This is a basic profile of an NZX50 listed company. It is not investment advice. We recommend you contact a qualified adviser if you need more information.

Kiwi Property Group

Directory

| NZX code: | KPG |

| Short name: | Kiwi Property Group |

| Legal name: | Kiwi Property Group Limited |

| Industry sector: | Real Estate Investment |

| NZX50 rank: | 25 of 50 |

| Head office address: | Level 7, Vero Centre, 48 Shortland Street, Auckland 1010 |

| Chairman: | Simon Shakesheff |

| Chief executive: | Clive Mackenzie |

| Financial year ended: | March |

| Locations: | New Zealand |

| Auditor: | PwC |

| Bankers: | ANZ, BNZ, CCBNZ, CBA, HSBC, Westpac |

Kiwi Property Group

Select chart tabs

Financial statement history

A. Recent trading and performance summary:

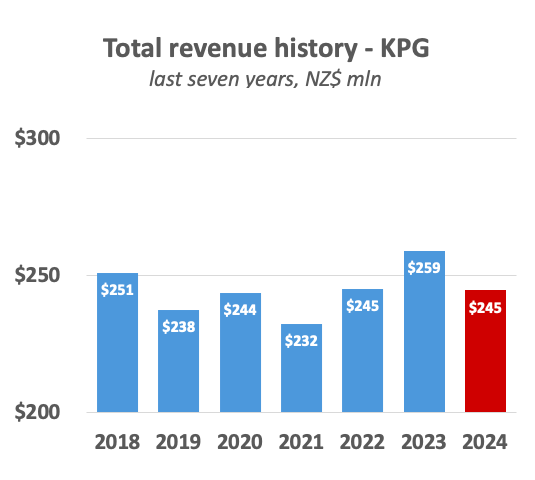

| Total revenue |

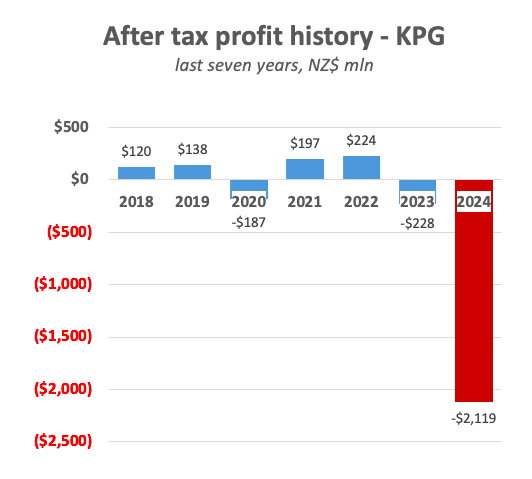

NPAT | Earnings per share |

|

| fye March | mln | mln | cents |

| 2018 | $251.0 | $120.1 | 8.7 |

| 2019 | $237.5 | $138.1 | 9.7 |

| 2020 | $243.6 | -$186.7 | -12.5 |

| 2021 | $232.4 | $196.5 | 12.5 |

| 2022 | $245.1 | $224.3 | 14.3 |

| 2023 | $259.1 | ($227.7) | -14.5 |

| 2024 | $244.6 | ($2,119) | -13 |

B. Recent financial position summary:

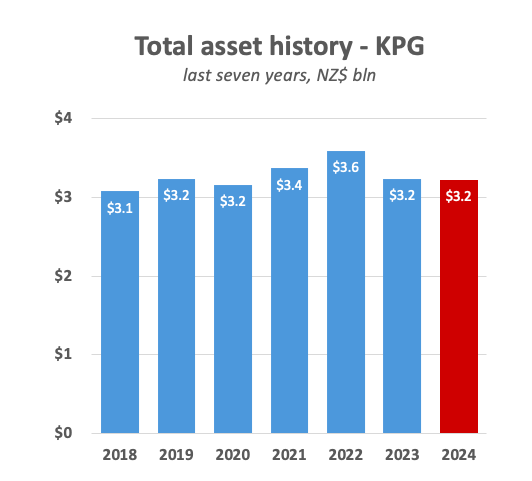

| Total assets |

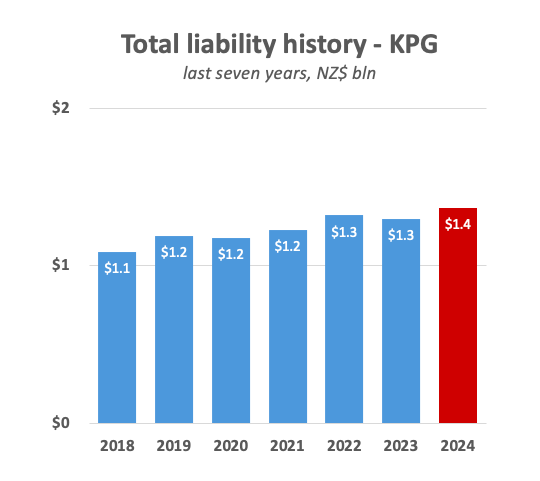

Total Liabilities |

Equity ratio |

|

| fye March | bln | bln | % |

| 2018 | $3.08 | $1.09 | 64.6 |

| 2019 | $3.24 | $1.19 | 63.3 |

| 2020 | $3.16 | $1.18 | 62.7 |

| 2021 | $3.37 | $1.23 | 63.5 |

| 2022 | $3.59 | $1.32 | 63.2 |

| 2023 | $3.24 | $1.30 | 59.9 |

| 2024 | $3.23 | $1.37 | 52.0 |

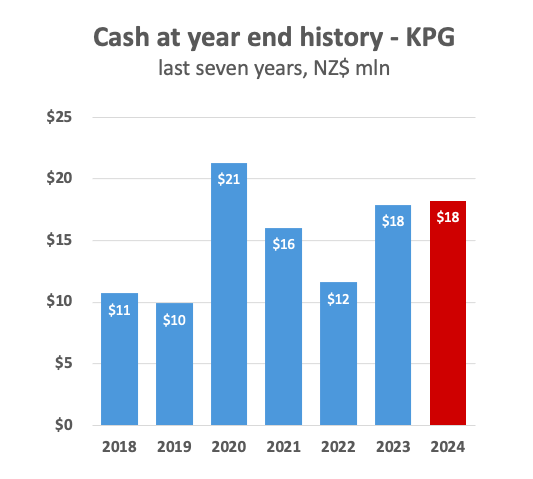

C. Recent cash flows and positions:

| Cash inflows |

Cash outflows |

Cash and equiv. at year end |

|

| fye March | mln | mln | mln |

| 2018 | $108.2 | $107.3 | $10.7 |

| 2019 | $103.0 | $103.8 | $9.9 |

| 2020 | $208.5 | $197.1 | $21.3 |

| 2021 | $111.6 | $116.8 | $16.0 |

