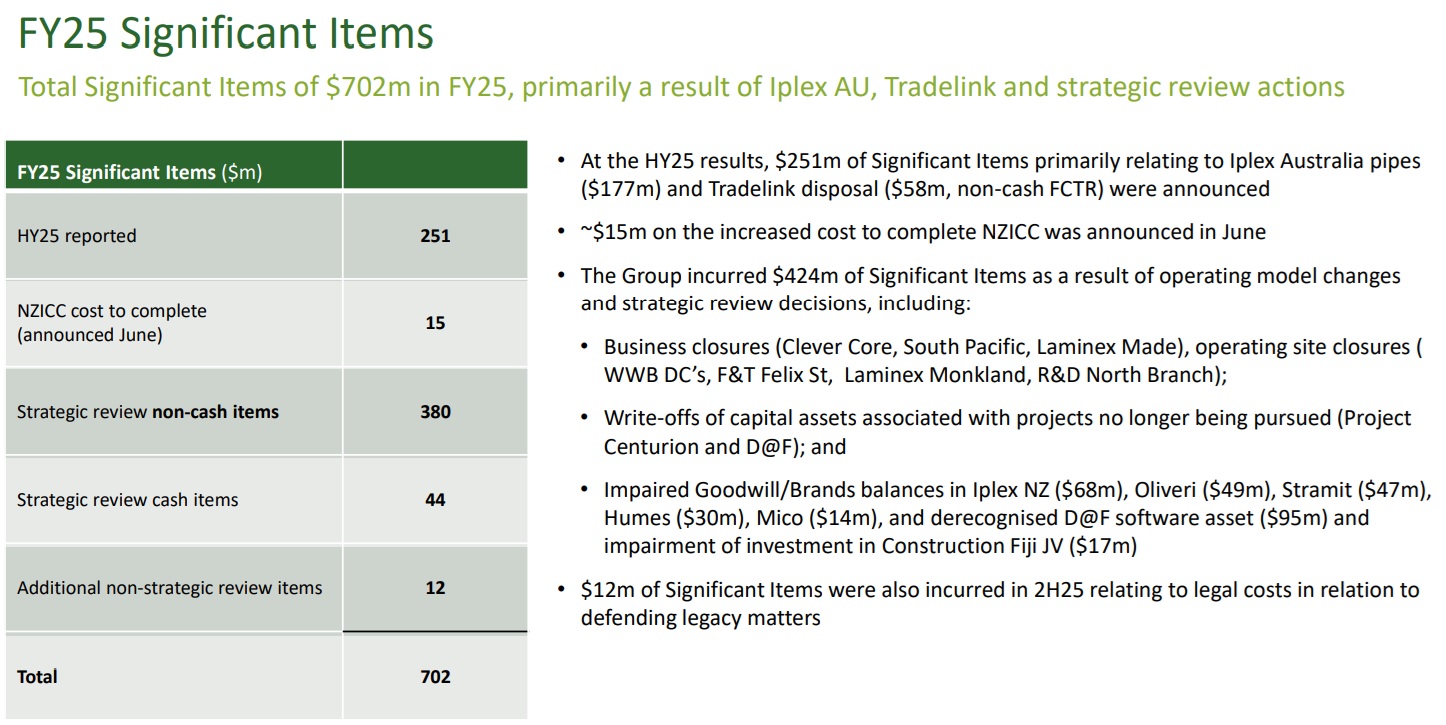

The full-year loss compares with a $227 million loss in the 2024 year and comes after Fletcher Building had to digest $702 million worth of writedowns in the latest year, with $644 million of those relating to continuing operations of the business.

The company isn't paying dividends at the moment and says it won't do so till it gets its net debt into the lower half of a $400 million to $900 million range. As at June 30, 2025 the net debt stood at $999 million, down from $1.766 billion a year ago.

