Bernard Hickey details the fourth in the series of the Top 10 charts for 2010 in association with Bank of New Zealand.

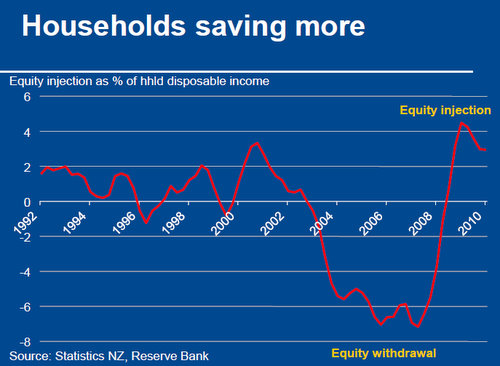

This chart from Finance Minister Bill English's presentation of the government's fiscal and economic update on December 14 shows how much equity households are injecting or withdrawing from their household savings going back to 1992.

It shows how between 2004 and 2008 New Zealanders used the rapidly inflating value of their houses as ATMs, withdrawing around 7% of household disposable income from the value of their houses each year for almost 4 straight years.

This was done in a variety of ways. Some households had flexible mortgages that allowed them to borrow at will to a limit without further approval from their banks. Others borrowed bigger fixed mortgages when it came time to roll over an old fixed mortgage, comfortable that the value of their house had risen in the meantime. The 'spare' borrowing was then spent.

Others sold houses with small mortgages and bought bigger houses with bigger mortgages, spending some money along the way on renovations and upgrades to furniture and home entertainment systems.

Essentially, that money withdrawn from the value of a home was spent, mostly on consumer goods and services such as flat screen televisions and holidays.

In some cases it may have been used to finance the growth of small businesses. Or it may have used to subsidise a struggling or failing small business.

From late 2008 however, it's clear that households pulled their heads in and started saving again. This was also done in a variety of ways.

Some borrowers kept paying off their mortgages as if they were still paying more than 10%, even though interest rates had fallen.

Others refinanced with smaller mortgages or moved to smaller houses with smaller mortgages.

Equity injection rose to as high as 4% of household disposable income by late 2009. This helps explain the struggles that many retailers have been having through 2009 and 2010 as the economy (more than two thirds of which depends on consumer spending) fails to get its mojo back.

But that savings spurt may not last.

The savings rate has fallen through late 2010 as some life returns to the housing market, albeit in a spotty way, and some start spending their tax cuts on wealthier properties.

We will see if it lasts.

The savings needed to offset the cumulative spending splurge of more than 25% of disposable income could take years to repair.

Are retailers and the government ready for that?

We welcome your views.

155 Comments

Without increased sustainable production in our economy we cannot, as a nation keep up paying for increasing prices on essential goods. Prices are killing us. As a consequence we are forced to reduce our standard of living.

Please read and understand in the context of Walter's many otter articles .

....first spelling mistake in 2010 by Gummy "otter" in stead of "other".

No , I meant to write " otter ".............. oooooooooh , shag , I am the fool aren't I !

Sorry Walter , all this time , I thought that you were blogging about otters ......... Sorry , man .

.......... well , we've had emus , ferrets , paua farms , cashmere goats ............ I figgered that you were promoting the NZ Otter milk co-op , or somesuch .

Knew I'd seen it somewhere... thanks.

"But that savings spurt may not last" ... Why is this repayment / lack of borrowing regarded as saving?

I stopped paying my mortgage principal during the good times and chucked the extra into the ASX and I have done sensationally well ( Europe this year, Barbados in Feb) and I am still better off. Bet I wont show up in the stats anywhere.

As we have seen the stats we get here are absolute rubbish, lets face it our current account reduced beacause we may get some EQC cash next year. There is a severe problem with our stats and they are mostly guess work and heavilt dependent on how our Aussie banks decide to adjust their tax bills.

You don't seriously expect to be told the truth do you...Govt is here to lead you Pongo....you're expected to trot along behind believing the spin and trying not to step in the BS. See the latest Treasury guff did we...promises of likely 4% growth in our time...which will be just like the promises they issued at the start of 09...it's a game Pongo...always the excuses when looking back and the positive when looking forward....works a treat with the peasants all the time. Half the country cannot remember a thing about 09...the brains are blank. They say it's the booze.

Great Bingo !

How can a nation, which imports most everything and a large majority of it’s population doesn’t produce, in the current and upcoming worlwide situation, financially survive the onslaught of fast increasing prices ?

In your case,. brother Wolly..it probably is the booze?

A case of the booze ? ................... Party at Rob's , guys . Excellent .......

....... Hey wot's that shit Wolly said about not remembering 2009 , why , we havn't got there yet ............ have we ?

"Hic"....."burp".....

........ do you look at all 'like Andy Capp , and is your missus called Florrie ............? ............. I only arsk , 'cos I'm getting this weird mental image of Wolly . ............ Best friend by name of Chalkie ?

I am the very model of a modern you know whatsit Gummy...burp.

Nah, chalkie vanished with the Independent as you well know norty Gum shark!

Chalkie got an unfair fax . You're stuff'd buddy .............. never gonna remain independent , after the under-armers got their sticky mitts on youse all .

actually i'm glad you've turned up Gumbo as Wolly has gone mad and appears drunk with power...lecturing on every subject all being cleverly puppetered by the evil Hickster..shut him down.....Wolly, i mean...just 'cos everyone's left town Wolly thinks it 's open slather...or in his case open blather!!

i actually see Popeye..rather than Andy Crapp....but then if the Crapp fits; wear it???????

As Bernard and his dreary band of Gloomsterisers have cleared orf , Wolly has an open floor to dance in ......

....... Personally , I don't care a hoot , sitting in the corner , little old wine drinker , me .

[ please read this and understand in the context of Walter's many udder articles ]

............ Hic !

Question:

Does the above imply that total household mortgage debt should be falling ?

I think this figure is available and should provide a cross check as I am not sure it is.

Household savings as a percentage of income are still negative according to other data.

Used to be - 15 % now down to ~ - 5 I recall.

I am confused - or more so than usual.

Yeah I think you are right JB...the blather states that households are saving more....the probable truth is that saving is on the up but that total household debt also is going up($180ooooooooo). Toss in Bill's effort to dig a deeper fiscal hole...the rural debt holding land prices in the stupid zone and business debt likely falling as business fails but being hidden by the banks.

Then turn the page to read of the bollard inspired covered bond game set to bring another wave of cheap dosh to keep the bubbles inflated....

I recall a film called "Dumb and Dumber"....

Household Savings to 2004 ex RBNZ

Have a look at the following which would seem to be in conflict with the graph above.

It shows household savings as negative for the period shown as positive above.

http://www.rbnz.govt.nz/research/bulletin/2002_2006/2005jun68_2goh1.pdf

You will see why I am confused !

It's simple to explain JB...the stats come from the RB cookery class but the graph is the result of a pet snail kept by the RB. The path taken up the window is determined by the music on the Snails ipod.....hic.

See what I mean?

cooking lessons, snails..what next?

cocaine and strawberries?

....... if you've run out of icing sugar , cocaine goes nicely over the strawberries ........... freaking oarsome to watch the elderly aunties tripping out ............... ummmmmmm , so my cobber told me ... Yup !

see gummy...you and i are living in a parallel (or pararrell) universe..they don't even acknowledge our presence and just go on raving?!

FIRE one..incoming...duck!

Nah , the neighbours already ate the duck , well fired in the BBQ methinks ......... I miss the wee waddler , around the beach .

We still got the native chickens . Gamey little buggers . The locals swear by them ........... " Bubble gum Chicken " I reckon . Chewy sods ............... Boil for 2 days , biff out , eat the pot ( it'll be softer ) ......

