Content supplied by Infometrics

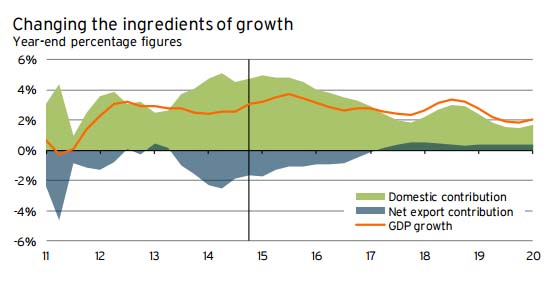

The New Zealand economy has drawn praise from connoisseurs around the world over the past year, with a perfect balance of ingredients pushing GDP growth above 3%pa.

Migrants have come from far and wide to sample our fare, while bubbles have continued to flow on the party circuit for construction and housing market participants.

Although the regions have kept the pantries well stocked with fresh primary produce, critics claim that our dairy products will struggle to cut it against a growing supply of European milk, and so must now be priced down accordingly.

Given these low dairy prices, at a time when growth in residential building consent numbers in Canterbury is being removed from the menu, economic growth is set to cool.

We forecast that GDP growth will reach an eight-year high of 3.7% pa in the September quarter, but be turned down to a simmer after that.

Fearing these cooler conditions could unbalance the development of flavours in the growth broth, the Reserve Bank has recently decided to cut back on spice and reduce the official cash rate to 3.25%.

This move is not without its short-term risks to prices, particularly if more people select the Auckland housing market to add some fat to their investment portfolios. However, Head Chef Wheeler is confident that the economy’s plentiful and diverse workforce means that the economy can keep cooking at a reasonable pace, without these price pressures becoming too persuasive.

Furthermore, plans are in the wings for a special menu to ensure that Auckland property investors maintain a diet that won’t upset the country’s sensitive financial digestive system.

Despite Head Chef Wheeler’s best efforts to shore up demand for the status quo in the short-run, our forecasts still show economic growth cooling to 2.3% pa by the end of 2017. This cooling occurs even as a scaling up of construction activity in Auckland offsets a winding down of the Canterbury construction party. Disappointingly, this transition is likely to be served with a side of unsavoury pressures on building costs.

Consumers and businesses’ appetites to spend and invest will gradually fade over the forecast period. To prevent any capacity going to waste, our economy will need to overhaul its balance of ingredients over the longer-term towards more of an export focus.

Pressure for a change in diet will become increasingly acute as an expanding current account deficit forces out the belt buckle a couple more notches. It may take a while for everyone to acquaint their palates to the new flavours, but we do see scope for an increasing focus on service exports and a recovery of goods exports, particularly as the New Zealand dollar depreciates. Even so, GDP growth is still forecast to have slipped to a lukewarm 2.0% pa by March 2020.

Population and demand support growth for now

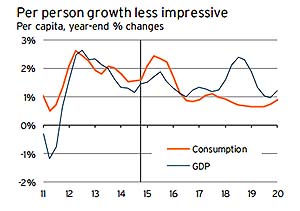

Surging net migration has pushed up population growth which, coupled with strong demand for employees, has seen all economic indicators firm. Employment, consumption, investment, and GDP all rose strongly in the March 2015 year.

We expect population growth to remain elevated over the next two years, helping to push up both the volume of consumer spending and economic activity by 2.9%pa.

However, from 2017 onwards, the economy will be in transition.

A combination of easing growth in business and household spending and slowing population growth will drag down the rate of economic expansion, while a lower dollar will help to drive an improvement in net exports.

Overall growth in economic activity will moderate, with GDP increasing by an average of 2.5%pa in the three years to March 2020.

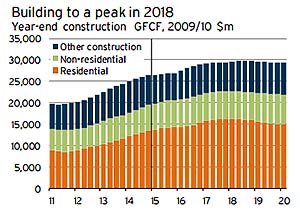

Construction sector pressures intensify in 2016

Falling infrastructure spending is leading to slower growth in total construction activity this year, but a catch-up in infrastructure investment is likely during 2016.

This lift will coincide with a strong increase in the residential build rate in Auckland, stretching capacity in the construction sector and resulting in significant building cost increases in 2016/17.

These pressures will lead to the transfer of resources from Canterbury to Auckland, particularly as residential and infrastructure work in Canterbury starts to wind down.

Total construction activity is expected to peak in 2018, as slowing domestic demand and a rising unemployment rate put a dampener on residential investment intentions.

