By Bernard Hickey

The Reserve Bank now expects interest rates to stay lower for longer over the next couple of years because of the worsening global outlook, a strong New Zealand dollar and a slow Christchurch rebuild.

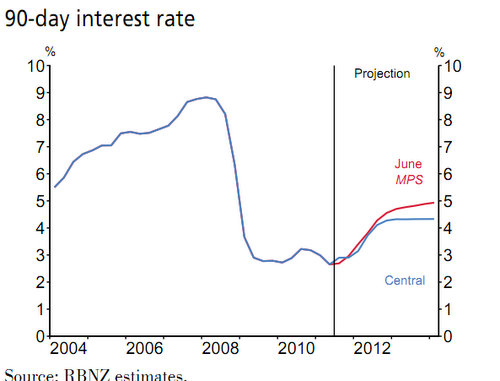

The Reserve Bank of New Zealand announced on Thursday morning it had held the Official Cash Rate (OCR) at 2.5% as expected, but had lowered its forecast track for the 90 day bill rate by around 60 basis points (0.6%) to a peak of 4.3% by the end of next year. This would imply a peak OCR of 4%. See the chart below.

That means the Reserve Bank is now expecting floating interest rates to rise around 140 bps (1.4%) over the next 12 months, rather than the 200 bps (2%) it forecast in June. See the chart below for more detail.

The New Zealand dollar fell from 83.5 USc before the announcement to 81.8 USc by late morning. See our interactive chart below. The big four bank economists shifted their forecasts for the first OCR hike out from December to January or March next year and some reduced their peak OCR forecasts to around 4-4.75% by the end of next year.

Floating mortgage rates have been around 3% above the 90 day bill rate since the Global Financial Crisis, meaning floating mortgage rates are expected to rise over the next couple of years to around 7.15% from around 5.75% now. Term deposit rates would also rise to around 5.5% from just above 4% now.

This forecast of lower interest rates for longer makes floating relatively more attractive than fixing.

The Reserve Bank said the risks of a sharp global economic slowdown had increased since its last forecast in June and the rebuild of Christchurch had been delayed. See more here on the Christchurch earthquake rebuild delay here in Alex Tarrant's article.

It also said it now expected a higher New Zealand dollar and lower commodity prices to do some of the work of lowering inflation pressures, which meant it could keep interest rates lower than it previously forecast.

Reserve Bank Governor Alan Bollard also noted that international funding costs for banks could increase if financial market turmoil in Europe and America did not settle in coming months. See more on that here in Alex Tarrant's article.

“If conditions do not improve, these pressures will see monetary conditions tighten, and banks would be likely to increase lending and deposit rates relative to the OCR,” the Reserve Bank said in its September quarter Monetary Policy Statement.

That raises the possibility that banks could raise mortgage rates and term deposit rates even though the Reserve Bank left of the OCR on hold. The Reserve Bank said actual bank funding costs had not risen yet, but there was a risk they could if the global financial turmoil does not settle in coming months.

What the economists said:

BNZ Economist Stephen Toplis said he now expected the Reserve Bank to hike the OCR by 25 bps on March 8 and eventually hike it to 4.75% by the end of 2012. Previously he had forecast a 50 bps hike on December 8 and a peak of 5%.

We, as has the Reserve Bank, have now abandoned the idea that the Reserve Bank will remove the emergency cut imposed for Christchurch following the February earthquake. For all intents and purposes the Reserve Bank has, in its own mind, replaced the Christchurch emergency with the European emergency. This is probably inappropriate because if you pose the question to RBNZ officials that had they hiked the cash rate to 3.0% in July would they now reduce it, the answer would be no. Nonetheless, that’s the approach that seems to have been adopted.

This is important because the removal of the Christchurch emergency cut implied the first rate increase would be 50 basis points. Potentially, changes in the European situation do not. It is for this reason we have plumbed for 25 as the next move.

