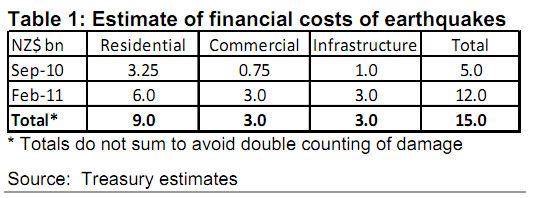

The two Christchurch earthquakes could cost around NZ$15 billion, while the total loss of tax revenue due the quakes could be around NZ$5 billion over the next five years, Treasury says.

In its Monthly Economic Indicators for February, Treasury said there was considerable uncertainty about its NZ$15 billion estimate, "which is best described as a working assumption rounded to the nearest NZ$5 billion".

Finance Minister Bill English said work was still being done on the potential impacts of the quakes, which hit on September 4 last year and February 22 this year, and the flow through to tax revenue.

“But based on these early assumptions, the total loss of tax revenue from all of these factors could be in a range of NZ$3 billion to NZ$5 billion over the five years. This is manageable in the context of the Government’s revenue base of about NZ$330 billion over the five years," English said in a media release.

Nominal GDP, which is not adjusted for inflation, could be down NZ$15 billion over the next five years, English said.

Recovery weaker even before latest quake

Even before the second major earthquake in Christchurch on February 22, the economy had been much weaker in 2010 than Treasury expected.

"As we began to prepare our 2011 Budget forecasts prior to the 22 February earthquake it was our view that the outlook for 2011 was also weaker than in the Half Year Update. The earthquake has now set the recovery back further," Treasury said.

Official figures showed the economy contracted 0.2% in the September quarter, while Treasury is now estimating real GDP growth (which is adjusted for inflation) was zero per cent in the December quarter (down from 0.9% in its Half Year Economic and Fiscal Update in December).

"This result would leave real GDP in the December 2010 quarter just 0.5% higher than the same quarter a year earlier," Treasury said.

In terms of the bigger picture, whether growth in the December quarter was slightly negative or flat was only significant for the near-term economic outlook to the extent that negative data releases can weigh on confidence, Treasury said.

"The more important story is that 2010 was fairly weak as a result of increased household saving, negative events such as September’s earthquake and storms, two droughts that bookended the calendar year, and a further hit to confidence from sovereign debt concerns overseas," it said.

"However, as discussed above, there were tentative signs of recovery taking hold in early 2011 prior to the February earthquake, with growth also expected to be boosted by rebuilding after the September earthquake and the hosting of the Rugby World Cup.

"As a result, we were expecting real GDP in the December 2011 quarter to be around 3.5% higher than a year earlier prior to the recent earthquake," Treasury said.

The February quake would now reduce growth by 1.5 percentage points, meaning real GDP in the December 2011 quarter would likely be 2% higher than a year earlier, as opposed to 3.5%.

Official figures from Statistics New Zealand on December quarter GDP were due on March 24, although it is likely the release will now be delayed due to the February 22 quake.

Here is the reaction from Finance Minister Bill English:

Here is the reaction from Finance Minister Bill English:

The Treasury’s preliminary assessment of the Christchurch earthquake’s economic impact confirms the need for the Government to carefully consider its priorities, Finance Minister Bill English says.

It also points out that economic growth was slower than forecast previously, even before the latest earthquake. This reflects soft domestic demand – as New Zealanders save more - despite exporters benefiting from higher commodity prices.

“At this early stage, our immediate focus is on getting good information about Christchurch’s requirements, and that will tell us more about the scope of the prioritising we need to do,” he says.

“Since being elected in 2008, the Government has taken the approach of protecting the most vulnerable and any spending changes we make will ensure that continues.

“Paying for the earthquake will likely involve a balanced combination of a bit more borrowing in the short term and reconsidering our spending priorities, so we can provide the financial resources needed to help rebuild Christchurch and the Canterbury economy.

“And we’ll also press on with our broader economic programme to reduce New Zealand’s vulnerability to foreign lenders, get the Government’s finances in order and build faster growth based on higher national savings and exports.”

In its Monthly Economic Indicators issued today, the Treasury provides a preliminary assessment of two aspects of the earthquake:

- It estimates the total financial cost of damage from the earthquake at between $10 billion and $15 billion – two to three times the estimated $5 billion cost of the first earthquake last September. This will be shared between central government, insurers, local government and businesses.

- In addition, the wider economic impact of the earthquake, combined with already slower economic growth than forecast in the Half Year Update in December, could leave nominal GDP a cumulative $15 billion lower over the five years to 2015. That is equivalent to about 1.5 per cent of the total value of GDP over this period.

“We're still working through the potential impacts of the earthquake on GDP and the flow-through to tax revenue,” Mr English says. “But based on these early assumptions, the total loss of tax revenue from all of these factors could be in a range of $3 billion to $5 billion over the five years.

“This is manageable in the context of the Government’s revenue base of about $330 billion over the five years.

“It’s clear that the earthquake will have an impact on the Government’s finances – through both increased costs and reduced tax revenue.

“We will work through those issues carefully as we prepare for the Budget over coming months,” Mr English says.

