By Bernard Hickey

New Zealanders learned this week that our output did not increase in the second half of last year.

Yet our spending in total and our wages rose over that period, as did our population and spending per capita. So how did we manage that? How did we spend more per person than we earned per person? Essentially, we borrowed the money from offshore or we sold assets to foreigners.

Figures also out this week showed we ran a current account deficit of 2.3% in the December quarter. That's much less than the 8.8% hit in the December quarter of 2008, but it's still a deficit and means we imported capital equivalent to 2.3% of GDP and spent it. Importing capital is another way of saying we borrowed money or sold assets.

That 2.3% also looked better than it was because of all the reinsurance money flowing in after the earthquake on September 4.

Yet again, we engaged in a national delusion that we could afford to spend more than we earned.

It's worth working out how long we have been deluded as a nation.

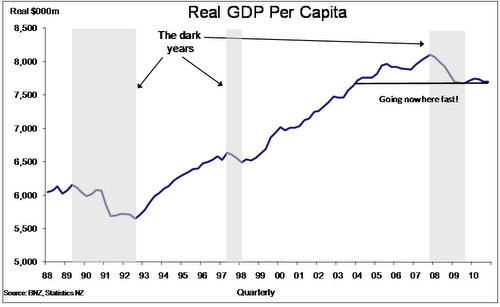

New Zealand's real GDP per capita is now actually below where it was in 2004. For at least the last 8 years New Zealanders have engaged in a national delusion that, as the advertisement from L'Oreal says, we were worth it.

Over the 10 years of the 'naughty oughties (2000s), New Zealand borrowed or sold off a total of NZ$350.3 billion. That's about two times GDP. We used that money to increase our wages and income. We didn't use that money to reinvest in new equipment or skills to boost our ability to produce more in the future. The proof of that is our appalling record on productivity or output per hour worked (see attached chart). It has gone nowhere for a decade, largely because we have not reinvested profits or saved.

Virtually no one was guiltless in this national delusion. Households deluded themselves first by borrowing heavily against the value of their houses between 2004 and 2008. That has stopped now and households are saving. Corporates have been less profligate, but they're borrowing offshore again too because they can get very low interest rates.

Now government has taken over as the borrower in chief. On Thursday the Treasury's Debt Management Office took advantage of a gap in the financial market turmoil to borrow NZ$950 million in one week on international markets. The immediate reaction was a rise in the New Zealand dollar as foreigners bought New Zealand dollars to buy the bonds.

This is another side effect of continued heavy borrowing. These capital inflows push up the value of the New Zealand dollar and punish exporters, the very people the government wants to encourage.

The upshot of all this borrowing is that now whenever our economy does look like recovering the benefits of any growth are shipped offshore in the form of profits and dividends from now foreign-owned assets here and in the form of interest payments on the debt incurred over the last decade.

In 2010 New Zealand paid NZ$15.5 billion in profits and interest payments to foreign investors and creditors. Only NZ$3.3 billion was reinvested.

That is the size of the drag on the New Zealand economy. It is unsustainable. We have to stop spending money we aren't earning.

If we don't, we will get poorer and poorer until either there is nothing left to sell or we can't pay the interest on the debt any more.

It's time we stopped kidding ourselves.

Here's a chart showing the stark truth that our real per capita GDP is still below where it was in 2004.

54 Comments

Government mismanagement of our economy for years.

The government import most of our infrastructure needs. Why on earth does Brownlee/ Joyce/ Hide/ etc. not allocate orders in sectors like transport/ energy and telecommunication to NZcompanies our NZworkforce ? The benefits for our economy would be massive, the economic performance over time outstanding. (please read my earlier articles about the reason why)

Without changes towards sustainable production we remain a low wages country without decent jobs for the wider population, but with talented, well educated young people exporting them selves. Even expenditure for daily needs is becoming less affordable and as a consequence our society is sliding increasingly into more debt.

http://www.youtube.com/watch?v=M_3T-Af57Pg what about NZproduction Brian and stop that nonsense - I mean John our PM ?

