Banks hold $315 bln in deposits from customers. This is a review of who has those claims on our retail banks.

New Zealand interest rates may seem low to us, but they are relatively high by western world standards. And non-residents are attracted to them. But perhaps not as much as you might think, although it is not easy being a non-resident and holding a New Zealand bank account.

However, non-residents do hold $25 bln in term deposits and at-call savings accounts. (70% of these balances are held by non-resident households; institutions find other, non-bank ways to invest in New Zealand.)

But resident households are by far the largest holders of bank deposits - and these balances are growing quickly.

In the year to August, household deposits at banks grew +7.6% to $161.8 bln and that is the fastest growth rate in a year and the fastest growth amount (+$11.5 bln) since June 2016. It is an impressive level of growth and the fact that it is picking up in both rate and amount is also impressive given the fall-off in residential real estate transactions which might have been the first assumption as to why this is happening. Clearly there is much more to it than that.

In fact, the +7.6% growth in deposits is faster than the +6.5% growth in bank mortgages over the same period - in fact faster than any loan growth for any other sector of the economy (business, agriculture, personal consumer, etc.) We weren't expecting to find that.

This data is available in the RBNZ's new S40 data that allows us much closer inspection of this aspect of bank balance sheets. But this new detail doesn't have history earlier than for December 2016 although the aggregated totals go back to 1998.

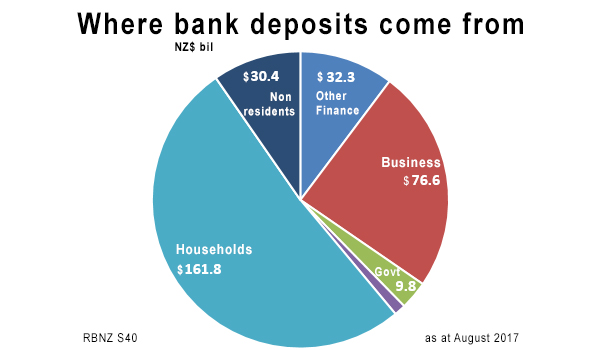

This, then, is how that $315 bln is made up by both the claimant groups (households, businesses, Government, etc) and where each has allocated its holdings (transaction accounts, at-call savings accounts, term deposits).

| as at August 2017 | Total | Transaction | Savings | Term | |

| see chart below | accounts | accounts | Deposits | ||

| NZ$ bln | $ | % | $ | $ | $ |

| Households (see chart below) | 161.8 | 51.4 | 21.8 | 50.7 | 89.4 |

| Finance businesses | 32.3 | 10.2 | 8.4 | 4.9 | 19.0 |

| All other businesses | 76.6 | 24.3 | 23.8 | 21.5 | 31.2 |

| Government | 9.8 | 3.1 | 3.1 | 0.6 | 6.0 |

| Not-for-profit organisations | 4.0 | 1.3 | 0.8 | 0.9 | 2.3 |

| Non-residents | 30.4 | 9.6 | 5.2 | 4.9 | 20.2 |

| ====== | ----- | ======= | ======= | ======= | |

| Total bank funding | 314.8 | 100 | 63.1 | 83.5 | 168.1 |

An easier way to visualise who has this money is by this chart:

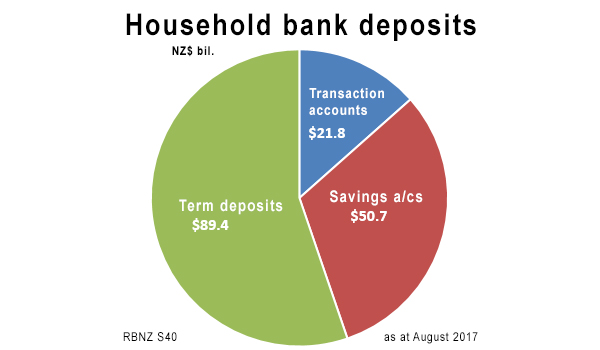

And that $161.8 bln household deposit base is made up like this:

These are the balances that are growing +7.6% per year. But the data is not deep enough yet for us to know which of these three components are attracting the growth.

And given that deposits are growing faster than loan demand, perhaps it is not surprising that banks don't feel any need to raise their interest rate offers.

22 Comments

Total bank funding 314.8 ($bln)

Is not quite the whole story. Banks' assets (net loans and advances) are reported to stand at $418.632bln. One can only guess the funding balance accrues in the form of off-balance sheet cross currency basis swapped foreign debt derived NZD bank liabilities.