........ Ka-boom ! Another homemade firework . No munny for bloody bigas ( rice ) these guys , but they can let off super-crackers all day . Serious shit too , that'd impress a suicide bomber ............... Shit ! What were we talking about , Rob ? ....

...... This French camembert is unctous gooey cheese , yummy Gummy .......

.....Yeah . I hate bloggers wot rave on about sweet naff all , too ............. How's the garden , buddy ? ........

Dunno about the garden Gumbo but she's going off over in BKK

BANGKOK, Dec 30 - Twenty-four people were killed and 425 were wounded in nearly 400 road accidents on the first day of Thailand's "Dangerous Seven Days" with past indicators showing that the major cause of accidents is driving under influence of alcohol, said a senior official of Transport Ministry on Thursday.

and it's not even N.Y Eve yet

Yeah , I know wotcha mean . Seen that story about the heir to the Anheuser-Busch beer fortune , a dead 27 y.o. blonde prossie found bound and gagged in his " play-boy " mansion . The coroners verdict , that she died " of natural causes " ........ there's alot of it about .

Butcha know , here on the Philippine roads , we have few crashes . There's bugger-all road rules and less signs . Everyone barrels around 'like lunatics on coke . ............ But they do have one golden rule , DON'T HIT ANYONE OR ANYTHING . And blow me down it works . They're skillful little beggars . Mad , but technically awesome . ............... But in Nanny State NZ , drivers are imcompetent and angry . Why ? 'Cos every 3 or 10 metres there's a new road sign or a light , telling them what to do ......

...... Rant over ..... Whew !

In Australia they build the roads even and straight for hours - here in NZ it is all curvy, sidewise and up and down - hopeless – we need better road designers. Hugh P. may can help.

Yes , NZ wastes alotta petrol on the curvey and hilly bits of road . As an avowed environmentallist , I plan for us to save precious fuel , and reduce ejaculations into the atmosphere .

We need to purchase some left-over nuclear war heads from Russia / France / England / USA / Nth Korea ............. and nuke the obstructing mountains in NZ . Flatten the gas guzzlin' sods . We'll straighten those roads . Create more flat dairy farm land .....

....... Man , this is a win/win par excellence ............ Where do I line up for the Knighthood and Nobel Prize for Fulton Hoganism ?

the best example of traffic mesh is in the main square in Hanoi.

thousands of people on scooters all going in different angles, no traffic lights and not one hitting the other..collective consciousness.

The RBNZ is a clandestine front for The Ministry of Truth which fabricates lies and the Ministry of Plenty which causes shortages (1984)

JB, valid point, your not really confused are you :-)

Good spin requires you to cover your tracks, this is not good spin :-)

I though most acci-dents over there are caused by Kangoroos crossing the roads at the same time or shortly before.

NZ Household savings ....

Not everyone's confused .. we have overtaken Spain to lie third behind Greece and Portugal with + 2.93 on the latest spread of 10 year Treasuries vs Bunds market ... Ominous !!

Anything to do with anticipation that interest rates will spike?.....

A quick question but I've got to ask it: Is anyone worst off now than at the beginning of the year?? Comment is rife about how bad are things, but how has it affected you? I ask this because I have numerous acquaintances who are doing well, have no big debt etc, and with the price of many items in the shops have even better purchasing power than ever. GBH is leading the life of Riley, Wolly is able to spend all day indulging himself and has stacks of gold, come in anyone who is honestly not doing as well as a year ago??

Keep thinking those happy thoughts and everything will be fine.

So, Lol be honest, for you personally, is that a yes I'm doing worse than a year ago or not??

No mortgage, no debt, money in the bank, other non-property investments. That's how I've been living for many years. My family has no worries. But we're in the minority.

Many or most people have a mortgage, and debt, but little or no savings or diversified investments outside of property. They have worries and they are in the majority.

There's no reason to assume or believe things are going to get any better for the majority in 2011 and good reason for them to be even more worried than they already are.

If they aren't worried they're either in the fortunate minority or they are (self) deluded fools.

You lot have all been at the happy juice.

"We're doomed, Captain Mainwaring, Doomed!"

Hickey's cleared orf to Lost Vegas , to troll the seedier subdivisions and suburbs for pics , to show us all how terribly bad Yankee Doodle land is .......

....... I know , I know , everyone else goes there to see the lights , the casinos , the fluffy bimboettes delivering drinks ..........

.... Bernard is a sad bugger , to be sure ............

........... Anyhoo , long story short , the tempo at interest.co.nz has slowed down , but the gloom has lifted . Happiness is sneaking in .................The anti-gloomsterisers are free to roam the unhickeysterical pastures ................ Oarsome !

OK Lol, thanks for your honesty, I thought you would be doing good. I am wondering who all these people are you decribe though, because most people I seem to see are more like you than not. Most householders don't actually have a big mortgage, quite a significant group have none. And I come back to all those bloggers on this site who rail about how bad things are, what is your reality? Who is honestly worse off than a year or two ago? Seems to me that there is a small group in NZ with a disproportionate amount of mortgage/debt.(and I'm not talking about the sector of society who own nothing or very little, because they have always existed and probably always will). Most of us should have happy thoughts because we truly have little to be unhappy about in NZ, (although may be some are happiest when they are criticising and sounding off?) It's reported that 1 in 4 NZ'ers are planning to go on an overseas holiday in next 6 months. Very much doubt most will borrow money to do that.

"Seems to me that there is a small group in NZ with a disproportionate amount of mortgage/debt"

Yes....and that debt belongs to the banks that imagined the credit into the market as they sold the mortgages....which because so much credit flowed so easily to so many who set about chasing so little in the way of property...the values went through the roof.....now the banks get to milk the fools who did the borrowing and the banks count on the RB and govt to make sure the values stay high...otherwise the banks are in the shit.

Pointing this slight problem out does not amount to "railing" as you put it.

" we truly have little to be unhappy about "......then off you go Muzza and with your savings you can pay the stupid asking prices on property and help make somebody really happy. Drop into the retail store in town Muzza and tell them they truly have little to be unhappy about. Call a public meeting for those who lost their life savings in one of the rorting thieving scams that were the NZ property finance sector...and tell them they truly have little to be unhappy about.

It is you who needs to take a cold shower Muzza!

So back to the question Wolly, who amongst the bloggers are worst off from a year or two ago. Not you it seems? And have had the odd cold shower, quite refreshing this time of the year.

Hmmmmmmm , good question . We've negotiated a global financial crisis since 2008 , and yet most people appear to be happier than back then ......

....... What else happened in 2008 .....

....... What was such a tectonic shift , that most Kiwis got happier .......

...... ummmm , apart from the election , the one where we booted Clark & Cullen out , nothing .........

........ BING BING BING BING BINNNNNNNNNNNNNNG ! ......... Aha , the light's come on !

My dear Muzza....I think it best to stay mum on my good fortune...your question leads nowhere!

Better to press the peasants to save...to avoid the mortgage misery....to help the sprogs learn to be prudent....to grow their own and run the chooks.

I see a move to force Councils to release land for alotments Pommy fashion. It would be a good thing to see this become a part of Kiwi life.

I wish we could see winz and doc joining forces to organise the replanting of native trees across the country. It would be a good development......don't hold your breath.

"...to help the sprogs learn to be prudent..."

But what a pity their slobberingly greedy moron parents' generation never learned the same lesson.

Now the kids have to look forward to years of belt-tightening, while servicing someone else's debt.

Well said, the reaction I get in this country that I think it is more sensible for me to retire before my 35th birthday...you can't, you have to work to pay for my retirement!!!