Why? Because any government in the last 20-odd years has corrupted the nation’s development in favour of lobbyists and bankers. Both Labour and National have impoverished our nation in almost treasonable manner. It is a bureaucracy hijacking the wealth of the country. And they have such an easy game because there is hardly any New Zealander with the necessary education in monetary systems, banking and (most important) history. The people are sheeple. One might say they don’t deserve much better. (For further reference: Thomas Hobbes 'Leviathan'.)

Good effort Bernard but it'll fall if deaf ears...again. Look at Bolly's effort to fake some confidence...cheaper money for longer.

The real jobs English spoke of coming from his 6 part strategy....just hot air.

Unemployment set to remain where it is at best.

Govt expenditure cannot be reduced without some political guts being put on the line.

Revenue set to keep falling because rates will rise and household spending will fall.

Building costs will rise as the vested interests in the Chch rebuild drive for higher margins pushing up the price of wood, steel, glass, aluminium, cement, concrete, labour and every service charge too. There will be more activity in Chch but less in the regions.

The mountain of debt arising form several years of stupidity....is here to stay...and rising rates are on the way.

Actually Western countries have for a time used finacial innovation, i.e debt to maintain social cohesion of the middle class, this group were squeezed by globalisation however debt allowed many to live the lifestyle with ever decreasing actual net worth.

Just the last decade? We've been on the downhill slide since 1960, if we choose to look at where we were in the OECD standings; when we were No. 3 of 26..and now we are ..22 and heading rapidly towards last place.

http://www.treasury.govt.nz/publications/research-policy/wp/2002/02-14/01.htm

"Helen Clark's bungle"

http://www.act.org.nz/news/latest-report-confirms-lav-purchase-bungled

"ACT Leader Rodney Hide ... described Labour’s highly controversial purchase of the 105 Light Armoured Vehicles (LAVs) as Helen Clark’s bungle.

“ The Chief of Defence himself said he didn’t want 105 LAVs. They were foist on him by Helen Clark.

“The purchase of the 105 LAVs was driven by Helen Clark’s driving desire to disband the combat air-wing. That’s what drove her thinking. So now we have no combat air-wing and 105 LAVs that we don’t know what to do with or how to use.

“It’s a shocking, shocking waste."

"Anarchists went on the rampage in central London".......

NZ Govt Cabinet members, RBNZ senior staff and some rich bankers, to be trained in the use of the LAVs...

I doubt the anarchists will target Chch...not many windows left to smash...looks like Auckland JK...are you ready....finger on the trigger....

Winsome Peter's bungle ! ....... Had he got the job of Minister of Defence for Ron Mark , instead of just seeking baubles for himself ......... the $ 600 million would not have been spent on those useless LAVs , most of which the Army don't want , can't use , and not a single one of them can be transported in a Hercules !

........ As the socialist wastrals were in charge of things , and Herr Clark and errand-boy Goofy knew best , we got the " best that munny can buy " !

At one tenth of the price a smaller number of eastern European LAVs were offered to the Labour Government ............ But NZ deserves the " best " of everything ........ aha ha de bloody ha ! .......

"Anarchists went on the rampage in central London as hundreds of thousands of people marched in protest at government cuts."

As opposed to "Liberal Imperialists", like Bill Clinton, George Bush, and Barack Obama, going on a rampage in Iraq, Libya, Yugoslavia, and Afghanistan? I think the violence and destruction wrecked by "Liberal" governments are rather disproportionate to that of a small band of anarchists breaking a few windows, no?

So you think its ok to trash a bunch of businesses in Central London just becasue you dont like what the yanks have done ?

Poor misguided Muppet.

"So you think its ok to trash a bunch of businesses in Central London just becasue you dont like what the yanks have done ?"

Why not? Those corporations are the key drivers behind the Western colonial adventures in the Middle East and chief beneficiaries of the destruction wrecked on populations overseas, so for me its a small degree of comeuppance. A VERY small degree.

