Here's my Top 10 links from around the Internet at 4 pm in association with NZ Mint.

I welcome your additions in the comments below or via email tobernard.hickey@interest.co.nz.

I'll pop the extras into the comment stream. See all previous Top 10s here.

My must read today is #1. Carmen Reinhart is right on the money. It's not different this time.

1. The Great Financial Repression - Carmen Reinhart, one of the co-authors of the excellent book 'This Time is Different', has been writing about 'Financial Repression' for some time.

She has written another excellent piece at Bloomberg.

Financial repression was the tactic used in the 1940s and 1950s to make huge US war debts 'go away'.

Essentially, central banks held interest rates lower than inflation to ensure GDP grew faster than debt.

They also forced pension funds and banks to buy and hold government bonds.

It's another way of saying savers were made to 'pay' for a slow motion (hope no one notices) debt restructure.

This is what's happening again, Reinhart points out this also results in increased controls on capital flows. Hope the RBNZ is watching.

Concerned about potential overheating, rising inflationary pressures and the related competitiveness issues, emerging- market economies may continue to welcome changes in the regulatory landscape that keep financial flows at home. Indeed, this trend is already well under way. This concern means advanced and emerging-market economies are finding common cause in increased regulation and/or restrictions on international financial flows and, more broadly, the return to more tightly regulated domestic financial environments.

This scenario entails both a process of financial deglobalization (the reappearance of home bias in finance) and the re-emergence of more heavily regulated domestic financial markets.

This line sums it all up (and the chart below is sobering).

Unlike income, consumption or sales taxes, the “repression” tax rate is determined by factors such as financial regulations and inflation performance, which are opaque -- if not invisible -- to the highly politicized realm of fiscal policy. Given that deficit reduction usually involves highly unpopular spending cuts and/or tax increases, the “stealthier” financial-repression tax may be a more politically palatable alternative.

2. The guv'nor attacks the banks - The Telegraph reports the Governor of the Bank of England, Mervyn King, has publicly attacked British banks as deserving the public anger now directed at them.

Accusing the banks of double standards, he said families and customers were lectured on living within their means by financial institutions that needed public money from bailouts when the financial crisis hit.

Sir Mervyn, who earns £305,000 a year, said anger against the banks was “very real and wholly understandable” and dismissed attacks by banks that he had failed to offer enough support during the crisis. “I think it is because they found it very, very difficult to face up to the failure of their banking model,” he told The Times. “That model needs to be restructured. My duty was to the United Kingdom economy as a whole and not just to one part of it.

“Market discipline can’t apply to everyone except banks.”

3. Watch the politics - Reuters reports on growing protests against Hungary's government, which is the most indebted in Eastern Europe and faces a bailout showdown with the European Union and the IMF.

Election results, protests, goverment overthrows and politics generally will be the key turning points as the Global Financial Crisis rumbles on.

Critics say the government has weakened the system of checks and balances, such as the Constitutional Court, and expanded its powers in areas like the judiciary and media regulation.

The ruling party also pushed through a new constitution with scant consultation with opposition parties, while its unorthodox economic policies shook market confidence and contributed to the weakness of the country's forint currency.

Konya's list of grievances included a flat-tax system that he said was unfair because it cut taxes for the rich while it did not benefit the poor; as well as the sanctity of private property and legal security, which he said were lacking.

4. 'A monetary tsunami' - The currency wars now raging across the planet are most intense in Brazil, which has recently slashed its interest rates to try to stop its currency from rising.

Now even Goldman Sachs is saying the Real currency is as much as 20% over-valued, Bloomberg reports.

President Dilma Rousseff last week pledged to take all necessary measures to shield the economy from a “monetary tsunami” caused by what she said were efforts by Europe and the U.S. to “artificially devalue” their currencies.

Investors and exporters have poured $15.5 billion into Brazil since the beginning of the year, contributing to gains in the currency, compared with an outflow of $3 billion in the fourth quarter of 2011, according to the central bank’s website.

5. 'Show us the money' - SMH's Matt O'Sullivan reports on the lengths that Flight Centre's Australian operation went to through 2005 to 2009 to ensure its fares were not undercut by fares sold by airlines' own websites.

In an email in May 2009, Mr Turner wrote to Singapore Airlines' Australian boss seeking ''an agreement that we will not be undercut on the web''. The emails from Mr Turner and another Flight Centre manager are in a statement of claim lodged by the Australian Competition and Consumer Commission in the Federal Court in Brisbane.

The regulator has used the emails to support its case that Flight Centre sought to illegally fix prices by attempting to collude with Singapore Airlines, Malaysian Airlines and Emirates between 2005 and 2009.

6.What's happening inside Europe's banking system - The European Central Bank's two big money dumps (Long Term Refinancing Operations) in the last three months have calmed down financial markets, but only for a while.

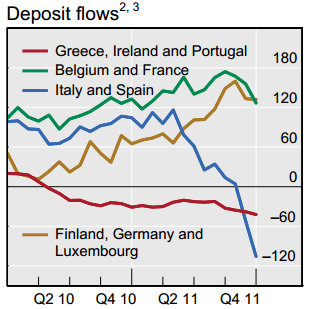

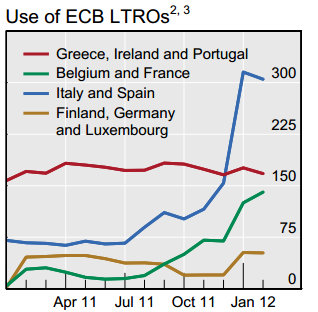

Money is being withdrawn from Portugese, Irish, Portugese, Italian, Spanish and Greek banks (red and blue lines in first chart below) at an astonishing rate. The only reason they aren't dead is they borrowed heavily in the LTROs (red and blue lines in the second chart below). And, we are led to believe, the Feb 29 LTRO was the last one.

This is far from over.

Here's the BIS's data and a couple of charts on the issue of European bank funding and deleveraging.

7. Corporate spying by China - WSJ reports on how the FBI is discovering that many episodes of corporate espionage are sponsored by Chinese government owned companies. The article cites a case involving Pangang trying to get hold of a rare titanium oxide development process created by Dupont 50 years ago.

China regularly denies that its government or state-owned companies engage in concerted efforts at corporate espionage. On a broader level, China aims at gathering already-discovered technical know-how to build global competitors through legitimate means such as joint ventures. More controversially, China has been insisting that foreign companies hand over technology as the price of market access. Within China, many foreign companies are so concerned about intellectual-property theft that they avoid bringing in their cutting-edge technology and manufacturing processes.