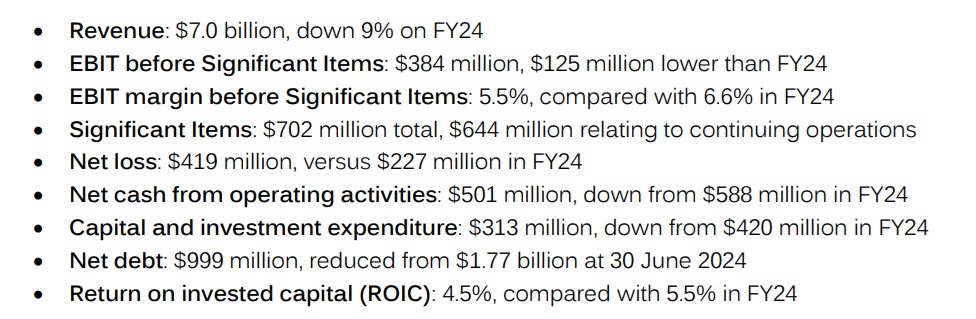

Below are the highlights provided by the company in its release to NZX.

Fletcher Building recently officially put the 'for sale' signs on its problematic construction division. Now it's also indicating that the residential and development operations may be following the construction unit out of the door - although very little has been said in either the commentary provided to NZX or a very spartan annual report issued on Wednesday.

Last year the company had indicated it was seeking partners for its residential and development business, but there's been no recent updates on this.

However, with the result announcement on Wednesday, Fletcher Building chief executive Andrew Reding said the "streamlined, decentralised, organisational structure and refreshed strategy" unveiled at the company's recent Investor Day "builds on our core strengths in the manufacturing and distribution of building products".

"As part of this strategic focus, we have previously confirmed a review of divestment options for our Construction businesses, and have similarly initiated a strategic review of our Residential & Development business. [The latter part of that statement is new.]

"These reviews are designed to simplify our portfolio, sharpen our operational focus, and unlock value for shareholders. While there is no certainty that they will result in transactions, any potential cashflow and cost-out benefits are expected to begin flowing through from FY27, further strengthening our position for long-term growth."

