This Top 5 comes from interest.co.nz's Gareth Vaughan.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz. And if you're interested in contributing the occasional Top 5 yourself, contact gareth.vaughan@interest.co.nz.

Cartoon: Ed Wexler.

1) A platinum coin to tackle US debt ceiling woes?

With the issue of the US debt ceiling, or statutory public debt limit, in the news again, Bloomberg's Joe Weisenthal has been airing what he himself admits sounds like a weird solution.

Weisenthal argues there's an easy way to defuse the debt ceiling "bomb." This would see US Secretary of the Treasury, Janet Yellen, mint a trillion dollar platinum coin, buy $1 trillion worth of debt from the Federal Reserve and retire that debt, thus establishing some breathing room under the debt ceiling.

Weisenthal says it's legal and would avoid a potential debt default and associated recession. With the choice, as he paints it, being between "weirdness" and "catastrophic default leading to a depression," there's a good reason to go with weirdness.

Here's Weisenthal from one of Bloomberg's free newsletters.

Because it's weird, people have all kinds of questions, so here's a short FAQ.

Q: Why does the coin have to be platinum?

A: Scroll down to section (k) here, and you can see that the law grants the Treasury Secretary a high degree of discretion when it comes to platinum coinage specifically. Odd yes, but that's what the law says.Q: Would the coin have to be big?

A: Of course not. Dimes are smaller than pennies but are worth more. There's no connection between the size of a coin and its monetary value.Q: Would this cause inflation?

A: No. And I explained this yesterday, and the short version is, because it's just an asset swap between two arms of the government (the Treasury and the Fed) no new money would enter the economy. It's just an accounting trick.Q: Wouldn't it be better to get rid of the debt ceiling entirely?

A: Sure, but that's not the world we live in. That option isn't on the table, so at this point to even bring that up is a distraction and a waste of time.Q: If we can seamlessly swap coins and Treasuries, why do we need a government bond market in the first place?

A: Legit question actually. There are some who argue that we should only do monetary financing, and that the entire Treasury market is unnecessary relic.Q: If debt can just be erased and it's all accounting and we can finance spending by coins, why do we need taxes?

A: Taxes serve other purposes. Progressive taxation can restrain inequality. Taxes can curb inflation by reducing domestic demand. Taxes create value for the currency by creating a need to acquire dollars (you need to acquire dollars to pay your tax bill). Basically, taxes do other stuff besides financing spending.Q: Would people keep buying our debt if we engaged in this budgetary hack?

A: Look at the dysfunction in D.C. as it is. Clearly that's had no bearing on the liquidity and demand for U.S. Treasuries. Just one more random thing isn't going to do much.Q: Wouldn't this be a violation of the separation of powers? Why even go through a budgetary process if the Treasury could do this unilaterally?

A: Paying the debt is different than a budget. A budget isn't just an agreement to spend a certain amount of dollars, but also it involves specific allocations to various entities and projects (like the social safety net, the military, infrastructure and so forth). Only Congress can vote to make these allocations, and nothing about minting the coin would deprive Congress of its role in making these decisions.Q: Wouldn't the Supreme Court declare this to be unconstitutional?

A: For one thing, it's not clear who would have standing to sue. For another thing, we have a Supreme Court filled with textual literalists, and the text is pretty clear on this. And for another thing there's an argument that defaulting on the debt itself is unconstitutional per the 14th Amendment. So this really doesn't seem like much of a concern.Q: Why not mint a $2 trillion coin

A: Yeah, that'd work too.Q: So why don't we just do it?

A: ¯\_(ツ)_/¯

2) Shamubeel Eaqub's path from pandemic to endemic.

As ex-PM John Key thrust himself into the Covid-19 discussion swallowing up a huge quantity of media oxygen over the past couple of days, a deeper article was unfortunately overshadowed.

This one, on Stuff, came from economist Shamubeel Eaqub. The section below, where Eaqub talks about a potential choice between an open border or more domestic restrictions, is interesting. Which way will we lean if it comes down to that?

When people talk about opening up, they mean opening up the border. The countries that have done this have domestic restrictions in place. This is because vaccination rates are still relatively low and people are still getting sick in large enough numbers to pressure health systems.

Unless vaccination is near universal and there is enough health system capacity to deal with those who may still get sick, and make the unvaccinated very sick, opening up the borders will come with more domestic restrictions.

The demand for opening the borders is linked to tourism, international education, immigration, and reconnecting with the world for trade, investment and knowledge flows.

Public support for tourism and immigration had been on the wane before the pandemic, and to date exports and investment flows have been very strong. There could be more resistance to domestic restrictions, than support for more open borders.