8. More China vs US vs EU trade tensions - The New York Times reports on flaring trade tensions between the world's three biggest trading partners.

Five separate issues — involving auto parts, cars, solar panels, anti-subsidy laws and rare earth metals — are all likely to see action by American officials, European officials or both, starting as soon as this week.

On Tuesday, in fact, the United States, the European Union and Japan plan to file a formal “request for consultations” with China at the World Trade Organization about restrictions on exports of rare earth metals. President Obama will personally announce the move, a senior administration official said.Such a request is the first step in a process that will lead to a full-fledged legal case at the W.T.O. by early summer unless China unexpectedly agrees to the West’s demands to ease the export of rare earths — materials vital to various sophisticated technologies.

9. New South Wales slowing - Leith van Onselen from Macrobusiness looks at the latest Australian housing finance data and finds a slowdown going on in New South Wales, particularly among first home buyers.

10. Totally Jon Stewart on Benjamin Netanyahu and his nuclear duck.

94 Comments

And FYI from the FT (via CNN) on China's decision to stop its currency rising.

http://edition.cnn.com/2012/03/12/business/china-halts-yuan-rise/index…

Chinese central bank officials have suggested the renminbi is no longer significantly undervalued after six years of gradual appreciation, citing the country's large trade deficit in February.

According to recently released government figures, last month China notched up its biggest monthly trade deficit since 1998, with imports outpacing exports by $31.5bn. "This trade deficit is a positive sign that the renminbi exchange rate is close to its equilibrium level," Yi Gang, deputy central bank governor, said at the National People's Congress, the annual session of China's rubber-stamp parliament.

So just buy more farmland, and companies overseas, and stockpile more iron, copper, oil, gold etc. and devalue even further.

Gotta laugh, after decades of imposing sanctions, and all manner of trade barriers against any country that criticises US global domination, and dominating the oil trade. Now the US has the sharp end of the stick, rare earths, apparently common, but only available for extraction in China and Afghanistan. I'm suprised there is a legal ability to force a sovereign nation to export it's goods. If price was the issue, it would already be resolved, this is a power play. If I owned resources I'd definatly want to keep them for future use, rather then exploit them for a quick buck.

Everyone seems to be missing the point on this rare earth debate, no one is insisting that China keeps producing them at the current rate if there are valid environmental concerns.

The issue is simply that they are selling them heavily discounted to local buyers and putting large taxes and restrictions on foreign buyers which gives their own manufactures an unfair advantage. This is breaching the trade agreement which is the central objection, the agreement is you can't subsidise your own manufactures or tax foreign ones to gain a competitive advantage which of course is exactly what they are doing.

Maybe you are right, if China stopped selling at a disount to local manufacturers, and stockpiled instead the US would be happy. As I see it, China is counting on peak oil etc, and building stockpiles of strategic resources that will become orders of magnitude more expensive on the other side of hubberts peak. Noone likes this, beacuse it exposes the fundamental flaw of consumption based economics.

US has rare earths but they stopped extracting them.....I think they are re-starting. Im not aware unless there is a trade agreement like NAFTA that there is any agreement to export?

future use v the western style of pillage and moveon.....the latter has been practiced for 200+ years but now there is nowhere to move on 2.

regards

Contrary to popular opinion, the NZD is undervalued, according to the highly acclaimed Big Mac index.

http://www.economist.com/blogs/graphicdetail/2012/01/daily-chart-3

#1 BH - This time it's different - I'd say it is....

After WW2 the US was the remaining industrial powerbase. It experienced a huge boom and could get away with financial regression as the economy was growing in leaps and bounds, government no longer needed war time spending and could close the deficit easily, as the private sector was booming - even babies were booming... everyone bought products made in America... that's not the case today now is it?

They were the world's biggest oil exporter until the 1950s.....long gone, even their coal output and coal reserves are questionable....maybe at present use maybe 80 years....everything was sourced in america....now much isnt.....just where do the export to? where do they get the raw materials? where is the industry? its all gone...

regards

#3

And therein lies one of the big problems. Forced austerity will lead to public dissent and disorder, this will make it very hard to get the kind of economic growth necessary to pull Europe out of its woes, its one big nasty cycle, that I suspect will be next to impossible to pull out of

There will be no economic growth....its a norwegian blue mate.....so the austerity is going to get a lot worse IMHO as we slide into global depression.

I think NZ nees to get natioanist very quickly now myself...simply stop exporting coal etc...

regards

Just to prove JK is a good politician but a poor and dangerous leader, check this out on him talking about student loans tonight:

He said the scheme was politically popular, even if it "may not be great economics".

"That is about the only thing that will get [students] out of bed before 7 o'clock at night to vote, but it's not politically sustainable to put interest back on student loans. It may not be great economics, but it's great politics.

MIA - Key was talking sense and reality. The poor & dangerous politicians were Klark & Kullen who made this policy to buy the 2005 election. After they won govt spending went out of control, the productive sector sank and NZ is where it is today largely because of piss poor policies voted in by NZers in 2005.

You reap what you sow.

Agree the origin of the problem was Clark and co.

But that doesn't mean hard policy reversal decisions should not be made. This is where future-orientated LEADERs make the difference, not careerist "want to be popular" PMs

His statement is "dangerous" because it shows he doesn't have the balls to make politically difficult, but important decisions. It's just another cop out in the process of this govt of extending and pretending

Its exactly the same kind of political populism that has got the likes of Greece in so much trouble

These are the exact sort of issues where the electoral commission needs to have a simple, cheap, fast and effective way of running a national internet based referendum on the subject. ie. direct democracy

That way if politicians are a bit timid on issues where they know there is a problem but are afraid of the political implications, it can be explained to the people and put to a snap referendum if you will, without having to wait for the financial ambulance to arrive before the policy is changed.

Thats just plain partisanship.

http://fmacskasy.wordpress.com/tag/michael-cullen/

I wouldn't claim myself that National are spending up large, because their deficit is mostly down to the global financial crisis and recession, but get your facts straight.

Considering brash did everything he could to win 2005 its kettle calling pot black really.... thank god we didnt get ACT..

The productive sector saw a squeeze on its inputs like exchange rate, oil and materials, hardly surprising it hiccupd....

