Content sourced from the Special Topic of Treasury's Monthly Economic Indicators report.

This Special Topic provides an overview of New Zealand’s trade composition and discusses some of the implications for the wider economy.

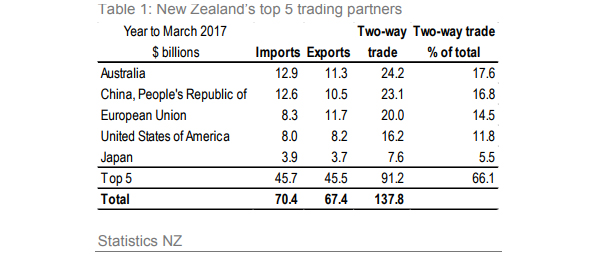

In the year to March 2017, New Zealand’s total trade flows (the value of goods and services exports plus imports) were valued at $137.8 billion, with just two countries, Australia and China, accounting for more than one-third of total trade. New Zealand’s top five trading destinations accounted for just under two-thirds of total trade (Table 1). Of the $137.8 billion, 51.1% was exported and 48.9% was imported, resulting in a trade surplus of $3.0 billion.

Trade in goods dominates

In the year to March 2017, goods accounted for 71.6% of total trade, while services accounted for 28.4%. Goods exports made up 69.2% of total exports while goods imports made up 74.2% of total imports. Goods as a share of total trade has been relatively stable over the past three decades, averaging 73.1%. However, this decreased slightly in recent quarters, as trade in services increased owing largely to a higher share of services exports, reflecting strong tourism.

New Zealand’s goods exports are concentrated in the primary industries. In the year to March 2017, over half the value of New Zealand’s goods exports could be accounted for by four categories: dairy (23.7% of goods exports), meat (12.3%), forestry (8.5%), and fruit (5.7%). Vehicles, parts and accessories accounted for 15.4% of goods imports. Mechanical machinery and equipment, petrol, and electrical machinery and equipment accounted for 13.5%, 8.8% and 8.2% of goods imports respectively.

Services exports are dominated by travel and transportation (63.8% and 12.7% respectively). The former captures spending in New Zealand by short term visitors (mostly holiday makers), the latter includes transportation of passengers, freight and other items though carriers such as ships and aircraft. While travel and transportation dominate imports of services (at 33.8% and 22.5% respectively), other business services – including merchanting (the margin on goods bought and sold offshore) and services, such as legal, accounting and consultancy – accounted for 17.3% of services imports. This compares to 8.8% of exports.

New Zealand’s top trading partner

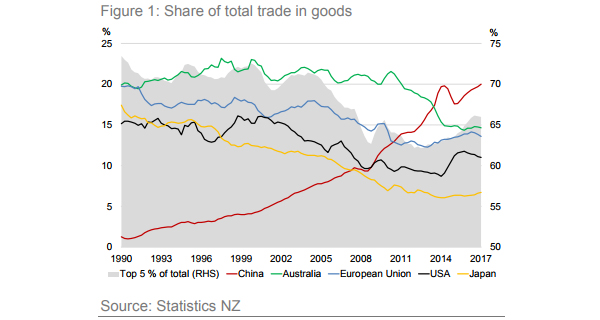

As measured by goods and services two-way trade, Australia is New Zealand’s top trading partner. However, for trade in goods, China is ranked first, leading in both exports and imports. In 2008, New Zealand entered into a free trade agreement with China (the first developed country to do so) which contributed to an increase in the pace of trade expansion with China2 (Figure 1). Since 1990, China’s share of two-way trade in goods has increased from less than 1.5% to over 20% in 2017. Prior to this, Australia was New Zealand’s top trading partner in goods for more than two decades.

Exports to Australia accounted for 18.3% of total exports in the year to March 2017, with goods accounting for 64.7% of this (Table 2). Of the $2.4 billion in travel services exports, 80.6% of this was other personal travel (holidays) and 19.4% was business travel.

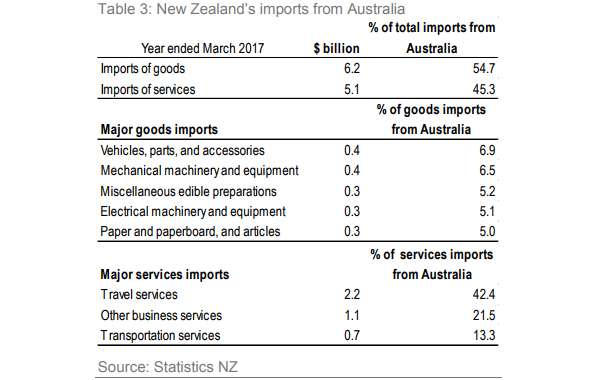

Imports from Australia accounted for 16.8% of total imports, with 54.7% of this goods imports (Table 3). Of the $2.2 billion in travel services imports, 72.6% was from holiday makers, 24.8% was business travel and 2.6% was education-related.