Most of those in retirement, as I am, do not have a mortgage, are not in debt and have a few investments. As we cannot get the interest rates we got a few years ago our purchasing power has reduced. When I go to the super market I am horrified at how much everything costs and that is just buying for me. How on earth a family on an average income (gross) can feed a family of five I do not know. Even with strengthening families. Probably the people who post comments on this web site are unlikely to be suffering much but there are many many people who are. We have a very high rate of children living in poverty in New Zealand so even by this limited definition there is much hardship in New Zealand Muzza.

A few judiciously picked shares will give you a decent income yield , far above interest rates from the trading banks . ......... Off the top of my soft gummy head ( and with no disclosure statement ) , Fletchers , Michael Hill , Cavalier , Ryman , Port of Tauranga , Steel & Tube , Colonial Motors , Millennium Copthorne , Restaurant Brands , Skellerup , Pumpkin Patch .

Thank you Gummy Bear but something happens as you get older. We get more frightened of the share market; Probably because we have experienced a few crashes. I remember the Oz crash in the late 1960's, then the NZ crash in 1987 both of which gave me losses not profits. Then when I got brave again I bought Telecom at $5.00 a share...............................

We are too old to go back to work now. All we have is what we have saved - and Super. We want to hold on to what we have even if we get less income. Not to give it to our children as everyone thinks but because we don't know when we will die. Poverty at any age is not ennobling but it is particularly not ennobling when you are old.

So on that happy note, Happy New Year everybody

When did you pay $5 Pat?

Oh a few years ago when I retired looking for income from dividend yields. At least it wasn't the $10.00 of a few years earlier!!!

Patricia , you're old enough to remember the inflation of the 1970's and 1980's . The greatest threat to your investment is inflation , debasement of the currency . Governments use inflation deliberately , to ease their debt burden . It is a hidden " tax " upon the holders of cash instruments .

Clearly none of us know our "exit" date . The longer your retirement period , the greater the erosion of your spending power , by inflation eating into your savings .

If you trust the government to be honest , and to take care of you , carry on as you are .

If you don't , start a personal education programme , get some investment books . Any of Peter Lynch's books are brilliant . Niall Ferguson's " Ascent of Money " is a superb read . And Ken Fisher's book of graphs , " the Wall street Waltz : 90 Visual Perspectives " is awesome .

Go and visit a reputable stockbroker , and pick his/her brains . ........... That shouldn't take all day , ha ha .............. If they recommend Telecom as an investment , dump them , and go to another stockbroker .

Care Bear...

Thanks Gummy Bear. I have Neill Ferguson's Ascent of Money but I have not read the other two Authors you have recommended. I will do so.

Yes inflation does do terrible damage but in those days I was working and incomes kept up with it because of the structure (Arbitration Court - something like that) took into account of inflation on wages and salaries. Now I just save 10% of my income to cope with inflation and it seems to work out as long as I don't lose any more money from my bond investments!

"reputable stockbroker "........................... I had one who recommended Feltex!!!

But enough of all this. I am all right but what I was trying to say was that a lot of people are not..

Happy New Year everybody.

It's also interesting to have a wee think about what underwrites 'wealth', indeed, without which there wouldn't be any:

http://www.energybulletin.net/stories/2010-10-05/work-exergy-economy-mo…

Peak energy = peak wealth. Yet there are those here who continue to think money invested will grow into more money. It's pretty late in the story to be still thinking along those lines.

Still, they were there for the tulips, the south sea bubble, the roaring twenties, there for the late '80's share-market, there for asparagus, there for the dot.com, there for real-estate. You have to presume they'll fall for the next one too.

It'll be happy for those who get it right :)

Hi Patricia Happy New Year!

Apparently all is not lost, the Great Chief at NZX says 2011 will be the year of Telecom.....

http://www.stuff.co.nz/business/industries/4506328/Eyeing-up-a-pivotal-…

Only thing is, after trashing the FMA he says in this article that its a good thing.

Wolly, try this for a new year's resolution:

If people tried to start their day by being grateful for what was good in their lives, rather than only thinking of the crosses they had to bear, their lives could be a lot more happier.

Gettting quite muggy now so I'll go and take a cold shower.

"Fifteen million Americans are now unemployed, according to the most recent jobs report. The unemployment rate for November inched up to 9.8%. The grimmest numbers, however, are for the long-term unemployed (see chart 1): 6.3m people, 42% of those unemployed, have been jobless for more than 26 weeks. That number does not include 2.5m people who want a job but who have not looked for a month or more, or the 9m who want full-time work but can only find part-time openings."..........you tell them Muzza....then explain your ideas to the Kiwi unemployed who are a bit luckier thanks to the dole having no time limits...and those who have had their home taken from them....and the poor sods who thought the govt was regulating the finance company criminals....you tell them Muzza.

Muzza, don't you know many young people or employees that have in real terms taken a hit this year. This place is dominated by the old folk with the advantage of age and timing i.e when they bought into financial assets. If you want a decent place to live in this country and also accumulated some financial assets for the medium term...in the last ten years you better be on a substantial six figure income to acheive it.

Businesses are unable to pay higher wages, because production/ sales are stagnating or worse – the spending power has gone ! How on earth can we pay for ever increasing prices ? Agriculture/ tourism our biggest earners are mutual biting each others arses, plus are increasingly suffering under Climate change and it’s consequences. Selling NZhouses to each other comes to an end. The money is steadily grinding down, even on middleclass people. Negative worldwide events and a high $ in 2011 will impact on NZ’s economy and our society. Especially political uncertainty and unrest will further slow down the markets. Ecological disasters will financially/ economically and socially cripple societies.

The systems are stuck - seized up !

Time for visionary ideas and their implications - urgently needed - people wake up !

Happy New Year to everyone !

Speckless, I'm not exactly in the 'old' category and do know lots of younger people in the workforce.

Property is a lot more expensive in the likes of Auckland and Wellington than many places in NZ. But many in my generation and those younger insist on wanting to be where the 'social action' is, particularly Auckland and Wellington. Well may be they can't all have their cake and eat it too!

I don't really think property is all that expensive outside of a few cities where it is more expensive for sure. And when you think about it, if a town has a median property price of $200,000 then half the houses are below $200,000. Some entry level properties will be well priced. But that's not the case in Auckland!

There's quite a lot of well intended but misguided comment on this blog tending to over accentuate the negatives. Like the rant about rates when really we get a pretty good deal for the amount we actually pay.

Heres one for the doomstershttp://www.telegraph.co.uk/finance/economics/8239707/HSBC-sees-China-and-America-leading-global-mega-boom.html.

An excellent link , Shag .

But as one domiciled in NZ , aren't you only eligible to comment on local stories ........... Not to advance into matters pertaining to the USA and the PRC ?

[ ......... just a thought , don't blow a fuse , dude........... aha ha de haaaaaaa ! ........... ]

As a producer and exporter of food of course it is extremely relevant to me. I will however refrain from advising said foreign citizens on their domestic issues.

I’m a producer and exporter since 40 years in a different sector. I have to stay positive challenged by changing market behaviours up and down for years - selecting carefully what products go into retailing.

I personally think your link is written by someone, who doesn’t make any correlation to mechanism’s, which are beyond human capability to regulate. Climate Change, politics, economic monetary, resource problems are for years a mess and some out of control. Business is going to be much more difficult with many unpredictable events coming. This has nothing to do with doomsters, but with carefully business planning - and we are still here for another few years. What about you ? Any mortgages ?

Read also :31 Dec 10, 6:28pm

Sheep Shagger - I think calling people doomsters could be the wrong term.

I guess everyone has a different perception of the risks out there and I agree there are very many. Where there is risk there is also opportunity and if you allow youself to get mired in the doomsday senario you might just miss the potential upside. The link above has some very important caveats which the likes of PDK would be all over like a rash so as you say careful judgement is vital.

