In signs that the labour market is definitely improving, job ads are rising at their strongest rate since late 2022.

Employment marketplace SEEK, in its latest SEEK NZ Employment Report, for October, says job ad volumes have risen by 1% for the past four months and are now 7% higher year-on-year.

Official labour market figures for the September quarter from Statistics NZ showed that unemployment rose to 5.3%, up from 5.2% as of the June quarter. However, Stats NZ's NZ Monthly Employment Indicators are now showing signs of increasing filled jobs numbers.

Obviously, Job ads are are clear leading indicator of trends in the labour market, and the indications are that the market is now improving again.

"Annual [job ad] growth has not been this strong since November 2022," the SEEK report says.

Applications per ad, however, rose 2% month-on-month, and remain at record high levels.

The report said monthly increases in job ads were recorded across most industries, the largest being Sport & Recreation (4%), followed by Education & Training, Legal, Construction & Hospitality & Tourism, all rising 3%. Job ads in Information & Communication Technology have risen consistently for 12 months and are now 15% higher year on year.

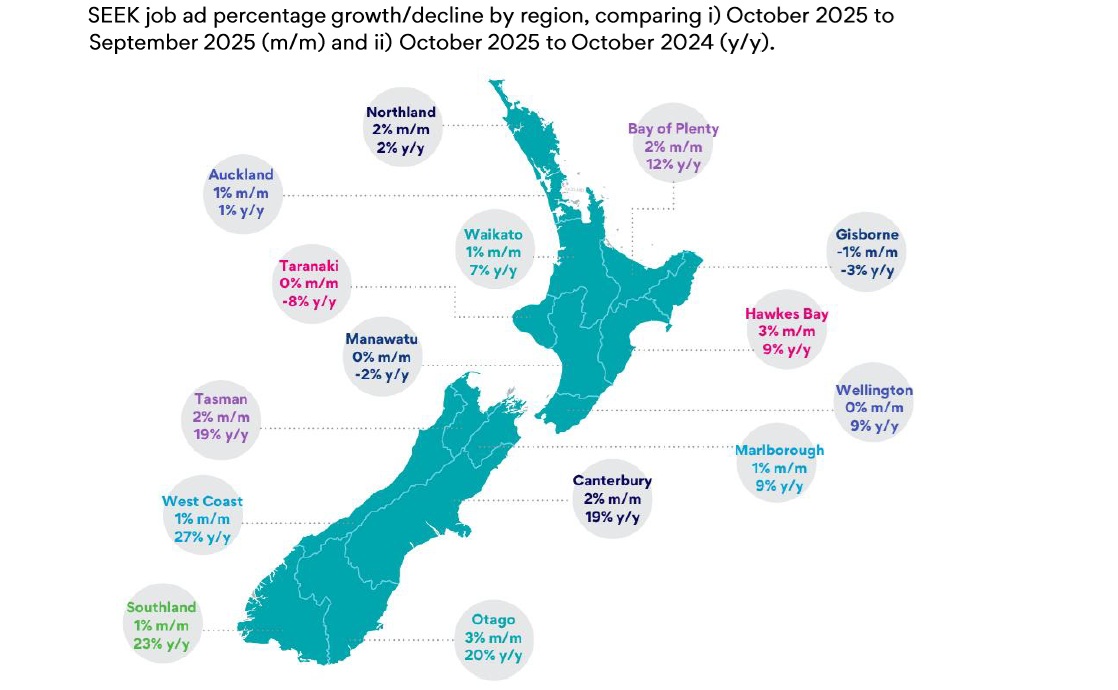

The report said that aside from Gisborne (-1% m/m), all regions recorded either no change, or growth, in October.

Job ads rose the fastest month-on-month in Hawkes Bay (3%) and Otago (3%).

"In perhaps the most promising sign that stability is returning on a wide scale, ad volumes have grown year-on-year in Auckland for the first time after two-and-a-half years of decline," the report says.

SEEK Country Manager Rob Clark said while he's mindful that many Kiwis are still "facing real challenges" in finding work, the latest data does indicate that hiring activity has stabilised after many months of decline.

"One encouraging sign is that this growth isn't concentrated in just one or two areas - we're seeing modest gains across most industries and in most regions around the country," he said.

"For candidates, this represents some encouraging movement in an otherwise extremely tough market."

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.