"...though hesitant to make a move while car bombs continue exploding in the streets of Baghdad, many of the largest U.S. companies reportedly are lining up for membership in the U.S.-Iraq Business Alliance, a group backed by the Bush administration that hopes to get American companies into Iraq before the best business opportunities are gone.

"We have support from the executive branch of government, and I would like to leave it at that," Bar Harbor businessman Dennis Sokol, one of four founders of the alliance, said in recent interviews. "The fact is, they've been very supportive."

The alliance was formed eight months before the U.S. declared war on Iraq and has been influential in getting the Coalition Provisional Authority in Iraq, led by the United States, to create business-friendly laws meant to spawn economic development in the war-ravaged nation."

http://maineowl.net/blog/item/2008/11/five-years-ago-in-war-18

You and your ilk might find you garner more public support for your cause if you moved away from the "rent a mob" antics you seem to prefer......

The US is just a convenient skapegoat for the anti-establishment movement and those bent on wanton destruction of others property. If they werent around you'd find some other "great Satan" to justify your actions.

"You and your ilk might find you garner more public support for your cause if you moved away from the "rent a mob" antics you seem to prefer....."

Don't make a mistake in thinking I associate myself with the so-called anarchists in Britain. Most of them are the spoiled brats of upper-middle class Mummies and Daddies and just use Anarchism as a gesture of adolescent defiance of their parents.

"The US is just a convenient skapegoat for the anti-establishment movement and those bent on wanton destruction of others property. If they werent around you'd find some other "great Satan" to justify your actions."

Hey Kermit, it appears that the Western imperialists are the ones engaged in "wanton destruction of property". Or are you of the opinion that property is only of value if its owned by white Westerners, similar to how Europeans regarded lands they wished to take over, as terra nullis? Too bad it often transpired that people of a darker shade of skin just inconveniently happend to already live there.

Actually I don't describe the United States as the "Great Satan", seeing I'm an atheist not a Muslim, but yes in our globalized world there will always be another State, whose superiority of force, people will be tempted to use for their own ends. If not the United Nations, then the European Union, and if not them than Russia or China. Perhaps with a power vaccuum created by the downfall of the United States, Indonesia will become a major power in our region. At heart I'm a fatalistic idealist, heh.

Not to mention the neocon's rather grandiose plans to attack and occupy seven Middle Eastern countries and furthermore their project to reshape the entire Middle East.

"In an interview with Amy Goodman on March 2, 2007, U.S. General Wesley Clark (Ret.), reveals the United States government’s plan to attack 7 countries: Iraq, Syria, Lebanon, Libya, Somalia, Sudan, Iran."

http://presscore.ca/2011/?p=1370

"It is unsustainable. We have to stop spending money we aren't earning. If we don't, we will get poorer and poorer until..."

linear extrapolation is inappropriate. If the Earth keeps moving in the direction it is going now, it will fly off away from the sun into interstellar space until...

Maybe it is wise to borrow now with lowish rates and a high dollar, and pay down debt with cheaper dollars later?

There is great wisdom in the proverb: "We do not inherit the earth from our ancestors, we borrow it from our children."

We spent our inheritance and borrowed against our children. We are no different than the Haitian who sells their child to a stranger. We have sold our children, and their children into debt slavery. This psychopathy of greed will come back to haunt us. It's karma.

Yes greed is a good word to use.....though I dont think ppl see it that way.....

At least two fold on our children....not only have we borrowed and spent a substantial p[art of their future earnings we have depleted the earth doing so....so their earnings will be substantially less.....

I dont actually see how theycna pay it off....

Im waiting on Ireland's default.....that will be.......uh......fun..................not

regards

While I am not happy we are borrowing so much as a nation it is helping the nation to function to some extent and despite that injection of borrowed money people are still being laid off. Business is still finding it difficult as spending has reduced from the levels prior to !st January 2009. If you stop the borrowing it will reduce business activity substantially and even more people will be laid off. How many unemployed do we want in NZ? How many can we afford to support. That is why the government is borrowing as it currently does. Not because it wants to. Not for the hell of it. But to keep us going otherwise we are really in trouble. Massive unemployment, less paye being earnt,less gst, less company tax and more people on benefits.