I personally do have a reasonable debt loading after expansion awhile back. I did so with my eyes wide open and if it goes pear shaped then so be it. I think its important to challenge yourself in life and this is my shot at it. At this stage im reasonably positive about my prospects based on the premise that food production is a great space to be in now and for the foreseeable future. I may of course be wrong, depression might strike and im on the street. However I can grow my own vegetables and kill my own meat so hopefully me and my family wont starve.

Youll be pleased to know Kunst that I do read your posts and think about your perspective and while I dont always agree I am always challenged which is great.

Quick short story for you SheepShagger. In '96, after having previously given away making money 'out of thin air', I gave 'real' work a go. Bought a small farm with the intention of 'doing something productive'. Sold up in 2001~ and two things stand out. (1) What you do is unbelieveably hard work! I have the scars from falling off the barn roof ( tried to fix the loose sheet in a howling gale...studid...but one does..) and the hernia operation...from...well could have been a multitude of things! and (2) the $zero -$50k net I managed to eek out each year paled into insignificance to the money I made 'out of farming'. But not the work...the buying and selling of the land. Now, there has to be something wrong with that?

Possibly, although it may just mean you purchased astutely and sold well albiet before even bigger gains.

You could also argue that gold with limited industrial use is way overvalued by an sane measure but it valued as a store of wealth and hedge on inflation. This is also a factor with land. In fact I read recently that Iowa farmland has a very high historical correlation with the gold price at about 7-8 ounces per acre, currently its about 3-4ounces per acre even after Iowa farmland had risen 18% last year. They were debating which was over/undervalued.

As with purchaseing any long term investment its all about judgeing future performance and in the case of land whether you believe food production is going to be more or less profitable into the future. Im clearly in the bullish camp but am made well aware by commentors on this site that there are allso substantial risks. I guess ya pays ya money ya take your chances.

I guess that's where we differ SheepShagger! I didn't have a go at farming for its 'investment potential', and yet it turned out to be excatly that ,by default. Naively, I wanted to produce something of real value, rather than just adding up the figures on a sheet of paper each day; and if the left hand side totalled more than the right, I'd made money. Funny, where we all end up, and what we want out of life....

Good on you for having a go NA, whatever your motivation.

I often ponder when reading this site and compareing it to my everyday experiences and contacts. There is a fair proportion of farmers that would be completely oblivious to the ups and downs of commodity markets,interest rates,inflation...etc. They just love farming, growing things, putting up a new fence,breeding up a nice line of stock, having the best weaners at the calf sale etc.The financial side of things are but a consequence of how that all works out. My accountant has one client for whom he opens all his mail, banks the cheques and pays the bills for him.

Dont get me wrong there are plenty who could tell you exactly what they are making cents for kilo of dry matter produced. Its just everyone has different motivations, I even suspect the former group would be the happiest.

Most people involved in production need to ask similar questions. One is certainly “Demand and Supply”.

What is bothering me much more right now and with upcoming events are - how to structure prices ? E.g. - how can we produce facing higher prices while consumer power is decreasing ?

My answer is: away fro mass production - branding, quality, diversity aiming for the high end niche market.

I agree,its not about going head to head with Brazil in commodity markets it about positioning higher up the food chain. From my perspective NZ sheepmeat and increasingly wool are well positioned whilst beef needs to do more to push the grassfed/ natural branding to take it further away from the US grinding beef market, which although very strong and strengthening at the moment is vulnerable long term to Brazil gaining greater access.

Dairy im not as well versed but Fonterra seem to be doing well in the basic commodity/ingredients markets and should do so for awhile whilst demand rises and grain prices will limit competitor expansion. Long term whether that is the right stratergy, im not informed enough to comment.

Your view that consumer power is decreasing is no doubt true in the west but not true in the East where it is clearly, for now anyway increasing. Expeniture on non discretionary items like food, shelter and energy will just add up to a far higher proportion of incomes than discretionary ones. I think its about being in the right space and my view is that fortunately NZ is.

NZ & Australian beef are sometimes promoted as a premium product here in Asian restaurants ........... . I'm guessing that is because it is not feedlot produced as in America or Europe , and is free of Mad-Cow risk .

Asians love excellent quality food . And they have this image , from NZ tetra paks of milk , of dairy cows grazing contentedly near Mt Egmont .............. So sell them what they want to believe in .

Find the 100 % pure niche / the care of production / the " sustainability " angle , that big producers in Latin America & North America can't compete with .

Ohhohhohhh - darling Roger are you saying we should brand, like some others and I do, for a “100%NZpure Economy” - Yyeessss ???

.....and repackage any old crap to be New Zealand beef. Look long and hard at what you buy to eat over there Gummy.!....sometimes the beef goes "woof woof"

....and miau miau and grrr, grrr - even shhhh shhhh !

.......... lucky thing that I got caught in that dog-fight ! ...........The rabies shots protect me against infection from eating lechon doggie ! ........... But for anyone who dares to slag the NZ health service , you gotta experience the " Animal Bites Clinic " in ilo ilo city , to truely understand what " third world " means .

[..... me knees are still hairy wee buggers , that's where 3 of the first 8 needles went in . Wish'd they'd jabbed them into my cranial-solar-panel , instead . ]

Mt Egmont is NOT (repeat is NOT) for sale

Either you're a tall sod or the nurses there are short Gummy...I thought a rabies shot was into the guts with a blunt needle. You haven't started clawing at the door have you!

Muzza little emotional are we, not much point if you don't understand or read the orginal post is there, appears your emotions got the better of you :-)

I'm sure if you know all these young people and take an interest in their financial affairs...they all did not in real terms maintain their income over the past year.

Any outside investor looking in on NZ as a place to invest would surely judge the property sector as being in a bubble and dependent on the support of the Reserve Bank effort to boost economic activity...consequently at risk of the approaching fear on the Reserve bank's part that inflation has slipped the net and will run amok. Bollard will surely react soon as the price of oil creeps closer to the $100 mark. Already the fuel price hikes are feeding through the food chain. The unions are set to run very public efforts demanding wage adjustments. They have nothing to lose in an election year and everything to gain. No amount of 'honesty' on the govt's part will sway attitudes of low paid workers when Sir humphreys in wgtn are creaming half million dollar pay packs. That is the consquence of foolish decisions to date by the higher salaries old boys club. The RB has never stepped in to demand these salaries increases are kept down...wonder why not!

So our foreign investor would by now be seeing this property market as something to avoid in anticipation of the approaching collapse in values. The rise in inflation is imported. it cannot be stopped because Bernanke is causing it to happen. Bollard must sooner or later get off his bum. When he does, rates will shoot up. When they do, demand will turn to smoke. No demand means falling prices no matter how much BS the banks spew out about it being the time to buy etc etc.

Now factor in the impact of the rising rates on the general market...yes we will see the recession deepen. The fiscal hole evolving into a fiscal crisis. When the rating grade on NZ debt is cut, it will drive up the cost of the credit Bill English is borrowing. That will drive up the household rates even more and a viscious cycle of misery starts to spin out of control. You just don't want to be in debt to a bank when it starts because the NZ legal and economic system is structured to protect the bank and bugger you.

Give it a rest Wolly, same old, same old. For the record, what do you actually do other than make these fairly fruitless posts that you and a few others in NZ like to read?

Actually Muzza..I work really hard trying to help the likes of you out on financial and economic matters. One day you will thank me....if you bother to take the free advice mind!

Pay off those debts Muzza. Expect rates to rise. Do not believe the banks. Speckles will explain that one to you. Beware of Goofy and his fellow socialists for they shall take you in. I wouldn't trust the other lot either if I were you.

Translated:

I'm an OF NZS beneficiary.

Hi Kate...you're Wrong...I'm a millionaire and stopped working many years ago and I don't collect a pension for a few years yet. Never been on a benefit. The pension is not a benefit! I use the banks but I do not invest in them, although I did once own a share of Westpac...pleased to say I sold it...for a capital gain on top of divs.