I suspect Key knows this, but it would probably be bad economic policy to put interest on student loans right now as well. If interest is put onto the loans this will encourage students and ex-students to repay their loans a bit faster. This could easily lead to de-leveraging of student loans at similar levels as there is presently de-leveraging of all other non-government debt. That de-leveraging draws spending away from other parts of the economy.

The deflation (the de-leveraging) is causing the recession, so this could make it worse, which would make it bad economic policy. I am not saying that student debt is a good thing, or should be encouraged by government, but with a debt based monetary system this is how deflation effects the economy at large.

His comments also show a degree of distain for young people, but he was never in danger of losing my vote.

very good points, I'm convinced by the argument -

so, negatives both ways, throw in the politics and maybe its the right call

but that does put more pressure on finding savings elsewhere

where will they come from Nic?

also, at what point do you say short term benefits outweight the bigger picture? Keeping WFF as is would also help the economy short term, but weigh on it longer term

So IMHO some harder future oriented calls need to be made. I guess the art is balancing a mix of short term and long term considerations

Plenty in this list, that you can legitamately ask what do they do?

http://www.libertarianz.org.nz/libertarianz-offers-clark-tax-cut-help/

Jesus wept, Is there any part of society that libertarianz wouldn't prostitute away for a tax break?

While they like to talk about personal responsibility, when it comes to the effects of libertarianz policy personal responsibility is severely lacking.

Yes the army and the police as they need those to protect them, and of course expect every one else to pay tax to fund their protection. What they dont accept/understand is,

1) when you have nothing you dont need the police or army...so why the hell pay to protect someone else..

2) The Police at least have ppl in them who care about society....take away that society and why would ppl want to do such a difficult job? cant be for the money.

3) We have over centuries developed a society of mutual independance, ie in groups we do better.....its a proven method......libertarians on the other hand are more like highwaymen....they wont live long or be tolerated....

So really complete lack of rationality in their entire outlook.

Have you looked at how many ppl voted for them? about 1000 so they are the fringe of the fringe....Even Destiny church poles better.....Any idea what % of the NZ population has mental health issues? because the ones ive met are frankly lifes rejects and fruity loops....and it seems to be mental illness as the root cause....and like god squaddies they latch on to something that gives them hope. "it was the Govn who took away my money so its the Govns fault Im a failure, give my tax back and I'll be a success".

Really though its only forums like this that they get any air time....99.999% of the population know nutters when they see them and walk away.

regards

Future carrot pullers?

The future is very opaque....however if the CVs of the Libertarianz wannabe MPs are anything to go by, but it goes as I suspect it will, yes....mind you I could be there as well....assuming no one wants an engineer/plumber/carpenter/smith type person.

;]

regards

The reality is that society needs to accomodate both independents/introverts as well as groups, afterall both types of personality exist. I can sympathise with the libertarian view as I would be quite happy for everyone else to bugger off and leave me alone, and for the most part I live that way. But that is a self centred view, as a designer I have to accomodate both the groups and the individual.

There are personalities that thrive within the group and in fact define themselves by thier place in the group. Not too dissimilar to a professional house wife that defines herself by her husbands position:-P There are also others that are driven to control a group, which works on various levels from those that are task focussed to those with a grander strategy.

My opinion of where we have gone wrong is that our groups have become too large and impersonal, thus allowing no accountability of our leaders.

An example on in an urban design context would be a culdesac, but the pattern could be expressed in other ways. The street corner would accomodate the busy body that likes to know what is going on, whereas the introvert can tuck themselves away up the end of the street, perhaps down a driveway.

Don't know about negatives both ways though. If you look at it in real terms its hard to form a credible picture of how the education system could be too expensive. The burden of the education system is entirely the wage level paid to teachers, and its far from enormous compared to most other burdens.

I think its always been politically expedient for politicians to kow tow to sectors of society who get a direct benefit from this. Having a stream of well educated, highly indebted workers to choose from, is tremendously helpful to some people. Even better if they are trained in specialist disciplines at their own expense, rather than on the company budget.

The kind of economics theory which thinks there is a burden and free-markets are better has only ever been around to remove democratic influence from the state. If somebody is telling you its too expensive, or equating the government to a household, think about if your interests can be better met by these institutions completely ignoring your interests.

I really question why 'there is no alternative' to cutting government expenditure.

A very good Q....the propaganda of the right has won the battle for the minds of the willingly duped voter...here's candy there will be more tomorrow we dont need to spend it....The public service is always lazy and inefficient....so we can cut it.....etc etc....

The same old rhetoric seems to win....thats sad IMHO.....however we are watching the likes of greece implode....great thing about the Internet ppl can see and ppl have friends and family back home......and can talk back and forth cheaply and quickly.....maybe yet ppl will start to question the dumb asses they voted in...

regards

They probably won't. The Transition and Sustainability movements will be in place, but they'll be swamped.

It's going to need a clear set of directions. 10 bullet points on one A4, although that may be too complicated.....

In a resource scarce world there will simply have to be less people that are reliant of others to provide the basics, ie: food. I am sure if you graphed it, there would be a strong correlation between the size of the public sector and energy consumption.

I found out today why some Austrian school ideas appear to be anti-science, its because they don't apply the scientific method.

http://en.wikipedia.org/wiki/Austrian_School

http://en.wikipedia.org/wiki/Praxeology

The practise of creating prima-facie untestable models and then arguing about the results is sure to keep Austrian school economists employed for some time to come.

Not sure that he's economic on it but political....

regards

#1 BH - Governments have always stolen from savers... Isn't putting GST up in essense the same thing? If you had worked hard and saved a modest $100,000 in the bank and GST went up from 12.5% to 15% overnight - you are instantly $2,500 worse off, as purchasing power has been removed from you. The government only compensated your earning income, not your savings...(with income tax rate reductions).

It's all just theft - a little here, a little there, a little printing here, a bit there and before you know it somehow the money you saved and worked for doesn't seem to go as far anymore.... and now more people are saving it means there's more to steal... oh joy, I bet the government is pleased about that...

Yes, except there is always tax just direct like PAYE and indirect like inflation, its how the system is so you shoud be working within the system not whining about it. While GST is regressive and putting it up was a con....you pay tax at on the interest earned, so I would assume you now pay less tax....but I suppose it depends on the interest quantity being earned...so very well off OAPs will be better off.

Lets qualify the theft a bit.....those now retired were PAYE and probably enjoyed considerable asset appreciation...they will be getting a state pension......state healthcare....etc....its not a one way street.

NB the govn we have is the one we voted for.......

