I'm Adam Stewart, founder and director of Compound Wealth. Over the past decade, I've specialised in KiwiSaver advice, guiding thousands of clients and advising on more than $100 million in funds through platforms like KiwiWRAP.

In my experience, investors with larger balances often achieve better long-term outcomes when they move away from generic provider funds toward personalised portfolios that align more closely with their individual goals, risk profile and convictions.

This article shares my perspective on why the standard KiwiSaver model is increasingly falling short for many, and how open-architecture platforms are offering a more sophisticated alternative.

For most New Zealanders, KiwiSaver remains a simple, set-and-forget vehicle. You select a conservative, balanced or growth fund from one of the major providers, set your contributions and watch it grow over time.

The reality, however, is that this standardised approach—where the vast majority of members are channelled into a limited range of similar funds—hasn't evolved much since KiwiSaver's early days. With total assets now exceeding $123 billion as of March 2025 and continuing to grow rapidly, the system still largely treats investors the same way regardless of balance size, personal circumstances or outlook. There is little room for genuine personalisation or reflection of individual risk tolerance, time horizon or strongly held views on particular markets or assets.

As balances increase through consistent contributions, strong market returns, lump-sum transfers or the upcoming rises in default contribution rates (to 3.5% from April 2026, then 4% in 2028, with potential further increases under National policy), many investors understandably start questioning whether a one-size-fits-all fund is still the best option. In my view, it often isn't. A more tailored strategy can provide greater control, improved diversification and closer alignment with your broader financial plan.

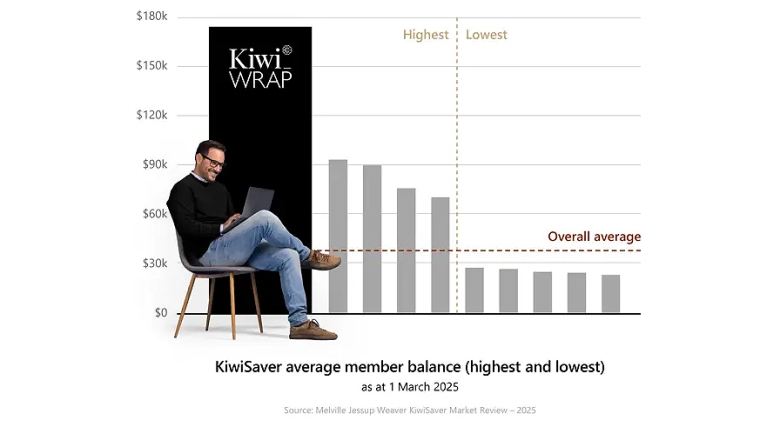

This is where platforms like KiwiWRAP come in. Available only through accredited advisers, the scheme has grown to more than $200 million in funds under management with over 1,000 investors. It consistently records some of the highest average member balances in the KiwiSaver system—around $190,000, nearly double many traditional providers and well above the national average of approximately $37,000. The number of accounts exceeding $1 million has nearly doubled in the past year, reflecting growing recognition among higher-balance investors.

What makes KiwiWRAP different?

KiwiWRAP, managed by Consilium, operates differently from traditional fund managers such as ANZ or Milford. It is an advice-led, open-architecture platform that gives accredited advisers and their clients access to over 400 investment options—significantly more than the limited in-house menus offered by most KiwiSaver schemes.

Portfolios can include:

- Direct shares in global markets

- Exchange-traded funds (ETFs) and low-cost index funds (including those tracking NZ and Australian indices)

- Managed funds from leading specialist managers worldwide

- Bonds and fixed-income strategies

- Gold and silver ETFs

- Regulated crypto ETFs and digital asset proxies

The key advantage is flexibility. If an asset is listed and compliant, it is generally available. Unlike many traditional providers that impose strict caps or guardrails on alternatives or individual holdings, KiwiWRAP has no preset percentage limits on any single asset or class. This allows for truly individualised strategies that can integrate seamlessly with an investor's wider wealth picture while preserving KiwiSaver's tax advantages.

A real-world example

One client approached us with a substantial seven-figure KiwiSaver balance accumulated in a standard growth fund. He sought a well-diversified core but also held firm long-term convictions in precious metals and Bitcoin as potential hedges against inflation and currency debasement.

Using KiwiWRAP, we built a portfolio with a robust core of broad global equity and fixed interest exposure and added targeted satellite positions in specialist ETFs for Bitcoin, silver and gold. These tilts were meaningful but measured, keeping overall risk appropriate. He also benefits from paying a lower effective tax rate on these holdings than he would outside the KiwiSaver structure. The funds remain locked until age 65, which in this case reinforces long-term discipline rather than being a drawback. The outcome is a portfolio that more accurately reflects his views while staying diversified and professionally overseen.