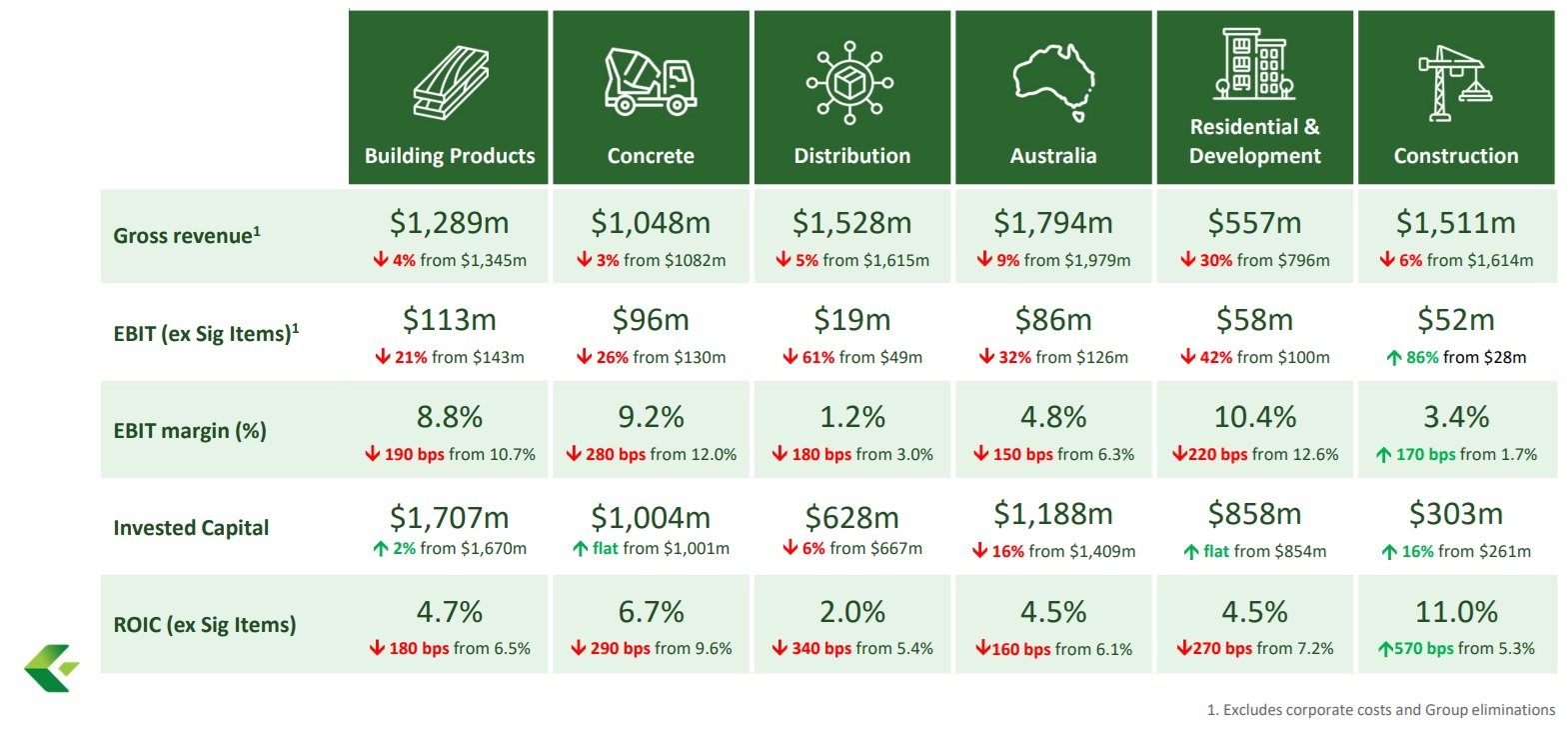

Below is the company's breakdown of divisional results.

Commenting on the company's latest result, Reding said the year had been "one of the most demanding years in recent memory, both for Fletcher Building and the industries in which we operate".

"Our businesses faced tough market conditions, as well as undertaking significant internal change, and addressing legacy issues. However, significant progress has been made on our strategic plan to reposition the business for more sustainable returns going forward."

The company had "made solid progress" in addressing "our longstanding legacy issues", Reding said.

"In June 2025, we reached a settlement with the New Zealand Transport Agency on the Puhoi to Warkworth motorway project and have recently settled our insurance claims in respect of the weather and landslips that affected the project. Final finishing and commissioning work on the New Zealand International Convention Centre (NZICC) remains on track for handover in 2025, ahead of its planned opening in early 2026. In Australia, the Industry Response for the Western Australian plumbing issues was signed, with a provision of A$155 million (NZ$170 million) recognised in the first half of the year, and the remediation work of the participating builders is starting to build momentum."