However things are looking bright for those who have saved in my view of our future....(at least initially)....ie I expect deflation....so those with savings are going to see a double benefit if they can keep their savings intact which is by no means certain. However they will watch as the un-employment % double and those who have jobs wages drop....and many ppl who work will have a hefty mortgage on a property worth less every year....hello negative equity.

So debtors, workers fear deflation, personally I dont think those with savings should....except they have to have their wealth in the right space........

So I see house prices collapsing 50% but more likely 75%...over 5 to 6 years ie 10% per year....so someone with money has to protect it during that and that seems to be "cash", though banks staying open is a worry. At the bottom of the drop then move out of cash and look for hard assets would be the conservative way.....

Of course this (A Great Depression) has only happened twice....few alive remember the 1930s and there is no one alive from the 1870s....and this time we are on the downward curve of fossil fuel energy.....so its unique this time and the problems will be un-predicatable.

regards

Look at my post at the top of the 90@9, if you think about the ramifications of that as production gears down prices have to go up. There will be reallocation amongst the assets in a stagflation sort of way, but overall prices have to go up to keep GDP positve. Negative is simply not an option under fiat money.

Dont get confused with some prices going up and going up overall, and GDP doesnt have to go up....it can drop aka Great Depression. Yes I agree some prices will go up, therefore with less energy other prices have to drop to compensate...that means re-distribution overall, which is a process and inherintly in-efficient....

So an example of what Im thinking will happen....So say food is $50, if we go from say $100 to $90 in our pocket...and food goes to $55 then whats left is $35 or with losses say $30 NET left....everything non-food has to cope with that $30...where before it was $50......thats a huge impact.....and its likely it simply wont survive/be available with a 40% "cut"

Hence why I think there is going to be such big losses and such big changes.

regards

Ahh yes, but you have to look at the aggregate. M.V=P.Q when all money bears interest means that Q is dropping and M is going up. V is also likely dropping is debt is serviced and people hoard. P is going to increase by the sum of both the drop in Q plus the increase in M.

That equation is an identity, it doesn't capture how inflation occurs well enough to reason through it. I suggest reading the following to understand the history of this kind of concept in practise,

http://utip.gov.utexas.edu/papers/CollapseofMonetarismdelivered.pdf

That article doesn't challenge the equation at all, just discusses what happens when you fiddle with different parts of it. They all completely miss that growth will inevitably be finite. The equation is simply supply and demand expressed. The article does explain the reasons behind the crashes without really putting the finger on the real culprit, that is the creation of price that is not backed by value(production perhaps). Fraud pure and simple.

There is nothing wrong with that equation, except if you take it to mean that the central bank can control P by fiddling with M. Thats the idea which Friedman put forward but it failed in practise.

You should take this to show that central banks have limited powers, they are not all powerful, though in the right conditions they might have more or less influence. Its a question of who is responsible for creating that artificial price in the system.

I don't think that equation should be applied to buying and selling credit either, which side of the equation does the loan go on, the M or the Q?

The equation does seem the cross the boundaries of the different theories. What I am getting at is when physics dictates quantity or production. Peak oil being one possibility, but there are others as well. I don't know all the theories, but there doesn't seem to be any the work in a deflationary environment. Even the t-Bill theory would have trouble holding up. Agree on the Credit.

Yes, I agree with you that any trend must come to an end at some point. As I see it however the present global recession is entirely the same as the great depression (the response has been slightly different). There was a trend of growing debt burden (essentially debt to gdp) per capita, at some point this had to reverse (lots of economic theory ignores this for obtuse reasons). This leads to a shrinking money supply (because credit is money, and its tied to debt). The process is called debt-deflation, actually by the author of that equation, Irving Fisher.

There might be oil shocks coming, there might be other physical issues ahead. But it should be understood that a financial system can be unstable in and of itself. Thats something which Minsky discussed with his financial instability hypothesis.

To me this says you should regulate away the source of instability, then put the money supply under democratic control.

That is some BS number, you would have to look at M3 because the equation refers to an aggregate. There has been a corresponding deflation in house prices during a fair part of that period.

The M3 was shrinking over this period. I am not going to look it up right now, but you can find that data from the public web site of the bank of Japan. The total M3 can shrink in a fiat money system, that is my point.

No sorry, only very briefly has the YoY rate of change gone negative. M2 in 1992 and M3 in 2006.

Steven, 'Yes, except there is always tax just direct like PAYE and indirect like inflation, its how the system is so you shoud be working within the system not whining about it' ...- This is not actually true as constant inflation is primarily just a fiat problem...(a way governments and financial institutions can steal from savers) I guess thats why I'm a property investor then? To hedge against inflation over the long term...

If property declines anything like you suggest you will loose 100% of the cash you have in the bank. Banks don't lend out your deposit - they leverage against it - thereby creating loans and deposits from thin air as a book entry... (when they make a loan they don't reduce your deposit amount by the amount of the loan...). Once you deposit you money with a bank it becomes 'their money' and you in law are an unsecured creditor and you just appear as a liability on their balance sheet...

RE 1930's both Greenspan and Bernanke openly agree the FED was the main cause for the 1930's Great Depression.... this is not the 1930s although we are heading for another depression... but as practically all hyperinflations are followed by massive deflations (and there are reasons for this) you will get your wish eventually.... M3 in the US is growing on an annualised basis yet the economy still hasn't recovered...

I suggest you read up on why Bernanke apologised to Milton Friedman for the FED causing the great depression, and what policy he used in 2008. Then you might ask, was Friedman actually right, did the Fed actually cause the great depression, and has the FED acted appropriately as a result this time.

The link is above.

link above?

Well Nic, I might also ask yopu for the 6th time (?) to do some research and answer my 2 questions for you;

Nic - 'Its very simple to see the gold market is driven by fear. Any outsider could see this'

Really Nic? So Central banks (major buyers in the gold market) are buying gold out of fear then? If that is true as you propose - YIKES! then the question is exactly what is it that central banks are fearful of?. This is what, the 5th or 6th time I asked you this? Have you done enough research yet to get 'it'?

and secondly - why does the IMF ban member countries from attaching their currency to gold?

I think you've had plenty of time to do some research by now...

"So Central banks (major buyers in the gold market) are buying gold out of fear then?"

URL? China and india are buying gold, some emerging markets RBs....now if I was china and had shed fulls of USD, then yes I'd swap it for gold....the Q is what %? of their total?

