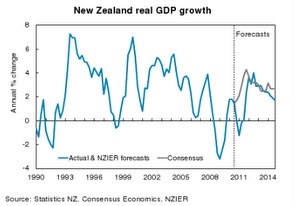

NZIER has cut its growth forecast for 2011 to 0.3% from 2.3% in its March Quarterly Predictions.

“The recovery has been deferred. We have revised down our 2011 growth forecast from 2.3% to 0.3%," NZIER’s Principal Economist Shamubeel Eaqub said.

"Around half of this revision is from underlying weakness in the economy, which will be compounded by a synchronised spike in food and fuel prices," Eaqub said.

"The other half is due to the devastating earthquake in Canterbury," he said.

"We expect the RBNZ to hold the OCR unchanged at 3% through 2011.

"There may be a need for rate cuts, but the RBNZ should fully assess the economic fallout before doing so."

See more detail below in NZIER's release

Canterbury earthquake will cause a substantial drop in outputThe financial and economic costs of the second earthquake in Canterbury are not yet clear but will be significant. Canterbury represents a significant portion of the national economy, with around 15% of national employment. Daily lost production is equivalent to 0.1% of national quarterly GDP.

Delays in rebuilding will reduce GDP by around 0.5% each quarter.

Cautious and considered policy response needed

A targeted fiscal policy response to the Canterbury earthquake will be required. This should include welfare assistance for households and businesses, and accommodation supplement type payments for mortgage and rent relief.

Monetary policy can do little; Canterbury’s problem is not interest rates. Lower interest rates will not fast-track safety checks, insurance assessments and payments or rebuilding. At best it may provide a temporary boost to consumer and business confidence. We believe it would be better for the RBNZ to wait and assess the situation.

Fiscal position should and can bear the additional cost of reconstruction

The Government will face additional costs from the earthquake. However, we do not believe this will reduce the government’s credit worthiness. Even with additional spending we estimate net debt will peak at around 40% of GDP. This is still low compared to our peers.

The Government can also reduce the impact on its fiscal position by re-prioritising capital projects, continuing to re-examine inefficient and costly policies and imposing a one-off levy to help fund the rebuilding of Canterbury, as happened in Australia following the Queensland floods.

5 Comments

http://economicedge.blogspot.com/2011/02/morning-update-market-thread-2…

Equities are shooting higher overnight as the dollar plummets down and has landed directly upon long term support. Bonds are roughly flat, oil rose to the $100 mark and has since fallen back, gold is slightly higher, and most food commodities are slightly lower.

Below is a 60 minute chart showing how the dollar plummeted down to exactly touch long term support, bounced, and then collapsed again. This is a critical juncture for the dollar. Should it break this level, then massive pressure will mount on the “Fed” and our politicians to act. Should it fall rapidly we may see a melt-up of commodities which would further pressure those on the margins

Inside job gets an Oscar

http://www.mediaite.com/tv/inside-job-best-documentary-oscar-winner-not…

Eathquakes ripples out to insurers.

Lloyd's of London insurer Hiscox has suffered a 36pc fall in profits following devastating earthquakes in Chile and New Zealand last year.

http://www.telegraph.co.uk/finance/newsbysector/banksandfinance/insuran…

my usual comment:

GDP is a nonsense measure.

I sell you somehing. You sell it back to me. I sell it to you. You sell it back.

It's good for GDP, but nothing happened.

Roll on a valid measure, properly accounting externalities - natural capital, depletion, stuff like that.

They will never allow it PDK. It's so obvious but having a valid measure would mean they can no longer spin the spin!

Bullshit rules PDK.

http://neithercorp.us/npress/2011/02/how-to-fake-an-economic-recovery/

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.