The roots of responsible investing arose from negatively screened investments at religious organisations.

Around the mid-1700s the Quakers prohibited members from associating with the slave trade. In the early 1900s the Methodist Church wished to exclude companies involved in alcohol and gambling from their investment portfolio. Shariah-compliant investing developed from the 1960s onwards where funds aimed to exclude companies deriving an income from alcohol, pork, and gambling.

Winds of Change

Social issues through the 1960s and 1970s started to influence how investment decisions were being made.

The origins of corporate engagement and proxy voting can be traced back to 1970 in the United States. Ralph Nader proposed corporate responsibility amendments at the General Motors annual shareholder meeting. These sought to address issues like air pollution and vehicle safety. This was supported by a student body at the University of Pennsylvania. The University was a significant shareholder in General Motors.

Negative screening became more prevalent during the Vietnam War where protesters called for a boycott of companies manufacturing weapons for the war. For example, Dow Chemical was boycotted for manufacturing napalm. In 1971 the Pax World Fund was created by two Methodist ministers for the churches’ funds which excluded weapon manufacturers. Anti-war protesters also put pressure on US university endowment funds to avoid investments associated with the war.

Anti-apartheid pressure through the 70s and 80s forced widespread withdrawal of capital from South Africa. The Sullivan principles were created in 1971 which promoted social responsibility as part of a corporation’s code of conduct. One example of these principles in use were by Catholic nuns who were able to confront corporations by filing shareholder proposals via holdings in their pooled retirement assets. The Calvert Social Investment Fund was launched in 1982 which integrated ESG factors and opposed any investments associated with apartheid.

The Exxon Valdez oil spill in Alaska in 1989 sparked the need for more environmental awareness in business conduct. Non-profit organisation, Ceres, was formed as a direct result of the oil spill with a specific focus on sustainable business practises.

The Domini Social Index (now called the MSCI KLD 400 Social Index) was created in 1990 to benchmark several US mutual funds that integrated ESG factors into their investment decision making.

In 2006 the United Nations Principles for Responsible Investment (PRI) was launched which created guidelines for the integration of ESG factors.

The United Nations Global Compact was launched in 2000 which encourages businesses to adopt more socially responsible and sustainable policies.

Responsible Investment Association Australasia (RIAA) was created in 2000, originally known as Ethical Investing Australia.

The Paris Agreement, often referred to as the Paris Accords or the Paris Climate Accords, is an international treaty on climate change, adopted in 2015. It covers climate change mitigation, adaptation, and finance. The Agreement was negotiated by 196 parties at the 2015 United Nations Climate Change Conference near Paris, France.

The United Nations Sustainable Development Goals were adopted by all member states in 2015. The SDGs have progressively made their way into investment management strategies.

From 2015 onwards there has been a proliferation of organisations with a focus on sustainability, including the Australian Sustainable Finance Initiative, Investor Group on Climate Change (IGCC), and the Centre for Sustainable Finance.

The United Nations Climate Change Conferences are global forums for multilateral discussion of climate change matters held on an annual basis.

The Mainstay of Today

RIAA issue a benchmark report each year which provides a comprehensive look into the responsible investment industry in New Zealand and Australia. Some of the key findings in the 2022 benchmark reports were:

Of the total professionally managed assets under management in New Zealand, approximately 49% (NZ$179bn) could be defined as responsible investment, compared to 43% (AU$1.54tn) in Australia.

Of the survey respondents, the most common primary or secondary responsible investment approach in New Zealand was negative screening, followed by ESG integration, and corporate engagement and shareholder action. In Australia, ESG integration was the most common followed by corporate engagement and shareholder action, and negative screening.

Of the investment managers within the responsible investment universe in New Zealand, 92% have a responsible investment policy but only 90% make the policy publicly available. This compares to 87% in Australia (a decrease from 92% in 2021), with 84% disclosed publicly (an increase from 76% in 2021).

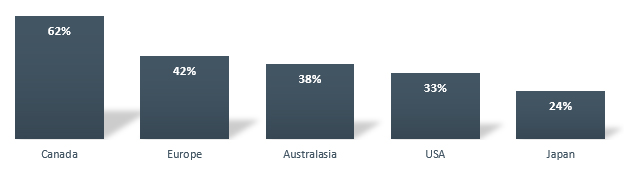

Looking at a comparison on a global scale, the proportion of sustainable investing assets relative to total managed assets differs significantly according to the biennial Global Sustainable Investment Review 2020. Canada had the highest proportion of sustainable investing assets (62%), followed by Europe (42%), Australasia (38%), the US (33%) and Japan (24%).