Also didnt the IMF sell off all its gold recently? in which case it counters your Q....adequately to my mind.

"IMF ban" URL? cant find anything at say,

http://www.imf.org/external/pubs/ft/exrp/differ/differ.htm

regards

Hi steven,

Just before I attempt to fight the AKL city traffic home to the eastern surburbs...

Actually if you read my post it was 'Nic the NZer' claiming everyone (not just central banks) buys gold out of fear (not me). This was from his previous posts between him and myself...

Sure if I was China (or India or RBNZ for that matter) I would be swapping USD for all the physical gold (and silver) I could get my hands on and be moving it into my own borders...

The IMF accept repayment of debt in gold - a lot from 3rd world countries - it is generally this gold it then sells off. You have to know the legislation that must be enacted by each member of the IMF - NZ has all its legislation on line so I will search and find it then post for you the link, and subsection - no worries.... Its why we will not be returning to a gold standard anytime soon...

...but my questions were to Nic who generally wastes my time with long silly posts debating something he understands little about...then ignores any real questions for which you actually need real understanding to answer..

Hi, Ive been reading on the IMF, I certainly cant find anything by them that says this....lots on gold bug sites claiming it......which starts to look kooky conspiritol. Whether the IMF is paid on gold or whatever they have sold the gold on.

I did read a while back that china was supposedly buying gold every time its price dropped effectively putting a floor under it....however its dropped for some weeks now....

Yes I read about the legislation....seems a pretty open idea and we dont have to stay in.

Nick has some fair points btw....and as for "little about" I think there is even more ppl showing even less than him opposing his view/opinion.

regards

I think this addresses both questions more than adequitely.

Steven,

It maybe in other places too but check out;

Articles of Agreement of the IMF

Article V, Section 12, subsection d - IMF accepts gold as payments.

Article IV, Section 2, subsection b - not permitted to value currency by gold.

http://www.legislation.govt.nz/act/public/1961/0003/latest/DLM326544.html

The IMF is not the saviour it claims to be. I could go on about this, but it would take up an entire book - and books like that have already been written. Yes Nic is learning, but from past posts I have found him just wanting to argue endlessly so I ignore it now... but he seems to be getting better....

There are obviously a number of intermediate steps which are needed to connect inflation, or lack of inflation with a gold standard. There is no evidence to support this, which is why you end up in the middle of conspiracy theories about who is manipulating the money supply. The simpler explanation is that the total money supply is not under official control, and there is pleanty of evidence and testimony to support that.

The reason monetarism is an important link here is that Friedman actually argued that the Federal reserve was the main source of inflation, so if they set regular monetary targets then inflation would level off and die. In practise however this didn't work, and this idea has been discarded as a failure. So in order to contend that the Fed is the source of inflation you need to prove that there was something wrong with the implementation of monetarism at that time, and basically to restore monetarism.

Essentially Bernanke has followed Friedmans recipe for dealing with the great depression, he stabilized all the financial institutions, the same policy is being applied across the world. So to contend that the Fed caused the great depression is also to contend that all our problems have now been solved, so does that seem to be the case? The effects of this however point more to Friedman being wrong, than the Fed being responsible for the great or even just the greatness of the great depression.

It is also well acknowledged that the Fed abandoned attempts to control the total money supply as they abandoned monetarism. So they say they don't try to control the money supply, just as the evidence points to them not being in control of it. The same is true of the RBNZ.

At the other end of this argument there is the contention that the IMF is afraid of gold as a basis for money. I think the most likely reason for these provisions in the IMF documents is they are there due to the end of the Bretton-Woods agreements. Of course the IMF doesn't want to repeat the mistakes it sees with the Bretton-Woods international financial agreements when many countries central banks came under attack from gold speculators. But I don't see any reason there is more to it than this.

Of course this is far from contending that the IMF is some kind of saint, their brand of neo-liberal, in some ways laissez-faire economics is very destructive in practise. Maybe they would be well loved if they had a fully functional theory of economics behind them. Say that they had swooped in and put up the capital and actually saved Greece from default then I expect there would be hundreds pandering to make them the basis for the next world government.

I think that the historical record shows pretty clearly that a gold standard doesn't lead to stability, though no doubt contending this would just lead to a slagging match, yes it does, no it doesn't, etc...

Nic,

If you are referring to 'many countries central banks came under attack from gold speculators' as for example when Nixon broke the Bretton Woods gold exchange in 71 as when the US subtly cheated and printed more money than they had gold to back it to pay for the Korean and Vietnamese wars as noticed by Frances President De Gaulle, who called their bluff, if you are labelling France and co as a 'spectulators' - I think the blame was not with the spectulators if you think about it, but with the ones who actually cheated. That just proves my point. Speculation would have no effect if they had only printed money that actually had gold to back it now wouldn't it? The historical facts were that the US cheated and France called them to account, then the US defaulted, because they wouldn't give its gold up for the fixed price of $35/ounce (testifing btw to gold true worth over paper). It's the IMF's dream come true to have itself as the master of the world fiat reserve currency - it tried it before in the late 60s pushing the SDR/bancor....

former FED chairman Paul Volcker;

'Its a sobering fact that the prominence of central banks in this century has coincided with a general tendency towards more inflation, not less. By and large, if the overriding objective is price stability, we did better with the 19th century gold standard...'

No you don't say? given that fiat has lost 98-99% of its value to inflation last 100 years I think that's an understatement from Paul... I don't know what history you are looking at - I think if you look at any inflation graphs over long periods anyone will clearly see that the gold standard leads to stability as it takes the money power out of the hands of bankers and politians... that's in part the point of a gold standard - that's why it works.

So, I guess what you are contending is that a gold standard is healthy because it doesn't allow governments to spend beyond their gold holdings (without cheating some how). But of course a monetary system is simply a tool, its not moral in and of itself. Sometimes wealthy governments will choose to do bad things, that is not something which a monetary system can solve. There were many influences to end the Vietnam war and of course the Korean wars. Not the least of which being the unpopularity of the wars in the US.

To put faith in this system, the gold standard, is to put faith into a plutocracy. The speculators are always out for personal gain, and they have to be wealthy to be significant political actors, there is no moral basis (good or bad) to their actions in the way they consider them. The only reason they would not attack a government policy is if its benefiting them. That is a plutocracy, almost be definition, and that is where this basis for money leads. First it will be government by the rich, then government for the rich.