Eaqub talks about the need to improve public health system capacity. Separately Stuff recently ran this article from Wellington ICU specialist Alex Psirides. He makes the point that it takes five years to train an ICU nurse. But also that a single ICU bed costs more than $1 million per year, and there are "convincing arguments" that investing similar sums in either public or primary health will produce greater benefits for more New Zealanders.

But back to Eaqub. He also argues NZ's public debt is not the problem some paint it to be. (A point I also made here last year).

While New Zealand has accrued significant debt due to the pandemic, it is low compared to other OECD countries. There is also none of the pressures of too much debt of the 1980s, when interest payments gobble up a quarter of our tax revenue, leaving little for other programmes.

Now, interest payments are the smallest share of taxes in history. We do not have an immediate debt problem and we should move away from this obsession with paying down cheap debt.

There's plenty more in Eaqub's article and it's well worth a read.

3) Suckers!

Parliament’s Finance and Expenditure Select Committee is undertaking an inquiry into "the current and future nature, impact, and risks of cryptocurrencies." Some 269 submissions are in and can be found here.

It's an interesting time in the world of cryptocurrencies. China has just declared "virtual currency-related business activities are illegal financial activities." And in the US Securities and Exchange Commission Chairman Gary Gensler has labeled the cryptocurrency industry a wild west, and wants more authority to police cryptocurrency trading.

Cryptocurrencies are not regulated in New Zealand. It should be interesting to see the Select Committee's final report. And whether anything actually comes from the inquiry.

As you'd imagine, a range of views are expressed in the submissions.

This one from "Crypto Daddy" is short and to the point.

You will never be able to regulate cryptocurrency, it is changing and shaping the financial world in a revolutionairy [sic] way and the govt with its stupid tax & inflation systems is going to be left in the dust!

Suckers!

Then there's one in the name of Satoshi Nakamoto, which is the name used by the presumed person or persons who developed bitcoin. Here's a flavour.

The root problem with conventional currency is all the trust thats required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.

Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. Their massive overhead costs make micropayments impossible.

The Reserve Bank, the sole issuer of New Zealand's existing fiat currency which is considering issuing a central bank digital currency, is pretty scathing about cryptocurrencies. They should be called crypto-assets it says, and are a high risk investment.

The term 'crypto-currencies' is used to describe a wide range of digital assets that claim to be alternative forms of money, Bitcoin being the most well-known. However, the Reserve Bank prefers not to use the term ‘crypto-currency’ as it implies attributes – a safe store of value, a stable medium of exchange and a reliable unit of account – associated with conventional currencies that ‘crypto-currencies’ do not have. The Reserve Bank considers ‘crypto-assets’ a more appropriate term than ‘cryptocurrencies’.

For example, popular crypto-assets such as Bitcoin exhibit a high and unpredictable volatility of exchange rates with conventional currencies. This volatility attracts and encourages speculation. It also makes it difficult for the holders to predict how much it may be exchanged for goods and services priced at a much more stable level in conventional currencies, as illustrated in the graph below. The FMA classifies Bitcoin as a high-risk investment and advises people to only invest in Bitcoin what they can afford to lose.

Among the other submissions there's one from Chartered Accountants New Zealand calling for a comprehensive taxation framework for cryptocurrency allowing it to fit into existing tax rules.

4) Auf wiedersehen to the Empress of Europe.

The ABC takes a look at the life and times of Angela Merkel, the physicist who grew up in East Germany and became Chancellor of a united Germany for 16 years. It contrasts her enthusiasm for enforcing austerity on Greece during that country's debt crisis with her compassion in allowing a mass refugee flow into Germany.

I found the bit about her actions in the immediate wake of the fall of the Berlin Wall interesting. It'd be fair to say she didn't get carried away.

When the Berlin Wall dramatically fell in 1989, removing the artifice between East and West overnight, she did not rush to the other side like so many of her compatriots.

Instead, she went to the local sauna, as she did every Thursday, with a friend.

"I figured if the wall had opened, it was hardly going to close again, so I decided to wait," she recalled.

It was quintessentially Merkel in her understated, pragmatic approach, a style that would stay with her as she made her unlikely rise to the chancellorship.

5) The myth of green capitalism.

In a Project Syndicate article Katharina Pistor, Professor of Comparative Law at Columbia Law School, argues governments and regulators have succumbed to the "siren song" of market-friendly mechanisms in the fight against climate change.

The private sector's embrace of "green capitalism" is another gimmick to avoid a real reckoning, Pistor argues.

The notion of green capitalism implies that the costs of addressing climate change are too high for governments to shoulder on their own, and that the private sector always has better answers. So, for advocates of green capitalism, public-private partnership will ensure that the transition from brown to green capitalism will be cost-neutral. Efficiently priced investments in new technologies supposedly will prevent humanity from stepping over into the abyss.

