Watch this space. We may be about to see a big outflow of term deposit money.

As interest rates decline this would be a logical response. But the big question becomes: Where would it go?

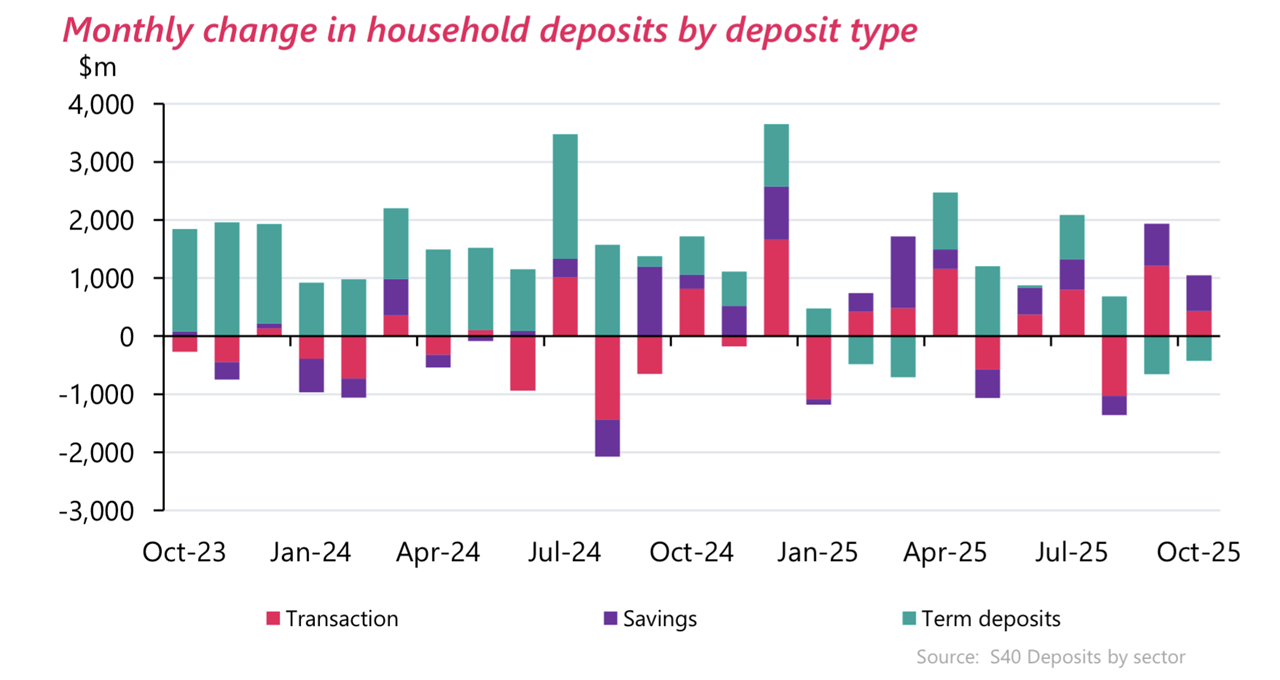

The latest monthly household deposit figures from the Reserve Bank (RBNZ) show over the past two months there's been a net withdrawal of over $1 billion from term deposits held with banks.

We did see something similar happen earlier this year, but there were then rises in following months. However, with interest rates now lower than they were then, the likelihood is that the withdrawal of funds will now continue unabated.

Mortgage rates always get a lot of attention at times of falling rates. But lower rates are very much a two way street - good for the homeowners, not so good for those looking for reliable, low risk income streams.

Yes, that's right, deposit rates come down too, and the fall of these has been somewhat faster than the fall in mortgage rates.

I've gone back through the RBNZ figures to take a look at the 'cycle', starting from the lows in interest rates seen in 2021, tracking the sharp rises we saw, and now the subsequent falls again. And I've looked at the lows, rises and falls of both mortgage rates and deposit rates.

The one-year fixed mortgage rate (RBNZ's average of advertised 'special' rates) was at a cycle low of 2.21% as of June 2021. The peak high was 7.30% in November 2023. As of October 2025 it was on 4.43%, down sharply from 4.73% in September 2025.

So, what about deposits?

The six-month term deposit rate (RBNZ's average of advertised rates) bottomed out at 0.85% in February 2021. It hit a peak high of 5.93% as of April 2024. By September of 2025 is was down to 3.86% and then it dropped further, to 3.59% in October 2025.

Arguably more instructive than the above figures is what's happening at the bank's end of the arrangement. The business end, if you like.

The banks' costs of deposits hit a trough in July 2021 of 0.46% for total deposits and 1.06% for term deposits. The subsequent peak in July 2024 was 4.38% for total deposits and 5.88% for term deposits.

As of September 2025 those respective figures were now down to 2.7% and 4.11%.

