By Rodney Dickens To keep in touch with what is happening at the coalface I monitor developments in a range of industries. The recent flow of news about NZ oil and gas exploration has caught my attention and I believe this is an issue that warrants monitoring because it could have a massive impact on many NZ businesses, including a significant negative impact on non-energy exporters. Having dismissed the recommendations of the 2025 Taskforce aimed at closing the gap between NZ and Australian incomes as being "too radical" the government needs to pull a rabbit out of the hat. The oil and gas industry appears to offer the government the only silver bullet available to both solve the major fiscal deficit problem and boost NZ economic growth. Recent announcements by Energy Minister Brownlee highlight the massive impact the oil and gas industry could have on the NZ economy and also signal the government's intention of chasing this opportunity.

By Rodney Dickens To keep in touch with what is happening at the coalface I monitor developments in a range of industries. The recent flow of news about NZ oil and gas exploration has caught my attention and I believe this is an issue that warrants monitoring because it could have a massive impact on many NZ businesses, including a significant negative impact on non-energy exporters. Having dismissed the recommendations of the 2025 Taskforce aimed at closing the gap between NZ and Australian incomes as being "too radical" the government needs to pull a rabbit out of the hat. The oil and gas industry appears to offer the government the only silver bullet available to both solve the major fiscal deficit problem and boost NZ economic growth. Recent announcements by Energy Minister Brownlee highlight the massive impact the oil and gas industry could have on the NZ economy and also signal the government's intention of chasing this opportunity.

I am no oil and gas analyst, but based on my layman's reading of the tea leaves it seems that it is matter of when not if we strike pay-dirt. So this Raving tries to put this issue in context, including looking at the UK experience with North Sea oil. In net, North Sea oil has been a godsend for the UK economy. However, it was not all roses because it is estimated to have boosted the pound sterling by 20%, which had a major negative impact on non-energy exporters. The title to a recent article in The Independent by Kris Hall was: New Zealand 'set for an oil bonanza'. The following is taken from that article:

Renowned for his bullish views on New Zealand's petroleum prospects, William Buechler insists New Zealand is set for an oil bonanza that will eclipse Britain's North Sea oil boom. "New Zealand is at the beginning of a country-changing event; the challenge is going to be to embrace the change and get it right. Activity and momentum are increasing but going under the radar screen." For more than 25 years, New Zealand has thrived on the hydrocarbons produced by its Maui oil and gas field, prompting little in the way of new exploration. However, as global reserves dwindled and the price of crude soared, new exploration has began in earnest. More offshore wells have been drilled in the last two years than the rest of the decade combined: 35 on and offshore wells were drilled between January 2008 and July 2009 alone. Helping drive this activity - some $200 million of exploratory drilling is planned this summer - has been a sea change in government attitude to the petroleum industry's potential, says Buechler, lead portfolio manager of the Kiwi Pacific Fund. "Crown Minerals has been gathering seismic data and offering it for free and that's allowed companies to look at data on a decreased risk basis." Buechler says the scope for economic success from oil is "unquestionable" but investors must act now to get in ahead of overseas backers. Only last week, Todd Energy chief executive Richard Tweedie confirmed Maari and its adjacent Manaia field in offshore Taranaki were home to 100 million barrels of recoverable oil, making it New Zealand's largest crude oil field and twice the original 50 million barrels found at the Tui fields.

Another article on 19 November reported:

The Government is rolling out the welcome mat to foreign oil explorers as new estimates show the country could be sitting on $60 billion of untapped black gold. Energy and Resources Minister Gerry Brownlee said yesterday that by 2025 the amount of now untapped oil and gas off the coast could be worth about $30b a year in export receipts. Mr Brownlee said the tax receipts would amount to about $10b a year "“ enough to wipe out the current cash deficit.

