In years to come New Zealanders will look back on the winter of 2010 as the moment when we finally realised the last 10 years of growth was a sham.

It's the moment when it dawned on New Zealand home owners, small business people, retailers and real estate agents that our household debt has hit saturation point and we just can't swallow any more.

It's the moment when we realised that without that extra debt our economy doesn't grow much, unless we can actually produce more useful goods and services for each hour that we work. We haven't boosted our productivity much in the last 10 years and now we can't disguise it any more by spending borrowed foreign money.

The giant Ponzi scheme of adding more debt to buy more houses (or spend more on the same houses) and then relying on capital gains to make up for it only works for as long as some sucker is jumping in at the bottom of the pyramid with yet more debt. It's now clear that New Zealand has been in a twilight zone over the last two years since the onset of the Global Financial Crisis wondering why everything seemed not too different.

Unemployment didn't rise too much, house prices dipped and then bounced, and then GDP seemed to return in mid 2009.

Phew, many thought, we seemed to have escaped. But this winter we have discovered that the tide was actually going out and it is in the last 6 weeks that we've collectively discovered the economy is naked without the extra debt. This may seem like an extreme assessment for those who haven't been following the statistics day by day, but this week all the data came together to show the debt-fueled growth of our housing-led consumer econony has ground to a halt.

Here's the latest:

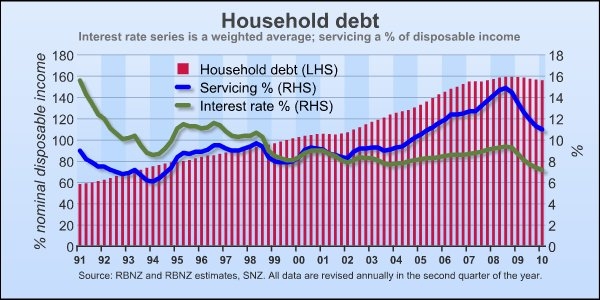

* Mortgage approvals hit a record low last week for a non-holiday week of 4,867 and NZ$601 million. Annual household debt growth has slumped to 2.5% from over 10% two years ago. Between January 2000 and January 2009 New Zealand households added NZ$100 billion of debt and increased our collective debt to disposable income ratio from 102% to 158%. That economic growth that happened through the Labour years from 1999 to 2008 was fueled by debt. When the debt stops, the growth stops. The ratio has been stable in recent months as debt has grown more slowly than incomes.

* The housing market went deathly quiet in May and June, Real Estate Institute figures showed last week. Turnover has dropped around 20% from a year ago. It's not just a winter thing. * Retail sales in May were again surprisingly and frustratingly weak. Core retail sales fell for the 4th month in 6 months and supermarket sales fell in May for the first time ever.

* BNZ's confidence survey showed a sharp decline among small business owners in particular as the real estate market went into the doledrums. Many small businesses fund themselves from their mortgages over their houses and when their values stop rising it's very hard to raise extra finance.

One banker said in the BNZ's survey that the market was very quiet with activity less than half normal levels.

"A few loan applications, but 80% rejection generally due to risk too high. Generally small business wanting to borrow have left it too late with balance sheets in poor state," the banker said.

Banks are being more cautious as their funding becomes more expensive and they are forced to borrow less from 'hot' short term foreign wholesale markets. Borrowers are being more cautious because house prices have stopped rising and they realise interest rates are rising.

The moment of truth arrived in the 6 weeks after the May 20 budget.

The coup de grace was the Reserve Bank's decision on June 10 to put up the Official Cash Rate.

The tide has gone out and New Zealand's housing dominated economy is now naked. It needs to put on some togs in the form of vibrant export industry and a productive sector. This will be a long hard grind without the help of extra debt.

4 Comments

BNZ has two sets of economists. The boys at BNZ Capital, which write for corporates and financial market types, wrote that research above. Here's all their stuff. https://research.bnz.co.nz/Research/NewZealand/Pages/NZpublications.aspx

Tony writes for BNZ's retail customers. Here's his stuff. https://research.bnz.co.nz/Research/NewZealand/Pages/NZpublications.aspx

They often have different views. Helps make the market go round.

cheers

Bernard

See above my comment on the two sets of economists at BNZ and their differing views.

I think it's healthy to have debate.

cheers

Bernard

Happy to be of assistance.

cheers

Bernard

Anonymous, please send in your photos to bernard.hickey@interest.co.nz Make sure you take your top off. We'll design a page 3 for it.

cheers

Bernard

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.