Who is it for?

In my experience, KiwiWRAP appeals to investors who want more influence over their retirement savings, including:

- Long-term savers with substantial balances seeking greater strategic input

- Investors looking to better integrate KiwiSaver with their overall financial position

- Those with specific convictions—whether in global technology, commodities, sustainability or digital assets—who want their retirement savings to align with those views

The vital role of professional advice

This level of flexibility only works with proper guidance. KiwiWRAP is advice-only, meaning portfolios are designed and monitored in partnership with a licensed adviser to ensure compliance, suitability and ongoing adjustments.

This advised model, combined with robust oversight, helps explain why the platform attracts some of New Zealand's largest KiwiSaver balances, including a rapid increase in million-dollar-plus accounts. More than 40 adviser firms nationwide now offer it, and many advisers have transferred their own KiwiSaver balances to the scheme—a strong vote of confidence in its structure.

How do the fees and tax stack up?

Fees and tax are always front of mind for interest.co.nz readers. KiwiWRAP charges a platform fee of 0.29% per year. Underlying investments have their own costs—for instance, the Invesco QQQ Trust ETF has a management fee of 0.20% p.a. There is modest brokerage on trades, mainly for international securities, but no additional layered fund-manager fees.

This structure gives investors real choice: you can construct a very low-cost portfolio using index funds and ETFs, opt for higher-fee actively managed options where you believe the manager adds value, or combine both approaches. The decision rests with you and your adviser. At Compound Wealth, we also provide access to independent model portfolios designed using what we consider best-of-breed managers across different styles.

An adviser fee applies for design, management and reviews; this varies but reflects the individual service provided. Both the platform and adviser fees are generally deductible at scheme level and reclaimed on members' behalf, which lowers the effective cost. Many investors find the overall expense comparable to—or better than—traditional managed funds when weighing the advantages of customisation and potentially lower underlying charges.

Full investment option details and fees are at www.kiwiwrap.co.nz/investment-options.

On tax, KiwiWRAP is structured as a widely held superannuation fund with earnings taxed at a flat 28%. This can prove advantageous versus holding comparable direct securities or ETFs outside KiwiSaver, where income might otherwise face taxation at an individual's full marginal rate (up to 39%). The age-65 lock-in encourages a genuine long-term horizon.

Is bespoke right for everyone?

Not necessarily. A standard approach from one of the major providers can still be perfectly valid for many investors, particularly those who prefer a straightforward, hands-off strategy.

However, once balances become substantial and investors seek greater involvement, the advantages of a bespoke strategy become compelling. The core benefits are increased personalisation and flexibility, combined with ongoing professional advice. A good adviser doesn't just manage the investments—they help you build a comprehensive retirement plan. This includes selecting more appropriate accumulation and decumulation products, providing clearer visibility on how much you might have in retirement, and calculating how much you can safely spend while pursuing your desired lifestyle.

At Compound Wealth, we use advanced cashflow modelling software to help clients visualise their options. This tool allows us to map out different scenarios, stress-test assumptions, and determine exactly how much investment risk you can comfortably take to support the retirement you want—whether that's maintaining your current lifestyle, travelling more, or leaving a legacy.

With KiwiWRAP, this integrated planning layer comes built-in. It gives your adviser the framework to align your KiwiSaver precisely with the rest of your financial life, offering confidence that your portfolio is working toward achievable, personalised goals rather than generic benchmarks. For many clients, this deeper level of planning and insight is what truly sets bespoke apart from the standard KiwiSaver experience.

KiwiSaver for grown ups

KiwiSaver has matured considerably, with assets now well past $120 billion and members becoming increasingly knowledgeable. Yet the majority still sit in default-style growth funds within a framework that prioritises uniformity over individuality.

Platforms like KiwiWRAP represent the next stage: a more sophisticated way to manage New Zealand's primary retirement vehicle, ensuring it works in harmony with your wider portfolio and long-term vision. The range of possibilities—from emphasising global equities to incorporating measured alternatives like gold or Bitcoin proxies—is broad and, when properly advised, empowering.

If your KiwiSaver balance has grown substantially and you're questioning whether your current setup is still optimal, it's worth exploring your options. Email adam@compoundwealth.co.nz or visit compoundwealth.co.nz to discuss your situation. A fresh perspective could make a meaningful difference to your retirement outcome.

Adam Stewart is the founder of Compound Wealth, specialising in KiwiSaver advice, retirement planning, and the construction of long-term investment portfolios aligned with a client’s goals and stage of life. You can contact him here.