Political uncertainty is everywhere.

We have a narcissistic adolescent as President of the US, playing cavalier power games with a nutty North Korean. We have Europeans dicing with existential threats in the UK and Spain. We have a Chinese President grabbing totalitarian power. Across the ditch, Australian politics is infected with crazy and unstable partisanship (even within parties). Dictators are feeling emboldened in Russia, Hungary, Turkey, Malaysia, the Philippines, and across Africa as well. A cyber war is going on trying to destabilise rivals.

Yes, there are pockets of stability - and New Zealand is one such place - but they tend to be small in the global scale.

Economically, the world is trying to find a way out of unconventional monetary policy, and that road is very uncertain still.

And millennials are besotted with bitcoin. Say no more.

But bond and equity markets are pricing in the lowest levels of risk in living memory, and certainly lower than before the GFC.

It's spooky.

Here's the data at the close of Wall Street for 2017.

1. The key volatility measure is very low

The VIX closed at an index level of 11. That is low; it ended 2016 at 14 and 2015 at 21.

During 2017 it got down to just over 9 on November 3 and its high for the year was just over 16. The equivalent levels in 2016 2017 were 11 and 28.

And remember, during the GFC this index got as high as 81.

The VIX is a market volatility signal. It is measuring very little volatility risk going into 2018. You can keep track of the daily movements here.

The VIX is also known as the 'fear index'. Basically, there is little fear exhibited by investors.

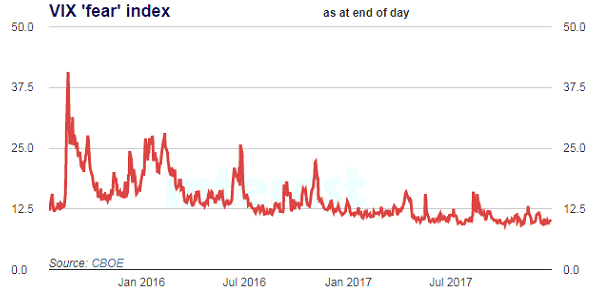

2. Credit default swap spreads are very low

CDS spreads measure bond default risk. They are ending 2017 signalling very low risks, unusually low.

They are back to levels we had just prior to the GFC.

More than that, AU-NZ corporate debt is unusually low. And the premium to US equivalents is at record low levels. There is a premium, but it is now trivial (+2 bps). It was more than +10 bps at the end of September and +42 bps at the start of the year. Recent "usual" is about 25 bps. It was +100 bps two years ago, and over +200 bps in early 2012.

All this is not happening because American risks are rising and we are static; no, local investment grade corporate risk is being marked lower faster than falling risks for American corporates. It is very unusual indeed.

And it isn't just investment grade corporates. New Zealand's sovereign risk is getting the star treatment as well. This is priced at just 14.94 bps, the lowest we have every seen it. It is lower than for Australia, the UK, or Japan. Only a handful of northern European countries are lower (Germany is 9.8 bps).

Our companies and our Government is rated by investors as almost fail-safe. Hard to fathom.

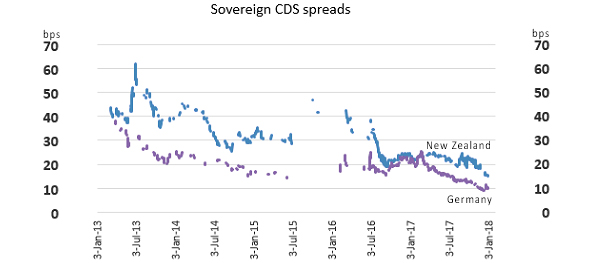

3. Short term rates are at record low levels

The New Zealand one year swap rate is just on 2%, at close to a record low level we reached in mid December of 1.98%.

This however is different to what is happening in the US. There short term rates are rising, and quite quickly. Check this UST chart for 1, 2 and 5 year rates. It will surprise you how quickly these rates have risen recently, even though the level are still not that high. Still, it is unusual how close our wholesale swap rates are to UST rates of the same duration.