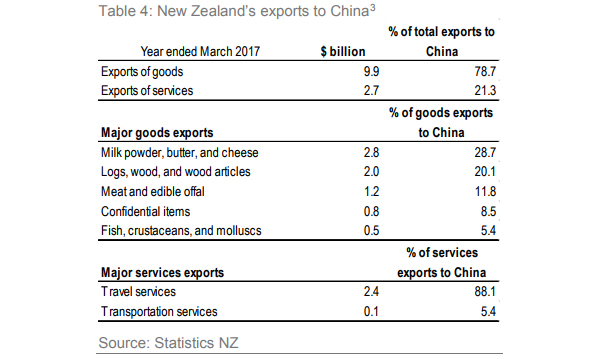

Exports to China accounted for 17.9% of total exports in the year to March 2017, with goods accounting for 78.7% of this (Table 4). Of the $2.4 billion in travel services exports, 59.1% was from holiday makers, 38.8% was education-related and 2.1% was business travel.

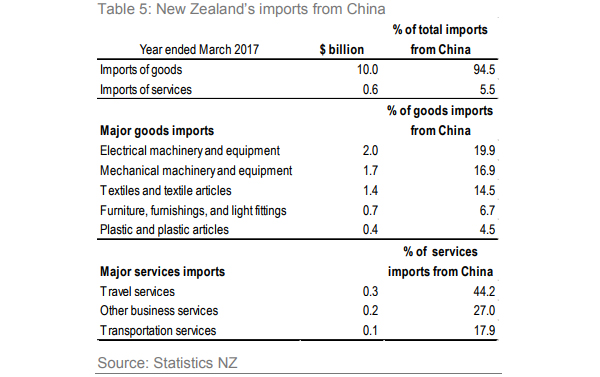

Imports from China account for 15.6% of total imports, with 94.5% of this goods imports (Table 5).

Terms of trade implications

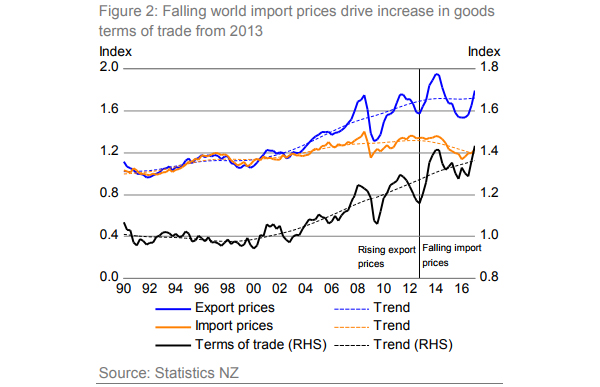

The terms of trade is the ratio of New Zealand’s export prices to its import prices. A rise in the terms of trade represents a rise in national disposable income, either through lower expenses from cheaper imports or higher revenues from exports. The goods terms of trade has been trending upwards since the early 2000s, and in March 2017, were at their highest level since 1973. Figure 2 shows that between the early 2000s and 2013, the rise in the terms of trade was driven by rising world export prices. From 2013 onwards, the rise was driven by falling import prices. In NZD terms, import prices are currently around the same level as they were almost 30 years ago, driven largely by lower prices for capital and manufactured goods. Conversely, export prices have remained elevated.

Growth in trade with China has contributed to New Zealand’s improving terms of trade, as Chinese urbanisation and ongoing transition towards consumption-led growth has supported demand for New Zealand’s primary products and kept export prices elevated. On the imports side, China’s ability to produce manufactured products more cheaply than most other countries (due to scale and low labour costs), has kept import price growth muted. However, it is difficult to ascertain the exact “China” impact as other factors, particularly low oil prices, have also kept import prices low. Oil prices declined from over $US100/barrel in mid-2014 to around $US45/barrel currently. This decline followed large-scale investment in shale oil extraction in the US and elsewhere, which increased global supply and reduced prices for oil, and subsequently petrol (New Zealand’s third largest import good) along with goods and services with a significant fuel component.

The impact on economic activity from a rise in the terms of trade will vary depending on the drivers of the shift. For example, whether the price change is concentrated in a particular industry or good, or whether it is broad based across many industries or goods. Higher export prices (as seen in the dairy industry in 2013), would generally lead to higher investment (such as farm conversions) which supports domestic activity. In addition, higher export revenues would increase disposable incomes and support growth in consumption. On balance, this additional demand would contribute to inflationary pressures leading to higher interest rates. Moreover, these effects may be more pronounced when a number of export prices rise simultaneously. The New Zealand dollar (NZD) would likely appreciate reflecting the stronger economic outlook and higher interest rates. New Zealanders who do not derive their income from exports (either directly or indirectly) would benefit from lower domestic prices for imported goods and services. In other words, the higher NZD would distribute some of the income gain from higher export prices to the rest of the economy by increasing the purchasing power of households.

On the other hand, the impact of a rise in the terms of trade owing to lower consumer import prices may be less stimulatory for the economy as a whole. While households would benefit through lower import prices, supporting consumption, the relative price shift could also drive higher imports of consumption goods. In addition, the impact on investment is less clear. In general, investment demand will be influenced by the type of import goods experiencing lower prices. Low goods import prices may increase competition in import-competing sectors and discourage investment. On the other hand falls in the price of imported capital goods may encourage investment. Falling import prices will also contribute directly to lower tradables inflation.

Notes:

1. http://www.mbie.govt.nz/publications-research/research/construction-sector-productivity/nationalconstruction-pipeline-report-2016.pdf

2. The New Zealand - China agreement is in the process of being upgraded. See https://www.mfat.govt.nz for further information.

3. Confidential items are suppressed to protect commercially sensitive information. See confidential items – exports for further information.

This is a repost of the Special Topic here.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.