central banks

[updated]

Reserve Bank Governor Anna Breman and other leading central bankers 'stand in full solidarity' with US Fed & its Chairman Jerome Powell against pressure from Donald Trump

14th Jan 26, 11:56am

23

Reserve Bank Governor Anna Breman and other leading central bankers 'stand in full solidarity' with US Fed & its Chairman Jerome Powell against pressure from Donald Trump

New Reserve Bank Governor Anna Breman on inflation, housing, mortgage rates, prudential regulation and RBNZ independence from politicians

10th Dec 25, 11:56am

21

New Reserve Bank Governor Anna Breman on inflation, housing, mortgage rates, prudential regulation and RBNZ independence from politicians

New Reserve Bank Governor Anna Breman pledges to stay 'laser focused' on low, stable inflation, a stable financial system, and safe and efficient payments

2nd Dec 25, 2:21pm

19

New Reserve Bank Governor Anna Breman pledges to stay 'laser focused' on low, stable inflation, a stable financial system, and safe and efficient payments

After a year of 'wide-ranging change,' Reserve Bank names Rodger Finlay as ongoing Chairman, adds Rhiannon McKinnon to board

27th Nov 25, 10:41am

After a year of 'wide-ranging change,' Reserve Bank names Rodger Finlay as ongoing Chairman, adds Rhiannon McKinnon to board

[updated]

First Deputy Governor of Sweden’s central bank Anna Breman to take charge at RBNZ in December

24th Sep 25, 1:12pm

27

First Deputy Governor of Sweden’s central bank Anna Breman to take charge at RBNZ in December

Speculation mounts new RBNZ Governor will come from overseas with announcement from Finance Minister Nicola Willis expected Wednesday

23rd Sep 25, 2:59pm

13

Speculation mounts new RBNZ Governor will come from overseas with announcement from Finance Minister Nicola Willis expected Wednesday

Patrick Watson argues US economic problems are deeper than interest rates being a little too high or low.

20th Aug 25, 9:06am

1

Patrick Watson argues US economic problems are deeper than interest rates being a little too high or low.

The Bank for International Settlements' Hyun Song Shin says a stabilising force is required in turbulent times

30th Jun 25, 9:00am

The Bank for International Settlements' Hyun Song Shin says a stabilising force is required in turbulent times

A temporary replacement for Adrian Orr will be recommended to Finance Minister Nicola Willis soon, starting a nine-month countdown to find a permanent replacement

1st Apr 25, 1:12pm

A temporary replacement for Adrian Orr will be recommended to Finance Minister Nicola Willis soon, starting a nine-month countdown to find a permanent replacement

Bank of England’s Catherine Mann and RBNZ’s Paul Conway say raising and cutting interest rates quickly was the right thing to do during the crisis

8th Mar 25, 9:30am

8

Bank of England’s Catherine Mann and RBNZ’s Paul Conway say raising and cutting interest rates quickly was the right thing to do during the crisis

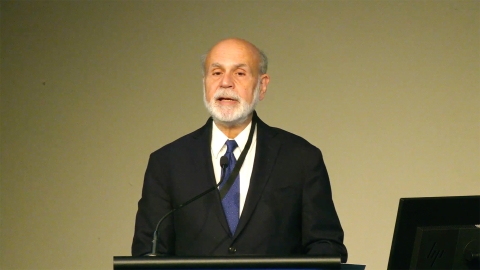

Nobel Prize winner Ben Bernanke believes central banks should provide alternative economic forecasts and explain how they might react if those scenarios were to happen

7th Mar 25, 8:30am

13

Nobel Prize winner Ben Bernanke believes central banks should provide alternative economic forecasts and explain how they might react if those scenarios were to happen

The gold price has surged to record highs. Dirk Baur looks at what’s behind the move

26th Feb 25, 9:47am

9

The gold price has surged to record highs. Dirk Baur looks at what’s behind the move

Dean Attewell suggests managing interest rates, mandatory retirement deductions and immigration in tandem to create a more balanced and sustainable housing market

15th Feb 25, 9:25am

81

Dean Attewell suggests managing interest rates, mandatory retirement deductions and immigration in tandem to create a more balanced and sustainable housing market

Bank for International Settlements paper sees significant contribution from businesses' price setting to inflation

21st Jan 25, 5:14pm

2

Bank for International Settlements paper sees significant contribution from businesses' price setting to inflation

[updated]

Reserve Bank to pay $597 million dividend, Governor Adrian Orr gets a pay cut, staff numbers & costs rise

8th Oct 24, 2:39pm

12

Reserve Bank to pay $597 million dividend, Governor Adrian Orr gets a pay cut, staff numbers & costs rise