This article is the executive summary1 from the Reserve Bank's 2024 General Insurance Industry Stress Test Results. The full 25-page article is here.

We use stress testing to assess the resilience of banks and insurers to severe but plausible risks. The 2024 general insurance stress test included seismic and cyber risk scenarios. Seven large insurers which accounted for approximately 80 percent of the general insurance market participated in this stress test.

Financial impact from the seismic scenario

The seismic scenario was based on a very severe event, to enable testing of entities preparedness and recovery plans. The event included a magnitude 8.7 earthquake on the Hikurangi Subduction Zone (HSZ), a subsequent tsunami and major aftershock. This resulted in a sharp fall in GDP and loss of productive capacity. The scenario represented a 1-in-1,200-year loss event. This is beyond the level of risk required to be covered by insurers’ solvency requirements.

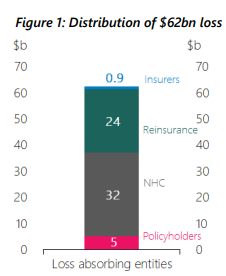

Participants, who accounted for around 70 percent of the general insurance market, modelled $62 billion of losses (insured value of damaged properties).

Approximately half of the claims were paid by the government-guaranteed Natural Hazards Commission (NHC), 39 percent were covered by reinsurance arrangements, 8 percent retained by policyholders and the remainder covered by the insurers (Figure 1). 2

As intended, given the severity of the selected scenario, locally incorporated insurers modelled a significant fall in their capital. The aggregate solvency ratio fell from 168 percent at the start of the stress test to 11 percent (compared to the minimum requirement of 100 percent for licenced insurers) at the end of year 1. In response, participants identified a range of actions to rebuild their capital levels including capital injections, repricing (especially in risk-affected areas), adjustments to reinsurance cover and cost cutting. The identification and assessment of these actions was a key focus of the stress test.

Insights from the seismic scenario

• Despite the severity of the scenario, all policyholder claims could be met. The results of the stress test indicate that existing policyholder claims could be met in this scenario beyond our solvency risk appetite of a 1-in-1,000-year loss event.

• The high proportion of claims paid out by reinsurers and the NHC suggest that policy changes since the 2010/11 Christchurch earthquakes have added to the resilience of the system. This includes the introduction our 1-in-1,000-year loss solvency standard, and the increase in the monetary cap on NHC payments to $300,000 plus GST per dwelling.

• More accurate loss estimation should aid pre-event planning. Catastrophe modelling in this stress test incorporates the latest earthquake science in New Zealand including the 2022 update to the GNS Science lead National Seismic Hazard Model.

• Capital injections from parent companies and ongoing availability of reinsurance were identified as critical to enabling insurers to continue to offer cover following such an event and maintain the functioning of the insurance market. Other actions insurers identified to improve their solvency ratios and continue as a going concern included repricing, adjustments to reinsurance cover and cost cutting measures.

• Insurers expected to pass on higher reinsurance costs to policyholders with properties at higher risk receiving the highest premium rise, hastening the move to risk-based pricing.

• Whilst the stress test is not used for setting capital, we encourage all participating insurers to use the results to inform their solvency positions, including management buffers, reinsurance arrangements and recovery planning. We encourage insurers who did not participate to consider using this scenario in their own stress testing and solvency planning.

• The results highlighted the importance of the Reserve Bank working with the industry to ensure insurers could return to required solvency positions. This includes how we deploy distress management powers rapidly and at scale and how we assess ongoing viability of insurers to avoid any unnecessary winddown of insurers.

• The exercise has provided valuable input into the Reserve Bank’s recovery planning and the next stage of our review of Solvency Standards.3

• A seismic event of the magnitude modelled in this scenario would have far-reaching impacts for New Zealand as a whole.4 While there is a high degree of uncertainty over total economic costs, experience with the Canterbury and Kaikoura earthquakes suggest the Crown could be exposed to over 50 percent, through its indemnity of NHC, coverage of uninsured public assets and funding of recovery support programmes. Ensuring sufficient fiscal buffers to manage such shocks is critical and has been identified as a key consideration of the Treasury’s current consultation on fiscal policy.5

Ultimately, this scenario highlights the importance of all stakeholders, individually and collectively, understanding the risks and preparing for these types of events.

Financial impact and insights from the cyber risk scenarios

The stress test included three cyber risk scenarios: a major data security breach; an outage of an important cloud service provider; and a ransomware attack. These events affect policyholders. The purpose of these scenarios is to assess the size of the cyber-related policyholder claims and the impact on general insurers’ profit and capital.

The reported losses were much smaller than the seismic scenario. However, given the size of the exposure the relative effect on profitability was significant, reducing annual aggregate profit by one-third in the cloud-down scenario.

Insights from the cyber scenario included:

• Reinsurance covered a large portion of claims on insurers.

• Insurers used the exercise to improve data collection, develop modelling, and inform risk appetite.

• The test highlighted exposure of particular industries to cyber risks and the need for greater clarity in policy wording regarding coverage.

Next Steps

Participating insurers provided positive feedback on the exercise. We will be providing them with recommendations and peer group comparisons to support development of their risk management and modelling capability in relation to significant seismic and cyber events.

The results from the seismic scenario will be used to inform our recovery planning in the case of an extreme event. The results will also help inform our current review of the solvency standard.

We will continue to engage with our government counterparts and key stakeholders to support system preparedness, particularly in relation to seismic and cyber scenario testing.

*Insurers that participated and contributed included AA Insurance, AIG Insurance New Zealand, IAG New Zealand, Tower Insurance, Vero Insurance New Zealand, Chubb Insurance New Zealand and QBE Insurance (New Zealand).

1 Key insurance terms used in this bulletin are provided in the appendix.

2 Under the Natural Hazards Insurance Act 2023, sections 108 and 112 obligate the New Zealand Government (the Crown) to provide the necessary funding for NHC claims when the Natural Hazard Fund is insufficient.

3 The seismic risk capital charge is scheduled for review as part of stage 2 of the Interim Solvency Standard review.

4 Some banks highlighted risks from a major earthquake and withdrawal of insurance in its aftermath, in their 2024 Reverse Stress test.

5 treasury.govt.nz/publications/media-statement/treasury-consults-responding-future-economic-shocks

2 Comments

"The seismic scenario was based on a very severe event, to enable testing of entities preparedness and recovery plans. The event included a magnitude 8.7 earthquake on the Hikurangi Subduction Zone (HSZ), a subsequent tsunami and major aftershock."

"Participants, who accounted for around 70 percent of the general insurance market, modelled $62 billion of losses (insured value of damaged properties)."

62 billion appears very low given the Christchurch quakes were estimated to have cost 38 billion (53 billion 2025 dollars)....in the given scenario you could pretty much total Wellington not to mention all the other damage.

Surely unless the Reinsurers were stress tested too, then this means bugger all? The article above acknowledges the importance of reinsurance to this.

Carrying a reinsurance policy implies an assumption the Reinsurer can cover all claims per the policy. That assumption needs to be tested too, within real world conditions, not in an isolated case. Christchurch taught some serious lessons

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.