There is nothing new in hype about NZ's oil and gas potential, but a number of factors, including high oil prices, are currently aligned that increase the odds of this potential being realized. The government needs a solution to the fiscal deficit problem and a silver bullet to placate concern about our low standard of living vis-Ã -vis Australia. The 2025 Taskforce recommendations to address the income gap between NZ and Australia, released this week, have already been dismissed as "too radical" by the government (see here). Dr Brash, who chaired the Taskforce, was reported to have responded to the "too radical" comments by Acting PM Bill English by saying, "there may be some other cunning plan, but I'm not aware of it". The oil and gas industry could be the silver bullet the government has in mind. The following extracts from a Businesswire article on www.sharechat.co.nz on 20 November makes interesting reading in the context of the idea that the government sees the oil and gas industry as the answer to both the fiscal deficit problem and boosting NZ economic growth prospects:

A partially privatised, government-backed oil and gas exploration business emerges as a practical option for kick-starting a higher level of activity in the New Zealand oil and gas sector, says a report prepared for Energy Minister Gerry Brownlee by broking firm McDouall Stuart. The report was released with a speech from Brownlee this week showing the government is intent on making a bigger oil and gas sector part of its efforts to achieve a "step change" in New Zealand's economic performance It canvasses options rather than making firm recommendations, but dwells in detail on how a part-privatised exploration and production business would have relatively lower risk than other "significant stretch" options, while building on a range of other actions the government is already taking to boost oil and gas activity. What makes the McDouall Stuart report particularly interesting is the fact that it identifies nine "minimal stretch option" actions that the government could take to encourage oil and gas discoveries, all of which the government is either undertaking or will do in coming months, in the eight point plan of action outlined this week by Brownlee. On top of this, Brownlee also released this week a report from Aberdeen University Petroleum Economics Consultants suggesting that preferential tax treatment under the royalties regime for gas-only reservoirs could be used to make such finds commercially viable. At present, gas is only mined as a by-product of an oil find.

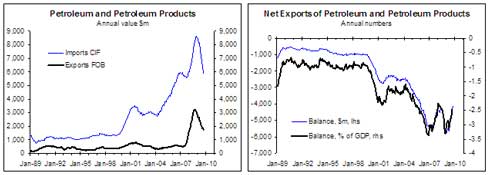

The government has motive to try and find a silver bullet, while Energy Minister Brownlee has shown intent to seek it in the oil and gas industry, but does the industry have the capacity to deliver? I am no oil and gas analyst, but based on my layman's reading of the tea leaves it seems that it is matter of when not if we strike pay-dirt. The appendix contains a selection of related the articles. Putting NZ's oil and gas potential in perspective The left chart below shows the annual value of NZ imports and exports of petroleum and petroleum products, while the right chart shows the net balance of trade in petroleum and petroleum products in both $m and as a % of GDP.  Swings in the oil price have a major impact on both import costs and export earnings, but the left chart confirms the claims that energy is now one of NZ's major exports. If oil and gas exports get even close to the $30bn a year level Brownlee has flagged then it would make oil and gas by far NZ's largest export. To put it in perspective, in the year to June 2009 NZ's total export earnings from all goods and services was $56b. Lessons from the UK experience with North Sea oil It was a drawn out process getting North Sea oil on stream. This Wikipedia link gives a good history. The salient points from the Wikipedia article are below, although the last two points are from a different source:

Swings in the oil price have a major impact on both import costs and export earnings, but the left chart confirms the claims that energy is now one of NZ's major exports. If oil and gas exports get even close to the $30bn a year level Brownlee has flagged then it would make oil and gas by far NZ's largest export. To put it in perspective, in the year to June 2009 NZ's total export earnings from all goods and services was $56b. Lessons from the UK experience with North Sea oil It was a drawn out process getting North Sea oil on stream. This Wikipedia link gives a good history. The salient points from the Wikipedia article are below, although the last two points are from a different source:

- Commercial extraction of oil on the shores of the North Sea dates back to 1851.

- The UK Continental Shelf Act came into force in May 1964. Seismic exploration and the first well followed later that year.

- BP's Sea Gem rig struck gas in the West Sole field in September 1965. The celebrations were short-lived because the Sea Gem sank with the loss of 13 lives.