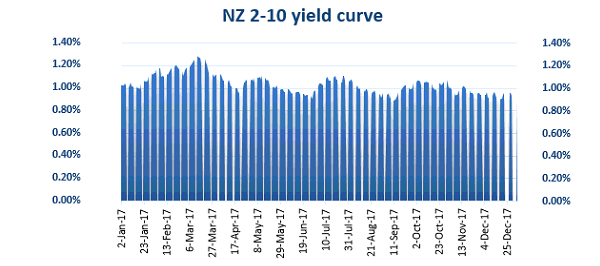

4. The yield curve is flattening

We do have a positive yield curve, so that's good. But the 2-10 curve is back under +100 bps and near its lowest in a year. At one point it was over +125 bps, but to be fair it has spent most of the year in the +100 bps region. (In 2016 it got down to just +26 bps.)

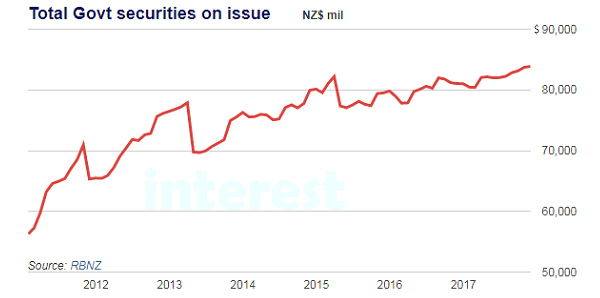

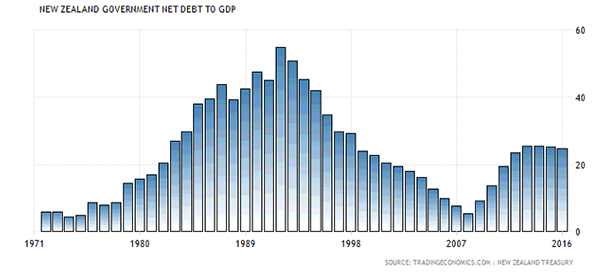

5. The Government must not pay down its debt

Wisely, the Government has made no attempt to pay down its borrowing. And the new government will likely follow the same strategy. Low "Govt-debt-to-GDP" is the mantra, not paying it down. The last time we did that, it almost ruined our bond markets, distorting the base-line risk-free benchmarks and starving access for trustees who are mandated to hold such securities. It was ugly. Now that problem is more acute, with large amounts going into KiwiSaver funds who have similar mandates. Paying down Government debt now would create a crisis for a significant section of KiwiSaver funds, and just force that money offshore and into even lower yield environments.

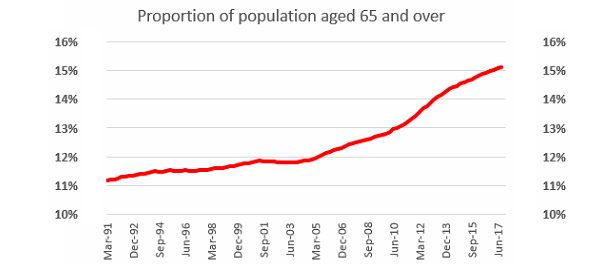

6. And there are big demographic shifts going on

The Western boomer generation is facing very low returns from traditional investments and are starting to chase higher yields, regardless of risk. Banks are flush with cash deposits and in many cases they are growing faster than lending opportunities. Banks only really look for lending opportunity if it is backed by real estate, but if values underpinning that security start falling, then their appetite for lending may in fact shrink. That will accentuate the mismatch between deposit growth and lending 'growth', leading to even lower bank offers for deposits. That in turn will make alternative asset investment seem attractive - but the problem there is that there is not a lot of that around. Demand for it will push down risk premiums. The problem is circular. (And a honey-pot for the unscrupulous.) These issues are very real for New Zealand.

It is this group, who hold a disproportionate share of household assets, who will drive demand for fixed-income investments.

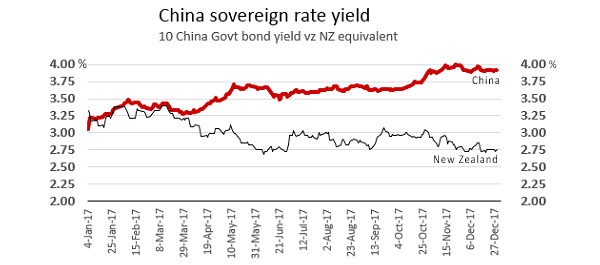

7. The yields on Chinese sovereign debt are rising

This benchmark has risen from 3% to 4% over 2017.