But this sounds too good to be true, because it is. Capitalism’s DNA makes it unfit to cope with the fallout from climate change, which in no small part is the product of capitalism itself. The entire capitalist system is premised on the privatization of gains and the socialization of losses – not in any nefarious fashion, but with the blessing of the law.

According to Pistor, this blessing of the law comes through legally encoding capital through property, corporate, trust and bankruptcy law.

But the mother of all subsidies is the centuries-old process of legally encoding capital through property, corporate, trust, and bankruptcy law. It is law, not markets or firms, that protects the owners of capital assets even as they saddle others with enormous liabilities.

Advocates of green capitalism are hoping to continue this game. That is why they are now lobbying governments to subsidize asset substitution, so that as the price of brown assets declines, the price of green ones will rise to compensate the asset holders. Again, this is what capitalism is all about. Whether it represents the best strategy for ensuring the planet’s habitability is an entirely different question.

Instead of tackling such questions, governments and regulators have once again succumbed to the siren song of market-friendly mechanisms. The new consensus focuses on financial disclosure because that path promises change without having to deliver it. (It also happens to generate employment for entire industries of accountants, lawyers, and business consultants with powerful lobbying arms of their own).

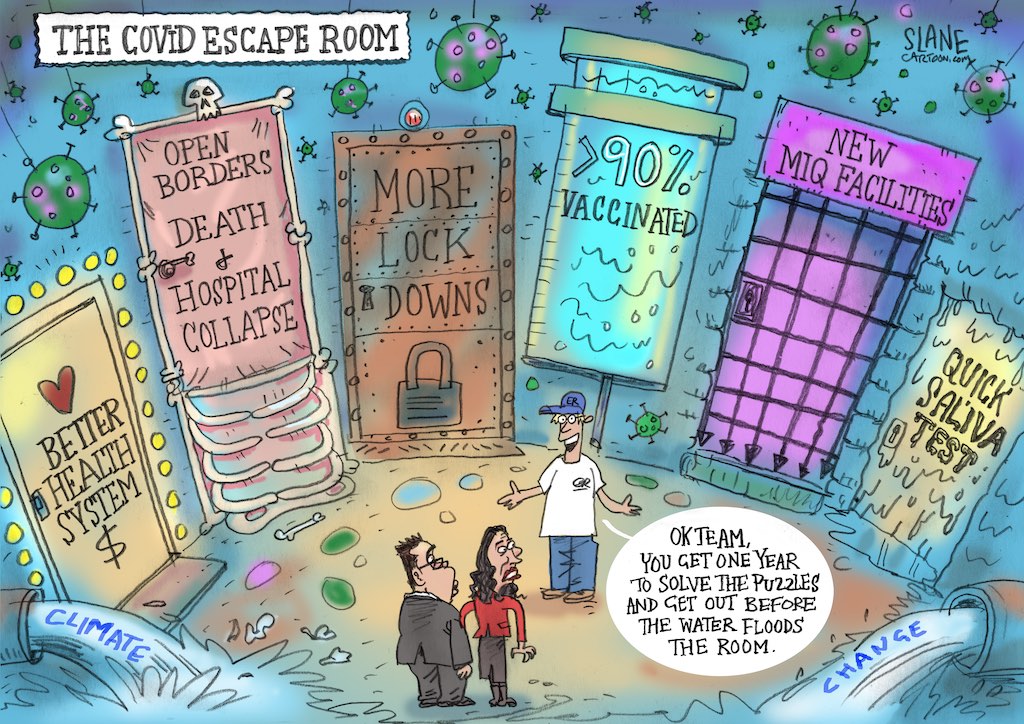

Cartoon: Chris Slane.

28 Comments

If anything sums up the pointless of the current financial system it is this:

This would see US Secretary of the Treasury, Janet Yellen, mint a trillion dollar platinum coin, buy $1 trillion worth of debt from the Federal Reserve and retire that debt, thus establishing some breathing room under the debt ceiling.

It's all just hocus-pocus.

Fixing the price of gold to bring order to the worlds finances must have also appeared hocus-pocus at the time.

Also sums up the point of Bitcoin....

I think Zimbabwe has a 100 Trillion dollar note

I think it is the pathway to currency decimation

The US is way too indebted and needs to think about how they can live more within their means, but each party who gets into power spends more. They really need bipartisan laws that restrict expanding debt to a % of GDP. And if they want to go beyond that they would have to sell off assets or resources. Not such vote pleasers those two.

"Stop issuing monetary sovereign government debt securities. They are unnecessary. There is no compelling reason to issue them. They confuse people. They bias macroeconomic discourse, policy making and outcomes. They are an anachronism. They belong, alongside tally sticks, the gold standard, the London discount houses, and neoclassical macroeconomics, in the history books.” (Global Institute For Sustainable Prosperity). http://www.global-isp.org/policy-note-121/

Mmm pretty useful for finance tbh.

