risk-based pricing

Tower launches Rainfall Response Cover in Fiji, expanding the insurer’s parametric cover as it also mulls a parametric offering in NZ

18th Nov 25, 6:09pm

3

Tower launches Rainfall Response Cover in Fiji, expanding the insurer’s parametric cover as it also mulls a parametric offering in NZ

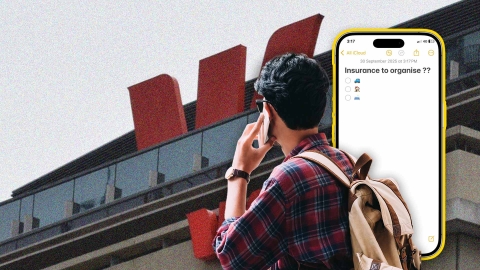

Tower replacing IAG NZ as Westpac NZ’s general insurance partner ‘strategically important’ in the long-term, Forsyth Barr analysts say

2nd Oct 25, 2:12pm

Tower replacing IAG NZ as Westpac NZ’s general insurance partner ‘strategically important’ in the long-term, Forsyth Barr analysts say

Westpac NZ ends insurance partnership with IAG NZ as bank switches to Tower Insurance which will become its underwriter for general insurance products

26th Sep 25, 10:08am

1

Westpac NZ ends insurance partnership with IAG NZ as bank switches to Tower Insurance which will become its underwriter for general insurance products

General insurer Tower secures reinsurance programme for 2026 providing 'greater certainty around future reinsurance costs and catastrophe excesses', its chief executive says

24th Sep 25, 3:33pm

General insurer Tower secures reinsurance programme for 2026 providing 'greater certainty around future reinsurance costs and catastrophe excesses', its chief executive says

General insurer Tower lifts annual profit guidance to up to $110m, if large insurance event costs remain low

12th Sep 25, 10:34am

General insurer Tower lifts annual profit guidance to up to $110m, if large insurance event costs remain low

AA Insurance puts temporary restriction on new home insurance policies in ‘a small number of postcodes’ after reaching its maximum exposure limit for seismic risk in these areas, its head of underwriting says

5th Sep 25, 1:11pm

2

AA Insurance puts temporary restriction on new home insurance policies in ‘a small number of postcodes’ after reaching its maximum exposure limit for seismic risk in these areas, its head of underwriting says

General insurer Tower extends risk-based pricing to landslides and sea surges meaning rising premiums for some customers

20th Aug 25, 12:14pm

2

General insurer Tower extends risk-based pricing to landslides and sea surges meaning rising premiums for some customers

Natural hazards abound in New Zealand and insurance premium costs are rising, so would a broader range of insurance products be useful?

13th Dec 24, 5:00am

13

Natural hazards abound in New Zealand and insurance premium costs are rising, so would a broader range of insurance products be useful?

Climate report warns of steep insurance premium increases and coverage gaps for coastal homes, with 10,000 properties at risk by 2050

11th Nov 24, 3:47pm

29

Climate report warns of steep insurance premium increases and coverage gaps for coastal homes, with 10,000 properties at risk by 2050

Reserve Bank’s latest financial stability report says risk-based insurance pricing is a continuing trend and high-risk properties may see further increases

5th Nov 24, 11:17am

8

Reserve Bank’s latest financial stability report says risk-based insurance pricing is a continuing trend and high-risk properties may see further increases

In a new Of Interest podcast episode, John Lyon explains why it's hard to judge insurers' finances on a year by year basis, and why NZ's risk profile is the most significant barrier to enter the local insurance market

1st Oct 24, 4:41pm

13

In a new Of Interest podcast episode, John Lyon explains why it's hard to judge insurers' finances on a year by year basis, and why NZ's risk profile is the most significant barrier to enter the local insurance market

The role of chief risk officers in the insurance sector is changing in the face of climate change as risk management and forecasting becomes even more vital for general insurers

12th Mar 24, 10:01am

The role of chief risk officers in the insurance sector is changing in the face of climate change as risk management and forecasting becomes even more vital for general insurers

Insurer Tower says it faced significant challenges this financial year, but its underlying result 'demonstrates resilience and strategic delivery' that positions the company well for long-term sustainable growth and performance

23rd Nov 23, 11:00am

5

Insurer Tower says it faced significant challenges this financial year, but its underlying result 'demonstrates resilience and strategic delivery' that positions the company well for long-term sustainable growth and performance

Insurer Tower says inflation, motor crime and supply chain issues continued to worsen over the third quarter of its financial year to September

19th Jul 23, 10:11am

10

Insurer Tower says inflation, motor crime and supply chain issues continued to worsen over the third quarter of its financial year to September

Mother Nature may always win but we can prepare for and respond to extreme weather more innovatively and realistically, Tower's Blair Turnbull says

13th Jun 23, 1:37pm

3

Mother Nature may always win but we can prepare for and respond to extreme weather more innovatively and realistically, Tower's Blair Turnbull says