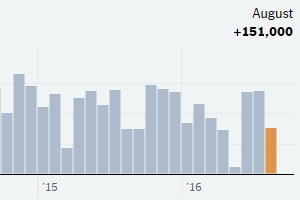

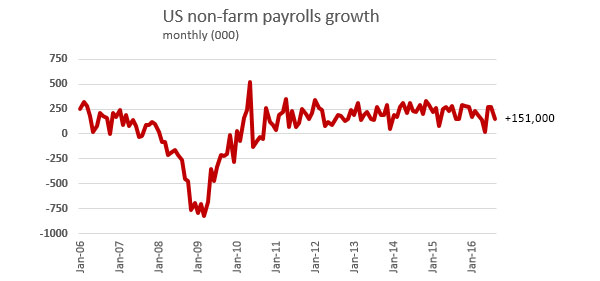

151,000 new jobs were added to the US labour market in August, less than was expected.

Although hiring cooled, it remains at a level consistent with steady job growth and capable of holding down unemployment. The underlying rate of job creation is still well-above the level required for the labour market to tighten.

The American unemployment rate remained at 4.9%.

Both the labour force participation rate, at 62.8 percent, and the employment-population ratio, at 59.7 percent, were also unchanged in August.

Apart from mining and oil, most other industries either saw rising employment of they were essentially unchanged.

This survey was taken in the middle of the country's annual summer holidays, but is seasonally adjusted.

Wage growth remains good. In August, average hourly earnings for all employees on private non-farm payrolls rose by 3 cents to $25.73. Over the year, average hourly earnings have risen by +2.4%. Average hourly earnings of private-sector production and non-supervisory employees increased by 4 cents to $21.64 in August.

Pay gains like this keep American workers' incomes growing well ahead of inflation. But the gains won't be even; those with skills will be benefiting, those without lagging.

Today's jobs report is unlikely to prompt a data-dependent FOMC to increase the fed funds rate later this month. After all, in order to be 'reasonably confident' that inflation will return to target, average hourly earnings will need to rise by more than 0.1% each month, as they did between July and August. That said, wage growth in the twelve months to July was revised higher, with average hourly earnings up +2.7%, a post-recession high.

How markets reacted

This data has reduced the chance of a September FOMC rate hike. It was probably low anyway because of the looming US presidential election, but few see it happening now.

Wall Street's biggest banks are sticking to bets that the Fed will raise interest rates only once this year, and the increase would most likely occur in December.

The S&P500 rose after the data release, having fallen in the hours up to the release. But the impact was minimal. It has been more than a month since we have seen a daily move of more than 1% and today's news didn't threaten the 40 day calm that has descended on equity markets. The US dollar was unchanged. The benchmark UST 10yr yield ended the week at 1.6%, up slightly.

Implications for New Zealand

The US economy is in relatively good shape, and that is a key driver for world trade. Consumption demand in the world's largest economy is unlikely to be affected by today's data.

That means economies we are dependent on, such as China and the other emerging ASEAN economies won't get a demand shock from this source. China's demand for Australia's minerals is unlikely to be interrupted by changes in demand from the US.

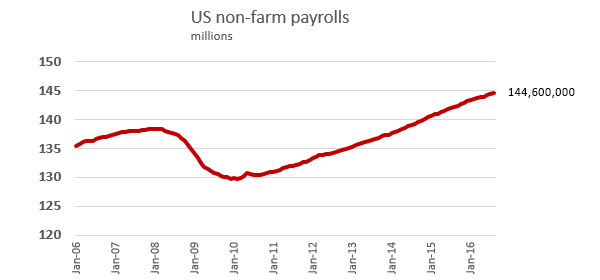

Further, the good growth in US incomes will be far more important that a employment of 10, or 20,000 people in a month in a labour market of 145 mln.

But the pushing back of Fed rate hike expectations to December will mean that the RBNZ's own review can't be under the cover of rising American policy rates.

Analysts here will be firming their expectations of one more OCR rate cut, something strongly hinted at by the RBNZ.

But given the good growth in our economy, it seems unlikely this will come in September.

The only remaining reason to cut NZ's official interest rates seems to be to "get the dollar down". But the RBNZ has been singularly impotent in achieving this via OCR cuts.

They don't have the resources to push against international currency traders, and our good economic performance undermines the case anyway.

The few attempts to encourage and accentuate a currency depreciation have had only a fleeting impact. The effort is characterised as 'throwing good money after bad'.

