The OECD has just released its June 2025 Economic Outlook.

It says global economic prospects are weakening, with substantial barriers to trade, tighter financial conditions, diminishing confidence and heightened policy uncertainty projected to have adverse impacts on growth.

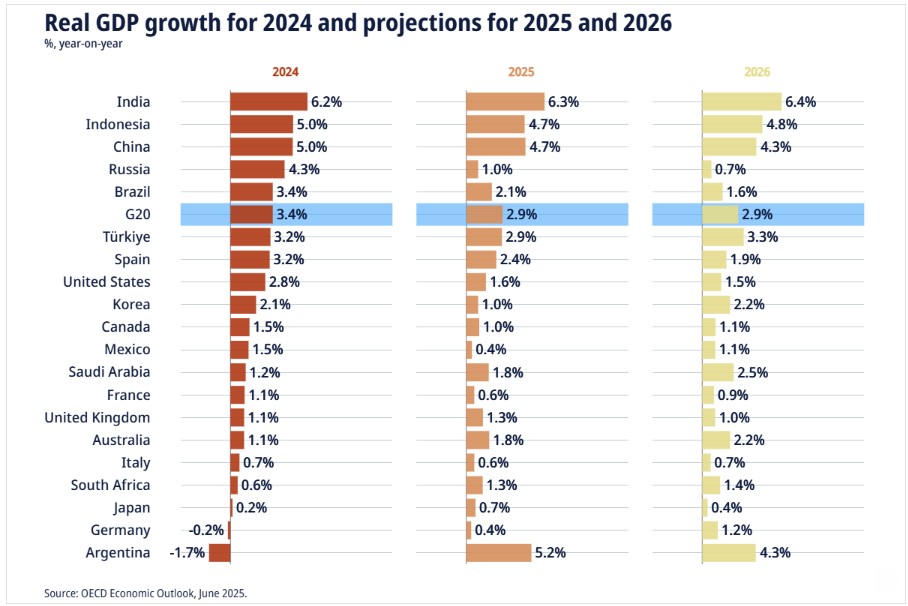

The Outlook projects global growth slowing from 3.3% in 2024 to 2.9% in both 2025 and 2026. The slowdown is expected to be most concentrated in the United States, Canada, Mexico and China, with smaller downward adjustments in other economies.

GDP growth in the United States is projected to decline from 2.8% in 2024 to 1.6% in 2025 and 1.5% in 2026. In the euro area, growth is projected to strengthen modestly from 0.8% in 2024 to 1.0% in 2025 and 1.2% in 2026. China’s growth is projected to moderate from 5.0% in 2024 to 4.7% in 2025 and 4.3% in 2026.

Inflationary pressures have resurfaced in some economies. Higher trade costs in countries raising tariffs are expected to push inflation up further, although the impact will be partially offset by weaker commodity prices. Annual headline inflation in the G20 economies is collectively expected to moderate from 6.2% to 3.6% in 2025 and 3.2% in 2026.

Here is the section on New Zealand.

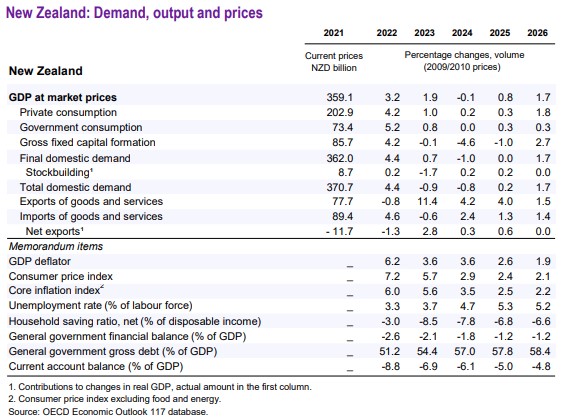

Following the deepest recession since 1991, economic activity began to recover in late 2024. The expansion is expected to continue with growth projected to rise to 0.8% in 2025 and 1.7% in 2026 supported by lower interest rates. However, increased trade restrictions and high uncertainty about trade policy globally will temper external demand, confidence and the pace of the recovery. Inflation is set to fall further due to lower oil prices and higher spare capacity including in the labour market. The unemployment rate is expected to peak in late 2025 at around 5.4%.

With core inflation declining, and inflation expectations well anchored, the central bank should steadily reduce the official cash rate to the neutral rate of around 3% and reduce it further if the recovery falters. The pace of fiscal consolidation is appropriate but may need to be slowed if the expansion stalls. Trend growth will remain modest without energy, innovation, investment and skills reforms to lift lacklustre productivity.