Mr Volcker is correct to say that the US monetary system is inflationary in tendency, however that is a different concept to stable. But a gold standard doesn't take money power out of bankers hands. As is obvious bankers will always be wealthy and so will have an un-democratic amount of influence in a gold standard based system.

You heard of the book, the creature from Jekyl Island, but did you hear of its predecessor, Secrets of the federal reserve. Thats the one about the federal reserve on the gold standard, and people didn't like this institution at that time either.

The other thing to address is the difference between inflation and stability. I will explain this by going through the series of steps which will happen if the Fed were abolished today. First there would be a series of bank runs, then the public will call for a lender of last resort, then the new reserve will be created, then there will be a major financial crisis, then the new reserve will weaken the gold standard so they can function beyond the countries gold, then the gold exchange rate will collapse, then they will go off the gold standard and back onto a paper system. That is why the system is not stable.

Thats why the system is unstable, because the monetary system is not aligned well with the amount of gold that happens to be being found. In a worse case scenario, the new reserve will not even be responsible to the political system at all. The money supply and system should be brought under better democratic control not privatised.

Thats why I think there are two things which must be done, first the institution of full reserve banking (which removes the financial instability, and inflation). Then the addition of the best possible democratic control of the monetary system. This might be the present control, with targets set by parliament, but I think further would be better. I think a direct regular referenda to select reserve bank targets could work.

The other thing that I think is relevant, is that the theory supporting laissez-faire economics has a significant flaw. The models used can't be in a state of a great depression, the only way an economic crisis is simulated in is as exogenous shocks. This points to the un-realism of these kinds of economic models, not to the stability of the economic system and reforms they point towards.

Well thats an entertaining fantasy at best. There is going to be bank runs with or without the Fed. The world survived just fine for centuries with out central banks, and yes the fractional reserve system needs to go to, but without gold a full reserve non - backed system is just the same weathers its run by bankers or politians. Paper money means you have to put your savings at risk in a 'bank' therefore empowering the banking system, with gold all you need is a vault, you don't need a bank unless you actually want to put your savings at risk Nic, which not everybody does... The quantity of gold available doesn't really matter - its the value it represents in real goods and services thats important anyway. You have it backwards... its the fiat system that is unstable and returns to gold as 'gold is money, everything else is just credit'. While I agree most don't get this as yet, esp in the west, in the years to come it will once again become obvious to people.

Yes the paper system is unstable because it is not aligned to the gold available, as you suggest, but that's not a real gold system, it's the paper system, but you don't get this. It really is noyt up to the people accross the street, as the market will take them there anyway. The problem in the world is not that there isn't enough money, as money is just in part a transaction medium for goods and services anyway.

Questions should be asked - and you still ignore my two questions though, but I'll add a third just for fun-;

3. Why do we need a monetary system that is subject to systematic risk in the first place? And if this risk was eliminated under a gold (and silver) system then there would be no need for central banks as we have them today anyway. Also banks could create money out of thin air and governments would be forced to live within their means... If fiat money is good and prefferred by the people, then why do we need legal tender laws? Also, if the fait money is not good and would not be preferred by the people, then why in a democracy should they be forced to accept it? This is really all the same question... Democratic control of the money supply always turns away from fiat to gold Nic... thats the point, to allow democracy to control the money supply (as you alude to) is to return to a gold standard...

A full reserve system is the gold standard.

I feel I have answered your first questions already. The IMF has good historical reasons to have rules set as it does, without leaving its purpose. The institution has a purpose, and I judge institutions on how they fulfill their purpose sometimes, not if I consider their actions 'good' or 'bad', I think you should do this also to see if it would indicate a simpler, and therefore more plausable, basis for institutional statement and action.

There will always be a need for oversight of the monetary system in my opinion, that is the reason for central banks existence. I doubt you can eliminate them, because what ever the rules are, they will need to be checked.

I didn't content that a fiat system is perfect, at all. More I want the monetary system under democratic control. Its obvious there why legal tender laws are necessary, its because the power to create money (in the form of tender) was in the hands of banks then in a similar way to what it is today.

http://en.wikipedia.org/wiki/Bank_Charter_Act_1844

As you know banks today basically do the same thing with electronic credit, that they used to do with bank notes.

If you will permit me to pose the obvious reciprical question, if gold is the only basis for money why is it not used as money? First of all you could legally carry out virtually all your commerce in gold, thats entirely legal. Then as an added bonus all the fiat inflation makes you less and less liable for tax over time. So if this is natural why isn't it common practise?

Its also apparant that a gold standard, of any kind, would be a massive subsidy for gold bugs. Because it will elevate the demand for gold quite appreciably, making existing gold holdings more valuable. Thats why gold has historically been used, because the wealthy had it, and it elevated their economic power and influence, and that is why gold money systems are plutocratic, not democratic.

Really Nic - did you state why you thought central banks are fearful and what they are fearful of? I must have missed that post...

Our fiat debt based system leaves all the wealth and power with the banks and governments, who can create more at will whenever, stealing the wealth of savers, those on fixed income and anyone else effected by inflation. All money currently enters circulation as debt, and the lender is in control. Not so with a debt free (asset backed) gold based system, which doesn't owe anything to anybody and governments and banks can't create unlimited amounts of, di-looting savings. If you think governments don't rip people off maybe you should read 'Gold Warriors' by peggy seagrave? its well researched and tells the story of how Japan ripped the wealth out of Asia and at the end of the war the US, knowingly pretended Japan to be broke to exempt it for war reparations to POWs - which gave the CIA thousands of tonnes of gold, diamonds, and all manner of wealth.

Gold - or any actual real thing actually, is not used as money because it doesn't allow the endless creation of credit that banks and governments use to rip wealth out of common peoples hands.

http://www.fame.org/pdf/buffet3.pdf

A paper money system is in effect a massive wealth transfer to banks as explained by Alan Greenspan. Do I really need to give examples of this?

Central banks know that gold is real money - thats why they hold it and return to it. With Germany and Switerland both (and many other countries will follow) now wanting to repatriate their gold the run back to sound money is just starting Nic...

Central banks are mostly sensitive to instability in their banking systems. I should not have to say that (Though I believe I did), its really obvious and they say it for themselves very frequently.

I think you have to be a bit paranoid to believe there is more to it than that, but yes this does mean saving large failed banks from their own mistakes or miss-deads. That is also one of the main reasons they were created, the most consistent simple reason is almost certainly the underlying reason.

That is what central banks are afraid of.

