This analysis was first published for Infometrics clients here, and is republished on Interest.co.nz with permission.

A couple of months since the updated US tariff announcements, and after a shockingly bad GDP result, we thought it is time to review how trade to the US is performing, and what more we can determine about the impacts of the tariffs so far.

In short, there’s a limited direct effect from tariffs that can be seen in various New Zealand economic indicators, although some trade sectors are feeling the hit more directly.

However, it is apparent that uncertainty after the tariffs has caused a short-term crisis of confidence that has limited business investment activity in recent times.

Less of a US boost, but strong trade gains with the UK and EU

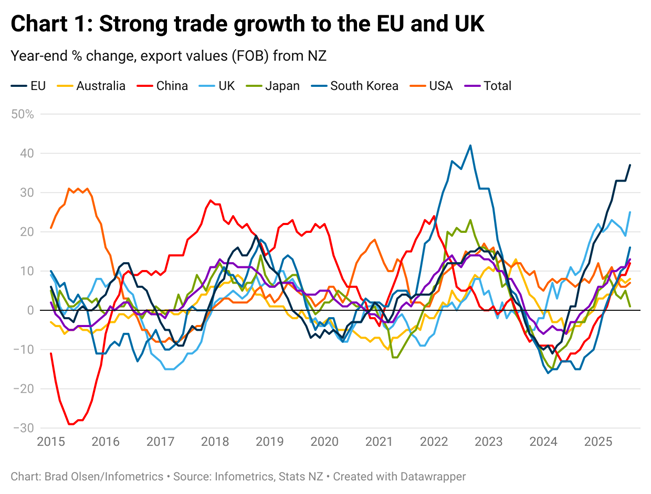

The value of New Zealand merchandise exports (physical goods) has lifted 13% per annum over the 12 months to August 2025, according to Infometrics analysis of Stats NZ trade data. Much of this gain has come from increased exports to China, with our largest trading partner accounting for a quarter of the growth in trade over the last year.

Trade growth with the EU and UK has been strong and substantial, with NZ exports to the EU up 37% per aannum over the same period, and exports to the UK up 25% per annum. Strong export growth to these countries has been driven by free trade agreements (FTAs) in recent years. The NZ-UK FTA entered into force in May 2023, and the NZ-EU FTA entered into force a year later in May 2024.

https://datawrapper.dwcdn.net/2P9DV/1/

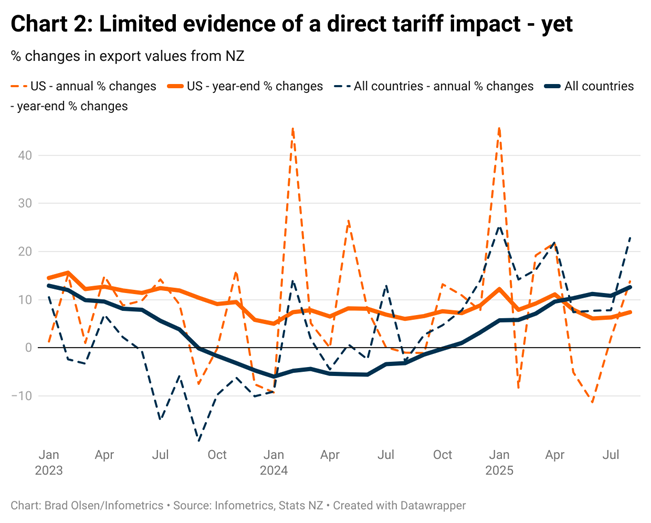

In contrast, growth in NZ exports to the US has been more restrained – although trade is still growing. Importantly, there’s little evidence of a sustained shift in trade activity between NZ and the US, despite the tariff concerns.

Goods export values from NZ to the US have increased 7.4% per annum over the 12 months to August 2025 – slightly slower than total trade growth of 13% per annum, but not a decline either.

https://datawrapper.dwcdn.net/Bcala/1/

Looking at the much more volatile annual percentage changes for each month, there is some evidence of a limited immediate response, with a 5% per annum decline in exports in May and then an 11% per annum drop in June, but then trade growth bounced back to 2% per annum in July and 14% per annum in August. March and April exports were also up around 20% per annum. The evidence of a direct tariff effect is hardly overwhelming.