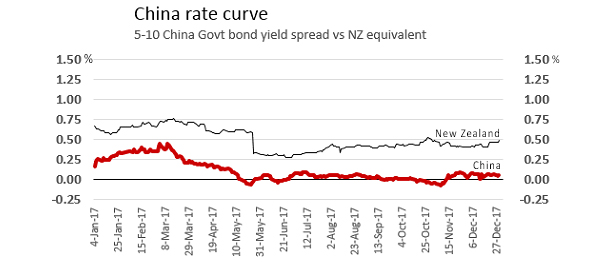

8. The 5-10 Chinese yield curve is non-existent

But the yield curve is completely flat in China, and the 2-10 curve is barely positive.

And then, there is this.

30 Comments

The market v the Fed game going on in the US is the one to watch. Either the Fed is right and they are justified in slowly increasing the short end in the belief inflation will rise sooner or later. Or the market is right in believing the Fed is doing nothing but taking the US economy to an eventual recession or at least lower growth. The Fed can be wrong and adjust accordingly but if the market is wrong panic could ensue. I'm hoping for the former over the latter.

"We have a narcissistic adolescent as President of the US" What?! You mean Bill Clinton is still in the White House? Donald Trump is different; no doubt about that, but many, many decades of 'the same' gave us what he inherited. Besides, he won! Just like Jacinda did, and Angela and Theresa.... and Hillary, didn't... so he might just turn out to be 'the right man, at the right time', and time, as it always does, will tell...

We might be just at the crack-up boom stage. The final blow-off before the next recession. At the moment all commodities are cheap or really, really, really cheap. They may be starting to wake from their long slumber.

Commodity traders say that the cure for high prices is...high prices, and the cure for low prices is... low prices. It works like this, when prices are low there is no money for exploration and development as all the producers of that commodity are in survival mode. Doesn't matter what the commodity is, milk, grapes, iron ore, oil, coal, tourism. One by one the producers go bust as the banks call in their loans. This process usually takes 2 to 4 years to complete. At which point the actual production is severely reduced and running at significantly less than demand. Eventually the massive stock piles built up during the boom years are used up and the price then bottoms and starts moving up.

At this stage, which is where I think we are now, and why this is a new paragraph, things get interesting. At first the prices rise a bit and then fall back, but by now the commodity is in short supply and there are no stockpiles anywhere and everybody knows it. So when prices start rising again they can be explosive, particularly if there are disruptions to the supply/distribution chain.

I recently read an old book by a chap calling himself Adam Smith, called "Paper Money" which describes how the Oil Glut of the 1960s (who knew, certainly not me) turned into a literally overnight 4 fold increase in the world oil price in the 1970s. Astonishing story of wonderful complexity (starring among other things, The Texas Railroad Commission running a price fixing cartel in the US on behalf of US producers, a very bright Venezualan, a French bulldozer cutting an oil pipeline in Syria, sunken ships blocking the Suez Canal, Saudi and the US falling out, and of course, Colonel Gaddafi ) but from it came our current dysfunctional monetary system, hence the title. (Note to younger readers - it also led to widespread fears that oil was running out as we had used it all up, which I subscribed to at the time. The point being these are long cycles.)

My guess is we may be about to have a 1970s re-run where inflation in the prices of real stuff comes barrelling out of left field and the bureaucrats all cry "no one saw it coming" in unison, meaning they didn't see it coming and they are very bright, which really is not quite logical but seems to fool most of the people most of the time. The bureaucrats thus keep their jobs in Central Planning and the process repeats, but I digress. Forest fires and all that. Back to the subject; prices of real stuff like the fancy metals in your iphone have recently doubled, by the way....

https://assets.bwbx.io/images/users/iqjWHBFdfxIU/ir5ACGzhIvpA/v2/800x-1…

https://www.bloomberg.com/news/articles/2017-12-12/glencore-to-restart-…

https://www.mcoscillator.com/learning_center/weekly_chart/golds_8-year_…

And then there is debt. Debt piled on debt from the poorest household to the biggest corporates and not to mention sovereign states right round the world. Could someone better at figures than me, provide the exact stats/ratio as to what small percentage of identities hold what great percentage of global wealth. Seems to me that debt is now incalculable, just one mammoth pyramid scheme, except that the pyramid here, is upside down and looking more than wobbly.