The banks' yields on their mortgages troughed at 2.83% (yield on total mortgages) in September 2021, with the yield on floating mortgages hitting a low of 3.62% and the yield on fixed bottoming at 2.72%, both also in September 2021. The subsequent peak for all mortgages came in October 2024 at 6.39%, but the floating peak had come a little earlier at 6.99% in August 2024, while the high point for fixed was 6.34% in October 2024 - remembering that the OCR started being cut from its cycle high of 5.5% in August 2024.

As of September 2025 the total mortgage yield was down to 5.36%, while the floating yield was 5.14% and the fixed yield at 5.39%.

For those interested in differentials, to date, the banks' total cost of deposits has dropped 168 basis points from the peak, with the term deposits' cost dropping 177 basis points (bps).

The total yield on mortgages has reduced by 103 bps from the peak, with the floating dropping 185 bps and the fixed dropping 95 bps.

So, some big changes there, although the sharp eyed among you may note that the total cost of deposits has reduced rather more sharply than the total yield on mortgages (168 bps reduction version 103 bps).

Back to the depositors then and what has been happening and what might happen next.

It is very interesting to note that, looking specifically at term deposits and going back to the popular six-month rate, in early 2019, we could get over 3% for six-month term deposits (TDs). However, within the space of two years rates of 0.85% were the go.

And if you think that sounds unattractive, a lot of people agreed with you. In mid 2019, households held over $103 billion in TDs. By mid-2021 the amount in TDs had dropped around $23 billion (which is a lot) to something only a little over $80 billion. So, where did all that money go?

What was the housing market doing in the 2020-21 period? Oh, that's right, it was bit busy, wasn't it?

But what goes down, comes back up again, and as interest rates surged in the latter part of 2021, so interest in TDs surged. A lot.

The amount of household money in TDs peaked in August of this year at $144.564 billion, meaning that the amount had increased by roughly $64 billion in the past four years. That's a lot of money being put aside for rainy days.

Going, going...what next?

Now the tide is going out. Across September and October the total has reduced to $143.482 billion, a drop of $1.082 billion. There's no evidence that's actually exited the banking system as such, given that savings and transaction account balances have increased in the same period and the total amount on deposit has risen to $266.447 billion as of October, up from $264.548 billion in August. But clearly there's some food for thought there.

The big $23 billion drop in TDS seen in the 2019-21 period clearly shows what people think of non-attractive interest rates. Sub 3% rates appeared to be quite a trigger point for people then and with rates now heading back towards 3% it is going to be very interesting to see how people react.

The obvious question would be whether money does start to make its way from TDs into the housing market.

In terms of mortgages, the market's not been anything like as moribund this year as some might imagine, following three years that were pretty quiet.

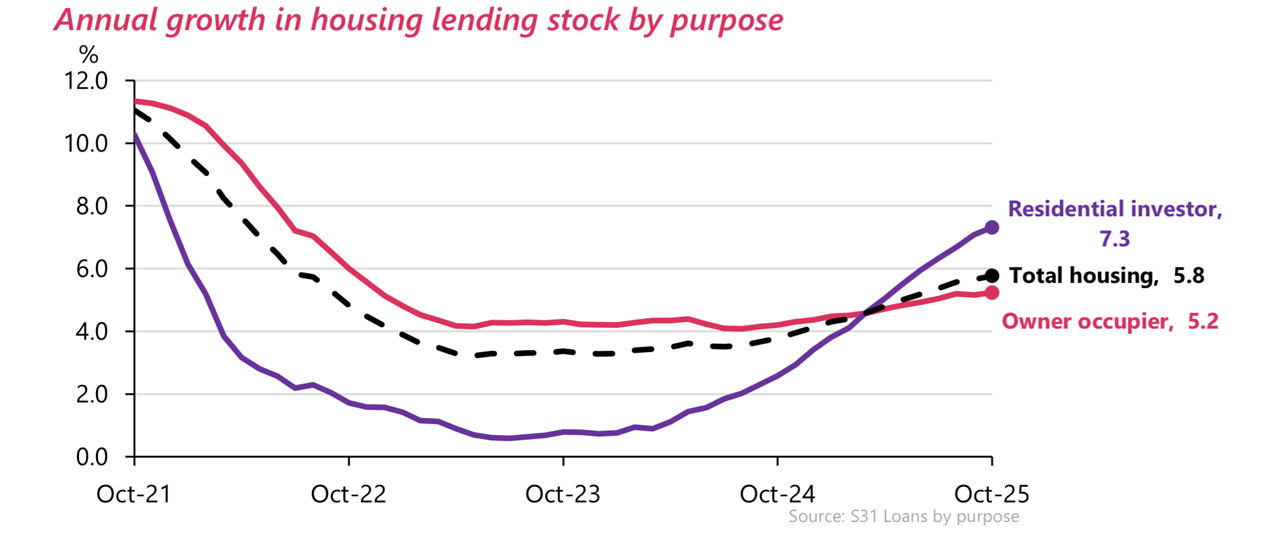

Investors do appear to have been more active this year, albeit off a very low base.

