This content supplied by Worldline.

Consumer spending processed through all Core Retail merchants in Worldline NZ’s payments network during the first 21 days of December reached $3.223B, which is down -1.3% on the first 21 days of December 2024 (following adjustments for merchants coming and going from the network.)

Worldline NZ’s Chief Sales Officer, Bruce Proffit, says while payments jumped sharply last week on the week before, as usually happens this time of year, the year-on-year spending remains below that of last year both for the week and month to date.

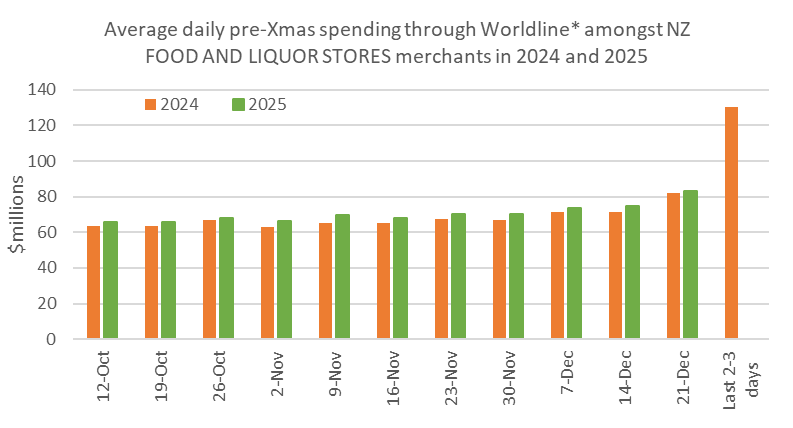

“As anticipated, we continued to see the spending at Food and Liquor shops increase in the third week of December, and the busiest days are yet to come for that retail sector,” he says.

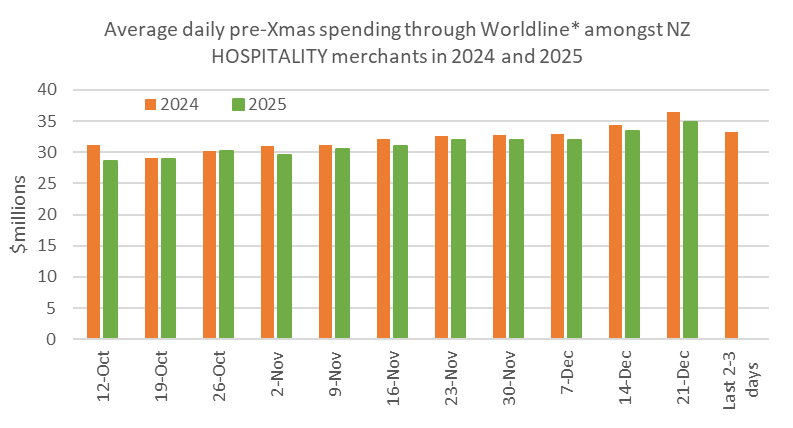

“The Hospitality sector meanwhile was very busy on Saturday (20 December) and likely reached its Christmas season peak that day. However, this peak day was 3.8% below the 2024 peak and even below levels recorded on one day in February 2025, which suggests spending on pre-Christmas parties was more modest this year,” says Proffit.

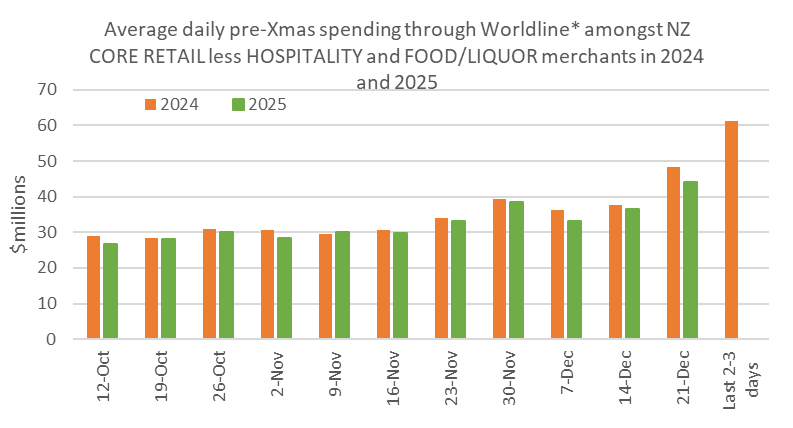

“Likewise, in the wider Core Retail sector, spending stepped up another level from the immediately prior weeks but spending remains below year-ago levels so far this month for stores selling electronics, gifts, clothes, furniture, appliances, sports equipment, and books.

“The exceptions, with spending up on last year, include toy stores, chemists, jewellers, and home decorating retailers.”

Proffit also says the gap between spending this year and last year will likely close to some extent in the next three days, as spending did in 2014 when Christmas Day was last on a Thursday.

Figure 1: All Cards NZ underlying* average spending per day through Worldline pre-Christmas for subsets of NZ core retail merchants (*Underlying excludes large clients moving to or from Worldline).

Combining the three merchant groups, annual growth of Core Retail spending through Worldline NZ’s payments network in the first 21 days of December was highest in Whanganui (+2.7%) and Otago (+1.9%), while spending declines were largest in percentage terms in Wellington (-4.8%) and Bay of Plenty (-3.4%).

| WORLDLINE All Cards spending for CORE RETAIL merchants or 1-21st December 2025 |

||

| Value | Underlying* | |

| Region | transactions $mln | Annual % change on 2024 |

| Auckland/Northland | 1,207.8 | -1.4% |

| Waikato | 274.9 | 0.4% |

| BOP | 220.0 | -3.4% |

| Gisborne | 30.5 | -0.4% |

| Taranaki | 74.6 | -0.6% |

| Hawke's Bay | 115.6 | 0.3% |

| Whanganui | 44.9 | 2.7% |

| Palmerston North | 98.2 | -0.7% |

| Wairarapa | 36.1 | -2.4% |

| Wellington | 267.4 | -4.8% |

| Nelson | 68.8 | 0.3% |

| Marlborough | 42.8 | -3.1% |

| West Coast | 24.3 | 1.7% |

| Canterbury | 388.4 | -1.6% |

| South Canterbury | 51.2 | -1.8% |

| Otago | 197.0 | 1.9% |

| Southland | 78.7 | -1.0% |

| New Zealand | $3,223.8 | -1.3% |

Figure 2: All Cards NZ underlying* spending through Worldline in 1-21st December 2025 for core retail merchants (* Underlying excludes large clients moving to or from Worldline)

9 Comments

Still feels like cost of living crisis.

Boxing day sales starting 6 days early was a hint

Yes it definitely still seems lackluster out there. My daughter works in a restaurant kitchen and there's been no noticeable uptick in patronage.

People looking for better value in eating and drinking at home, in preference to the comparatively expensive business of going out for their Christmas cheer.

Maybe a return to older ideas of valuing time with others over cheerless consumption?

is it meat you fate in 28 or

be in heaven in 27

Change your kiwisaver quick '26

Definitely doing my bit to drag that wellington figure down - the only thing getting my funds now is my mortgage.

Went to the mall this morning. Got a car park easily and there was no queue.

It does seem bleak out there. The green shoots are dying in the summer heat.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.