The pension is not a benefit!

Yeah right - what is it then - an "entitlement" - indeed the most crippling "entitlement" in our welfare system at that.

I'm a millionaire

Not much to shout about these days, Wolly, as it was pretty easy to get there over the last couple of decades - just admit, you were born at the right time making you able to cash in at the expense of the current younger generation. I'm guessing much of your accumulated wealth was achieved via untaxed capital gains ... and you still see your forthcoming pension as an "entitlement".

Get with the program, Wolly, you are no more deserving of a welfare handout than the next generation - who most certainly won't get any "super" or otherwise.

Yes they will Kate and attacking me is not going to change matters one little bit. I will receive the pension as an entitlement and do with it what I wish. You will play a different tune when you are close to the pension age of that I am sure. I did not put the system in place any more than I am responsible for ACC or WFF or the Dole or any other schemes. I never claimed to be more deserving...that's you going off like a Tom Thumb. I don't shout about my wealth either.

" you were born at the right time making you able to cash in at the expense of the current younger generation."...utter rubbish. The youth of today have a dam sight more opportunities than I ever did and the paye they are expected to pay is a fraction of what the BB paid. Don't blame the BB generation for youth being bloody lazy and wanting it all now.

However I do think the govt has to cut back on the spending. Perhaps it's time to stop wasting money on one sex in this country.

Jeeeezzzzzz Woolly .. delete double post

Jeeeezzzzzz Woolly .. with a few years on you and being a man of many words a better explanation should be forthcoming .. something like this .. many years ago .. dont know how many .. (a generation) at age 65 you could get the "old age pension" unless you still had an income in which case you were "entitled" to the lower amount of "universal super" everyone was entitled to it guaranteed. That was what you paid your "social security tax" for until they amalgamated it with the ordinary tax (when they changed to decimal currency) and paid it into the consolidated fund instead. I understand that they now call it the "pension"

Wally - right and wrong.

Those youth of today, they're being advertised to by your generation, sold to by your generation, rented to by your generation, held to ransom by your generation.

That includes pensions. Sadly, the underwriting of ever-increasing pensions was enacted on the assumption that growth was forever.

There are still fools who think that, of course.

@ Kate

Several articles have been posted here over the past week dealing with the levels of taxation that the BB generation paid including surtaxes, and husband and wife combined incomes for tax purposes, that make current levels of taxation pale into insignificance. I would suggest you do some inter-generational research before you make ill-informed comments and judgements.

As someone younger I have played nice so far on this issue as I fully understand both sides however with those articles you starting to push it :-). I can put my economist hat on and rubbish quite easily by examination the definition of Govenment cost and taxation applied across the period...great data mining, I have reviewed the research papers.

Or I could take a more worldly wise perspective and note that prior to the IRD penalties regime - tax accountants had limited risk undertaking an abusive taxation position for clients and therefore many of the self employed never paid their share of tax through mis-stated income. hhhmmm

Simply graduating and leaving University just after the student loan scheme was introduced was a great advantage over the following generation so lets take a holistic approach. Current younger generation does not at all have it easier.

Its been fun as I work on this report over the past week. Try to be kind to each other!!!

Didn't see the articles but I would be interested in the links.

Don't forget that when income taxes came down - GST was introduced.

I'd be very interested to see comparisons, as long as those included calculations on both tax paid on income and consumption. It's a well rehersed arguement by the BBers trying to justify their super "entitlement" was actually "paid for" by them in taxes. Somehow, I doubt it.

This is getting messy...

Did I understand that 'the pension' can be paid as a lump sum? (Outside of Kiwisaver).

I thought I read Wally recommending this option - can't find it now.

Don't much like this discussion mind you, I've always regarded 'the pension' as some sort of proof of a civil society.

The absence of a decent funding mechanism is the 'oversight'.

Getting a Retirement Income in New Zealand

"There are variety of ways of generating an income for your retirement in New Zealand.

Many New Zealanders hope to buy a second home with the intention that before retiring they will pay off the mortgage. This is done using a combination of rent paid by the house's tenants plus, if necessary, earnings from their job. When they retire, the rental income from the house acts as a potentially inflation-proof pension. "

Seems like it's almost a policy!

Lump sum KWJ...not the national super...the state employee super scheme long since closed.

Where those retiring wish to pass on wealth to their offspring..they must take the lump sum option.

I was a bit short with the youth of today..apologies to those offended...none to those who fit the comment...there are many who work dam hard and for bugger all over a long period...just as there are many who expect handouts, great employment and top pay soon as they leave school without qualifications.

The pension payments need adjusting but time must be allowed for people to prepare. The current mess is a creation of poor govt and very poor banking control. I doubt either will change for the better. Pension change alone will not fill the fiscal hole. Far too much splurge by Clark and unwise promises by Key have trapped us.

NZ does not earn enough to cover the spending by govt. A trend set in stone. Either spend less or earn more or do a bit of both....but for fecks sake do something beside bloody borrowing to reach the next election while playing the 'wait and hope' tune on the fiddle. And for Labour....enough of the bullshit promises and the blinkers...the whole friggin bunch of you need to be forced to run a business using your own capital for a minimum of 5 years before you are allowed to shoot your mouths off about work creation.

Thanks Wally,

"Where those retiring wish to pass on wealth to their offspring..they must take the lump sum option".

I'm still admit to being confused...

My rather naive idea of superannuation is that the State pays it to all/anyone of age until death. I'm unsure why it has anything to do with 'inheritance'.

I fully appreciate the seeming inequities of someone who dies before entitlement age, but I had no conception that a 'lump sum' could be paid from a State funded scheme.

Has a successful fund been set up in the past, that enables some NZ superannuitants to take lump sums? If so fine...

My only point is that if the funding of superannuation is done 'hand to mouth' (as in the UK), and looks to all like a 'welfare benefit', why are lump sum payments permissible.

Sorry for the confused thinking.

No worries KWJ...there was a scheme for state employees to pay into...a super scheme...it was terminated in the 90s....I think from memory 6.5% of salary was deducted and govt contributed the same....you had to stay in for a certain time period etc etc lots of red tape....on retirement you received options to take a full pension col adjusted which worked out at bugger all for most on the lower state pay scales but better than nout....or you could take some loot and a smaller payment each fortnight etc....or you could take the lump sum but only if you invested it as the govt said you had to!...as I pointed out..... red tape. This last option remains the best for most still to retire because once the loot is beyond the govt control you can invest it as you like. The point being that when you cark it, the capital remains.

Thanks again,

Effectively a 'private' scheme then. The fund successful enough to pay all who contributed.

Spend it how you like....

Yeah it was but do understand it was bugger all for those on lower scale pay and you did need to lock away the 6.5%...and stay in govt employment!...see how it was a sort of employment trap for many. The Sir Humphreys did very very well out of it. Figures!

Hate to think how many took the lump sum and put it into those property finance rorts and scams.

@ Kate

National Superannuation is an entitlement, it's not a benefit, and that entitlement is established by Statute (i.e., New Zealand Superannuation and Retirement Income Act 2001) and it binds the Crown.

Interpretation.......Blah blah blah blah blah........New Zealand superannuation means the entitlements under Part 1, including both the standard and non-standard entitlements.

Part 1 - Entitlements to New Zealand Superannuation blah blah blah.....

New Zealanders due to their age and residential status are entitled to receive National Superannuation as of legal right. It is not a benefit paid under the Social Security Act.

National Super was brought in as an entitlement by the Muldoon National Government back in ~1977. As the BBers back then were aged between ~15 - 35, it's quite apparent over the last 30 years that the BB generation has paid a substantial proportion of their taxes in support of National Superannuation payments for their parents and grandparents.