And there is the public policy problem of supporting industries that depend on an artificial exchange rate level to 'survive'. Such industries actually need the higher real rate to encourage them to change and make and sell products that are not exchange-rate dependent.

14 Comments

Labor Day is an appropriate moment to reflect on a quiet catastrophe: the collapse, over two generations, of work for American men. During the past half-century, work rates for U.S. males spiraled relentlessly downward. America is now home to a vast army of jobless men who are no longer even looking for work—roughly seven million of them age 25 to 54, the traditional prime of working life.

This is arguably a crisis, but it is hardly ever discussed in the public square. Received wisdom holds that the U.S. is at or near “full employment.” Most readers have probably heard this, perhaps from the vice chairman of the Federal Reserve, who said in a speech last week that “it is a remarkable, and perhaps underappreciated, achievement that the economy has returned to near-full employment in a relatively short time after the Great Recession.”

Near-full employment? In 2015 the work rate (the ratio of employment to population) for American males age 25 to 54 was 84.4%. That’s slightly lower than it had been in 1940, 86.4%, at the tail end of the Great Depression. Benchmarked against 1965, when American men were at genuine full employment, the “male jobs deficit” in 2015 would be nearly 10 million, even after taking into account an older population and more adults in college.

Or look at the fraction of American men age 20 and older without paid work. In the past 50 years it rose to 32% from 19%, and not mainly because of population aging. For prime working-age men, the jobless rate jumped to 15% from 6%. Most of the postwar surge involved voluntary departure from the labor force. Read more

More manufacturing jobs lost and replaced with bad waiter and bar tender jobs,

GREAT RECOVERY!

I know that is the "election conversation", but this data does not show that. Factory jobs are unchanged. Yes, hospitality jobs were one of many sectors that did rise.

Overall, pay rose way faster than inflation (pay up +2.4%) to US$25.73/hr and that is the average for full and part-time. It is not huge but it is not low either, and is far above NZ averages. At these levels it does not support the election meme that factory jobs are being replaced by flipping hamburgers.

Factory jobs are more at risk from automation than 'globalisation', but still, they are not declining. The July data out today shows that factory durable goods orders rose +4.4%. That is not an indication that US factories are in decline.

The US is full of apocalyptic conversation. Among 320 million people it is easy to find a big number who are negative. But at this time, they are plain wrong. And I suspect, many more people are not negative. The gullible just get sucked into the loud crowd.

The gullible just get sucked into the loud crowd.

Exactly.

In the technical notes for the Employment Situation Report, the payroll numbers that everyone obsesses over in fine detail, the BLS still shows a 90% confidence interval at 1.6 standard deviations that works out to +/- 115k. That means that whatever number gets splashed onto every headline and worked into every major commentary piece isn’t really the number of payroll changes. It is a statistical estimate that only anchors that confidence interval.

What the BLS actually reported for August was that if they gathered all the data again and again100 times, it is expected that in ninety of those the payroll gain would fall in a range of +266k at the upper end of the confidence interval and +36k at the lower end. That changes the interpretation dramatically from the certainty that is reported about how there was a “disappointing” 151k jobs created in August 2016. In fact, given that confidence interval, it could be that the true amount of job gains was something like 266k and consistent with the mainstream interpretation of the past two months that made everyone forget all the economic problems, or closer to +36k and the disaster that so unnerved everyone in the May report (and anything in between those extremes). Read more

The primary symptom of the economic malaise or depression that has developed since the Great Recession (which wasn’t a recession) is an economy that works less and thus earns less. Such a condition would suggest a shrunken system or at least vastly diminished potential. That much is well-established even in the orthodox literature though it isn’t ever talked about publicly. What happens, however, when an economy that is already working and earning less starts to reduce even further? Read more

Fill the gap with debt?

Household Debt and Credit Developments in 2016Q2

Student Loans, Credit Cards, and Auto Loans

Outstanding student loan balances declined slightly, by $2 billion, and stand at $1.259 trillion as of June 30, 2016. 11.1% of aggregate student loan debt was 90+ days delinquent or in default in 2016Q2,2 roughly unchanged from 2016Q1.

Auto loan balances reached $1.1 trillion, a $32 billion increase. Auto loan delinquency rates were flat, with 3.5% of auto loan balances 90 or more days delinquent.