`Ex agent.... yes.. that's right... That gives the Govt a limited window of opportunity to make some structural changes...( maybe the next 10yrs).. The GFC was 3 yrs ago.... so they have wasted 3 yrs so far.

Ideas that come to mind are:

Gareth morgans "Big Kahuna"

Hugh Pavletichs' ideas on making housing more affordable.. ie.. unwinding the monopoly that councils have on urban land supply. ( building sector is in a depression )... Opening up the supply of housing would have alot of "win..win" snowball effects.

Tax cuts that would actually have an impact on aggregate demand. eg. ist $5000 tax free

Reducing the size of Govt.

I have not really figured out what their game plan is..... but they have "blinked" and seem to be getting nervous about the rapidly growing debt.

They dont have 10 years to make structural changes, they have maybe 2, might be 6....but Im also sure that my structural changes do not match yours.

regards

Steven.... I'm interested to know what structural changes u would make...???

cheers Roelof

He said high net worth individuals were now paying very little tax and a whole industry of tax advisers, accountants and lawyers were earning livings out of inconsistencies and loopholes in the various systems in place now.

"The biggest suckers in the tax system are PAYE earners"

Hmmm....ho hum........I could almost agree...except it it now pointless....

regards

Tax cuts with first $5000 free? Yes but pay with getting rid of the previous cuts on tax on high incomes and even expand that. The UK has not been afraid to tax the rich (and lift their tax free threshold!) and remember the receivers of high incomes (don"t call them earners) do not have enough votes to do much other than make a noise. Most of the supposedly mobile richer lawyers speculators and business owners are not as mobile as they suggest. They are stuck with their own little financial fiefdoms right here and maybe they would be no real loss anyway. Yes doctors and similar professionals with special skills are mobile and we would need to adjust their returns but they represent a small price to pay to rebalance.

Reduce the size of Govt? And add all those to the dole queue? However start by reducing higher pay scales as some have been hiked by doubtful remuneration statistics from the private sector. Why do MPs justify their rates for another?

Add it all up and National is just as gutless as labour was and probably more so because they know they are now on a hiding to nothing without a natural coalition partner.

Boom! Boom!

Basel

Looking at how the "rich" are effectively paying little tax its pretty clear that needs addressing....Gareth Morgan laid out one possibility, broaden the tax base.....really its pretty clear we have to do something pretty drastic in order to get our system in order...there is no advantage in minor fiddling at the edges....

regards

I don't see any real need for major structural changes other than the very basic type of ones like Bernard has suggested, like shock horror, only actually spending what you earn.

Or maybe even one day saving more than you earn.

A country in that respect is no different than a household, if you spend more than you earn, it will always come back to bite you in the end.

The only ways you can be richer are either earn more or spend less.

When ppl can go to a tax lawyer/accountant and walk away and legsally paying little tax while those on less and PAYE bear the brunt of the tax burden, sorry but that indicates something needs to be done and on 2 levels 1) They are not paying their fair share 2) there is an industry created that generates no national wealth for NZ......all those brain cells dedicated to not paying tax instead of doing something that will earn something, by shock horror making a good.

regards

Depends how you define "their fair share".

Steven, you've mentioned how "PAYE workers bear the brunt of the tax burden" on several threads. While I completely agree that it is plain wrong for some people to use loopholes to pay little tax, if you don't like the PAYE system there's nothing stopping you from getting "off it", ie, you may not have the power to change the system but you certainly have the power to change your own situation (I'm assuming you are a PAYE earner).

