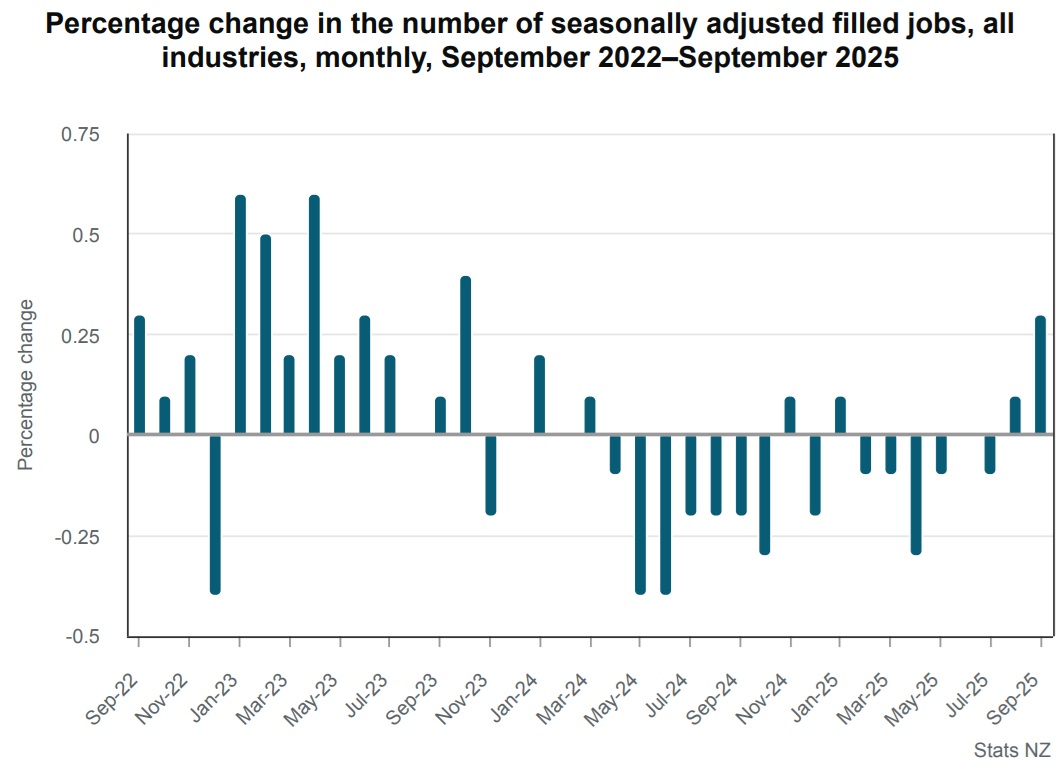

The labour market is turning with the speed of an oil tanker, but there are signs it may now be turning for the better.

Latest Statistics NZ Monthly Employment Indicators (MEI) figures show a 0.3% rise in filled jobs for September.

As ever these figures have to be treated with caution, since they are almost inevitably subsequently revised - and usually down. However, a gain of as much as 0.3% is likely to survive future revisions.

And the latest move follows an originally announced gain of 0.2% in filled jobs in August, which has now been duly revised down, but remains as a gain - now just of 0.1%.

But taken together, the figures across the two months may well suggest the jobs market is turning ahead of the release of official labour market data, and the unemployment figures by Stats NZ next week (on Wednesday, November 5). These forthcoming figures will be for the September quarter.

In the June quarter the unemployment rate rose to 5.2% from 5.1%. The Reserve Bank (RBNZ) forecast in its August Monetary Policy Statement (MPS) that the unemployment rate would rise to 5.3% in the September quarter - but that would be the peak.

The MEI figures are not directly comparable with the official unemployment figures as they are sourced quite differently - coming from Inland Revenue data - but they nevertheless have tended to be quite a good indicator of future trends.

So, these latest figures may give cause for belief that if indeed the official unemployment rate does blip up to 5.3% for the September quarter, then that may well be the peak.

Stats NZ said highlights of the MEI job figures in September, compared (seasonally-adjusted) with the August 2025 month, were:

- all industries – up 0.3% (6,779 jobs) to 2.35 million filled jobs

- primary industries – down 0.5% (534 jobs)

- goods-producing industries – up 0.1% (549 jobs)

- service industries – up 0.4% (6,737 jobs).

In terms of actual (not seasonally adjusted) figures for September 2025 when compared with the same month a year ago, there were 2.33 million actual filled jobs, down 10,647 jobs (0.5%), compared with September 2024.

By industry, the largest changes in the number of filled jobs compared with September 2024 were in:

- construction – down 4.5% (8,982 jobs)

- health care and social assistance – up 1.8% (4,911 jobs)

- professional, scientific, and technical services – down 2.6% (4,853 jobs)

- education and training – up 2.0% (4,332 jobs)

- manufacturing – down 1.7% (3,802 jobs).

By region, the largest changes in the number of filled jobs compared with September 2024 were in:

- Auckland – down 0.8% (6,603 jobs)

- Wellington – down 1.3% (3,241 jobs)

- Canterbury – up 1.0% (3,092 jobs)

- Hawke’s Bay – down 1.8% (1,451 jobs)

- Otago – up 0.8% (921 jobs).

By age group, the largest changes in the number of filled jobs compared with September 2024 were in:

- 15 to 19 years – down 6.6% (7,778 jobs)

- 25 to 29 years – down 2.9% (7,163 jobs)

- 30 to 34 years – down 2.4% (7,079 jobs)

- 35 to 39 years – up 2.5% (6,944 jobs)

- 20 to 24 years – down 2.6% (5,561 jobs).

Stats NZ said that in September 2025 compared with September 2024, the number of filled jobs fell by 1.1% (12,864 jobs) for men and fell by 0.1% (723 jobs) for women.

Stats NZ economic indicators spokesperson Michelle Feyen said there were 914 more filled jobs for women than men in September 2025.

"This is the first time female filled jobs have exceeded male filled jobs, however these figures are provisional and may be updated in future releases."

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.