There is an outside chance that the Reserve Bank will still need to move this year but outside it is. Importantly, the Reserve Bank’s pick for Q2 GDP, to be published on September 22, is 0.6%. Our view is that the number will be just 0.2% and, conceivably, could even have a negative sign in front of it. If we are right, this will keep the Reserve Bank well and truly on the back foot. Also keeping the RBNZ on the back foot is what is happening to pricing in fixed interest markets and its flow on impact to bank funding.

Currently, global tensions are adding cost to longer term funding for the banking system. At this stage, the quantum of funding being done is sufficiently small that this is having a negligible impact on the Banks’ average cost of funds. However, there is a heightened likelihood that it soon will. That being the case, raised lending charges could yet result in tighter monetary conditions anyway. Any further strength in the NZD would create even greater tightness.

ANZ Economist Cameron Bagrie said he expected the Reserve Bank to raise interest rates, possibly from early next year, before reaching a peak of around 4.5%.

Picking the timing of the tightening cycle looks more problematic. Domestic interest rates still look too low relative to the local inflation and growth outlook. The profile of the RBNZ’s 90-day interest rate track implies an early 2012 start to the tightening cycle. In addition, the RBNZ has stepped away from talking about the “insurance cut” in March, which we take to mean a 50bps unwind is off the table (for now). Even if the global scene settles, it will hardly be stable, so some caution will be warranted when unwinding policy support.

We see stabilisation and improvement in offshore funding markets as a prerequisite to higher interest rates (i.e. the RBNZ will not want to be hiking when funding costs are going up at the same time). Given the scale of Europe's challenges, it seems heroic to think things could be improving by year-end, though policymakers could yet pull a rabbit out of the hat. In this situation the risk profile is clearly tilted towards a March 2012 hike over December 2011.

We strongly suspect inflation indicators will favour the earlier start, with upcoming data such as the Q3 unemployment rate, Q3 CPI and the next inflation expectations readings supporting this. However, tail-risks in the global scene will urge some chance being taken on the inflation trajectory.

ASB Economist Jane Turner initially said she expected the RBNZ to hike the OCR by 50 bps on December 8 and then pause until April next year, before resuming with 25 bps hikes until a peak of 4%.

Then ASB changed its view in a fresh late morning research note, saying it now saw the first 50 bps hike delayed until March 8.

With concern about the escalating debt crisis in Eurozone dominating RBNZ’s outlook, we now expect the RBNZ will leave the OCR on hold until March next year. While there is much uncertainty about both the timing and size of the first OCR increase, for now we see a 50 basis point OCR increase in March as the most likely scenario.

Beyond that, we continue to expect 25bp increases at the subsequent meetings until the OCR reaches a peak of 4%.

Westpac Economist Dominick Stephens changed his OCR hike forecast to a 25 bps hike on January 26 from a 25 bps hike on December 8.

The bottom line is that domestic conditions already warrant higher interest rates, and at some point the RBNZ is going to have to hike into a less-than-ideal global environment. However, that environment has become much more perilous in the last few months, and the complex interaction of financial markets and policymakers makes it impossible to anticipate just how this will be resolved. For now, we believe the most likely start date for OCR hikes is January next year (the RBNZ’s projections suggest March, but we believe emerging inflation pressure argues for a slightly earlier move).

But like markets, we will take our lead on New Zealand monetary policy from developments in Europe over the coming months, and will adjust the short-term outlook accordingly. Markets barely responded to the central bank’s missive. Two-year swap rates fell around 2 basis points, while the NZD fell to a low of 81.77 from 82.55 before. We regard today’s swap rates as too low. New Zealand’s interest rates will have to rise at some point – the mammoth reconstruction task in Christchurch will make sure of it.

HSBC Economist Paul Bloxham said he expected the Reserve Bank to hike the official cash rate by 25 basis points on December 8 and then by a further 125 basis points to 4% next year.