Alan Greenspan :Gold and Economic Freedom.

http://www.constitution.org/mon/greenspan_gold.htm

'This is the shabby secret of the welfare statists' tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists' antagonism toward the gold standard.'

Ohh, gold gold gold gold, gold gold gold gold. If Greenspan knew this in 1966 why did he push for market de-regulation? Prove that the same Alan Greenspan was the primary force responsible for de-basing the US$ during his tenure as Fed chairman and then you might start making a self consistent point about the real world.

As usual Noam Chomsky discusses this very eruditely, without over simplification,

http://www.chomsky.info/talks/20110407.htm

'Of course the IMF doesn't want to repeat the mistakes it sees with the Bretton-Woods international financial agreements when many countries central banks came under attack from gold speculators.' ???

If you call truth a 'mistake' and deceit and stealing via printing money the real objective - then I can understand why you and the IMF might think of 'speculators' as bad and evil.. yep if thats the case it would be terrible to return to a gold standard.

On the other hand one might ask why would speculators speculate on a product that has a fixed price anyway? (unless of course that fraud has really occurred and that price is artificially held down to hide it). Then 'speculation' would make sense I think. I wouldn't call it 'speculation' though, it's more like 'contractual enforcement' of a promise to pay in gold..., a promise that gets broken as one side committs fraud on a massive scale and then has the nerve to blame the other side as evil 'speculators' who are trying to rip off the system when the opposite is the truth...

From what I can see historically inflation is a net zero game.....so say in 1750 I bought a house, in 1850 it would have more or less a little been the same amount of $s. Since WW2 this has not really been the case. So historically there was periods of inflation and periods of deflation it balanced out until WW2....so by this alone we are overdue a wopping period of deflation....

I have no idea why you are in property....if we take away the aspect of your house being your home.....then say investing in multiple houses is a valid way to guard against inflation.....so yes....but I think its fooolish for anyone to consider that there is no risk of asset ie house price deflation and be prepared to jump out when that is likely.

...Loss of 100% of cash in the bank. Good, yes you see this and that its leverage. So yes that is a real risk and infact because of leverage "my" 100% loss happens long before the assets on the banks books have fallen significantly. Hence why when we see 30% losses in USA housing ppl seriously question whether US banks are really solvent....I think the answer is no. So, look at the 1930s depression....banks closed en mass....and the leverage was way less than it is today....and I suspect that the property ponzi scheme is yet another multiplier making today worse than the 1930s.

Greenspan is a libertarian/austrian/randite...OK so sure I can accept that Greenspan thinks this....it isnt how many other economists view it though. Indeed considering Greenspan is probably the most responsible one man for this present mess I wouldnt spend too much time on his opinions being terribly right, right now. Not sure on Bernankie, Ive never read seen him say it was the Fed, got a URL? I have seen him comment that it was partially the Fed's fault not to have stopped it by printing....but thats a totally different view to the Fed caused it. But happy to read up and change my mind if you have verifiable URLs.

I would contend that we will see hyper-deflation long before we see hyper-inflation....and yes its possible and indeed probable there will be inflation after severe deflation but its not written in stone it will be of the hyper kind.

Which is pretty much what ive been saying, ie going into a depresion cash and cash like things....so piles of cash in a fireproof safe when we have deflation is a valid strategy, short term govn bonds, valid....now maybe gold will do better or maybe not....usually not....but way better than multiple houses IMHO.. Now once at the bottom then yes multiple houses become valid wealth protectors and maybe enhancers....sure...

So say fair value of property is 40% of what it is today so expect a 60% loss to get back there but its usual that there will be an over-correction however....hence I think down to 75% of present value and then back up...but some ppl think as bad as 90% loss in property....at that point however the best bet is guns and lead I suspect.

So we are I think of opposing views, tahts OK there is always 2 sides to a deal....sit back....and watch.....lets see who's right.....life is about learning....

regards

http://www.wnd.com/2008/03/59405

"In short, according to Friedman and Schwartz, because of institutional changes and misguided doctrines, the banking panics of the Great Contraction were much more severe and widespread than would have normally occurred during a downturn. …"

In fact the way I read bernankie is the Fed didnt stop the problem/downturn escalating.....so its not really the Fed causing it but the Fed failing to stop it...

and Bernankie is known as Helicopter Ben because his solution is to dump money enmass.....doesnt look like his perfect solution is panning out too well...now if you follw Keynes which Bernakie is sort of then the dumping was and is 50% too small.....its like being given anti-biotics for 10 dys but taking them for only 5....and oh surprise the infection comes back....except now it needs 20 days of a different anti-biotic....if there is such a thing.....and then the govn steps in, refuses and only pays for 3 days.....

regards

Yes, the point being we have seen Friedman's solution in practise now (Friedman called for a full scale bank bailout, essentially), and it has been about as effective as Monetarism was. To my mind this makes his argument that the Fed caused the great depression incorrect, and I expect Bernanke knows this by now.

Its also worth recalling that the Feds liquidity support going to the banks doesn't hit the real economy unless its borrowed. Friedmans argument was that deficit spending was un-necessary.

http://utip.gov.utexas.edu/papers/CollapseofMonetarismdelivered.pdf

Paragraphs 25 and 26 deal with this.

Hi steven,

You are correct - under a gold standard inflation wasn't an issue. If we were on a full gold standard we never would have seen the run up we have and the misallocation and therefore wouldn't see a deflation. We are on a different monetary system now so you are not comparing apples with apples. 100% (meaning 'all') of the time all fiat systems have ended in inflation followed by deflation as people run to real money...(inflation being the loss of purchasing power of each currency unit). Greenspan knows this. Greenspan vs Bernanke vs other economists - it doesn't matter, they can't fix this problem because fiat money systems on the 'debt standard' always blow themselves up. They are unstable be design, but along the way enrich a priviledged few...

Sure I will explain further tonight, I'll even put in some links - its lunchtime and then I have work to do... oh and also I'm going out tonight but will try and add something - or maybe tomorrow night...

I think we both agree we are heading into a depression, we just disagree how we get there. But the how will determine wether you come out saving your financial butt or not, so it is important.

I am saying they will fight it by printing (actually creating more 'debt', much more) which in the end I am saying will not work, you are saying that paper money will gain in value over real assets, causing a deflationary depression (like the 1930s) if I understand what you are saying...

eco.

Im not convinced that the gold standard matters, what matters is manipulation by Pollies. Gold and silver coins were snipped in the past....debased with cheaper metal etc etc thats still inflation while on the "gold standard"...all because the system didnt and does not really work very well. So for me all systems inflate and are unstable...the more they are manipulated for short term pollie gain the faster they have issues....