Figure 1: Proportion of sustainable investing assets (Source: GSI Review 2020)

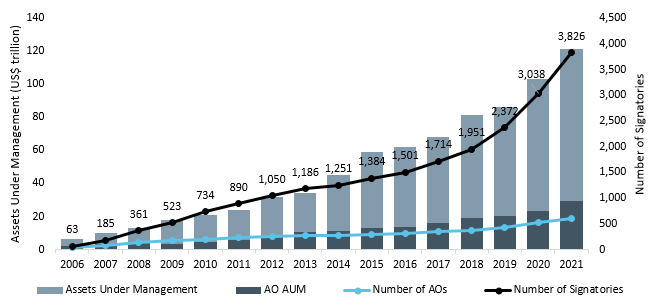

An indication of the growth in ESG integration as an investment approach is shown by the growth in UN PRI signatories in Figure 2 below. The number of signatories more than doubled over the five years to 2021 (latest data available).

Figure 2: Growth of PRI signatories including breakdown of Asset Owners (Source: unpri.org)

Keeping investments on an even keel

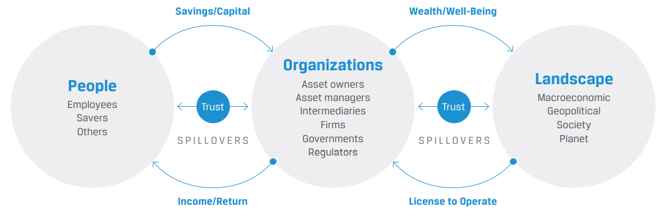

Financial markets, the real economy and broader society are all interdependent. An efficient financial market should reflect the real economy and broader society over the long run, thus ESG issues should impact the ongoing concern of companies. Considering ESG issues will be critical to risk management. ESG considerations may disrupt the myopic nature of earnings announcements that have been a critique of financial markets for years.

Figure 3: The Financial Ecosystem (Source: cfainstitute.org)

The following developments are likely to see the further growth in responsible investment:

Market expectations

Consumers, investors, and fiduciaries will continue to demand more transparency on their investments and how ESG issues are considered. The idea of financial citizenship will grow; the person on the street will become more aware of the role they can play as an investor, for example, by ensuring stronger stewardship of companies as long-term owners via investments in their KiwiSaver fund. Greater transparency on responsible investing will enable a wider group of investors to direct capital where they wish, rather than relying solely on public institutions and NGOs to achieve similar non-financial objectives. Greater market expectations with responsible investing will continue to blur the lines between values and value, so any perceived cost of investing responsibly will be null.

Regulation, disclosures, and standards

Due diligence requirements for investors, financial advisers, and investment managers will increase with the volume of ESG information disclosed. Regulators are progressively implementing requirements for ESG/sustainability disclosures. Standard-setting bodies are developing and improving existing frameworks.

More concrete data

Consistent, objective, and timely data will help regulators and standard setters provide more clarity on their requirements; it will enable investors to make more informed decisions; and ultimately direct capital to align more closely with investors’ intentions. Big data has the potential to advance the link between financial objectives and non-financial objectives.

Technology

Greater freedom of choice will be available with growth in the number of investment platforms available. Platforms will continue to evolve and adapt to the needs of financial advisers and consumers. The range of managed fund products will grow. Competition amongst Fund Managers will help create more effective responsible investment strategies. Greater transparency and awareness will enable investors to decide which strategies are best for them – financial advisers will be at the heart of this.

The latest version of ‘Beneath the Surface of Responsible Investing’ can be found here.

2 Comments

If you listened to these people, you would never have invested in Monster Beverage - +111,000% increase in stock price since 2001.

https://twitter.com/leadlagreport/status/1465290449694900226

An interesting article but in my view, more than somewhat utopian. Fair enough to ensure investors have information available to enable them to invest in activities acceptable to them.

As the author points out it was religious organizations who first discriminated in their choice of investments. But as we know even they suffered from all the usual human frailties,...greed, envy, corruption etc.. In this post religious age with no concept of eternal damnation to guide us, the idea that directors and investors will act with morality is even more fraught.

The growing intrusion of ESG into company consideration is one way to guide behaviour but is it really anything more than a general trend toward "wokeness"? Frankly I find it all very irritating, especially the concept that companies have "stakeholders" to consider, including the general public.

Customers might perhaps have a "stake" in a particular company, but only to the extent that they can choose to buy the product,...or not. But generally a "stakeholder" is someone who has a tangible (financial?) Involvement in the continuing success of a particular enterprise. All these idealistic, but largely ignorant folk who infest modern life by throwing paint, gluing themselves to whatever, are the last people to be graced with the title of "stakeholders" deserving serious consideration?

However, I am not holding my breath. I am guessing I will be increasingly bombarded with company reports telling me how angelic they are,...hopefully without losing complete sight of a need to turn a profit.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.