With global markets in disarray, it was no surprise that the RBNZ kept rates on hold today. The Governor reminded us that, purely on domestic grounds, the RBNZ would be hiking, but that concerns about a possible weakening in demand for exports and increase in bank funding costs were enough to keep them benched, for now.

RBNZ is clearly in wait and see mode on global scene, but with a bias to tighten. We still expect rates to rise before year-end.

JP Morgan Economist Helen Kevans said she expected the Reserve Bank to lift the OCR by 50 bps on December 8 and then by a further 100 bps through the rest of 2012 as long as the global economic and financial situations improve.

The statement accompanying the decision, not surprisingly, flagged officials’ concerns about heightened offshore risks. That said, the central message was that, provided recent global developments have only a “mild” impact on the New Zealand economy, the official cash rate (OCR) likely would need to increase.

Indeed, we maintain that the next tightening cycle will commence in December with a 50bp hike to the OCR; this call, though, is heavily contingent on a normalization in market sentiment and ebbing of risks around the US and Euro area fiscal situations. Provided such risks “recede”, and the domestic dataflow stays on its current trajectory, a rate hike before year-end still appears likely.

(Updated with reaction from Finance Minister Bill English, video, chart above showing forecast 90 day bill track, links to articles on bank funding costs and earthquake rebuild delay, NZ$ fall, Bill English video; Full news conference video; Economists comments from HSBC's Paul Bloxham, JP Morgan's Helen Kevans, ASB's Jane Turner, ANZ's Cameron Bagrie, BNZ's Stephen Toplis and Westpac's Dominick Stephens)

Here is the full news conference video here:

Here is the full statement from the RBNZ below:

The Reserve Bank today left the Official Cash Rate (OCR) unchanged at 2.5 percent.

Reserve Bank Governor Alan Bollard said: “The New Zealand economy has performed relatively well while headline inflation has increased somewhat since the June Statement. At the same time, however, global economic and financial risks have increased.

“Domestic economic activity has surprised on the upside and capacity usage appears to have increased. Continued high export commodity prices and, in time, reconstruction in Canterbury are expected to provide impetus to demand over the projection horizon.

“However, the outlook for New Zealand’s trading partners has deteriorated markedly. There is now a real risk that global economic activity slows sharply.

“Global financial market sentiment has also deteriorated. Sovereign debt concerns in Europe and the weakened global outlook have caused international bank funding markets to tighten. If conditions do not improve, New Zealand bank funding costs will increase.

“Largely because the New Zealand economy has been doing better than many others, the New Zealand dollar has appreciated since the June Statement. The high level of the New Zealand dollar is having a dampening influence on some parts of the tradable sector and on imported inflation.

“Annual headline CPI inflation continues to be above the Bank’s 1 to 3 percent target band. However, much of the current spike in inflation has been driven by last year’s increase in the rate of GST, and will therefore be temporary. Wage and price setters should focus on underlying inflation, which, while rising, is currently estimated to be near 2 percent.

“If recent global developments have only a mild impact on the New Zealand economy, it is likely that the OCR will need to increase. For now, given the recent intensification in global economic and financial risks, it is prudent to continue to hold the OCR at 2.5 percent.”

No chart with that title exists.

57 Comments

More likely cuts to the OCR (reading between the lines).

yep....as we progress towards the end of the year look for that 140basis points to shrink....by Decembermaybe they will think 50.....assuming the Europe Union has not exploded as Greece defaults and is ejected.....or leaves.........so riot time.....and when it does the OCR will see cuts....

So who's in the hyper-infaltion camp still? sems to be shrinking as we stare at the abyss of a Depression....

Welcome to the Great Austerity...

regards

Bernard, why do you waste time publishing comments from the bank economists, they haven't a clue. Alex Tarrant makes the same mistake. Just look at the facts, bank economists say "OCR will go up", then next week "Oh, the OCR willgo down", blah, blah blah. They don't have a clue, don't listen to them. Go back and read what they said under Alex Tarrant if you don't believe me. If you want to know what the OCR will do then follow Steven, he has been consistent and correct all along.