When you have a govt debt security for 2,5,10,20,30,50 years you've built a yield curve upon which private sector risks can be built to arrive at an appropriate required rate of return.

Bollocks.

A lot of Limits-to-Growth-ignorant people place bets, and on that basis you construct something?

Nuts. Did you pay to learn stuff like that?

It's just all politics, Biden's administration and democrats knew the debt celling will be raised, of course Republican wouldn't easily agree with the democrats without putting up a fight. So now all these talks about concerning of not raising the debt celling is just democrats trying to make political gains.

American politics is far worse than even ours. The way they carry on over there has no logic whatsoever at times. Love that $1 Trillion Dollar coin idea but I guess you would be pretty pissed if you lost it out a hole in your pocket.

LOL, not a chance if it's the size of a ute!

Imagine the kid who finds it, trots into his local Dairy, and asks for a quadrillion 1-cent lollies...

Ah the Simpsons foreshadowing the future again. Give what back:

Banning crypto may actually help to uncover paedo, launderers and druggies as they eventually have to find a traditional way to transact.

It's better to trust a unreliable government than to trust and enable criminals.

You mean when they just have to go back to suitcases full of cash ? I think some corrupt governments have squandered far more than the criminals in their countries at times.

I remember the story someone told of when they'd gone into prison and the hardened crims there told this person that they'd rather be politicians than criminals because the politicians can steal all they want and never have to go to jail!

Guess they'll just go back to laundering money though NZ housing eh.

I’d trust a blockchain protocol over a politician. Blockchain protocols are consistent and transparent, so the opposite of central banks. The reason governments and central banks fear crypto is because they can’t manipulate it.

Buying some Platinum shares today.

looking myself. care to share what you settled on?

"Banks are centralized middlemen with respect to financial transactions,” Prins, author of Collusion: How Central Bankers Rigged The World, tells TIME. “The more popular cryptocurrency or digital currency becomes, the fewer profits the banking system can reap from traditional services and verification methods that allow them to hold, take or use their customers’ money, and the more financial power they stand to lose as a result".

"In cities across China, the country’s central bank has begun rolling out the e-renminbi—an all-digital version of its paper currency that can be accessed and accepted by merchants and consumers without an internet connection, credit or even a bank account".

Above from a recen TIME Magazine article.

The reason the US is not in the race for CBDC and letting China win the race for the future of Money ?

"Green Capitalism" got my attention, and I'd bet PDK has a view! But the slow drift of all natural resources into private, elitist ownership will be the goal of capitalists with a goal to entrenching their wealth, power, and privilege. This needs to be firmly restricted if not stopped and/or stringently regulated.

Any reporters know what time today government are releasing details on new interest deductibility policy ?

Thanks

Out now, story soon.

Everyone should read that first quote under "The myth of Green capitalism" about 4 times to make sure you understand it.

Only way you will ever effectively solve climate change IMO is a global carbon tax at a set rate, ramping up fairly quickly at the producer level (farms/electricity plants/mines/crude oil sales/coal sales etc). With the proceeds used to decarbonise all economies producing carbon. Using some sort of market for carbon exchange is both a waste of time/resources AND completely ineffective as the author refers to by policy makers "succumbing (sic) to the siren song of market-friendly mechanisms". Forcing all carbon emitters to pay for their socialised outputs via tax that is the same everywhere, is the only way to solve a global problem.

Start off with 1c per tonne, then next year double it. Then next year double it and so on and so on. Do that for 10 years and when it's over $5 per tonne, I bet there won't be many industries producing carbon in huge amounts... also make that $5 equivalent to the retail price of a basket full of products and assets in every currency, so to avoid governments just printing money to escape the consequences.

Our and America's debt outlook simply depends on what China does in the next months in response to their real estate market.

China is now a major consumerist society, as well as the largest exporter. If China goes for the traditional approach of letting large numbers of capitalists go broke and has a recession, we will see disruption to our supply chains and stagflation. Then a recovery that is more likely to be Chinese consumer driven than export led. Both of these things will put different upward pressure on our interest rates.

Or maybe the Communist Party will give billions to Chinese billionaires with unprofitable companies - like America and the EU do.

Seems to be a bunch of myths around "store of value" and "capital" that nobody wants to address.

Why is that?

This video gives some support to the Platinum Dollar idea and explains how it is clever. Go for it, Uncle Sam.

https://www.facebook.com/ajplusenglish/videos/499346571251946/

Where is option keep borders secure, not allow the disease to become endemic and require vaccines for new strains every few months and Associated health problems till the 90%, take the reduction in tourism emissions as a first step to our overall necessity to cut and the stopping immigration led of population growth, a step to not increasing pollution? People still have the choice to go through quarantine if they choose to pay, rather than externalising their costs into the rest of humanity.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.