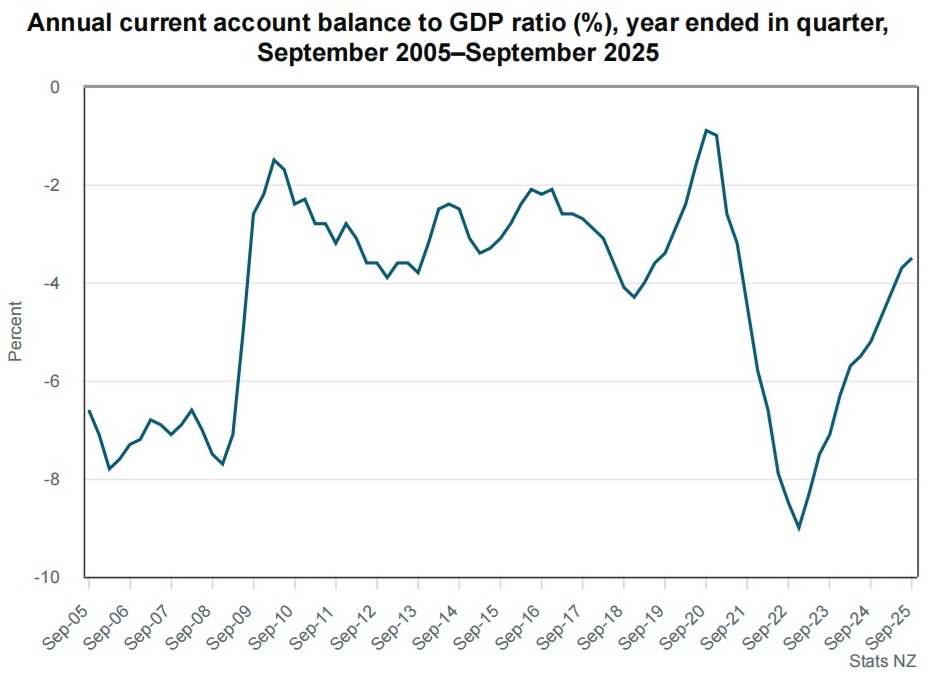

The deficit between what we earn overseas and what we spend as a country has continued to shrink in moves that should please international credit rating agencies.

Statistics NZ reports that in the 12 months to September 2025 New Zealand’s annual current account deficit was $15.4 billion (3.5 percent of gross domestic product (GDP)).

This compares with a $16.3 billion deficit in the year ended 30 June 2025 (3.7% of GDP).

The 3.5% figure is actually slightly higher than some economists were forecasting, although is in line with the Reserve Bank's most recent forecast - which was 3.5%

The latest figure is the lowest since the September quarter of 2021 and is all a far cry from December 2022 when the deficit had blown out to 9% of GDP. A year ago, in September 2024, the figure was 5.2%.

The global rating agencies that assign sovereign credit ratings to this country take a dim view of high current account deficit figures. And they have expressed concern in the past about the level of our deficits. So, these latest figures will provide cheer for them - and take the pressure off our credit ratings.

In terms of the quarterly figures Stats NZ said New Zealand’s seasonally adjusted current account deficit for the September quarter widened by $153 million to $3.8 billion.

"The primary income balance widened by $435 million, while the goods balance widened by $414 million for the September 2025 quarter," Stats NZ's international accounts spokesperson Viki Ward said.

She said in the September 2025 quarter, the primary income deficit was $3.0 billion.

"The main contributor to the primary income deficit was a net outflow of investment income, led by dividend payments overseas," Ward said.

New Zealand’s investors earnings fell $293 million, while foreign investors earnings increased by $200 million.

A key contributor to New Zealand’s lower investors earnings were due to lower profits of New Zealand’s overseas subsidiaries.

Foreign investors earned over two and a half times higher dividends this quarter compared with the last quarter. The increase in dividends paid this quarter was due to several banks paying their parent companies.

The seasonally adjusted goods deficit was $489 million in the September 2025 quarter, following a deficit of $75 million in the June 2025 quarter.

Goods imports increased $801 million (4.0%) to $20.7 billion, led by rises in motor cars and mechanical machinery.

Goods exports increased $388 million (2.0%) to $20.2 billion, led by rises in dairy, fruit, and meat.

in the September 2025 quarter, the seasonally adjusted services balance was a deficit of $148 million, compared with a deficit of $634 million in the June 2025 quarter.

Services exports increased by $434 million to $8.5 billion, led by travel. Services imports decreased by $52 million to $8.6 billion.

In the September 2025 quarter, New Zealand’s financial account recorded a net inflow of $4.7 billion, which partially funded the current account deficit.

"This quarter, New Zealand’s borrowing was driven primarily by the issuance of bonds and shares to foreign investors," Ward said.

New Zealand’s net international liability position was $202.5 billion at 30 September 2025, $6.9 billion lower than $209.5 billion at 30 June 2025.

"International share markets had a positive quarterly performance, meanwhile, the depreciation of the New Zealand dollar against major currencies led to moderate increases in both assets and liabilities," Ward said.

3 Comments

New Zealand’s net international liability position was $202.5 billion at 30 September 2025, $6.9 billion lower than $209.5 billion at 30 June 2025.

Aotearoa's net international investment position (NIIP) is a net liability position - we owe significantly more to the rest of the world than we own in foreign assets. This negative NIIP has been a persistent structural feature of the economy for decades.

The NZ Superannuation Fund (NZSF) and and private pension/KiwiSaver funds help offset large gross external liabilities, but their scale is not sufficient to prevent a materially negative NIIP (around −47% of GDP).

I would suggest the only way we will reverse this is through KiwiSaver and our own offshore capital investments. This will take a long time but in time it will even up. Everything else we have tried has not worked. We need to do to them what they do to us as it works for them.

We need to reverse from deficit into surplus for about twenty years. Say 10%

Ownership, not debt is the way.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.