Well how close was I ... Bernard...?

No doubt the P.I's will take it as a win...the savers as a kick in the nether regions..while the local banks will have mixed feelings about the impending cost of borrowing.

It's what I expect....but now the real market for credit is leaving Bollard's ocr game in the rubbish bin......As the banks in Europe are exposed as being utterly bust, the cost of credit will rise because those that survive will still have losses and the rush will be on to recapitalise...to get cash fast. That rush for cash will smash into mortgage holders here who are too bloody slow to fix but even if they fix the terms on offer are so short as to be a joke. Soon as the short terms end they will get a boot in the head.

The aussie housing bubble is on a fizzer like a party balloon let go...and we know what that will do for the aussie banks...they too will need capital fast....cash....your cash!

Bollard will keep up with the charade that he can pork growth with a low ocr...but in truth the RBNZ is now sidelined as useless. The massive Kiwi property debt mountain remains and from here on in it is set to cost more and more to finance.

Consider how much better off we would be had earlier govts and this current one, pushed thrift and prudence down the throats of Kiwi.

As for Bollard's comment that underlying inflation is only about 2%.....and he's serious....jeez oh dear what a joke.

Not as bad as the spin overnight regarding Greece, Bollard is just a small fish in the ability to move markets with a few well chosen words.

Interesting perspecitive....

"the rush will be on to recapitalise"

Supply and demand......If ppl dont want to lend then the interest rates will climb...so for the EU and US banks, yes the wholesale rate will go up.....however the lenders want to lend......so they will be looking for safe havens.....witness that NZ Govn recently sold bonds at a lower interest rate than expected as proof that is a possibility. So actually as the money floods out of the EU it has to go somewhere.....if its the USA, they are charging investors to hold money......and there is a risk the US Govn will tax or seize it....so the choice is in a nice (relatively) safe NZ Govn bond or sitting in a US bank that with CDs's could blow at any time and fast (why do you think ppl are buying US treasuries and losing money on the deal?) Note also that the AU and NZ banks have suffered very little share price losses recently.....compared to the EU and the US....

Th OZ banks are a bigger worry...even not being with them wont protect me I suspect....if the ex-CEO on Kiwibank bailed because he could see this coming....he's one of the wiser ones...

Bollard cant pork growth, at best he can slow the decline....he's between a rock and a hard place...

lets not blame HC and Cullen too much, they ran a surplus which in a boom is the thing to do.....and at least Cullen saved some.....Lets not forget taht Brash forced Cullen to boost WFF in order not to lose teh 2005 election....Then in 2008 Jelly Key and Buggered English promptly did a tax cut for the rich aka President Bushy when the could see this was going to be bad.....

Bollard is correct, core or underlying inflation is about 2% and its falt, ditto in the USA....it seems you are not capable of understanding even some basic economics....despite repeated telling.

I will try again CPI is volitile and misleading....core gives you the annual trend, which is what teh OCR is set against.

regards

Lets not forget taht Brash forced Cullen to boost WFF in order not to lose teh 2005 election....

You still spouting that BS that WFF wasn't Cullens fault. I didn't see anybody holding a gun to his head. What about interest free student loans - who forced that one?

Then in 2008 Jelly Key and Buggered English promptly did a tax cut for the rich

Tax cuts were the right idea - the average wage/salary earner had been overtaxed for nigh on a decade to support Labour's bloated government. What National got wrong was not addressing the spending issues (WFF etc) properly, implementing the incorrect tax brackets and thresholds and not broadening the tax base properly.

Those tax cuts are why we are borrowing so much now. And before moaning about middle class welfare, how about commenting on the upper class welfare (i.e., bailouts), and noting that in other countries it's the erosion of the middle class that is being linked to the economic mess that countries like the US have got themselves into.

Point is, both are as bad as each other, the only difference is who benefits.

I agree totally that both (all) are as incompetent as each other.