Funny stuff debt. No one really knows exactly how modern money works as it keeps changing. Modern money is created as debt and when debt is repaid it ceases to exist; it just folds back into the nothingness from whence it came. As long as the chains of payments don't all break at the same time it seems to work, so we keep creating it (mainly via new mortgages, ie debts based on an individual's future earnings stream, secured against property), using it, and paying it back quite happily (for the most part).

Modern money is a complex system, far beyond the capacity of even the brightest individual to understand, so don't feel bad about it. The guys at the big banks that went bust in the last crisis were super bright, highly experienced, highly trained and they had been through a gruelling corporate selection process to get to the top, yet they still failed.

Complex systems do tend to make mincemeat of experts. It is why Central Planning in all its forms tends to disappoint, despite its seductive allure. Creativity, Experimentation and Adaptation are much better and much worse, but seem to be more likely to result in survival. To me that is why the wild and chaotic nature of a democratic capitalist society tends to work better than a centrally planned society, although on the face of it you would think the planned approach would be better. So a building boom leads to a bust followed by cheap housing; chaotic but effective.

Yes understood alright. A long long time ago there was theSouth Seas Bubble. Times & technolgy have obviously moved on light years but was that collapse basically about a debt mountain toppling. Agreed all those fine executives of today a la 2008 know a thing or too, or should, but perhaps it is the culture of the system itself now that is of the greatest concern as it manifests in personal ambition and plain old greed. In simple terms there used to be a scenario where staff reported to management, management to executive, executive to directors, directors to shareholders and the whole performance from that was reflected ina share price. Not that simple of course but the problem nowadays is that the lenders and traders on the shop floor, so to speak, do not give a toss about shareholders and share price (think Enron, Barings, Lehmans) nothing else is considered other than individual personal gains and booty and that is little different in form, than the above unhappy event some centuries ago.Happy NewYear, thus speaks the doomsayers!

Hi Roger, watch this wee clip, it explains it well:

Good clip. Emphasized the fundamental importance of the Mittelstat. The small and medium sized productive enterprises are the backbone of the country. My personal interpretation of the Brexit vote was as a protest vote by the productive regions of England against the financial/government region.

The funny thing about NZ is that while the situation is pretty darned silly it could very easily come right with a few small tweaks here and there, quite likely adopted by accident. For instance, the current restrictions on bank lending for the purchase of residential housing could unexpectedly turn the tide, stop the excessive credit creation by the big Aussie banks and keep the NZD at a level where the productive sector can make a decent profit, thereby setting up a virtous circle. It could happen quite easily.

I watched the video, ..

In my view, Prof Werner does not give a complete description of the credit creation process... also I feel his redefining the terms" deposits" and "Loans", kinda clouds things more.

Banks do create "credit", BUT... credit is a claim on "money". At some point in the transaction process a Bank will have to "settle" the credit note it has written. The borrower will spend the "IOU note" which will eventually end up with another Bank.. The receiving bank will demand settlement of the IOU note, in "money".

All claims are settled thru the payment systems that Central Banks operate. The payment system comprises Private Banks accts. held with the Reserve Bank. The settlement process is done with "money" and not "credit".

https://en.wikipedia.org/wiki/Monetary_base

If Prof. Werners explanation was correct, then Banks would be totally unconstrained by how much credit they create.... ( ie. they could simply create credit, and buy everything ).

The reality is that credit is a claim on money. Credit is fungable with money ,( because we use it as money) so it is difficult to see the distinction between the 2.

Its very similar to the gold days when people stored their gold with goldsmiths who issued promissory notes to redeem the gold on demand.. Because gold was heavy , people started to transact with those promissory notes.. those promissory notes became "as good as gold'.