70% of these balances are held by non-resident households

And the Approved Issuer Levy system allows an effective tax rate of 2% to be charged.....

http://www.ird.govt.nz/nrwt/approved-issuer-levy/glossary/nrwt-ail-glos… issuer levy (AIL)

I wonder if those non residents know about the OBR!

And covered bonds.

Now there's a worry, preventing depositors knowing the actual level of risk they take and if the return is sufficient - RBNZ to address this please?

Could the difference between mortgage growth and deposit growth be a deposit? Cashed up baby boomers put the entire amount in the bank, whereas the new mortgage takes out a mortgage of only 60-80% of the value. The deposit is lost from the savings side mind you.

Or could it be more buyers deferring a purchasing decision, so the size of their deposit keeps accruing?

The pie chart titled "Where bank deposits come from" could equally be drawn with a very substantial slice of the pie labelled "Bank loans".

As the Bank of England clearly explains most bank lending is new "money" created by the banks themselves. This has to find a home somewhere and the majority ends up as deposits in the same banking system that created it. Now that's what I call a "Magic money tree".

im glad it does not quite work like that... but QE could be consider magic money... but normally no ..

So perhaps you could explain how you think it works?

@ accountingsoftware comment:

"Henry Ford is supposed to have remarked that it was a good thing that most Americans didn't know how banking really works, because if they did, "there'd be a revolution before tomorrow morning".

https://www.theguardian.com/commentisfree/2014/mar/18/truth-money-iou-b…

"The Bank of England let the cat out of the bag. In a paper called "Money Creation in the Modern Economy",....( from a link in that article)

Turning back to the money side, in our scenario, only $90 of the $900 in new money is likely to be withdrawn as cash, with other payments being possible through electronic transfers of account balances. Bank A thus has a further $810 to lend out. As this process continues, the ultimate outcome is that the initial $1,000 in deposits can be used to create new deposits (money) and credit (loans) to the value of $9,000. This new money is generally termed ‘inside’ money to reflect that it has been generated by the private bank ‘inside’ this economy. Bank A’s balance sheet has grown from $1,000 to $10,000. This is shown below:

Lets check out RBNZ S10 Banks: Balance sheet ($M)

Asset s ($m), line 1 - Cash (notes and coins) : 755

Asset s ($m), line 4 - Loans and advances (Net): 418,632

This is a cash to bank asset ratio of 0.1803% - magnitudes (~55.46) smaller than the 10% fractional reserve claim made above - which in fact is only applicable to the moribund US Federal US banking system reflected in H3 statistics - based on the current t0% ratio required reserves are ~$180.4 billion for ~$14.7 trillion bank liabilities - ~1.3%.

From the IMF website,

http://www.imf.org/external/pubs/ft/fandd/2016/03/kumhof.htm

"The availability of savings of real resources does not constitute a limit to lending and deposit creation, nor does the availability of central bank reserves. Modern central banks pursue interest rate targets and must supply as many reserves as the banking system demands at those targets. This fact flies in the face of the still very popular deposit multiplier narrative of banking, which argues that banks make loans by repeatedly lending out an initial deposit of central bank reserves."

Thank you Peri for once again correctly challenging the repeated presentation of tiresome nonsense as fact.

That is what I say in a more convoluted way above Tom, but I was also using that process to try and explain the differential.

I agree with uninterested , also how many kiwis no about the OBR , an NZ banks are not ring fenced from Australia banking system . When the Sh.t hits the fan an it will ,Australian banking system will use us as the cash cow !!

Sanz,

I have an email from the Reserve Bank which says; The first point to make is that the subsidiary of an Australian parent bank would be rig fenced". That was in response to my query as to what whether an Australian bank which collapsed,could call on the assets of its NZ subsidiary.

Link to OBR explained by RBNZ https://www.rbnz.govt.nz/-/media/ReserveBank/Files/regulation-and-super…

We also have an article on how the OBR might work if it was implemented here - http://www.interest.co.nz/bonds/64411/if-bank-failed-and-open-bank-resolution-policy-was-implemented-how-would-it-affect-bank

These latest stats are showing a material slowdown in lending growth. Let's see how the banks react......

In a credit led economy, bank saving running ahead of loan growth (itself falling quarter on quarter, in % terms) means recession coming.

anyone have an opinion on how Kiwibank would fare in an aussie led banking crisis?....

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.