I disagree with the upper class welfare as well hence my point on the tax brackets and thresholds. The middle and lower class received less of a benefit than the upper class.

I moan about any type of welfare because it doesn't address the problems/causes of why any one group needs welfare. Handouts don't fix the causes.

The tax cuts are partly why we are borrowing. Not addressing spending is also why we are borrowing so much now. Like any responsible household you won't slash your revenue without addressing your spending.

Seems to me that this whole GFC has actually rewarded the kind of behaviour that caused the mess in the first place.

yep....hence the next dip is going to be way worse and I suspect un-stoppable til we hit the bottom.....its going to be a bowel moving 3~6 years.......

regards

Bolly was seen entering the thinking box talking to himself "what can I say to get the AUDNZD back to 1.31" ??????????.

more fuel for the housing market obviously - who would be a saver ?

No, only a nutter would be buying houses...IMHO.

But be my guest, buy 5 or 6 more.....

regards

Quite right SK....when the wheels start to come off..."go faster faster". It's the prudent thing to do. All the more reason to stay as far away from a mortgage as you can get. The worse the wobble gets...the fewer people willing to take on debt....leap to safety while you can...

lower rates for longer - not going to encourage people to be prudent is it.

depends on how you look at it.....from my angle its going lower because ppl are being "overly" cautious and not borrowing.....

regards

My savings are being "robbed" by interest rates that do not match inflation.

Isn't now a perfect time to get into debt? High inflation & low Interest Rates?

Or do you think interest rates will skyrocket? I can't see that happening in the next 5 years personally.

FYI updated with links to Alex's story, video, chart and NZ$ fall,.

cheers

Bernard

FYI updated with HSBC's Paul Bloxham expecting a 25 bps hike on December 8 and a further 125 bps next year.

FYI updated with JP Morgan's Helen Kevans expecting 50 bps OCR hike on Dec 8 and a further 100 bps through 2012 as long as Europe and America don't meltdown.

cheers

Bernard

Not a change in hell of any OCR rise in December, or in 2012.

And yes Europe and the USSA will meltdown guaranteed, its just a case of simple mathematics.

There ain't much horsepower left in the debt fuelled consumption engine.

Thats the key, if they dont melt, fat chance....but even if they dont.....raising the OCR as we stagger along is rather....daring shall we say....

regards

FYI updated with ASB Economist Jane Turner saying she expected the RBNZ to hike the OCR by 50 bps on December 8 and then pausing until April next year, before resuming with 25 bps hikes until a peak of 4% by the end of 2012.

Updated now with fresh ASB note.

ASB have now put out a fresh late morning research note revising their view to a 50 bps hike in March rather than December.

cheers

Bernard

It is stil December...but 2013

hehehe...but whats makes you think it will be fixed in 2 years? I dont, 2 decades maybe.....so 2031....

;]

regards

Bollard making sure Key and Co have a smooth ride through November.

No $2.50 petrol until after the election.

While Key should be able to rout the opponents without help it just shows how insecure he may be feeling despites the smiles and waves.

The greasy pole awaits.

No need for Bolly to be a wily old fox on Jolly Kid's behalf ... Goofy and Cunny are ensuring that the Nat's are a shoe-in , come November . And if the other AB's do their bit too , the rout of Labour will be legendary .

[ .. is the Prime Minister of Poland expecting a visit from Jolly Kid ? .. ]

If you accept the EU is going to blow.....and it will, then when it does we will be looking at a depression which will collpase the price of oil to $35USD again......it will stay there for a bit and come back to $80USD.....eentually it might rise to $120 again and then something else will blow......rinse and repeat for the next 30 or so years.

regards

Interest rates arenot going up too much in the future, that's good for business,farming and of course the housing market.

It is only good for those who are over-borrowed.

Any business, farm, home owner worth their salt should be able (and should have a plan) for interest rates at 9% plus irrespective of whether it is imminent.

The banks fall over themselves to encourage waste and that is why house and farm prices are unjustifiably high. They know they will be bailed out as they assume they are too big to allow failure.

