USA

Jiao Wang asks if US tariffs have failed to bite given China’s trade surplus hit a record US$1.2 trillion

20th Jan 26, 2:03pm

Jiao Wang asks if US tariffs have failed to bite given China’s trade surplus hit a record US$1.2 trillion

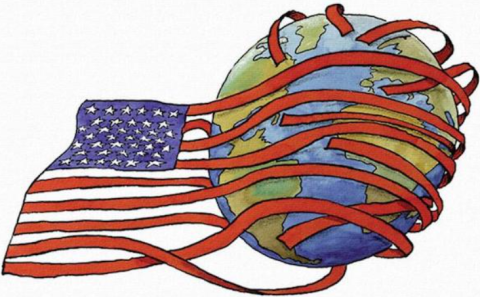

Anna Breman’s call was the right one. The America which Winston Peters seems so determined to placate is fast becoming a nation undeserving of New Zealanders’ allegiance

19th Jan 26, 9:16am

16

Anna Breman’s call was the right one. The America which Winston Peters seems so determined to placate is fast becoming a nation undeserving of New Zealanders’ allegiance

Australia is betting on a new ‘strategic reserve’ to loosen China’s grip on critical minerals, Susan M Park says

16th Jan 26, 9:52am

2

Australia is betting on a new ‘strategic reserve’ to loosen China’s grip on critical minerals, Susan M Park says

Robert Chernomas and Ian Hudson explain why America hasn’t become great again

16th Jan 26, 9:05am

Robert Chernomas and Ian Hudson explain why America hasn’t become great again

Nolan Fahrenkopf says rogue nations are capitalising on gaps in crypto regulation to finance weapons programmes

13th Jan 26, 9:41am

1

Nolan Fahrenkopf says rogue nations are capitalising on gaps in crypto regulation to finance weapons programmes

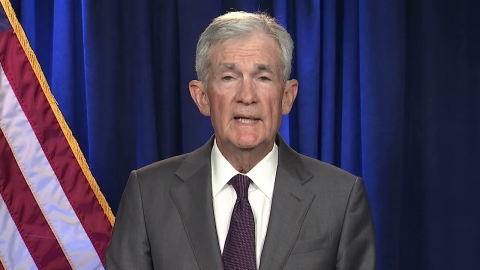

Federal Reserve Chairman Jerome Powell says Department of Justice subpoenas 'a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President'

12th Jan 26, 3:06pm

33

Federal Reserve Chairman Jerome Powell says Department of Justice subpoenas 'a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President'

Patrick Watson points out the housing market is the US economy’s thousand-pound gorilla. Bad things happen when it gets angry

19th Dec 25, 11:06am

1

Patrick Watson points out the housing market is the US economy’s thousand-pound gorilla. Bad things happen when it gets angry

Be warned New Zealand: An America made great again will have no need of allies – only vassals

15th Dec 25, 8:30am

32

Be warned New Zealand: An America made great again will have no need of allies – only vassals

What will Trump’s deal with Xi mean for the US economy and relations with China?

31st Oct 25, 1:08pm

What will Trump’s deal with Xi mean for the US economy and relations with China?

Xi-Trump summit: Trade, Taiwan and Russia still top agenda for China and US presidents, 6 years after their last meeting

29th Oct 25, 2:52pm

Xi-Trump summit: Trade, Taiwan and Russia still top agenda for China and US presidents, 6 years after their last meeting

Kate Hua-Ke Chi looks at why countries struggle to quit fossil fuels, despite higher costs and 30 years of climate talks and treaties

20th Oct 25, 10:07am

15

Kate Hua-Ke Chi looks at why countries struggle to quit fossil fuels, despite higher costs and 30 years of climate talks and treaties

Tom Harper looks at why Trump fails to understand China’s trade war tactics, and what his negotiators should be reading

9th May 25, 9:21am

3

Tom Harper looks at why Trump fails to understand China’s trade war tactics, and what his negotiators should be reading

In trade war with the US, China holds a lot more cards than Trump may think − in fact, it might have a winning hand, Linggong Kong says

14th Apr 25, 10:36am

1

In trade war with the US, China holds a lot more cards than Trump may think − in fact, it might have a winning hand, Linggong Kong says

Trouble in the United States financial markets suggest some investors are losing faith in its status as a global reserve and the dominant superpower

12th Apr 25, 9:00am

58

Trouble in the United States financial markets suggest some investors are losing faith in its status as a global reserve and the dominant superpower

Consumers are boycotting US goods around the world. Should Trump be worried?

10th Apr 25, 10:50am

10

Consumers are boycotting US goods around the world. Should Trump be worried?