When National Superannuation first came in it was paid to all those aged 60 years of age and older regardless of their employment status, income or assets, and was pegged at 80% of the average New Zealand weekly age for a married couple. Muldoon believed that the scheme would be sustainable going forward as it would be paid for out of New Zealand’s natural growth in GDP and population. Sadly that growth never happened. And as you are aware there have been substantial reductions in its entitlements as a result. The age of eligibility is now 65 and it pays only 66% of the average NZ weekly wage for a maried couple. (It has been as low as 60%) It is in one respect a victim of the inadequate economic performance of New Zealanders over the last 30 years and unfortunately it looks set to continue to be a victim of that inability by us to deliver.

I am familiar with all of this because when I first left school (1979), I worked for a couple of years before going to Uni, and I ended up working for the Department of Social Welfare in my home town on National Superannuation processing claims for it.

One of the comments that always disturbed me that came from applicants and it was almost universally said by them to me when they handed in their applications was that they had paid taxes all their life and now it was their turn to get those taxes back. (An absurd comment)This was not the BBer’s who were saying that. Remember, they didn’t qualify for National Superannuation in 1980. This was their parents, the so-called Greatest Generation that fought WWII who was saying this.

My reactions to those comments were very similar to your reactions now, Kate, to the same comments that you believe are coming from the BBers. Clearly you must be able to see though that this is not a generational thing it’s just what people are like. And when your generation faces retirement, it will be saying exactly the same thing. Trust me on that!

One difference I am aware of though between the BB generation and yours is that I did not hear resentment from BBers about paying tax to support National Superannuation for their parents and grandparents, or any accusations about their elders being selfish bastards keeping it all to themselves and ruining it for everybody else. Views of that nature appear to be unique to your generation but maybe that’s not surprising given that your generation has been characterised as the most selfish, narcissistic, ‘it’s all about ME’ generation of all, and that the making of a sacrifice for others for whatever reason is simply not regarded as being on by your cohort. Unfair? Who can say?

But I do have one question for members of your generation:-

If it was good enough for the BBers to pay their taxes to support National Superannuation payments to their parents and grandparents, why isn't it good enough for your generation to do the same?

David B - I'm a BBer - so sorry can't answer your last question.

But you support the point I make nicely in saying, Muldoon believed that the scheme would be sustainable going forward as it would be paid for out of New Zealand’s natural growth in GDP and population. Sadly that growth never happened.

Exactly, and the funding shortfall is only going to get worse. If it's not fully funded through savings, then it's welfare - or an entitlement to welfare payments - i.e. other people's money distributed by the State.

But your logic ends here when you say, And when your generation faces retirement, it will be saying exactly the same thing. Trust me on that!

Sadly, the next generation(s) cannot "trust you" on that (as you are deluding yourself). The State funded superannuation as we know it today simply is not sustainable. And certainly NOT alongside State funded education and health as we know it today.

What I would like to see are BBers take their head out of the sand and drive change now - change that will affect THEM in the pocket - not just affect their kids and ther grandkids only. A simple start is to means test it - so that the "Wolly millionaires" (many of whom made the millions on untaxed capital gains) don't qualify. I am one of those. I also took out private super. When I get to that age, I probably won't need it and I'd see it as akin to stealing from my grandchildren if I collected the benefit without being in need of it.

However, more than means testing super is needed. If the elderly are in need I see no reason for them to be any different than any other person without independent income. Hence the reason I like Gareth Morgan's big kahuna proposal. We must transform both tax and welfare (superannuation included), or we will lose the things that really make us a civil society - those being equality of access and opportunity offered by State funded heathcare and education.

"means testing"....how so Kate?....tell us what the rules would be....don't hold back.

Mimic the Aussie rules - adjust for local averages. Easy as!

Elaborate Kate!

http://www.centrelink.gov.au/internet/internet.nsf/payments/age_iat.htm

Join the Google program too, Wolly.

You're never too old.

Thanks Kate...you should try the online educational programmes...you're never too old...that way you might learn about the cost of Beaurocracy!

I can only conclude you must be Mrs Kate Applebee....Humphrey would be so proud of you.

The savings that might come from applying the aussie system in NZ with means testing etc etc would be minimal because so many would escape the noose through family trusts et al and the cost of the Beaurocracy would be staggering...

Think about it!

I have thought about it, Wolly.

Get rid of family trusts. Been of that opinion ever since the first accountant suggested we should have one.

Well there you go kate...the first topic for your online educational plan...learn about the history of Trusts and discover why they are needed and likely to be around for hundreds of years to come.

While you are playing with your mouse Kate...have a look at the incredible range of service on offer to Australians by all manner of entities who provide Family Trust advice and services...have a wee think why it's such a big 'business' over there!

Wolly, I hardly think I need educational coaching about bureaucracy from a guy who spells it "Beaurocracy". And by the way, neither is it a proper noun - in other words - don't capitalise it.

Gosh I'm Human. Thanks kate.

You said nothing of my idea that the govt spend on one sex should stop!

How are you going to do away with Family Trusts?

1. We're all human, Wolly. What you want to aim for is becoming humane.

2. I had no idea what you were referring to there - if abolish the Dept of Woman's Affairs - who cares - it's a minnow in terms of Govt debt/expenditure anyway. Not worth commenting on really as it won't make one iota of difference in isolation.

3. Repeal the enabling legislation.

Hey If you don't want to collect your pension payments, go for it, but why should I take advice from you as to what I do with mine. My point about the cost of having a means tested system remains valid....and there is also the question of unintended consequences of means testing. Quite apart from the family trusts matter, would means testing not encourage people to 'spend up' as they approach 65 so they fit inside the rules....and if means testing the pension came into play, why not means testing the DPB.

We've already been around that track, Wolly. How about we instead focus on whether you think you might give becoming humane, as opposed to just human, a go?

@ Kate. Fair enough. However you could answer the question by saying whether you support the proposition that later generations should also pay their fair share or are you an enabler of the Me generation’s narcissism and hold the view that they should make no sacrifice, rather all sacrifice should come from others?

And where do you get this daft idea from that National Superannuation is not sustainable? Of course it is. It is a fixed and predictable cost that Government faces. Oh I see the baby boom cohort will cause the scheme to collapse by sheer weight of its numbers. And EVERYBODY knows that!

Just as recently as 2003, Treasury released a working paper 03/27 entitled The Aging of the New Zealand Population 1881-2051. It spelt it out in clear terms the doom and gloom that faced us all. The population projections clearly showed that by 2011 our population would be 4,248,000 and by 2021 it would only be 4.5 million yet the numbers of those aged 65+ as a percentage of the population was going to exponentially increase placing a greater and greater burden on fewer and fewer workers. Calamity awaits unless something is urgently done. In fact I think I can still hear the hands wringing in Treasury now!

Question. If Treasury were to make a prediction about what the size of our economy would be in seven years time, and what our budget surpluses/deficits were going to be, would you believe those projections were worth the paper they were written on? So why believe their projections about National Superannuation?

Interestingly, it is 2011 now! Let’s check how accurate their population projections of 7 years ago for this year turned out to be. In the 2003 working paper, they projected NZ’s population to 4.25 million in 2011, and then for a 250,000 increase to 4.5 million by 2021 rising to 4.8 million by 2051 by which time most of the BB generation will be dead.

What does the Dept. of Stats population clock say our population today is? http://www.stats.govt.nz/tools_and_services/tools/population_clock.aspx Well whadda ya know? It’s 4.4 million and rising. I’m not going to belabour the point. The take home message should be obvious to everyone. At this rate of increase we will be at 4.5 million by about 2014, and who knows what the population will be in 2051? Six million? It’s impossible to predict that with any accuracy at all and hence it is also impossible to predict with any accuracy what the cost of National Super will be. We have to stop speaking in clichés and being intellectually lazy in his country when we discuss it.