I dont think its so much the 9% as the collaps in payouts....it seems that dairying is working on $7 a shot for their payouts.....in a depression that could and will go a lot lower....so even if we have a OCR of 1% if the payout is substantially under $5 quite a lot of over-levaeraged farms are toast.....and then its the banks turn......and BE doesnt think it will effect us much? dunno about that...

Allowed to fail? I bloody well hope so, just look at Ireland and then look at Iceland....cant see how JK and BE would get re-elected in 2014 if that happens......mind you Labour? oh god....

We're so f*cked if they get a bailout....

regards

Updated with BNZ changing its view to a 25 bps hike on March 8 from a 50 bps hike on December 8. It has also lowered its forecast track to a peak of 4.75% from 5%.

The RBNZ is currently forecasting a peak 90 day bill rate of 4.3%, which suggests a peak OCR of 4%.

cheers

Bernard

If Elliot wave theory is anywhere near correct.The next down should be as bad as 2008 or worse..Its interesting looking at the PIGS. As their really isnt anyway out now, default is almost certain, in fact it might be necesary. If you look at Greece it once had an agricutural sector that was working for Greece. When it joined the EEC..Greek farmers were paid not to produce...The Germans put in Supermarkets and imported food from outside Greece and made a lot of money.Did the germans realise what they were doing? the Pigs were ripe for a payday loan, but..a good parasite doesn't kill its host,but this fact has been totally ignored to the point where the host has no blood left to give and is dying.When ordinary people have to go out onto the streets to protest, because they have to pay for decisions,they had no part in,which impoverished them..We are definiatly looking at a change in the social order..any new government which springs from this will not consider itself liable to past debt.

You dont need an elliot wave theory to tell its going to be way worse than 2008.....its even worse than the Great Depression.....its laughable that Obama is calling for Leadership from Europe, he who touchs his toes for the Republicans, banks and any other lobbyist with $.

"any new government which springs from this will not consider itself liable to past debt."

I hope so.....

regards

But of course you would say that

You have to have a giggle at all these bank economists. Have they ever got a forward projection on the OCR right over the last year or two? Not that I'm aware of. Why don't they just say that due to the volatility and uncertainty surrounding global markets at the present it is impossible to predict with any accuracy what the OCR will be in 3 or more months, and by when and how much it will move. Rather that, than looking stupid, serially stupid.

yeah must be a cushy number being an economystic - they can put out a whole lot of nonsense without affecting their pay at all ! why dont the banks sack the lot of them and use the savings to give us all lower bank fees. If the banks need forecasts they can ring Ken Ring or similiar and probably get the nonsense for free..

Or even better, just read the nonsense here for free

Economists know 100 ways to have sex they just don't know any women!

"Australia’s central bank, which pays its governor more than Federal Reserve Chairman Ben S. Bernanke and European Central Bank PresidentJean-Claude Trichet combined, will for the first time lose its sole power to set compensation for its board and executives, Treasurer Wayne Swan said." bloom berg

Hmmmmm...I don't fancy the aussie govts chances when the next election draws near...poking the RBA money bag bosses in the eye while fingering their wallets, is a recipe for rate rises when you don't want any.....and Swannie can kiss goodbye to a seat on that board and every bank board too...

Bank of MB Economist forecast : Dec cut. to 2.0. March 2012 1.5. July 2012 1.5. Jan 2012 QE starts in NZ

FYI from NZMEA via press release:

The Government and the Reserve Bank must take ownership of the overvalued exchange rate say the New Zealand Manufacturers and Exporters Association (NZMEA). It is not acceptable just to decry the effects of a high New Zealand dollar. Other countries are taking action and it is long past time for our policy makers to the same.

NZMEA Chief Executive John Walley says, “There was some talk at this morning’s Monetary Policy Statement about the Swiss intervention to reduce their currency, whether non-tradable inflation would be a better target for the Reserve Bank and on additional tools that could be used. Unfortunately we see no action and the resulting decline in the tradable sector.”