Easiest way: instead of relying on an employer, go set up your own business. That's what we did and it works fine for us, so far. That said, you might like to bear in mind that being in the PAYE system doesn't have just disadvantages - job security (relative to self-employment), no financial investment required on your part, no effort to make to keep the work coming in, holiday pay, sick pay, and many companies also offer life insurance, profit sharing and health insurance (that's why I had while in PAYE in NZ anyway). On the other hand, by going it alone we certainly gained flexibility (work from home), earn a much higher hourly rate (x2-3) and yes, possibly pay less tax (simply because we don't have to pay ourselves all the company earns, only what we need while the rest can be reinvested or used to pay for equipment that an employer would normally provide). But we also have to find the contracts, be able to put up with not knowing what the next month's income will be, be happy to work week-ends/nights, have to keep the accounts, do the returns etc, and we don't get paid for slack-time (eg blogging!). So while PAYE is not perfect, avoiding PAYE (by being in business) is not for everyone.

So the difference is what? I work for myself and uh dodge tax...

In terms of self-employed or not, actually what you are saying is seek a job or income to minimise tax....this shouldnt be the case, I should seek a job to maximise my income/lifestyle.

So everyone goes self-employed, this doesnt solve the problem of the tax base being too narrow and the burden concentrated on the PAYE middle income ppl.

The point is if I earn $100k say as a PAYE and pay say $35k tax or say $120k as self-employed but only pay $30k tax that is not right IMHO.. We should be paying the same % amount of tax...as self-employed OK you get more money, but not pay the less tax, that in effect means im subsidising the self-employed soits welfare for the well paid....who sure take a risk but enjoy the other advantages.

Work should be encouraged in areas that bring in foreign income/earnings as thats what makes NZ rich....so the endevour of say me as a PAYE subsidising someone should be where that is a national benefit and not an individual one. For instance there are quite a few tax lawyers / accounts who are probably self-employed Im sure and earn good money, that doesnt benefit NZ, those brain cells are wasted dodging tax instaed of making a good.

And actually I do have some power to change the system its known as the vote.

I have been self-employed I found the work wasnt terribly satisfying, and its very unlikely I could match my salary....so the advantage of self-employed dont work for me.

'In terms of self-employed or not, actually what you are saying is seek a job or income to minimise tax". Then I didn't make myself clear. The one and only reason we personnally went into self-employment was flexibility, namely being able to be around for our young children and not having to ask permission for time off to a boss anytime one was sick. And what I was saying is that if you don't like PAYE, whatever the reason, nothing stops you from getting off the wagon.

"We should be paying the same % amount of tax" uhhh? The tax system the way it is now is not that everyone pays the same flat tax rate actually, what % you pay depends on what salary you are on. And I'm not sure what you are saying. If you earn 120K as self-employed (ie pay yourself 120K and fill in your return honestly) then you'll be taxed on 120K. Not sure where the problem is with that.

"Work should be encouraged in areas that bring in foreign income/earnings as thats what makes NZ rich". Well, you'll be pleased to know that's what we do.

"And actually I do have some power to change the system its known as the vote." Granted, however I wouldn't hold my breath waiting for the pollies to make things the way I want them to be while fuming the whole time that "the system isn't fair". I'd rather make changes to my situation where I feel I have more power (as it only depends on my & my husband's decisions).

Re-Kate below, that's something we might do if things get too slow in the current economic situation + local Chch situation although not our preference.

Re-Speckles below, paying ourselves a market salary for our specific job is what we do so no tax avoidance issue here, but as I said by being self-employed we earn a higher hourly rate than if we were employees so we are able to leave some cash in the company, which is the way it should be. In other words, we don't pay less tax than if we earned the same amount as PAYE earners, only there is some earning leftover (on which the company pays tax, not us) which can be rightly used to re-invest, buy equipment, employ sub-contractors etc.