| 2022 | $115.6 | $120.0 | $11.6 |

| 2023 | $112.9 | $132.4 | $17.9 |

| 2024 | $99.33 | $99.0 | $18.2 |

D. Recent key ratio analysis:

| Earnings per share |

Price:Earnings ratio |

NTA/share | Dividend yield |

|

| fye March | cents | annual avg | dollars | annual avg % |

| 2018 | 8.7 | 15.4 | 1.44 | 5.11 |

| 2019 | 9.7 | 15.3 | 1.44 | 4.68 |

| 2020 | -12.5 | -7.5 | 1.32 | 3.76 |

| 2021 | 12.5 | 9.9 | 1.36 | 4.15 |

| 2022 | 14.3 | 7.7 | 1.45 | 5.09 |

| 2023 | 14.5 | N/A | 1.23 | 7.76 |

| 2024 | -0.01 | -630.7 | 1.17 | 8.03 |

Description of trading activities

Kiwi Property Group owns New Zealand property assets. This includes retails centres and office buildings to thriving mixed-use communities. They have a team of more than 160 people who manage $3.2 billion worth of NZ property and $400 million worth of property on behalf of third parties.

CEO profile

Clive Mackenzie has been in involved in property and finance for 20 years and became the CEO of KPG in 2018. Before this, he held senior roles in Washington and NZ, with Westfield and St Lukes Group, across leasing, development and shopping centre management. There his main role was to create and implement transformational strategies to evolve, strengthen and develop the company's real estate portfolio.

Chairman profile

Simon Shakesheff is an Australian-based professional director, holding experience with property, finance, strategy, and mergers and acquisitions. As well as being Chair of KPG, Shakesheff is also a Director of Cbus property, Assembly funds management, SGCH, and is the Chair of HomeCO. Previously, Shakesheff has been an executive at Stockland, Bank of America Merrill Lynch, UBS, J.P Morgan and Macquarie Bank.

Links:

| Company website: | https://www.kiwiproperty.com/ |

| Investor information: | https://www.kiwiproperty.com/corporate/investor-centre/ |

| NZX listing: | https://www.nzx.com/companies/KPG |

| Annual reports: | https://www.kiwiproperty.com/corporate/investor-centre/ |