Influential stock broker JB Were has recommended its clients reduce their exposure to the New Zealand stocks, arguing they were trading as much as 15% above global stocks, rising interest rates would generate a headwind for New Zealand next year and there were rising political risks given a potential change of government.

JB Were Strategist Bernard Doyle said in a research note released to clients on Friday that initial warnings about the New Zealand market in October had not been assuaged in recent months.

Doyle said the local NZX market continued to trade at a 5-15% premium to global stocks and the New Zealand dollar was elevated against all its trading partners.

Higher interest rates in New Zealand would also be a headwind, as would the potential for US Federal Reserve tapering of Quantitative Easing.

"The 2014 election will be an important development for the local equity market. We don’t like the binary risk this presents to investors," Doyle said.

"This backdrop leaves us underwhelmed with the risk-reward presented by the local market," he said, adding however he didn't necessarily think New Zealand stocks would fall in 2014.

"It simply reflects we don’t believe investors are likely to be adequately rewarded for the risks they bear in this market," he said.

JB Were had maintained a 'neutral' allocation to New Zealand stocks since June 2011, he said.

The New Zealand market's premium to global stocks was 7% as of November, although the tailwinds that had elevated valuations were beginning to reverse.

"Firstly, as global economic recovery becomes entrenched, investors are becoming less interested in safety and more interested in growth," Doyle said, adding New Zealand was not a growth-focussed equity market.

"Secondly, economic recovery is translating to rising bond yields – something the Federal Reserve’s tapering of Quantitative easing will probably extend. This will make New Zealand’s dividend yields relatively less attractive to investors. In addition to rising bond yields, higher interest rates engineered by the Reserve Bank are also likely to hamstring our market," Doyle said.

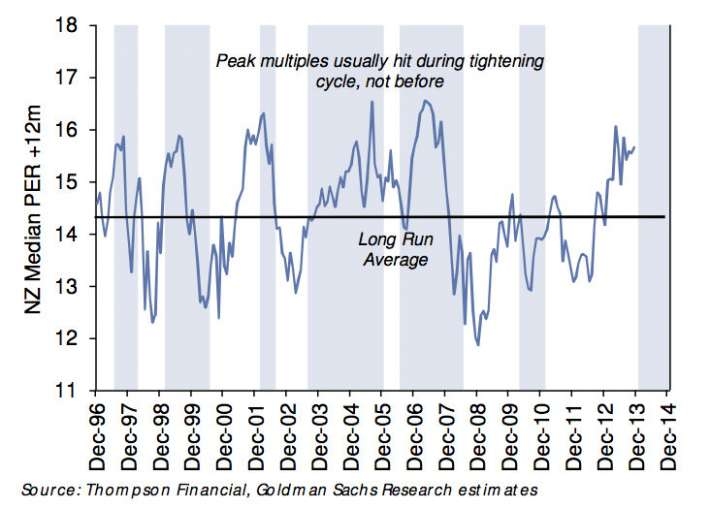

He also pointed out New Zealand's stock market struggled to grow its price to earnings multiple when interest rates were rising in New Zealand.

"So with the RBNZ likely to raise interest rates sometime over the first half of next year, further multiple expansion, which fuels the >20% returns our market has enjoyed, seems unlikely," he said.

The looming election likely in November 2014 was also a factor to watch, given unusually significant policy differences between National and the Labour/Green/NZ First block.

The Labour/Green NZ Power policy affected about 15% of the New Zealand stock market, while "less formal policy comment has also raised uncertainty around the regulation of Sky City, and to a lesser extent Fletcher Building."

Doyle's warning follows comments reported by David Hargreaves on Friday from a global fund manager that New Zealand was as risky as Pakistan, while Mark Lister from Craigs Investment Partners last month argued in this NZ Herald piece investors should reduce their New Zealand exposure last month.

JB Were is 80.1% owned by National Australia Bank, which owns BNZ in New Zealand, and 19.9% by Goldman Sachs.

(Updated with more detail and chart)

7 Comments

Quick Bro, buy my Xro shares, so i can buy some houses with the proceeds, that much more safer. No bubble there.

Are JB WERE still part owned by that stellar performing and uncorrupt company GOLDMAN SACHS?

We are now 80.1% owned by NAB and 19.9% owned by the Australian arm of Goldman Sachs. NAB is the parent company of Bank of New Zealand, which gives us a strategic relationship with one of New Zealand’s most significant banks. Read more

Seems as though NAB is intent on divesting itself of anything New Zealand, including it's unsecured claims on BNZ

So in summary, NZX is overpriced and best to avoid. NZ housing is also bubbling away and best to avoid. NZD is way too high, manufacturing cost is also high..

Great future NZ... give all your moolahs to Destiny, it might save you on judgement day..

Could this be a ploy by JB WERE to get people to divest themselves of investments in NZ so that they can plunder the markets at a lower cost themselves;

Its perfectly true , the NZX is mostly overpriced, yields are too low relative to risk, and the strong currency is likely exacerbating the issue .

Interestingly , in the past 12 months many NZX share prices increased way more than Auckland house prices.

The government was right to unlock some value from SOE's when it did.

The NZX 50 capital index hardly made a GFC come back.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.