One last thing I'd say on the PAYE/tax system is that I think the whole family income should be taken into account for tax rates rather than individual incomes. Eg, we both have the same degree, same level of experience and same earning power as proven by our employment history. If we wanted to split the income declared 50/50 in our returns to avoid paying top tax rate on a portion of the income, there'd be nothing stopping us to do so...even though it wouldn't be correct as I work currently work less than hubby. Nobody would ever be able to prove who did what (we work from home, together, only we know the "time split" of the total time worked). We happen to be honest so we split the income earned appropriately but I am well aware that not everybody would do that and that it is an easy way to minimise tax.

Elly, sometimes you can do that and sometimes not....but maybe I mis-understood, it certainly sounded like as a generalisation you were suggestion the general population should be picking an employment mode depending on minimising tax and not other reasons, maximising pay or time off are valid to me.....for tax reasons isnt IMHO.

Last para, yes i agree should be on the family income and not on individual income.....but then that would help us a huge amount.

regards

glad you have it covered, my comment came about as you mentioned you pay only what you need which is not the same as market rate....

Better yet, get the best from both systems, especially if you have two workers in the family.... one provides the security, the other the risk/return.

Totally agree........that was our plan at one stage....

regards

The catch is you have to pay a market related salary under the current tax law via you company assuming it is generating that level of cashflow. Otherwise you riask the anti-avoidance provisons and note several cases are being pursued currently.

Is this an incomplete story?

People that have money to invest use it to buy AUS dollars to invest in the ASX. Are we sure how this dynamic works? Is there some way that the NZ Govt keeps these statistics?

Are we sure how much those foreign investments earn for NZ investors?

As for the NZ government borrowing more money - they are possibly the most restrained in a very dubious bunch of central and federal bankers. I am disgusted that there are those in charge of policy that drink from the eternal fountain of cool aid and then blame the regular person on their spending and investing habits.

Someone needs to stand up and tell Bernank a thing or two first.

The spending and investing habits of private ppl is actually the issue....

NZ has a low public debt true, but one of the world's highest private debt per capita....I think we are in the top 3 or 5......its a crazy amount of money and most of it is locked up in massively over-valued property (50 maybe 70%)....if that bubble pops we are in serious doo doo....think Ireland but without the EU....

Sure you can lay the blame at the Fed's door for making lending easy and cheap, but we decided to borrow it.....Bernanke is also the one left standing, he's dropping money in a desperate attempt to avert the second great depression and stop US un-employment going pat 20%...and the US housing market totally imploding........

...the one to really blame is Alan Greenspan.....for putting us and Bernake here.

regards

I remember at that time circa 2004 and seeing the underpriced bank lending. We took advantage of that too, borrowed for capital gain, speculation.

At that time it felt absolutely right that we protect the small amount of wealth that we did have.

Unfortunately our household income was dropping at the time, due to market forces, and to survive we had to be nimble.

The small protection those investments afforded us was the thing that kept us afloat.

It very much felt that it was government policy versus us.

Our situation has changed vastly since then.

We are looking at investments now. But it doesn't matter what the returns are, it very much matters whether they can be retained by currencies holding any value through the ongoing missmanagement afforded us by our central banks.

Quite, chrissy. It's not the 'return on your money' that matters now, but 'the 'return of your money'. Money in the bank, even at 0%, will have increasing purchasing power as assets are cashed up to pay-to-live. Those retiring, from now on, don't need 'inflation'; they need 'deflation' to make their savings last. Picking a particular currency is risking the 'return of your money', but may very well prove useful to those who get it right. I live in NZ, so NZ$ will have to do for me. And the fall in all asset prices, other than cash, will help me afford the increasing cost that I will have to pay for daily living items.

Actually yes, the BBs seem petrified of deflation but they shouldnt be IMHO they should be praying for it....I guess because they are asset rich and are basically greedy not wanting to bail out and miss "profit". If they were "sensible" they'd cash out, put it in a deposit account or something risk free at a few % and hope for a depression/deflation so they get a triple benefit, inflation doesnt eat their savings and it buys more....Going into a depression its 10% or more per annum...that on top of a few % in a deposit account plus of course you are not paying tax on that 10% is a hell of a rate.