- The situation was transformed in December 1969, when Phillips Petroleum discovered oil in Norwegian waters. The same month, Amoco discovered the Montrose field about 217 km (135 miles) east of Aberdeen. The discovery of Ekofisk prompted BP to drill what turned out to be a dry hole in May 1970, followed by the discovery of the giant Forties oilfield in October 1970 - production from the field peaked in 1979 at 500,000 barrels per day. The following year, Shell Expro discovered the giant Brent oilfield in the northern North Sea east of Shetland. Oil production started from the Argyll field (now Ardmore) in June 1975 followed by Forties in November of that year, in a 17-year period the Argyll field produced 72.6 million barrels of sweet, light crude.

- The largest field discovered in the past 25 years is Buzzard, found in June 2001 with producible reserves of almost 64×106 m³ (400m bbl) and an average output of 28 600 m³ to 30 200 m³ (180,000-190,000 bbl) per day.

- Now, the North Sea is regarded as a mature province on a slow decline. However, thanks to ever more sophisticated technology, important amounts of oil and gas could be drawn for anything up to 50 years. New discoveries are still being made and the industry is now well established west of Shetland in the Atlantic.

- Two of the key centres of the industry have been the Great Yarmouth/Lowestoft area, centre of operations for the Southern North Sea gas industry, and subsequently, Aberdeen, now regarded as the oil capital of Europe. Other centres of the industry have been the northern isles of Orkney and Shetland. (See here)

The following is from an article by Philip Thornton, economic correspondent to The Independent in 2005. The article is dated in some respects but it is useful in terms of looking at the broader impact of North Sea oil on both the UK economy and on Aberdeen.

The impact of North Sea oil on the UK economic come via economic growth, the current account, sterling, employment, innovation, corporate profitability and the public finances In 2004, for example, oil and gas extraction amounted to £32bn or around 3 per cent of total GDP. Schlumberger Professor of Petroleum Economics at the University of Aberdeen who has written numerous articles about the prospects for North Sea oil, says the discovery of energy reserves has transformed the local economy. He has calculated that while the population of the Aberdeen area fell by 32,000 to 436,000 in the 20 years up to 1971 it jumped back up to 533,000, an increase of almost 100,000, by 1995. However employment in the sector gyrated according to movement in oil prices and the timing of new oil field discoveries. According to a research project led by Andrew Cumbers of the University of Glasgow and funded by the ESRC, the rapid growth of the North Sea oil industry fuelled the development of a cluster of oil-related activities around Aberdeen. A survey of 192 companies and face-to-face interviews with 34 firms showed that there was a relatively high level of innovation among small- and medium-sized enterprises. More than three-quarters (77%) claimed to have developed new products and services in the previous five years. Meanwhile a separate research project at the University of Strathclyde, also funded by the ESRC, found the global nature of the oil industry created potential opportunities for Scottish suppliers, as the same major oil-gas production and oil-related companies can be found in all the key international markets for the industry. Until North Sea oil came fully on stream towards the end of the 1970s, sterling had traditionally been a weakening currency. But rising production of oil and gas from the North turned around the UK's trade deficit in fuels from a peak of 4% of GDP in 1974 into a balance in 1980 and a surplus of 2% of GDP in 1983, leading to a 20% appreciation of sterling's effective exchange rate. The side-effect on the economy in the early 1980s was unfortunate, the rise in the pound's exchange rate had a detrimental impact on the bulk of non-oil manufacturing as factories found their products rising in price in their key export markets. Sir Michael Edwardes, then chairman of British Leyland, was reputed to have said he wished Britain would "leave the bloody oil in the ground". Lady Thatcher, then Prime Minister, did not take that advice.

_________________ * Rodney Dickens is the Managing Director and Chief Research Officer for Strategic Risk Analysis (SRA), which is a boutique economic, industry and property research company. Rodney produces regular free reports on topical issues and on specific property markets. Find out more about SRA here and sign up to SRA's free reports here. Appendix $60b of oil off New Zealand coast? Busy offshore oil and gas exploration season starts Oil seeps to surface after earthquake NZ Oil Exploration: Huge Pay-Off From Taranaki Oil Untapped resource could offer energy boost

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.