More of a hit to wine and machinery so far

Looking at some of the specific goods that New Zealand exports to the US, results remain patchy.

- Meat exports, which make up 32% of New Zealand exports to the US, fell 8% per annum in both May and June, but then rose 9% in July and 8% in August.

- Dairy exports, which make up 11% of New Zealand exports to the US, are more volatile anyway, falling in February and March (pre-tariffs) from a year earlier, dropping again in May and June, but rising in July and August.

- Beverage, spirits, and vinegar exports (the group that includes wine), which make up 9% of New Zealand exports to the US, were broadly growing before the tariff announcement, but then fell 8% per annum in May, 11% per annum in June, and 45% per annum in July, before a smaller 21% per annum boost in August. Exports for this group are sitting 8% lower over the April-August period, a decline of around $23m in value.

- Machinery exports, which make up 6% of New Zealand exports to the US, have recorded some more substantial falls since the tariff announcement, declining 29% per annum in April, 19% per annum in May, and 44% per annum in June. A slight boost of 15% per annum in July was followed by a 46% per annum decline in August. Exports for this group are sitting 28% lower over the April-August period, a decline of around $74m in value.

These trends are broadly in line with how we expected specific export groups would fare – wine is an elastic good, where pricing differences will shift the dial for consumers, and machinery exports are likely to be larger pieces of equipment, for which any uncertainty over economic trends could cause businesses to pause investment. Continued strong demand (relative to supply) for meat and dairy means those groups have been less affected.

So why the GDP downturn?

Despite weaker NZ exports to the US for wine and machinery, overall NZ-US trade has still increased in recent times. Yet there has been considerable blame for the downturn in economic activity being placed on the tariffs. What gives?

Looking more closely at the unexpectedly large 0.9% fall in GDP (seasonally adjusted) in the June quarter suggests that the drop was a combination of weaker export trends (although this could be a timing issue) and weaker business investment.

Overall gross fixed capital formation (otherwise known as investment) fell 1.1% in the June quarter (seasonally adjusted), led by a 5.4% drop in transport equipment investment, and falls in plant, machinery, and equipment investment (-1.4%), and residential buildings (1.9%). Those falls were confirmed by declines in imports of machinery and plant and transport equipment.

On the production side of GDP, lower construction and manufacturing drove the decline, with the latter dragged down by falls in transport equipment, machinery and equipment manufacturing and, to a lesser degree, food product manufacturing. Taken together, there was clearly a lower appetite for business investment in the quarter which, in our view, was spurred by a sharp increase in uncertainty stemming from the tariff announcements.

That uncertainty saw businesses step back from making investment decisions, with a sharp decline in new manufacturing orders in May according to Business NZ’s Performance of Manufacturing Index. However, this index has regained momentum in the June to August period.

Important, too, is the seasonal adjustment balancing item, which contributed 0.4 percentage points to the 0.9% quarterly decline. This balancing item is “the difference between directly seasonally adjusting total GDP and seasonally adjusting each component of GDP and adding them together.” It sums to zero over the year, so there will be a 0.4% boost across other quarters to compensate.

Taken together, the economic hit in the June quarter was hard, but perhaps not as bad as the headline figures suggest.

1 Comments

Brad, really appreciate your analysis on the tariff impacts.

Just noticed though, your April through August analysis was mostly during Trump's 90-day tariff pause (April 9 to August 7). The full reciprocal tariffs only kicked in at the very end of your study period. So you were really analyzing the threat of tariffs rather than their actual implementation, which explains why trade stayed relatively stable.

The reality is we've gone from 2.5% to 17.4% rates, that's around 600% increase. For comparison, Smoot-Hawley was 48% increase. We're experiencing a shock around 12 times larger in percentage terms, implemented in months.

Unlike interest rates which transmit slowly, tariffs hit fast. If history is any guide, the coming months will bring trade collapse, companies busting, layoffs surging, and debt defaults spreading.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.