What counts is the buying power of your $ not how much $ you have.

regards

Yes, Andrew Little does impress and coming from outside Parliamentary politics would be a good thing. I suspect he doesn't suffer fools gladly, and I think he is also prepared to admit what a mess we (and the world/established order) are in.

A change-agent is what's needed. He could be one.

Even if they were economically literate....they will still try and promote growth, which is a dodo.

regards

Can we take it that you will be carrying Little's bag Iain...!

Regarding your love affair with Lee etc....just for once how about considering the question of the right for people to determine their own future...going on now in Libya Iain...and the Yemen and Jordan and Iran and a few other shite places where to date the masses have had their lives determined for them....

When the state creates credit to build stuff like houses...the afterglow leads to more credit for more stuff because....the pollies come to see their position in power as guaranteed so long as they create credit and make stuff....ie the bridges to nowhere!

This can appear as wonderful govt, especially to the Little's swinging the hammers with heaps of 'stuff building' work planned for them to make...and cheap state housing to live in....never having to leave....

But it comes at the cost of strangling private enterprise.....the very thing a country needs if it is to make real progress in building wealth...not something the state has been good at. The private investment of wealth shrivels away....why start up a coffee vending business when the state owns and runs and staffs coffee shops in every town and city and street. Why invest in a farm when the Little's in the state machinery claim the right to fix prices...and determine how many you will employ...and to whom you may sell...and a higher tax on your profit because you are a rich man...you are a capitalist...you have to pay more...you must be a bad person.

We all should learn more about this guy's knowledge. Here just a short introduction:

http://www.youtube.com/watch?v=dAu4fzWwFhg

http://www.youtube.com/results?search_query=chomsky+2011+capitalism&aq=f

To get back to the point of Bernard’s article the Country can’t survive if we borrow and borrow just to achieve our instant wishes and desires and personally I do not think the economic structure should permit it. A Government that borrows and permits such private borrowing is not a governing in New Zealand's interest but its own - the politics of re-election .

Surely it is the way and when you spend your money that is the main point (I am not including all the people in New Zealand who are on the minimum wage or those with families who are receiving the WFF tax break because I do not know how they manage at all). Budgeting used to be how people managed and achieved but the short termism of the last 30 years coupled with the Banks’ lending and the advertising associated with that, meant everything is wanted NOW THIS MINUTE. The advertisement “Because you are worth it” has been a very powerful message. Last week I was in Sydney and I met a man who can’t manage on a tax paid income of AUD$200,000.00 per month!! Now I ask you. For those who are above the WFF threshhold and for those who do not have families it is the same. It is how they manage their money. If everything is wanted now then they won't manage and will need more - like the man I met - but goal setting is a very satisfactory way of living and achieving what you want and New Zealand. can be saved

Governments aren't elected to govern in 'the country's best interest'; but to represent the interests of those that elect them. If voters that want to 'borrow and spend' are in the majority, that is what we will get.

Yes that is true but it is short termism at its worst. It is the politics of re election and that emerged over the last 40 odd years. A statesman/woman is what is needed but perhaps that is not possible now and we will have to go through dire times for someone of that calibre to emerge.

I suspect those 'dire times' are lurking just below the surface, and maybe...just maybe...a man with tens of millions of personal wealth, and hence no financial reason to fear being a statesman, might just emerge from his cocoon of popularity, when the true state of our nation become apparent. It would be handy if he did it first! But better late, than never......

No, he hasn't got it.

Ever since around 1973 when The BNSW introduced A $100 overdraft facility to non business accounts, then not long after that credit cards and hire purchase came into vogue....Our population has come to believe that possession = higher living standards.

Since then we have had several generations who have not gone thru school with the ASB savings, and grown up thinking that leverage is the only sensible, common sense way to get ahead. We also have generations that have no idea of the difference between "want" and Need"

Its simple to fix..have a government with enough balls to make credit cards illegal, and compulsory 10/20 /30 % deposits on any major purchase

Till then we can do it the PC way (helps unemployment I suppose) by spending millions of dollars in our education system and TV etc to so called re educate our population....yeah right.