(Updates with table, Treasury comments on growth, link to full Treasury document, Bill English comments)

8 Comments

don't listen to a word these dweebs have to say

Their forecasting track record has been appalling in the last few years

They still think we'll get 2% growth in 2011.......

your right about their track record but pretty much that has been on the high side every single time - I think it could be a lot worse than what they are saying matt

I reckon we are looking at a negative growth figure of 2%+ in 2011 with a possibility that it could go as low as 4% - virtually none of the rebuild that was planned has started yet after hte first quake and this will be delayed further - most of the new build issues wont even begin this year so there will be no help their.

Meanwhile wew were really struggling to keep heads above water anyway before the quake so i think any growth even in 2012 will be minimal and probably not even allow us to creep back up to 2010 figures.

If we factor in a lower dollar, higher fuel and imports, increased food costs and finally man on the streets understanding of paying off debt instead of borrowing more, it could be very nasty.

Now inflation on the other hand ......

agreed, personally I don't think -4% , I think it will be around -2 to -1%

definitely looks like stagflation territory

It would be nice if it forced the Nats to finally make a few of the logical hard decisions, such as a capital gains tax or equivalent land tax, and paring back WFF to its logical function (unlike many on this site, I am not opposed to WFF: its just that paying it to the middle classes is insanity; plus it is at a ludicrously generous level to a lot of people, a disincentive for mothers to go back to work etc)

Plus it would be nice if policy was introduced that encouraged a meaningful share market & the consequent economic benefits. However to be honest I think it is too late for that now, after all the crazy policy decisions over the last 30 odd years (yes, the Nats are as tarnished with this as Labour).

Bit nippy tonight, have lit the fire! Its makes me feel for those poor people in Chch who have no heating options now.

Cheers to all.

Throw in the nascent oil price shock allied to a big slow down in Australia and you might well be looking at some crushingly BAD GDP figures.

I'm continually toing and froing on the merits of a CGT

Surely if any increases in property prices from here are likely to be muted, there won't be much potential revenue coming out of a CGT?

We needed it 10 years ago - maybe not now

WFF is a hard one. I fundamentally don't agree with it. But if we take it away now there will be some negative repercussions. Key's suggestion of removing it for higher income earners is probably a good one

there certainly won't be easy answers over the coming years - its going to be a slog

HELP WE HAVE HAD AN EATHQUAKE AND THE ONLY ANSWER IS TO SELL EVERYTHING!

Asked whether proceeds from partial asset sales could be earmarked for Christchurch repairs, Mr English said they "would certainly help" if the sales went ahead.

"We've got some fairly big commitments we'd like to maintain, such as the ultra-fast broadband," he said.

"Equally, we're not sure yet of the Government's support for reconstruction in Christchurch ... that's something we'll be looking a pretty hard over the next couple of months.

"But in terms of the ability to fund infrastructure without going back to the financial markets, the mixed ownership model may turn out to be reasonably timely."

http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=10709598

Once again idiot Neocons running policy for the National Party are at work, as they know you should 'never let a good crisis go to waste'. And so once again the answer is sell everything, as we don't have much left to sell, todays answer is 'sell the power companies'. Brilliant. Oh and because it is not a complete sell off, we can sell the rest off for the next crisis.

Ask this would Singapore do it- no they would not, they would like 'our' power companies of course. So would the international bankers as they know that New Zealand shareholders will sell.

Speaking of bankers,the 'code words' used in the Goldmans report on selling off our common wealth, demonstarte their thinking:

• NZ investors (rather than foreign) would be “at the front of the queue”;

• The companies would offer good opportunities for investors;

These 'code words' tell the market that if Goodman's get the job they will price the issue to ensure a good 'stag' for all those 'Mum's and Dads'.

More on Goldman's

http://www.ft.com/cms/s/0/c3a18da0-4432-11e0-931d-00144feab49a.html#axz…

A former Director of Goldman Sachs, Rajat Gupta has been arrested in the US on charges of insider trading. He is of course a 'former Director' because as always, Goldmans front ran the market and shorted him first. The use of the word 'former' of course allows Goldman's to distance themselves- in fact he is charged with insider trading while he was a Goldman's Director. And yet we should to trust these sort of people with the part of the common wealth of New Zealand. The Goldman report should be seen for what it is, an advertising pitch poseing as analysis written by a PR flack* all in all not a great combination.

*The NZ Herald article confirming this sorry situation is an interesting piece for other reasons as well, though. Written under Philip Borkin’s byline, the article cites the salient facts about credit card inactivity etc and then seeks commentary from…Goldman Sachs economist Philip Borkin, who conveniently confirms the trend that his journalist self had just gleaned from the figures. Namely, that the Christmas period had not been joyous for retailers and – judging by these figures - the level of spending in the New Zealand is still stuck much where it had been back in the middle of 2008. In all, Borkin-the-economist takes up six paragraphs of Borkin-the-writer’s 12 paragraph piece.

Well, I think this is gonna cost a bit more if John Key goes ahead with this plan

http://tvnz.co.nz/national-news/government-may-buy-quake-hit-residents-…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.