Credit card balances increased by $17 billion, to $729 billion, while credit card delinquency rates improved, to 7.2% in the second quarter of 2016 down from 7.6% in the previous quarter. Read more

Last I checked LIBOR was 0.84% and still moving up. It was 0.33% a year ago. It is predicted to be more than 1.5% a year from now. Our economy is strong by my observation. No shortage of discretionary spending. No shortage of new vehicles. Lots of cash looking for a home to buy. So growth is a little slack compared to other recoveries, but I don't understand all these proponents of negative rates. Monetary policy is being tighten indirectly!

Hevi, I believe one should view that 3 mth LIBOR quote as a heightened liquidity risk indicator by those lending to customers. The implied interbank lending function has long disappeared given QE reserve ledgers maintained by G-SIBs at central banks now act as wholesale liquidity repositories.

Nonetheless, deferred Eurodollar futures contracts point to a diminished economic horizon. Read more

Thank you Stephen. A very educational paper, it provided a clear path in action on the dynamics between LIBOR, TED, and Eurodollar futures, interactions I did not understand until now, and a brilliant link!

The Inarguable Math of the Morally Unfit, is another paper by the same author worth reading.

Thanks again!

Fear and greed - it drives market - people make money by using the volatility generated by these "opinion" pieces.......

I worked in a market making capacity US bank in London for 16 years and never took any notice whatsoever of "opinion" pieces - basically because there was no time for such indulgences beyond position taking off the back of the market making function.

One of the main issues confronting the recovery of the US labour market is that the bulk of the reduction of unemployment has occurred in the low-skilled sector. Hence the rather average wage growth and perhaps an explanation for the perpetually weak capex we have seen from corporate America.

Really? You think +2.4% pa is "rather average" ? Looks much better that EU growth of +1.8%, AU growth of +2.1%, and NZ growth of +1.6%, surely.

That US growth is coming at the expense of productivity. Which means workers are getting paid more without producing commensurately more.

And it is way above any measure of inflation. US = +0.8%, EU +0.2%, AU +1.0%, NZ +0.4%.

Real wages are growing everywhere. Actually, they are growing as employment is growing too.

It is a golden time for the "average" US worker. I am sure you can find many at the bottom end not benefiting (and you can do that in any economy you look at), but on average its actually quite impressive.

Jeffrey Dorfman , Forbes

Contributor

May 22, 2016 @ 12:30 PM 5,463 views

The Little Black Book of Billionaire Secrets

U.S. Debt Binge Not Producing Growth Because It's Mostly For Consumer Spending

I use economic insight to analyze issues and critique policy.

Opinions expressed by Forbes Contributors are their own.

(AP Photo/LM Otero, File)

Student loan debt is famously up to $1.3 trillion, auto loans recently reached a high of $1.1 trillion, and credit card debt is inching toward its own $1 trillion total, perhaps reaching it this quarter. Yet, even in the face of this growing pile of debt, economic growth and consumer spending have stubbornly continued to plod along with steady, unspectacular growth. This begs the question: why is so much debt producing so little growth?

The answer is that it is consumer debt. Debt comes in two general forms. You can borrow money to invest in a productive asset that provides value over some relatively long time period like a factory or, perhaps, a house. Or, you can borrow money for current consumption such as dinner out, clothes, or a vacation.

Debt used to increase the stock of productive assets means the economy can produce more stuff, the prerequisite to economic growth. More stuff per person is what we want, it is the basic premise that America has been delivering on for almost its entire existence. More factories mean more stuff plus more jobs making that stuff, which leads to more spending power for those workers when they wear their consumer hats. The best part is those factories produce those benefits year after year; productive investments are the gift that keeps on giving.

Debt used to finance current consumption, however, provides none of these benefits. You might object that buying stuff means somebody has to make it, thereby creating jobs, but that is not true when the purchase is debt-financed. The consumer is spending borrowed money so that spending simply replaces the spending that would have taken place if whoever lent out the money had spent it themselves instead.

Student loan debt is really more akin to an investment in a productive asset than regular consumer debt as it is meant to finance an increase in the stock of human capital, leaving the students with life-long increased labor productivity and earning potential. However, while the debt is being accumulated, there is no payoff. Given the weak economy of the post-recession years, much of the human capital gained since around 2005 or 2006 has just begun to provide paybacks as the job market finally regains something approaching normal status.

Recommended by Forbes

The growth in auto loans (up 30 percent since the recession) and credit card debt (back about to pre-recession levels), is all unproductive debt. Essentially, a large group of Americans, unhappy with their slow income growth over the past decade, are living beyond their means assisted by the buildup of debt.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.