Budget 2018 - Summary of all tax collections

17th May 18, 3:36pm

by

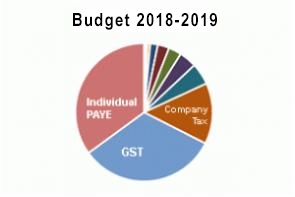

This table outlines the New Zealand Government's planned tax collections for the 2018/19 budget year.

Actual tax collected for the previous four years is on the left for the sake of comparison.

The numbers are drawn together from data released by the Minister of Finance on May 17, 2018.

Links to the primary sources used, from Treasury's website, can be found at the bottom of the page.

Figures for each allocation are in millions of NZ$

| Actual 2014/15 | Actual 2015/16 | Actual 2016/17 | Actual 2017/18 | Actual 2018/19 | % | |

| NZ$m | NZ$m | NZ$m | NZ$m | NZ$m | ||

| - | - | - | - | KiwiBuild Housing Sales | 210.0 | 0.2 |

| 264.1 | 196.3 | 198.0 | 214.5 | Interest from Securities and Deposits | 214.8 | 0.2 |

| 181.0 | 214.1 | 222.9 | 237.2 | Motor Vehicle Registration | 225.1 | 0.2 |

| 221.3 | 224.3 | 230.4 | 246.3 | Benefit Recoveries - Current Debt | 243.8 | 0.2 |

| 194.4 | 203.9 | 183.5 | 254.1 | Payment of Capital Charge by DHBs | 262.4 | 0.3 |

| 386.9 | 212.4 | 280.7 | 230.4 | Defence Equipment | 294.1 | 0.3 |

| 276.4 | 275.8 | 297.6 | 290.2 | ACC - Reimbursement of Non-Earners Account | 299.2 | 0.3 |

| 264.4 | 275.5 | 297.7 | 317.0 | Gaming Duties | 312.0 | 0.3 |

| 237.9 | 284.8 | 252.7 | 289.0 | Overseas Pension Recoveries | 323.3 | 0.3 |

| 20.0 | 510.0 | 140.0 | 145.0 | Reserve Bank Surplus | 348.0 | 0.3 |

| 462.1 | 473.7 | 464.2 | 471.0 | Child Support Collections | 481.0 | 0.5 |

| 514.1 | 502.4 | 524.8 | 555.0 | Fringe Benefit Tax | 572.0 | 0.6 |

| 604.2 | 603.3 | 602.5 | 590.0 | Interest on Impaired Student Loans | 584.0 | 0.6 |

| 733.2 | 800.8 | 1,023.5 | 805.5 | Dividends from SOEs | 783.5 | 0.8 |

| 134.7 | 272.1 | 444.4 | 642.5 | Emissions Trading | 783.8 | 0.8 |

| 1,113.8 | 1,208.9 | 1,272.8 | 1,353.0 | Student Loans - Receipts | 1,449.0 | 1.4 |

| 1,283.0 | 1,381.1 | 1,469.5 | 1,505.4 | Road User Charges | 1,499.9 | 1.5 |

| 1,933.6 | 1,997.2 | 1,817.1 | 1,882.5 | Capital Charge - Departments | 1,932.2 | 1.9 |

| 3,023.3 | 2,876.8 | 2,317.9 | 2,493.0 | Other Revenue | 2,254.3 | 2.2 |

| 2,028.9 | 2,277.1 | 2,228.7 | 2,268.0 | Excise Duty | 2,412.0 | 2.3 |

| 2,391.1 | 2,441.6 | 2,549.5 | 2,656.0 | Customs Duty | 2,583.0 | 2.5 |

| 2,839.0 | 3,019.1 | 2,803.5 | 2,948.0 | Withholding Taxes | 3,175.0 | 3.1 |

| 4,253.2 | 4,047.4 | 4,743.9 | 4,884.0 | Other Persons | 5,204.0 | 5.0 |

| 8,065.6 | 8,461.1 | 8,491.5 | 9,289.0 | Goods and Services Tax | 9,692.0 | 9.4 |

| 10,384.2 | 11,531.9 | 13,743.4 | 13,681.0 | Companies | 14,453.0 | 14.0 |

| 15,612.0 | 16,440.4 | 17,899.2 | 18,824.0 | Goods and Services Tax (IRD) | 19,990.0 | 19.3 |

| 25,777.8 | 27,498.6 | 29,123.9 | 30,878.0 | Source Deductions | 32,748.0 | 31.7 |

| 83,199.9 | 88,230.7 | 93,623.8 | 97,949.5 | Grand Total | 103,329.4 | 100.0 |

| 245,013 | 257,716 | 274,290 | 290,750 | GDP (nominal, per RBNZ) | 308,192 | E |

| 34.0% | 34.2% | 34.1% | 33.7% | Govt taxation - % of GDP | 33.5% | E |

| and this compares with spending as follows: | ||||||

| 83,200.2 | 86,218.5 | 89,455.5 | 94,919.7 | Total government spending | 102,281.4 | |

| click on this link for details | ||||||

Sources: You can download the data behind these tables from the Treasury website here >>

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.