Goldsmiths thought they were smart by issuing more promissory notes than there was gold, which was like free money for them, but they had to skip town when too many people wanted to redeem those notes for gold.. ( for as long as there was confidence in those promissory notes, the goldsmiths could issue more and more.... those promissory notes were "as good as gold", "as good as money" .. until they weren't )

Yes, I didn't mention his misunderstanding of the Queen's relationship to the City of London, as it is not technically correct as far as I understand it. There are a lot of traditional practices around the constitutional arrangements in the UK that are a lot more subtle than they appear. A lot of them have to deal with issues of the demonstration of trust rather than serving an obvious objective purpose that makes sense to the logical mind. Major cities all operate as countries within countries to some extent, just as Auckland is quite unlike the rest of NZ.

If Prof. Werners explanation was correct, then Banks would be totally unconstrained by how much credit they create.... ( ie. they could simply create credit, and buy everything ).

Not at all. Banks currently accept various asset classes as collateral to issue credit against. If the financial stability status of an asset sector becomes questionable banks restrict credit to fund it's purchase. Currently, we are in a state where the global reserve currency eurodollar issuing banks are moving to restrict credit creation to those presenting pristine collateral - namely US Treasury securities. Other collateral types attract prohibitive borrowing costs which restricts business opportunities or are out-right denied credit - witness SME loans in our own backyard - no house, no loan, unless it's priced up around 9%-11% or more. Admittedly, RWA concerns are a factor as well.

PS - I must admit I never watched the video. I tend to prefer the written word.

During 2017 it got down to just over 9 on November 3 and its high for the year was just over 16. The equivalent levels in 2017 were 11 and 28.

Should that be equivalent levels in 2016?

Or 2007?

Yes. 2016. Thank you.

I wonder if with the massive movement to index funds vs active management over recent years very much driven by Buffett recommending Vanguard and now winning his 10 year bet for passive vs active by a huge margin - that we have a lot less people concerned about day to day equity activity and hence volatility than we used to.

I think Vanguard took in over $ 1 Trillion US to its passive funds just in recent years - not chump change by any means and now has > $ 4 T under passive management !

Similar situation here vs 10 years ago with now very significant funds in NZ equities via Kiwisaver with resultant much lower activity also with increased passive long term investors.

Perhaps someone more informed than I could comment on the proposition that maybe we can't / shouldn't compare with equity volatilities of years prior - their shareholder base is now very different with the massive growth of passive investors who just don't care about the day to day.

It is interesting. Presumably they all rush for the exits together when the next period of difficulty arrives. Lots of bargains for Mr Buffet at that time, and anyone else who actually has cash, cash flow, and unencumbered assets, plus, of course, the ability to sort the wheat from the chaff. Anyone can buy rubbish when it's cheap.

zachs good with dates

You should give him a weekly platform David

Great piece of writing and extremely astute

The fool POTUS has yet to be impeached but 2018 will see the DNC gain many seats & leave the GOP out in the cold. We are in crazyland here and the FED are treading lightly because they do not know how high they

can go without being the catalyst for this worldwide debt ponzi to start its implosion

How will banks keep would-be house buyers incentivised to borrow?

Longer terms, lower rates, new products, multi-generation mortgages ...?

The Western boomer generation is facing very low returns from traditional investments and are starting to chase higher yields, regardless of risk. Banks are flush with cash deposits and in many cases they are growing faster than lending opportunities. Banks only really look for lending opportunity if it is backed by real estate, but if values underpinning that security start falling, then their appetite for lending may in fact shrink. That will accentuate the mismatch between deposit growth and lending 'growth', leading to even lower bank offers for deposits. That in turn will make alternative asset investment seem attractive - but the problem there is that there is not a lot of that around. Demand for it will push down risk premiums. The problem is circular. (And a honey-pot for the unscrupulous.) These issues are very real for New Zealand.

Overall, bank assets inevitably match liabilities, otherwise the liabilities would have no interest cover and become untenable for depositors and banks together. View RBNZ S10

Moving on:

Thus, the decline of interest rates to zero corresponds with a monetary imbalance in favor of deflation, if at least an abundance of deflationary pressures. This is something that Milton Friedman also talked about, particularly in 1998 with regard to Japan. He called it the interest rate fallacy, meaning that low nominal interest rates signify "tight" money conditions, or what would be consistent with significant deflationary pressure. It is and remains a fallacy because economists like those at every central bank around the world have decided instead that low rates are only "stimulus."