The adequate provision of pensions for the elderly is a hallmark of a just and fair society. We should not abandon that principal because the Government and the people of this country can’t or won’t get their act together sufficiently to grow this nation’s economy. We should not be looking to place the burden for our economic failures onto the most vulnerable of our society, the elderly. The answer to the sustainability of National Superannuation is not to keep cutting it in a shallowly thought out pretext that we can’t afford it. We need to make it a priority of fixed Government spending and establish the best way to fund it. And I agree with you that we need to look at whether entitlement should be universial. Why for example, should you be able to work full time AND collect National Super? Surely one or the other would be best?

I don’t have much time for Michael Cullen’s achievements as Finance Minister, but I think he was on the right track with the Cullen Fund. Maybe in this area, he got it?

At the end of the day we need to grow this economy. But cutting super is too easy and it’s lazy.

David B - regards the notion that later generations "should pay their fair share" - well, I see that as rather "rich" (cynically). The present generations (in the main lead by BBers for the last 30 years) have squandered a vast amount of the world's resources... so much so that even from my own children's generation they cannot enjoy nature/freedom/abundance in the same way I enjoyed it as a child - because it simply isn't there or available to them.

And I imagine that the next generation will be even more deprived.

In other words - they (future generations) WILL pay MORE than their "fair share" - I have no doubt of that whatsoever. Just look at the "austerity" measures being enacted on the European continent - and that gap between the top earners and the rest-of-the-world grows wider and wider every day.

"should you be able to work full time AND collect National Super"

We had a 'super tax' in the 90's that did exactly that. As your income over a threshold increased, a 'super tax' abated your super until it was reduced to nil. Peters campaigned on removing it, the oldies (not the BB generation) voted for him, and the tax was gone!

The strange thing was that it only cut in at around $25k of other income but the talkback was full of little old ladies saying "I've only got the pension but I am going to vote for that nice Mr Peters because he's going to get rid of my 'super tax.'" They must have been very disapointed when the tax was removed and they didn't get any more super!

Peters was always a bit slippery with the truth!

@Kate: You, as I do, advocate the "Big Kahuna". Surely, the old age pension is a "Little Kahuna"? It's universal; those who need it to keep from dying in the gutter will use it to survive, and those that have 'done the right thing' and saved for their old age will get an effective tax break on their endeavours. It's non dicriminatory and as such effective in whatever circumstances one finds oneself in old age. Or would you also suggest that the Big Kahuna is also means tested etc. which makes the suggested scheme pointless?

The Big Kahuna proposal reforms both welfare (super and other benefits) as well as taxation. A universal anything is unaffordable unless the taxation side of the ledger is also addressed... in particular taxation of accumulated capital (be it accumulated by individuals or other legal entities).

So, yes, you are right universal super is a type of kahuna, but without the tax reform - it's a tax on future generations - one they will be unable to repay.

@ Kate and David B

Sums it up nicely David.

To add some History and references

When the Labour government left office in 1949 the top income tax rate was 76.5%.

http://www.teara.govt.nz/en/taxes/4

Universal Superannuation

At age 65 those not entitled to the Age Benefit received a small "universal superannuation" payment of £10 a year effective from 1940, plus the promise that this payment would gradually be increased to match the Age Benefit. However, it was not until 1960 that this point was actually reached. At its inception the new pension scheme was expensive, with more costs signalled through the universal superannuation promise. In addition to "Ordinary Income Tax" a new Social Security Tax of 5 percent of earnings (one shilling in the pound) was introduced to cover the increased costs of pensions, other social security payments and health.

http://www.goodreturns.co.nz/article/976486047/super-history-nz-s-super-system-unique.html

In 1961 the rate of "Social Security Tax" was 7.5%

Where did the "expectation" come from

The guts of it this - People paid "Social Security Tax" in addition to "Ordinary Income Tax" at either 5% or 7.5% on total income before exemptions

In the view of those who paid the tax it became a social contract between the Government and Society.

There were two additional Tax imposts the BBers and their parents and their grandparents paid. Surtax at 90% (not many paid that you had to be very wealthy) and the "Spouse Aggregation" Tax where the incomes of both husband and wife were aggregated and if the sum exceeded a specific amount an additional rate of ordinary income tax was imposed.

Oh those were great times for any govt icono...the state had its dirty nose into everything...hard to identify something not 'owned' and under Cabinet control...a real socialist state...just what Goofy wants to return to. Absolute power in the hands of the Beehive mob and them under the thumb of the big fat banks.

Wolly

"The pension is not a benefit"

What is it then? Payment for past services? Of course its a benefit. Anytime the govt takes money from one person (taxpayer) and gives it to another who hasent actually worked for that money that is a benefit.

And don't give me any BS about "I have worked all my life so I deserve it" That was told to you by politician who were lying about it's feasibility.

p.s. How, if you are a millionare, how do you shelter you dividend income from your shares - that you frequently spout off about, because that wouldn't effect your pension?

What do you mean mark s...to shelter div income from shares?

I was under the impression that if you had a separate income ( assuming that some of your shares are paying div) that effects your pension. If not that is ridiculous! Do you genuinly beleive that millionares like yourself should get a subsity/benefit just for being old? Does that sit well with you?

I don't get a pension mark s.....some ways off actually...I didn't make the rules did I?....so at 65 if alive I collect the loot and likely as not it will be invested and when I cark it the lot will be left as I see fit.

Your comment raises a question...should I have saved and invested and gone without to build a nestegg...or spent all and counted on a pension being mine?

Sorry I assumed you were either getting a pension or just about to based upon your glee at collecting it.

"I didn't make the rules did I?"

That can't be your argument for why it is justified.

You can have another go at that if you want.

"when I cark it the lot will be left as I see fit"

As is your right to do what you wish with your property.

"Your comment raises a question...should I have saved and invested and gone without to build a nestegg...or spent all and counted on a pension being mine?"

You should be reliant on one person Wolly. Thats is Wolly. That question presupposes you are guarenteed a certain quality of life as a right. I'm pretty sure that is a tennant of communisim.

Do you beleive that you have that right? Hands up anyone else that does.

Yes consoldated fund and the Governments that dipped into it have a lot to answer for, i.e the edge which is clear by Kate and Wolly comments

From the rural news on this site!

"Over the Christmas break I visited a new dairy conversion in Southland complete with it's Fillipino dairy worker.

I was informed that this nationality dominated the dairy sectors work force in Southland, and were respected for their hard working ethics.

With youth employment in NZ reaching nearly 20% what is wrong with our young people, when there are many opportunities in the expanding dairy sector.

The hours are long and hard, but that is the ideal reciepe for young people to accumulate capital and work habits, that will return good dividends later in their lifetime."

Wolly, I would challenge the comment below. We need to remember that this interview was conducted with a company that recruits immigrants only, not kiwi dairy workers.

this nationality dominated the dairy sectors work force in Southland, and were respected for their hard working ethics

Their nationality may dominate the immigrants of the dairy workforce, but I do not believe they dominate the workforce overall. Of the farms in our local discussion group only two filipinos are employed compared to around 20 kiwis. They are not really represented at contract milking or 50/50 sharemilking level in Southland.

Fair cop I missed that though it would be nice to know the stats...the honest stats.

This news from aus is a pointer to coming events.....

"Fixed-rate mortgages rose in popularity this year, grabbing 12.6 per cent of the market in 2010 compared to 2 per cent a year ago.

Mr Hewitt said lenders were aggressively marketing fixed-rate loans in 2010 as consumers grew more wary about future interest rate rises."

http://www.perthnow.com.au/real-estate/was-mortgage-market-shrinks/story-e6frg3o3-1225983742978

I agree with Kate.

