Company failures hit a 15-year high in New Zealand last year, according to credit bureau Centrix.

In Centrix's latest monthly Credit Indicator report, chief operating officer Monika Lacey said the rising liquidations "underscore ongoing financial strain across parts of the economy, as well as the IR’s ongoing crackdown on outstanding debts".

However, Lacey said despite this broad rise, there are signs of resilience in some sectors.

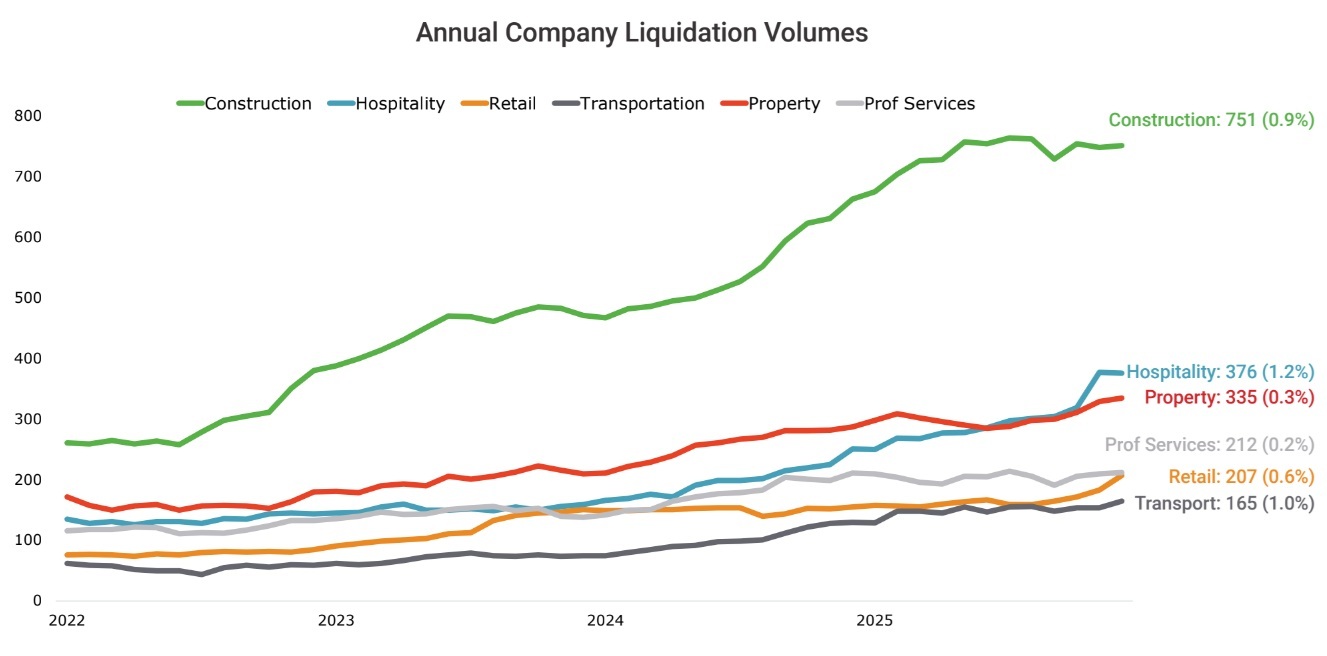

In terms of the detail, business liquidations saw the sharpest rises in hospitality (+50%), retail trade (+34%) and transport (+27%), "highlighting ongoing financial stress in these sectors despite improving credit conditions".

Construction (+13%), manufacturing (+12%) and property/rental (+17%) also recorded higher liquidations, even as credit defaults declined and average credit scores improved in many areas.

Construction remains the leading contributor to company liquidations, with 751 firms liquidated in 2025, although this did represent just 0.9% of all registered construction companies.

Second highest number of liquidations was in the hospitality sector ranks, where there were 376 liquidations, "reflecting ongoing financial pressure in the industry".

"Despite these increases, early signs of improvement are emerging, with liquidation trends easing in six of the 19 industry sectors, Lacey said.

"Notable improvements are being seen in agriculture, wholesale trade, and information media and telecommunications services."

Consumer debt demand off to strong start in 2026

Elsewhere, the Centrix data shows consumer credit demand opened 2026 with solid momentum, rising 9.4% year on year, driven by stronger mortgage applications and elevated personal loan borrowing through the holiday period.

"Furthermore, new household lending also strengthened over the December quarter. Lending for new mortgages was up 14.3% while non mortgage lending also climbed 12.0%, supported by active summer housing markets and people taking advantage of the lower cash rate to refinance to lower interest rates," Lacey said.

"Arrears trends were mixed heading into the new year. Overall consumer arrears rose seasonally to 12.07% in December but remain lower than a year ago and broadly in line with 2023 levels. Mortgage arrears were stable and continue to sit below last year’s levels, while credit card arrears increased slightly."

"Vehicle loan arrears, however, climbed 6% year-on-year, indicating mounting repayment pressure for some households."

Lacey said personal loan arrears also rose, whereas essential services such as retail energy and telco accounts saw continued improvement, providing some relief for household budgets.

Business credit demand lifted modestly, up 0.7% year-on-year, with growth concentrated in hospitality, education/training, and retail trade.

5 Comments

Maybe there were too many of these companies to start with so they can only survive when times are very good.

Big post Xmas tax time again at the moment. This stat will get worse. Covid support kept a bunch of companies in business that were doomed regardless.

The "extend and pretend" has now run out of free rope.

Its trap door release and whos been swimming naked time!

Some of these liquidations will be a result of closing the border for two years. To do that and think there won't be ramifications is naive.

I'd put more money down to the fact everyone kept getting paid to sit at home, either during lockdowns, or if them or anyone in the house was sick once people were allowed out.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.