We go hunting for the reasons fixed home loan rates have not followed the OCR down. Although these reasons are somewhat technical, they are real and may well indicate that fixed mortgage rates are about to go up

Competition between banks on mortgage rate offers started the year actively, but since the August Monetary Policy, the main banks have stopped competing on price.

The challenger banks are still trying, with TSB currently offering -10 bps lower than the main banks, the Cooperative Bank a bit less, and some of the Chinese banks are lower too.

Since August, the OCR has fallen -100 bps. But the one year fixed rate has really only declined -25 bps.

August 20 MPS down -25 bps to 3.0%

October 8 MPR down -50 bps to 2.5%

November 26 MPS down -25 to 2.25%

None of the fixed rates are much affected by the OCR, although the one year is the one that can get some influence. But not this time.

The one year swap rate has moved like this:

From the August MPS, the one year swap rate has actually risen, from being 2.41% immediately after the RBNZ -25 bps cut, to now be at 2.57%. In that intervening time the OCR has been cut by -75 bps. But none of that has shown up the wholesale cost of money the banks are facing.

In the background, the NZ Government bond yield has gone from 2.91% after the August OCR cut, to 2.71% now, a -20 bps reduction in this benchmark.

The US Treasury one year benchmark has gone from 3.91% to 3.61%, a -30 bps reduction.

But financial market participants, the ones who make the swap market pricing, are apparently having none of that. At the same time, the NZD has depreciated from 59.6 USc then to 56.1 USc at November 25, (although in the past week or so it has made a small recovery). So foreign investors have required higher returns to weigh against that -6% currency devaluation. The local banks have not been offered the lower rates in wholesale markets that the sovereign benchmarks have indicated.

Banks also fund mortgages from their deposit base and household deposits are the largest part of that. And within overall household deposits are term deposits and they comprise more than half all household deposits.

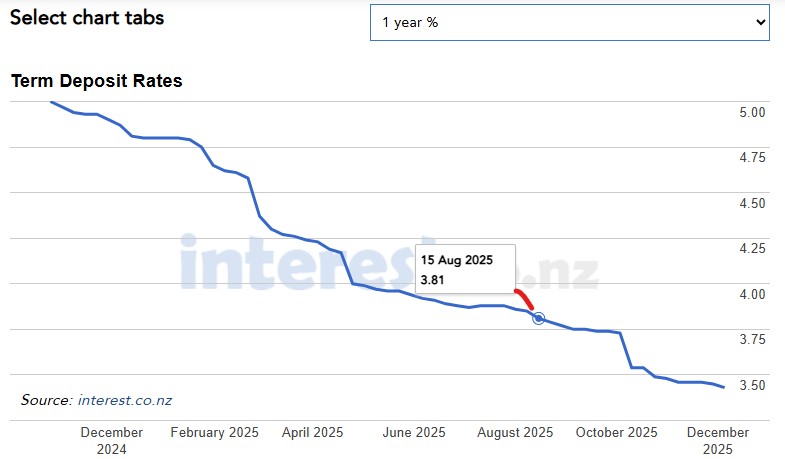

Over the same period, the one year TD rate has fallen -40 bps, far less than the OCR shift lower. The six month TD has fallen the same -40 bps. But banks are in a bit of a jam with term deposit funding. As we have reported earlier, savers have started withdrawing these funds at an increasing clip, down -$1.1 bln in the past two months in a sudden shift. So to protect this funding source, banks are under pressure to keep these TD rate offers higher than they would need to 'afford' lower fixed home loan rates.

So, even though the OCR may have been cut by -100 bps since August, banks have only cut their term deposit rates by -40 bps to retain this funding (and that hasn't been very successful), while wholesale funding has actually risen.

It has been drivers other than the OCR which have moved the cost of money - international money market rates, the exchange rate, and savers' growing reluctance to hold lower-returning term deposits - making it not possible to cut fixed rates.

In fact, there is more than half a chance that fixed home loan rates could rise from here, despite the November OCR cut. Bolstering that case is the rising demand for fixed housing loans. RBNZ data shows bank mortgage books are up at their fastest pace since July 2022 (+5.8%), which is a growth rate that is at a three year high. This demand needs to be funded.

And for the record, banks no longer have the "Funding for lending" pandemic support, at the cost of the OCR rate. Almost all this emergency funding has now been paid back to the RBNZ. It is the real world funding that calls the shots again.