How many people over 65 do you know that are still working full time? Including many politicians. Why should workers who hit 65 suddenly pick up the old age benefit as well? How many hundreds of millions are paid out to those on full time salaries? Why is this not questioned?

Then again skeeter, it may be that many who receive the pension, have decided to stay at work so they can make ends meet or because they enjoy being at work. The cost of means testing the pension is too high. There are too many ways to slip through the rules.

Give up Kate. Wolly has completely highjacked and ruined this site and driven so many people away from commenting on it. As I have said before he must be unemployed as he spends so much time on it. Also he obviously has no interests at all other than commenting on this site. There is hardly a minute of the day when he is not on it. Someone said he might be Bernard himself just trying to stir things along. Sometimes I wonder whether that might be true as anyone with half a life would not bother being on it so much. Wolly give us a rest from your inane dribble.

Back again Ex agent...indeed I am unemployed...and loving it. What's your excuse?

Wolly only 4 minutes to respond. Just proves you are never off this site and that you do not have a life outside of it. Please give us a break and go out for a walk and get some fresh air.It might do you some good.

Blow it out your ear ex agent...try finding me on the site after 8pm...fat chance. You're here as often as I am.

ex agent : If you want to put it to the test , we could lobby Bernard to set up a shoot-off , you vs Wolly . Users can vote on which of you two they want booted off the site , by being banned ...............

............. For one , I'd be sorry to see you go , 'cos when you're not wasting your & our time by bagging Wolly , your posts are worth reading .

Morning Gummy...thought you might drop out of the hammock about now...check out that Oracle link I posted...it'll keep you awake at night.

Thanks GBH for the kind thoughts. I have had a lovely week off at the beach and spent it with my wife's cousin and her husband who are from Sydney. A few years ago he sold a business he had worked very hard to set up in several countries and now he does not need to work again even though he is only 52. He is starting up another one so he can afford to buy an ocean going yacht that would have permanent staff on it. Like me he can life off his savings so I do not see the point as life is too short.But everyone to his own. He is very smart and he spends his days trading shares in the meantime. He believes the world is going to have another big economic crunch this year so he is liquidating his long term stocks. I for one hope the big crunch will not happen as the consequences would be catastrophic. Businesses would close down and there would be heaps more unemployed.

I see 2011 and beyond as a time when incomes will not increase much if anything at all. The costs of living will increase in terms of basics such as interest costs,food costs,power and petrol costs,rates and insurance costs and alike. Asset values of all kinds such as farms and houses will continue to drop in value a little each month unless there is a big spook in the markets and if there is there will be bigger falls in the values. You only have to drive through the business and industrial areas of anywhere in NZ and see the huge number of empty premises that are for sale or lease or both. Drive down any residential street in NZ and the number of houses on the market is staggering. Until incomes start to come up in NZ and the cost of living starts to stabilise the average NZ family is just going to cope with their basic costs of living so asset values must continue to drop. More and more people are not even coping with their basis costs so they will look to share housing costs which is why there are currently over 1000 empty rentals currently in Hamilton. This is the new norm and we have to get used to it investors and retailers alike.

Ahhhhh , we're back on track . Well done , guys . The Gummsters gotta nip off , the wifey's spinster cousin has snagged her a man finally , and we're off the Miag-ao Catholic Church to read him the last rites ............. Gummy gets to do a speech at the wedding reception ........... Must remember to take a big box of tissues along for the groom . Poor sod ! .............. Pa-alam guys . Play nice , and it's Gummy Bears for one and all !

@ ex agent.

"Drive down any residential street in NZ and the number of houses on the market is staggering".

Huh? I guess you and I must drive down different streets.The only house in my street that was up for sale recently went to Auction and sold. It was on the market for about 4 weeks. In the last 2 years two other houses that are close to me have come to market, and they both sold too. Neither were on the market for very long, 3-4 weks. In fact in my suburb all the houses that come to market sell. And there's hardly been a stampede of them either.

I guess we must all be happy little campers over here? Hi Dee Hi.......

David B I can only presume you live in a nice street and that the houses in them are mid to high range price wise. The average NZer does not live like you. In fact the majority of them don't. The average house in NZ is not regularly maintained and is not that great from an architectural point of view. The latest REINZ statistics for Auckland show the higher end of housing is selling better than the lower end.Just go down the East Coast Bays road and the number of houses on the market is staggering. As the prices go down for the average NZ dump the prices will go down for the higher end as the gap between the average and the better homes will be too high for those trading up otherwise. I spoke to a teacher this morning who taught my son at his High School. He and his wife bought a $880k lifestyle property recently.To do that they sold their home and their rental. They had to reduce their expectations on the two cheaper homes and so when they were ready to go unconditional on the purchase they forced their vendor to drop the purchase price on the new property. They said they did not enjoy renegotiating the price but they had to as they were getting screwed on the two sales. It is one big market and you need a thriving entry level market to keep the higher end thriving. As the economy continues to be sluggish in terms of incomes and activity watch those housing values continue to drop.

David B I can only presume you live in a nice street and that the houses in them are mid to high range price wise. The average NZer does not live like you. In fact the majority of them don't. The average house in NZ is not regularly maintained and is not that great from an architectural point of view. The latest REINZ statistics for Auckland show the higher end of housing is selling better than the lower end.Just go down the East Coast Bays road and the number of houses on the market is staggering. As the prices go down for the average NZ dump the prices will go down for the higher end as the gap between the average and the better homes will be too high for those trading up otherwise. I spoke to a teacher this morning who taught my son at his High School. He and his wife bought a $880k lifestyle property recently.To do that they sold their home and their rental. They had to reduce their expectations on the two cheaper homes and so when they were ready to go unconditional on the purchase they forced their vendor to drop the purchase price on the new property. They said they did not enjoy renegotiating the price but they had to as they were getting screwed on the two sales. It is one big market and you need a thriving entry level market to keep the higher end thriving. As the economy continues to be sluggish in terms of incomes and activity watch those housing values continue to drop.

Dream on Wolly I comment a fraction of the times you do. If you go back you will find I only comment when I spot a topic that interests me. You comment on everything that hits this site and about 99.9% of your comments are immature and misinformed dribble and you carry on in that fashion even though a constant stream of people come on this site and tell you so. It is a nice day today. Go out and hit a golf ball. I do that several times a week in between looking after my lifestyle property. I had a holiday last week and so went off this site for a week. If you like I will send you a cheque for a holiday but you must promise first you will stay away from your computer.

Time you gave it a rest Ex agent..here have a read of this:

"The United States and its leaders are stuck in their own Catch 22. They need the economy to improve in order to generate jobs, but the economy can only improve if people have jobs. They need the economy to recover in order to improve our deficit situation, but if the economy really recovers long term interest rates will increase, further depressing the housing market and increasing the interest expense burden for the US, therefore increasing the deficit. A recovering economy would result in more production and consumption, which would result in more oil consumption driving the price above $100 per barrel, therefore depressing the economy. Americans must save for their retirements as 10,000 Baby Boomers turn 65 every day, but if the savings rate goes back to 10%, the economy will collapse due to lack of consumption. Consumer expenditures account for 71% of GDP and need to revert back to 65% for the US to have a balanced sustainable economy, but a reduction in consumer spending will push the US back into recession, reducing tax revenues and increasing deficits. You can see why Catch 22 is the theme for 2011."

http://www.marketoracle.co.uk/Article25421.html

Is it any different in NZ?

Just after Xmas went for a drive around one of the crappier suburbs of a large North Island town, and the number of houses on the market was staggering. I've never seen anything like it. Whole streets where every second house had a for sale sign. Isn't somewhere I'd want to buy (scuzzy backwater infested with gangs), but there was no shortage of choice. No way of knowing for sure, but one of the possibilities is that a few landlords had bought up large in the area and were trying to get the hell out of multiple properties.