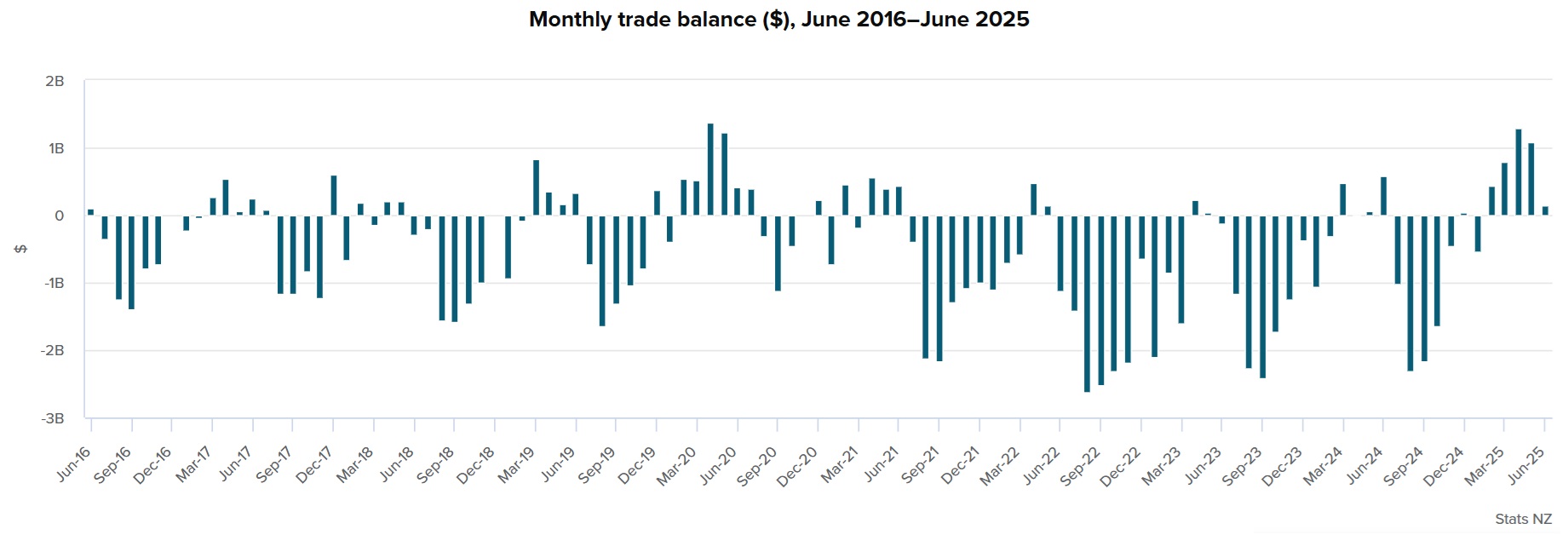

The primary sector's continued strong performance saw New Zealand record its fifth consecutive monthly goods trade surplus in June.

It was the first time since the pandemic-affected trade in 2020 that New Zealand had racked up five consecutive surpluses. However, the latest one was the smallest of the five - at just $142 million and well down on the $1 billion-plus surpluses in both April and May.

Statistics New Zealand reported that in June 2025 compared with June 2024 our goods exports rose by $601 million (10%), to $6.63 billion, while goods imports rose by $1.04 billion (19%), to $6.49 billion.

One interesting thing to note within the data was New Zealand's exports to the United States, which of course announced tariffs in April.

While our imports from the US were up 20.6% in June compared with the same month in 2024 at $636 million, our exports dropped 8.8% to $753 million. The drop in exports followed a 5.1% fall in May compared with May 2024, while in April there had been a 21.8% year-on-year rise and in March a 19.2% rise.

Meat is a significant export from NZ to the US and it's worth noting that after four consecutive months of topping $1 billion in exports for meat, the figure in June was just $814 billion, albeit that this was up slightly on the figure in June 2024.

In terms of the total exports, the top export destination in June 2025 was still China, up 10.8% (compared with June 2024) to $1.539 billion, while Australia moved ahead of the US into second place with $807 million in the month of June, up 15.5% on June 2024.

As ever, in June 2025, our 'star' export was dairy products, with $1.805 billion worth exported, up $323 million, or 22% on the same month a year ago. Biggest contributor within the dairy products group was milk powder, with $860 million worth exported.

In the month, dairy products made up 27.7% of the $6.63 billion total export figure.

And in fact, if you add in $814 million for meat, $738 million for fruit and $429 million for forest products, these four primary industry stars made up over 57% of the total exported.

It's the same if we look at the annual picture. In the 12 months to June, total exports were $76.364 billion, up 11.4% on the 12 month period to June 2024.

Of the total in the 12 months to June 2025, dairy products exports were $22.818 billion, up 20.1% on the year.

And across the whole 12 months to June 2025, dairy products accounted for 29.9% of the total exports.

Looking at the 'big four' of dairy, meat, fruit and forestry, these accounted for 56.5% of all the exports in the 12 month period.

Special mention is due for fruit exports, which at $5.741 billion across the 12 months, were up $1.726 billion, or 43% on the previous 12 month period.

19 Comments

Good on the dirty, filthy farmers and growers across NZ (according to Labour & Greens....) for continuing to allow NZ to maintain its first world living conditions. I don't think the general population understand just how drastically their standard of life would change, for the worse, if it wasn't for the farmers and growers up and down this country.