To correct this view, Friedman pointed out the basic, non-trivial distinction between a liquidity effect and an income effect. Low rates can be stimulative in the short run (the liquidity effect), but over the long run their persistence means something far different. A yield curve is supposed to be upward sloping given the core time value of money and investing. That arises from opportunity cost, meaning the more plentiful the opportunities the greater the time value and the steeper the curve (the income effect). Yield and/or money curves (the eurodollar curve and even the history of the OIS curve) that collapse and remain that way unambiguously demonstrate that "stimulus" deserves only the quotation marks. Read more

Getting one's money back and not the return assumes paramount importance, thus rated sovereign debt reigns supreme. Retail investors are tempted to think otherwise.

Stephen

Investment advisors are predicting another great year for 2018

Even with a crazy Whitehouse the sentiment remains bullish here thanks to taxcuts for corporations

All that will happen will be greater dividend payouts not jobs HomeDepot etc plan to do just that

My question is would you take the risk to miss great returns this year or park your money and wait ?

Most of the funds are holding a greater % of cash

You know who Stephen is, right!? That he was getting multimillion dollar bonuses 20 years ago when he worked for....an American bank!

The reality was more modest given the realised returns - there were many senior mouths to feed in NY together with the non-producing research and HR departments. And thereafter grasping shareholders.

So did John Key,

Millennials to receive 'inheritance boom' - but it won't be enough to overcome housing crisis. The windfall will not come for some decades and will still see today's young people fall short of the previous generation.Young people between 17-35 will have to wait until the age of 61 on average to receive any inheritance

http://www.independent.co.uk/news/uk/home-news/millennials-inheritance-…

If The Inheritance Boom comes at all? By the time many Boomers meet the grave, they'll have spent-and-borrowed everything they have. That's what happens at 0% interest rates when savings are destroyed by the cost of living and replacing them, borrowing, is 'cheap'.....

Interesting to see what China does about its shadow banking economy, it seems that they want to tackle it head on (Better now then never).

Reuters article: China targets trust industry next year in fight against shadow banking: sources

https://www.reuters.com/article/us-china-banks-trust/china-targets-trus…

Quote from article: "Trusts have been a key part of China’s shadow banking sector, which helps channel deposits into risky investments via products often designed to dodge capital or investment regulations".

Reuters article: China's leader fret of debs lurking in shadow banking system

https://www.reuters.com/investigates/special-report/china-risk-shadowba…

they also need to deal with a diabetes epidemic.

https://qz.com/756585/diabetes-is-chinas-next-public-health-crises/

What a State of affairs....We are forever blowing ...Bubbles, pretty Bubbles in the air...

https://www.aol.com/article/finance/2017/08/01/8-states-with-the-bigges…

Curiouser and curiouser!

Bonds, pricing and risk fall into the “hard to fathom” basket – a continuation of a theme.

And so the doctrine rings ever true:

“The market can remain irrational longer than you can remain solvent.”

I find markets can be infuriating – while underlying fundamentals scream the obvious to all and sundry – the day to day machinations of the market merrily carry on paying scant regard – for that is how it works.

In my mind ultimately the fundamentals will win – it just takes a frustratingly long time to play out.

And in between, opportunities possibly lost.

Can we just have a degree of normalisation?

Yes, inflation in a historical context is bubbling away, yes, there are far too many asset bubbles merrily inflating and ultimately leaving too many participants vulnerable, yes, there are far too many financial decisions being made on the basis that there is some magical “put” that will save all, and yes, there are far too many that have never felt the chilling realisation that the government or CB’s of the day will not, in the end, be able to save them from their poor financial decisions.

I think the US ultimately cleansed its system – although it now seems hell-bent on undoing its good work. NZ never really did so – lessons were not learned – instead poor behaviour was “excused” (and in some cases rewarded!?!)

The GFC was years ago – and in Europe still no one trusts the banks – what on earth.

This is not capitalism, not the free market, not the “invisible hand” – this is a nonsense, and may be judged by history as, in the end, simply foolhardy.

Vent over!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.