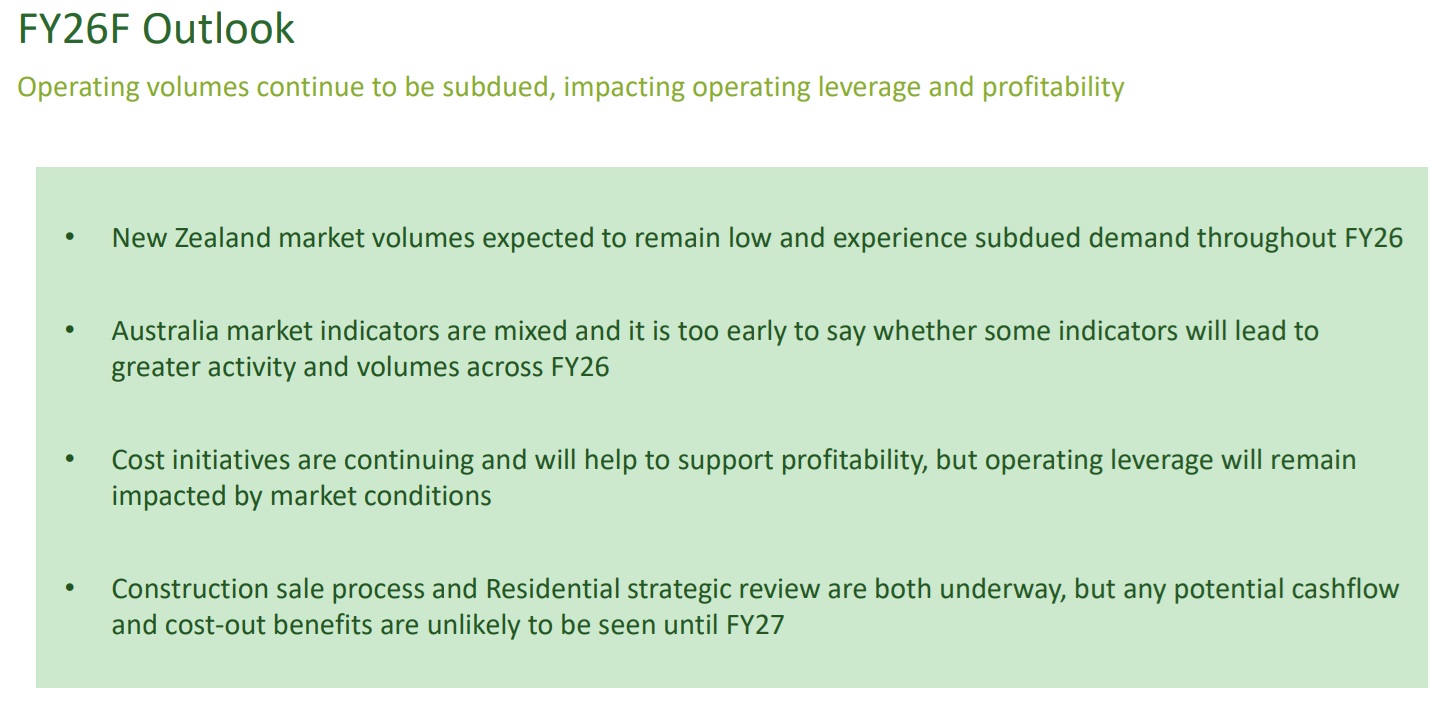

However, Reding gave a fairly downbeat outlook for the new financial year.

"In New Zealand, market volumes are expected to remain low with subdued demand through FY26. Indicators are mixed in Australia, and it is too early to determine when recent signals might translate into greater activity and volumes. While the near-term environment remains uncertain, our focus on cost control, operational discipline, effective capital allocation and portfolio simplification is positioning Fletcher Building well to both navigate current headwinds and deliver stronger, more sustainable returns over the medium to long term."

In terms of the Residential and Development division in the 2025 financial year, the company said it had to "navigate persistent demand headwinds, cautious buyer behaviour and pricing pressures".

The division earnings before interest and tax (EBIT) were $58 million, down from $100 million.

"Whilst volume softened from FY24, operational discipline, customer satisfaction and meaningful community impact remained key highlights," the company said.

A total of 666 residential units (including 41 apartment units) were taken to profit in FY25, compared to 886 in FY24 (-220 units), the company said.

"Three Kings reached a major transformation milestone, evolving from a quarry to a thriving community with new housing, sports fields and roading network now open.

"Matai Springs, Halswell (Canterbury) completed and sold out in FY25, delivering ~160 homes over three years with strong profitability and positive community outcomes.

"The Hill, Auckland launched with flagship Belvedere Apartments, achieving record pricing, underscoring market confidence in premium urban design."

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.