By Alan Bollard*

Is Oppenheimer a movie for our time, reminding us of the tensions, dangers and conflicts of the old Cold War while a new one threatens to break out?

The film certainly chimes with today’s big power conflicts (the US and China), renewed concern about nuclear weapons (Russia’s threats over Ukraine), and current ideological tensions between democratic and autocratic systems.

But the Cold War did not just rest on the threat of the bomb. Behind the scientists and generals were many other players, among them the economists, who clashed just as vigorously in their views about how to run postwar economies.

Without their allocation systems, funding mechanisms, technological advances, economic mapping and fiscal policies, neither the big powers nor the minor players could have afforded their defence expenditures or operated their economies.

One of J. Robert Oppenheimer’s colleagues, genius Hungarian mathematician John von Neumann, not only worked on the Nagasaki bomb at Los Alamos, but also turned his mind to economics. He developed game theory for economists – which the RAND Corporation used to test first-strike nuclear attacks against second-phase reprisals.

Von Neumann also developed the computer architecture on the EDVAC machine that allowed simulations of these nuclear and economic “games”. He went on to build the famous expanding economy model that showed the possibilities of dynamic growth through investment.

Spies and ideologies

The US had a huge financial advantage in this game, but it did not have everything its own way. Von Neumann’s nemesis was a Russian prodigy named Leonid Kantorovich. He survived the siege of Leningrad and invented linear programming to help Soviet factories build wartime planes more efficiently.

When he proposed extending these techniques to the whole planned Soviet economy, he was knocked back by the Marxist ideologues because he used prices to indicate scarcity. Kantorovich escaped incarceration and execution, unlike some of his colleagues. But he found himself assigned to the ENORMOZ project, the desperate Soviet race to build their own atomic bomb.

Kantorovich was helped in this contest by information leaked by Soviet spy Klaus Fuchs from von Neumann’s laboratory at Los Alamos. Such espionage was endemic in the period.

US Treasury Assistant Secretary Harry Dexter White, a principal architect of the 1944 Bretton Woods agreements (which established the IMF and the World Bank), was feeding US secrets to the Soviets. More than 20 of his New Deal colleagues in the US administration belonged to Soviet spy rings.

In economics as well as the military, there were defining ideological differences: those like Austrian economist Friedrich Hayek who saw market allocation and price signals as the only way to allocate resources efficiently in a modern economy; and those like Polish Marxist economist Oskar Lange, who argued that planned socialist economies could also be efficient – at least theoretically – by using frequent data on shortages and gluts.

The Soviet Union used this latter system tolerably well to meet the military needs of the second world war. But it failed when faced with the more sophisticated civilian demands later in the Cold War.

Academic warfare

Such arguments were fought out on the Washington beltway and in the Kremlin. But some of the most brutal arguments took place in the hallowed halls of academia.

For example, Joan Robinson, the brilliant yet erratic upper-class Cambridge economist, tried to rewrite Marxian economics but ended up with something closer to dynamic Keynesianism – an interpretation of how John Maynard Keynes’ 1935 General Theory of Employment, Money and Interest might be extended to lead to growth.

And for the next 30 years she argued this with Paul Samuelson of the Massachusetts Institute of Technology, himself from a tough steel town, about whether the reinvestment of profits or the surplus value of labour was the key to dynamic growth.

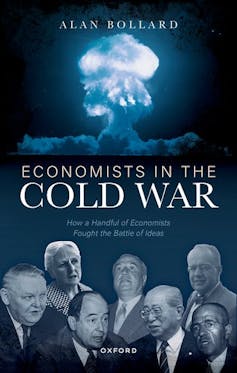

Robinson, Samuelson and other economists are profiled in my new book: Economists in the Cold War: How a Handful of Economists Fought the Battle of Ideas. Through their eyes we see the war of economic ideologies, the competing social objectives, the fight over allocation mechanisms and the different views on what drives an economy.

This was binary economics, though there were some attempts at a middle way, such as the “social market economy” promoted in the late 1940s by the German economic minister and cigar-smoking technocrat Ludwig Erhar.

After several decades of disagreement, the economic battlegrounds seemed set. Centrally planned economies were lagging, but by 1970 new computing power (partly the work of von Neumann and Kantorovich) seemed to offer them new opportunities.

Fascinated by the possibility of computers helping direct an economy, Oscar Lange wrote just before his death:

So what’s the trouble? Let us put the simultaneous equations on an electronic computer and we shall obtain the solution in less than a second.

Computers and coups

The next round of this battle would play out not in Europe, but in Chile, where socialist president Salvador Allende employed British management consultant Stafford Beer to design a new tool for central planning.

In Santiago he built a futuristic control centre: a ring of armchairs with controls, monitors and a software system named Cybersyn. Allende had nationalised 500 businesses and he linked them up to the control centre by fax machine (ironically, using the wired network of the CIA-influenced ITT company).

Each day, the controllers would fax orders to the factories and receive information on shortages and gluts. Could a computer-based allocation system provide a workable alternative to markets?

We will never know, because on September 11 1973 General Augusto Pinochet mounted a military coup, bombed the presidential palace, assassinated Allende and sent a contingent of soldiers with fixed bayonets to ritualistically stab the monitors in the control room.

Pinochet established his own cabinet, heavily populated with “Los Chicago Boys”, the economics students trained at the University of Chicago on Ford and Rockefeller Foundation schemes.

One of them, Milton Friedman, later visited Chile to advise the dictator Pinochet on the economy. When criticised, he replied:

I do not consider it as evil for an economist to render technical economic advice to the Chilean government, any more than I would regard it as evil for a physician to give technical medical advice to the Chilean government to help in a medical plague.

But it was not all so divisive. In 1954, the left-wing Oppenheimer was pulled before the Atomic Energy Commission in a secret hearing to testify on charges of having communist sympathies. The right-wing von Neumann was the first to organise a group of witnesses for the defence, despite completely disagreeing with Oppenheimer’s politics.

Despite all the geopolitical tensions, economists today can at least argue in a far less hostile environment.![]()

*Alan Bollard, Professor of Economics, Te Herenga Waka — Victoria University of Wellington. Bollard is also a former Governor of the Reserve Bank of New Zealand. This article is republished from The Conversation under a Creative Commons license. Read the original article.

2 Comments

'He went on to build the famous expanding economy model that showed the possibilities of dynamic growth through investment.'

Shows that even the Mensa-level types can be incredibly short-sighted. The Donella Meadows-led team at MIT, a couple of decades later, blew that wee premise of of the water.

https://en.wikipedia.org/wiki/Thinking_In_Systems%3A_A_Primer

Yet economics still runs blind; doggedly, deteminedly... I have a copy of Crisis; no mention of global resource limits, no mention of energy, nor of overshoot. I look forward to the first economist who acknowledges the shortcomings of the 'discipline' as expressed/taught.

He was an excellent communicator and had good insight (the best in my experience) when Governor of RBNZ so it should be a good read whatever one’s views.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.