A recovery is underway

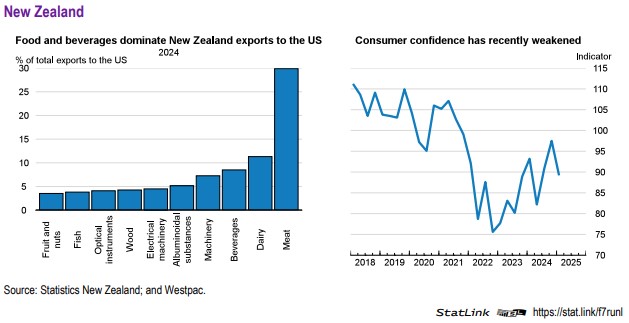

Rebalancing of the economy following a severe episode of post-pandemic overheating is well advanced. Headline inflation has declined towards the midpoint of the central bank’s 1 to 3% target range and core inflation is also declining, albeit more gradually. The economy started to recover in late 2024. The rebound was narrowly based on exports, public consumption and stock building. Private consumption and investment growth remained subdued and consumer confidence fell sharply in early 2025. Indicators for the construction sector are showing signs of bottoming out. Net inwards migration has fallen from a peak of 135 000 per annum (2.6% of the population), to a more sustainable level of around 30 000. Commodity export volumes and prices grew strongly in late 2024 and early 2025, Tourism growth has been buoyant, with arrivals rising to 85% of their pre-pandemic level in 2024, but showed signs of weakening in early 2025.

The additional 10% minimum tariff imposed by the United States on imports of goods in April 2025 will increase barriers to exports and notably beef, which benefited from a low-rate tariff quota. The direct effects of higher trade restrictions are likely to be mainly via weaker export prices rather than lower volumes as in the short run agricultural export volumes are supply driven and New Zealand is a price taker in the United States market. In addition, New Zealand’s export prices are expected to come under pressure from greater competition in markets outside the United States. Weaker external demand is also projected to eventually slow export volume growth, weighing on the expansion. The projections assume no trade policy retaliation by New Zealand. As a result, effects on inflation are assumed to be only indirect, via higher costs in global production chains, as well as cheaper imports other countries that are attempting to sell exports no longer bound for the United States elsewhere.

Monetary policy is expected to loosen further while budget consolidation continues

With inflation falling and inside the target range the central bank cut the official cash rate by 200 basis points to 3.5% between August 2024 and April 2025. It is assumed to cut the official rate to a neutral level of around 3% during 2025 and should reduce it further if the expansion falters. Public debt has risen significantly, and the budget is coming under pressure from rising pension expenditure and faces growing defence spending needs. The 2025 Budget continues the programme of reducing expenditure as a share of GDP. It also took an important step to address the economy’s low capital intensity by introducing the “Investment Boost”, which allows firms to immediately deduct 20% of the value of a new asset from their taxable income on top of normal depreciation. Provided the expansion continues, the government should continue to fully pursue its programme to reduce expenditure as a share of GDP. This is expected to increase the structural fiscal balance by 1.2% of GDP and 0.2% of GDP in 2025 and 2026 respectively.

A modest expansion is expected

Looser monetary policy is expected to be the main driver of the expansion with a return to growth of construction and other interest rate sensitive activity. However, escalating trade restrictions, weakening external demand and high trade policy uncertainty are hitting confidence and are set to hold back the recovery. High and rising prices for electricity hedges are contributing to industrial closures and are expected to restrain investment. The unemployment rate is set to peak at around 5.4% in late 2025 before gradually declining as employment growth picks up. Headline inflation is projected to fall to 2.5% in 2025 due to the decline in oil prices. Core inflation is projected to continue falling slowly. A large increase in tariffs on New Zealand exports, or low rainfall that reduces hydroelectricity generation and raises electricity prices would slow growth. However, a faster recovery of investment may occur as the “Investment Boost”, and other reforms to accelerate FDI and infrastructure construction, take hold.

Increasing trade and investment linkages is key for sustaining the expansion

An increasingly febrile and fractured geoeconomic environment means New Zealand will need to work harder working with like-minded countries to expand trade and encourage foreign direct investment. This is crucial for boosting investment and management skills required to address the chronically low capitalto-labour ratio and poor productivity growth. As well as maintaining low trade policy barriers and further expanding free trade agreements, the government should continue efforts to attract more foreign investment via more streamlined government support and lowering high restrictions. Competition and energy related reforms are required to improve the reliability and affordability of electricity. This is a prerequisite for more investment in digitalisation and lowering greenhouse gas emissions.

2 Comments

More uncertainty and declining growth a senate vote away?

https://www.youtube.com/watch?v=8sL9hJwJ7Ho

'and poor productivity growth'

I can see why nobody wanted to put their name to this piece.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.