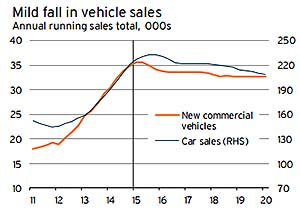

Vehicle sales volumes to be gently pruned

Car and commercial vehicle dealers have enjoyed boom times over recent years, but the coming years are shaping up to be a little leaner for the sector.

Not only will a depreciating New Zealand dollar gradually put upward pressure on prices, but many businesses and households have already taken advantage of favourable buying conditions to replace aging vehicles this business cycle.

Nevertheless, falls in sales are unlikely to be anywhere near as bad as in the last business cycle, due to relatively favourable interest rates on vehicle loans, high levels of employment, and elevated construction activity.

Over the five years to March 2020, we expect total car and new commercial vehicle sales to both fall by an average of 1.7%pa.

9 Comments

"ladies and gentlemen: place your bets"..

You forgot to mention the TPP and the thousands of jobs it is going to create which will boost our exports beyond imagination. Just like our FTA with China gave us lots of trade surpluses and our FTA with Australia gave us trade surpluses

Yeah Right

We will all be driving around if flash cars and living in flash houses.

So yes

Dont forget the TPP and how this is going to change all our lives forever.

I see China are _still_ claiming "emergency price protection" on their dairy imports...what is National party doing (apart from bowing and scraping)

China and America are the superpowers and do what they want.

If we say "I dont like that" they wont even hear us.

Trade deals are not about what we want but what they want.

and here is a worked example.....

Get used to seeing these four letters: ISDS. They stand for Investor-State Dispute Settlement. They are legal clauses common in trade deals and they lend a foreign corporation the right to sue a government if that government has the cheek to govern in a way that damages their commercial interests.

And there they were this very week: ISDS provisions interred in the minutiae of Australia's Free Trade Agreement (FTA) with China – provisions which may give the Chinese rights to sue Australia if they feel aggrieved by some change in our laws.

As corporations slowly but relentlessly tighten their grip over governments, it is worth considering how far they are prepared to go to enforce their rights, especially as the secretive Trans Pacific Partnership (TPP) trade deal includes ISDS clauses too.

This is how far they have gone already: Egypt raised its minimum wage at the beginning of last year. It wasn't much by Australian standards, just $74 a month, but for a state employee on 700 Egyptian pounds a month ($102), a rise to 1200 pounds is not to be derided.

A French multinational with operations in Egypt, however, did not like this minimum-wage effrontery. A couple of months later, Veolia, the global services juggernaut, bobbed along and sued Egypt for the grievous disadvantage it had suffered thanks to the industrial relations changes.

Veolia's claim relies on ISDS provisions in a trade treaty between Egypt and France.

http://www.smh.com.au/business/comment-and-analysis/trade-deals-acronym…

Ergophobia bets that Infometrics, some global event excepted, are wrong re. 2.3% - 2017 and 2.0 - 2020. Economists, by and large, are a gullible herd. It is obvious that this NZ latest NZ "downturn" has been engineered by government and its lackeys (RBNZ) to bailout fontera and Auckland real estate agents with cheap debt and a debased NZD. Just wait and see, in a few months time the current GDP number will be revised up when the "data" has become ubiqitous and so cannot be manipulated by Departments. I live in provincial North Island and the big handbreak on exports from here is rubbish utilities and infrastructure to get them out of the country. Growth will stay well above Infometrics guess.

The biggest brake on the Kiwi economy is NZ's devotion to its Cult of Failure.

Here is one of the few great things about the USA's culture: In the USA, you are not a loser if you fail. You are a loser if you quit or if you don't try.

In America, failure is seen as an almost inevitable step to eventual success, but here in NZ it is considered to be the worst thing that can ever happen to anybody, so it's best not to try.

Most successful Americans have a long history of repeated failure under their belts but they just kept at it until things turned around, and one reason for it is because nobody was gleefully sharpening knives in readiness to stick them when they fell down the way happens here in NZ.

It's like from birth Kiwis are taught the worst fate of all is failing at something, and that everyone will laugh at you and you'll never recover.

In NZ, people are defined by their failures, not by their successes. It is how people here are known and remembered always and forever and so Kiwis never really go for gold except maybe in sport. Kiwis do not take risks due to their in bred fear of being seen to fail and that's why the Kiwi economy is just about the same as it's always been for 100 years and will likely stay that way.

In America if you fail you become an "unperson", nobody cares about you and you won't get any medical care, you may as well have been vaporised(from Orwell)

Admittedly a few repeat bankrupts succeed through skullduggery and persistence.

That's not how it is.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.