The latest RBNZ mortgage figures show that in the 12 months to October, investors increased their mortgage borrowing by $6.765 billion, a 7.3% rise, to a grand total outstanding of $99.305 billion.

In the first 10 months of this year, the investors increased their mortgage borrowing by $5.833 billion. That's already blown out of the water the increases for the WHOLE of calendar years 2022, 2023 and 2024, which were, in order $1.4 billion, $337 million and $3.087 billion.

Matching the big years

Depending on the outcome of the last two months of the year, this year's borrowing increase by investors could come close to matching the increases during the BIG years of 2020 and 2021, when the increases were $7.373 billion and $7.697 billion. In fact if we look at the figures for the first 10 months of each of 2020 and 2021 we can see that for the first 10 months of 2020 the increase was $5.051 billion, while the corresponding figure for 2021 was $5.752 billion - so, actually, both figures lower than this year's at the same time of the year.

If we look at all mortgages, IE, including owner-occupiers, the total outstanding stock stood at $381.370 billion as of October. That's up $20.79 billion, 5.8%, on an annual basis and up $17.271 billion for the year to date. The year to date figure has easily outstripped the figures for the whole of the past three calendar years (which ranged between increases of $10 billon to $14.5 billion). But this year's figure is still dwarfed by the momentous $30 billion increase in the mortgage pile we saw in 2021, which just maybe will stand as an all time record.

So, mortgage indebtedness is going up. And so for a good period of time too, was the level of distressed mortgage debt. But that, courtesy of rate reductions, appears to be very much on the mend now.

The RBNZ's latest loans by asset quality figures show that in October the total of non-performing housing loans dropped by $33 million to $2.239 billion. That's now the fourth consecutive fall, which has seen the non-performing tally drop by $218 million (8.9%) from the peak of $2.457 billion. At peak the non-performing loans made up 0.66% of the outstanding mortgage loans, while as of October that was down to 0.59%.

*This article was first published in our email for paying subscribers. See here for more details and how to subscribe.

12 Comments

For those over 65 would it make sense to shift term deposits into KiwiSaver accounts?

Agreed . . . and split your funds between different types of funds within the same provider.

Pensioners do not need to hold all their funds in low risk fund types such as cash - just what they require in the near future - and some in higher risk longer term funds as most are likely to have ten years and more life expectancy.

KS fees are relatively low and funds are readily available within a few days,so KS as part of an investment portfolio makes great sense.

If you're over 65, why would you put your money in a KiwiSaver fund vs. a retail managed fund? Some providers offer the same fund to both KiwiSaver and retail investors but charge a higher management fee on the KiwiSaver fund.

some of the best funds need higher amounts but I am assuming those smart enough to more have higher funds available

mother in law plays lots of dosh this way and is way way up this year

That's a good point. I think my KS provider does offer these alternatives and they may be cheaper.

The following comments are relevant only if you are over 65.

Be aware with many non-KS managed funds there is either an entry fee and/or withdrawal fee in addition to the management and administration fee.

From experience with a couple of banks, the management and administration fees for non-KS managed funds is usually higher. This is due to both the size of the non-KS fund often being smaller than the KS fund, and KS funds are more competitive as a comparison of fees can be easily made when chosing a provider.

One also needs to consider that there is considerable competition among KS fund providers to perform well as KS funds are readily compared such as by Morningstar.

Thanks printer8, to tell the truth, I would be more comfortable using the existing KS even if it cost a little more.

2020/21, assailed by Covid, catalysed a monumental miscalculation in crash diving an already bottomed out OCR to supposedly protect the property market but instead generated a stampede into it and resultantly a price boom, unprecedented and unsustainable. All of that of course largely identifies why TD’s across the board were simultaneously jettisoned.

It doesn't quite though does it? People took term deposits out and bought houses, and the recipients of the money put the money back into term deposits. When house prices were going gang busters in late 2021, the flow of money into term deposits was positive. Many billions of mortgage debt was being created, and this was flowing through house sales into term deposits.

Sure not quite, the scenario was both unusual and hardly simple. But a quick general search, relative to that period, has RBNZ figures indicating that mid 2021 household term deposits were at around $80 billion that being $23 billion less than the equivalent two years earlier. The last half of 2021 saw said deposits rebuilding as interest rates started to rise.

That was just shuffling between accounts though - household bank deposits between mid-2021 (jun-aug avg) and mid-2019 (jun-aug avg) changed as follows:

- transaction accounts: +$24bn

- savings: +$24bn

- term deposits: -$21bn

So, total households balances were up $27bn - this was mortgage loans flowing through house sales into bank accounts. Unsurprisingly, people bought other financial assets, or held money in transaction and savings accounts until term deposit rates improved.

Is most of the recent growth in residential investor lending likely to be the new build high end Queenstown properties and new build townhouses/apartments in the main cities?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.