Farming allows the country to keep its head above water and little more. It's a commodity business not a high end niche business like many are lead to believe.

It's a commodity business NZ manages to do on a relatively low cost basis, marketed at the higher end of the price curve. That's the best type of business to conduct, of any sector. It effectively exploits some of the few inherent advantages the country has.

It's not electric cars, but that doesn't look like a race anyone should want to win.

Contracting the domestic economy with rising unemployment and falling demand means imports fall relative to exports. It's called 'Milei Math' after the Argentine President - who halved the currency value by decree to give exports a boost and destroy imports.

In NZ we should expect a weaker dollar to do the same here and make local assets more attractive to FDI - cheap labor and falling asset prices are an investors dream.

What does it tell you when NZ's most significant building firm is selling part of its construction arm in a depressed market. Ouch.

.

Contracting the domestic economy with rising unemployment and falling demand means imports fall relative to exports. It's called 'Milei Math' after the Argentine President - who halved the currency value by decree to give exports a boost and destroy imports.

This lacks the context of why Milei Maths exists. Which is due the ramifications of the sort of "let's just spend money irrespective of the outcome" government fiscal approach you espouse. It assumes the government can spend money as efficiently, or more efficiently than the market. Which it definitely couldn't in the case of Argentina.

We probably sit somewhere in between. I debated with Jfoe (Johnny Foe) a year or so ago that higher interest rates would improve our account deficit, as higher interest rates would have us buying less crap and exporting more relatively. That looks to have been the case. It's just not in a fashion people are happy with, but it tells us how debt related our lifestyles are.

What does it tell you when NZ's most significant building firm is selling part of its construction arm in a depressed market. Ouch.

Again, lacks a qualitative understanding of the situation. NZs "most significant building firm" has ridden it's coat rails and been poorly managed for 20 years now. If not for its legacy it should have gone to the wall some time ago now. It just takes a slump to highlight the weakness. The way a semi legit market should.

"let's just spend money" - yes - "irrespective of the outcome" - no. There was a great quote from someone being interviewed about China and how they have managed to grow their economy through technological innovation. In China "government spending is incredibly wasteful but also incredibly effective".

It's an interesting dichotomy but it applies to business, household and the government - if you don't focus on investing in the future using debt you end up weaker with lower quality assets and a lower standard of living for future generations.

This is not rocket science - economists figured it out in the 1930's and the strongest and most successful economies have followed that path.

The US and Europe were exactly the same pre and post WW2.

This is not rocket science

Quite right, rocket science is a hard science discipline with rigid boundaries.

Economics and commerce is more like an art, hard science adjacent. There's a binary formula there, like "education+infrastructure+policy = prosperity" but much of the success is within far greater nuance.

"Just keep pumping it in and it'll be fine" is not a reliable recipe.

But that spent money needs to be respent many times over to produce the desired effect. In NZ that money is hoovered up real fast and sent overseas due to socalled investment. The article on Netflix is the ultimate example where they don't even bother complying with fundamental rules, just suck it out.

The economy is not a 'market' and we don't let it behave like a market either - that would be silly and lead to massive instability, high unemployment spikes and irregular tax revenue.

The reason we have fiat currencies and reserve banks is to control the money supply and prevent true free market behavior and consequences. This is a good thing and operates as an automatic stabilizer against free market activity and cycles.

Fruit exports from South Africa to Asia and Europe are experiencing strong, sustained growth, especially apples, pears, stone fruit, and blueberries.

NZ apple exports are experiencing strong competition in China, ASEAN, and Germany from South Africa (and Chile). For ex, South African apples can sit on the shelf at 20% lower prices than NZ apples. Also, they don't spend as much on in-market brand activation as brands such as Rockit and Envy.

We are not as special as we might think.

Not all produce is the same. NZ is a fairly special place agriculturally, although that's by circumstance than any human related influence.

Not all produce is the same. NZ is a fairly special place agriculturally, although that's by circumstance than any human related influence.

So you reckon Chinese and German shoppers will choose NZ apples over Chilean and South African apples because 'NZ is a special place'?

I think retailers and shoppers will buy apples based on a range of factors - price being a key determinant. If NZ apple brands think they don't want to compete on price, that's fine. However, it's not a smart strategy in 2025 and beyond when all the evidence suggests that shoppers are looking to stretch their wallets as far as possible.

So you reckon Chinese and German shoppers will choose NZ apples over Chilean and South African apples because 'NZ is a special place'?

No, I'm saying our environmental advantages has us producing agricultural products of a better quality and type that command higher values.

There's less variation with apples being the example, but the approach there is to develop higher value varietals best suited to our growing conditions.

No, I'm saying our environmental advantages has us producing agricultural products of a better quality and type that command higher values.

So NZ apples are better quality than South African and Chilean apples because we have environmental advantages over those countries?

If you had evidence of this, it would go some way to convincing shoppers. Regardless, if shoppers are constrained by their wallets, it makes sense for them to choose apples with prices that fit within their budgets.

This is how many of our products are market and purchased.

Hence, a bottle of NZ grape juice fetches significantly more than an Australian one; most of their climate is incapable of achieving the same sorts of flavour profiles.

We don't have to think we are special. But we should acknowledge how good this is for us.

Can we think we are special though for pointing out others arent special?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.