“The Swiss said what they would do and got on with it; to date it has worked. A firm commitment from the Reserve Bank to target domestic inflation would immediately see the dollar fall. Currency traders know that another tool would have to be used as interest rates don’t work against domestic inflation.”

“Reserve Bank Governor Alan Bollard freely admits that a high exchange rate is keeping inflation down – this has been happening since 2005 and it is no surprise that the same point marked the beginning of the tradable sector’s decline.”

“The Statistics New Zealand Survey of Manufacturing released this week shows the same trend; added value exports to the United States and Europe are becoming less and less viable.”

“A future relying on raw material exports is a low growth and low wage future. The Government and the Reserve Bank need to work together to find a solution.”

Updated now with full news conference video, Westpac reaction, Bill English video

cheers

Bernard

Revised Bank of MB forecast: 50 BP cut Dec 2011. 25 bp. Cut in Mar 2012. We are revising every hour as we have no idea what is happening globally - we just wish we could get back to the 'old' normal when we could predict rising rates and hurry people along. .. we really have no idea. .. you may as well keep floating for the next few years ...

I've been reading local bank economist crap for over 2 years and it s the same old self serving bullshit; "we think the ocr will rise again in 3-6 months time by blah blah points, so you better bloody well get down to my employers bank and fix your DAMN mortgage at a god damned high rate for 5 years, otherwise you will bloody well miss out !" (.......on not getting screwed over... sarcasm absolutely intended). Economics is an especially dismal science when you look at the nonsense spouted by this lot, urghhhh.

Haha ... maybe iPredict may be more accurate! I think it's the 'shock' strategy they are using on borrowers - get them anxious, then relieved, then anxious, then ....widen those margins and maximise the profit ....

I have been reading the same kind of c... from many uniformed and opinionated bloggers on this site who have been no more accurate than those so called bank economists.

As for self serving, many economist have been clear that there is clear choice in regards to rates:

fix for certianity or float for lower rate and flexibility.

As more wanting people to fix the margins Banks are making more on floating rates so why would that want all borrowers to fix at a lower margin????????????

8 months ago this is what they predicted for: December 2011: "projections are: ASB and Westpac expecting the OCR to end the year at 3.75%, ANZ expecting 4.00% and BNZ 4.25%." How many customers fixed for 2 years or so on the basis of that "prediction"?

You can only make predictions based on the infomation avaialble at a certian time.

A prediction is just that: not a certianity or going to be a fact rather one persons opinion based on their assessment of facts at that time.

They have been very wrong for 2 years because they cannot admit that the global financial system has drastically changed .... their narrow modelling tools do not allow systems thinking or major changes in borrower behaviour. Also they cannot allow transparancy of their margins of their debt products to Joe customer ... e.g. the mystical break fees or Floating rates rise either on the back of the OCR or if it suits from offshore borrowing ...

Break fees for fixed rate loans are a real cost of exiting a contract. Google Swaps and you might understand.

But its interesting that KiwiBank, the Holly Grail of Banking, break fees are twice that of some other banks.

Rember also OCR is only one infuence on pricing at it is the rate RBNZ charges banks on their settlement shortfalls with them.

What a joke, thankfully economists dont forcast the weather, they would say every day is going to be sunny. If Jim Hickey was an economist he would be giving sever weather warnings, and heavy rain warnings. A financial storm is comming in from the north, European cyclone Debt, is due hit soon.

Skudiv, in my flying days we used to call the met service the 'department of science fiction' as they usually had no idea what the weather was going to do and often just made it up. I remember one day not being able to get airborne because the met was telling me there was a major storm over the airfield I was flying to. My mate actually at said airfield was calling me up on my mobile and asking where I was as it was a beautiful still autumn day there...

Am not sure what to call economists... one high level Westpac economist actually laughed at me like I was a silly child in June/July when I dared to suggest there might be no hike from Bollard this September...

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.