Or lets just turn this ression into another full blown 1930s depression....or simply let our personal borrowing do it for us.

Debt is toxic

One observation I would make is that we should not beat ourselves up about what we have done wrong, plenty of other countries have done the same. It really isn't all our fault. Most of our debt has been spent bidding up the price of our own assets (houses, farms) rather than government debt over the period you mentioned. Only thing to do is acknowledge that we have a problem and do someting about it. Take a look around the world at countries that have maybe done a better job of it and learn from them.

Things like.

1. Return Cullen Fund to NZ, pay off all government debt immediately and invest the balance back home.

2. Get the banks under control- they run a cartel, so they need to be managed. Increase the deposit required on a new home as they are still playing us for suckers.

3. Acknowledge that banks don't lend to grow companies they only lend against property. So we need a new way to grow our companies rather through loans on property. Make equity pay rather than debt and make it easier to get people involved. Make sure that they know it can all go wrong and that investing is a risk.

4. Keep our own assets- don't let National sell them off. Keys is doing the dirty on us all with that one. 'me or the dams'- what a cheek.

5. Remake the tax system into something fit for purpose rather than the complete mess that it is. I suggest getting some engineers to work out how to do it rather than asking accountants. The land tax idea seems to be the best of a bad bunch. You can't move the land or hide it or offshore it or anything so it shoul be a good base for the tax system. Taxing enterprise, seems like a waste of time- it makes every single person working less compeitive than the imported version. So keep it to a minimum. Taxing lad strangely enough actually can help keep asset prices under control. Ramping up GSt is not a winner either as it is being offshored as well and anyway it means that the poorer you are the higher actual tax rate you are on. It really does.

Heaps to do , but tinkering is not the answer, neither is looking to the politicians, they have to be told the right answers, trouble is they seem to be asking the wrong people the questions.

One thing that needs repeating is that the debt we owe was created when we borrowed it. So stop borrowing so much the amount of cash out there is only limite by our ability to pay the interest. Wolly is a bit wrong that the Pollys are worse than Banks when it comes to debt, they are both hooked on debt neither are to be trusted we need to set the rules.

Too right Bernard, we have moved past the house / property investment falling 30% issue and should be focusing on the debt burden that inflationary housing / land costs now force on every member of society.

As the US and Europe cough we are catching a cold due to the infection of cheap borrowings with no productive output invading our lifestyle.

Of-course for bankers here in NZ lending money is business and they are no-doubt making a killing but we need to look at the economies of Europe and America and learn a lesson by not following them down the path of serfdom of their people.

One point to hand Bernard, you point to higher wages with no increase to output, that this has been paid for by borrowing, YES!

But also you talk of the need to save money and how can money be saved without increased pay? I would argue for increased pay conditions and increased output from pay as a means to enable saving of money which could in-turn be lent out. And that this was partially the case as the increased wages came in with Kiwi Saver lollipop.

I would also argue that interest rates should increase to 8% to encourage personal saving through banks and other secured institutions. Also something I don't remember you having talked about in the past is the need of businesses to own property to secure loans at reasonable prices.

A business lease / loan on a computer incurs an interest rate of around 24% per annum over five years - it is no wonder that NZ business and individuals output hasn't increased under these conditions and also that business owners invest in property with their savings in order to grow their business.

Surely the bigger picture in defined by the past changes to our sovereignty by laws around banking.

Our annual outflow of earnings to banking is damaging and often crippling. Banks are not sacred cows inspite of the hands off warning and threatened consequences to authors of shift away from feeding the greed of banking oligarchies. Our future is diminished by bankers.

John A Lee mamged to get State housing off the ground in NZ without bankers and it was a simple mind shift.

http://video.google.com/videoplay?docid=-515319560256183936#docid=60761…

http://video.google.com/videoplay?docid=-515319560256183936#docid=-7336…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.