"I am saying they will fight it by printing (actually creating more 'debt', much more) which in the end I am saying will not work," Oh I think we will agree on that...the difference is I think we will go into a depression so fast we wont see much of an inflationary event...hence why I think gold is not the place to be.....but certainly gold is probably way better than houses......I can but see carnage and real long term misery there...

Not sure what else we agree on, zero or minimumise debt? for me I cant see any sense on taking on debt today unless you see significant guaranteed inflation for a number of years....now if I saw that as the case then I'd consider buying a second house as an investment...but I dont see that. Now its possible that for some crazy months when this blows up that interest rates could go potty...purely because no one will lend at any rate.. Now what I could do about that being on a floating mortgage if the bank cam along and said sorry tomorrow our lenders insist on 1000% so your rate is 1002% I dont know....I cant move because all banks are in teh same boat.....then I guess a fixed rate makes sense....maybe even fixing for 6 month lumps makes sense....

"come out" the classic good use for gold is to protect all or most of your wealth through an event....not to make money on it....which is how I see things right now.....so its a specualtor game to my mind and gambling.....

"important", yes very....my distress is the large % of the ppl wont be thinking about it. I have made my bed and Im totally happy with what I have done or rather I have done the best I can. If you have looked at this disaster and made your consious but different decision then that is cool.... the ones I laugh at are the likes of big daddy....I dont hold any sympathy what so ever.

regards

Under gold as money inflation is a 'zero sum game' over time - as you say. Debasing coins by removing the gold is not technically 'inflation' - its just making a smaller gold coin (or one with less gold - which is the same thing). That doesn't rob savers who have stored their wealth in gold though, so I don't agree its the same thing steven.

Alan Greenspan (and no matter what other say about him - he is a very intelligent man), has written very clearly that the Great Depression was in fact caused by the FED feeding too much credit into the banking system. Because the FED induced the banks to create so much credit - all of which was theoretically 'payable to the bearer in gold' there wasn't enough gold in the Treasury to redeem the FED notes. So Roosevelt seized the peoples gold and erased the gold clause from all domestic contracts (he also reassured the country that their money would not be fiat). Its interesting that the gold price mirrors the Federal debt in the US, so I guess if you believe their government will balance its books then don't buy gold. No one knows who actually holds what gold as central banks are permitted to confuse the issue with gold and gold receivables on the same line in their accounts. They lease out gold to lower interest rates and principly the LIBOR rate, as I have said in previous posts. The last audit of Fort Knox was 1951 and it was only a partial audit - we know that some gold from Fort Knox has entered the market as coin melt - which was rejected as london good delivery (coins didn't have the purity required to be good delivery - the only country that had coin melt bars was the US...). There are moves to audit Fort Knox but the banking powers that be are resisting it... and it goes on and on... Eventually we will return anyway to some form of gold standard again. There is much, much to say on these matters and more....

Fiat money systems steal from the poor and give to the rich. Either we make an orderly transition to an honest system, or we will face a disorderly one later (history tends to point to the latter). Historical record shows when politians and bankers are in charge of the integrity of fiat money, they have never been able to resist the temptation to manipulate the fiat money for their own benefit. They have always driven its value to the cost of production - which is near zero. Thats inflation. The last partial audit of the FED revealed 16 trillion in interest free loans for its friends - of which the US taxpayers where on the line for... oh but thats just the beginning.... The bankers have to hold the system together at all costs - its the source of their power (and as long as people believe that a dollar today is the same as a dollar yesterday and tomorrow they will get away with it)...

If all money is debt and bears interest, it is impossible to deflate. You are a peaker Steven, so apply the equation MV=PQ to the situation and you will see that deflation isn't an option. Hyperinflation or default on debt are the options. Deflation will come after default.

Even taking peak resources out and applying debt saturation, the greater of amount of money devoted to debt repayment the lower velocity goes. So to keep everything going then Money must be printed, until it can't go that is.

I have been putting my own piece together on this over the last couple of days as for me the penny dropped when I read this. The net result is also the interest rates will stay low.

Scarfie - great link. Puts it well. I've been in the inflation camp for some time. Given that there will be a concurrent lack of availability of 'stuff', you have to pick stagflation.

Good to see the way it puts to rest the bleatings about Govt being a cost. What's the bet the Matt in Auckland/Wolly types don't change their tunes, but.

You are right about Japan, there is no significant deflation in their M3. I think this points to the economic sense of the countries economic policy in response to their crisis, and the countries ability to export probably helps as well.

Of course its possible to claim that the deflation has not been long enough to count, but I think not only can the GDP ratio of debt fall but also the total M3. The US YoY was negative for the entire of 2010, according to shadowstats at least.

http://www.shadowstats.com/charts/monetary-base-money-supply

And the same has been occuring in Ireland, also for over a year.

http://www.deflationite.com/blog/?p=212

http://www.centralbank.ie/polstats/stats/cmab/Documents/ie_table_a.3_mo…

And Greece also points to the same thing,

http://www.bankofgreece.gr/BogDocumentEn/Greek_contribution_to_euro_are…

M3 can go negative temporarily, but if it stays down then you know default is close.

I thought you might say that, but I would contend a year is long enough and all three examples were a year long at least.

Well in the case of the US the default has been in residential mortgages, but that hasn't been marked to market yet:-P

I think going off The Great Depression then three years is what it takes, but with the current means of trickery perhaps a bit longer.

But I thought you claimed that total M3 could only go up over any significant period, because of the interest payments. It seems unlikely that every bit of shrinkage in those three examples represents a personal default.

That comment was made as I rushed out the door. But I bet if you coud get your hands on the correct figures then M3 would actually be up. But don't underestimate the mortgage issue in the grand scheme of things. I have pointed out on here before the RBNZ figures that show 74% of our total overseas debt is in residential mortgages. Whay should the US be any different. Anyway I have put a longer piece together to illustrate how it works, but it is too long for the forum.

Hi steven,

Here's an interesting link about gold and in particular 'what central banks are doing'

1. Gold is the asset to be in for a deflationary depression, by the way, because banks are failing and people run to real money, not credit paper. You seem to equate a depression with deflation? But I am saying we will end up in an inflationary depression, one in which peoples savings are rapidly loosing value faster than they can replace them. I think that for many reasons, not the least of which is that governments will inflate their obligations rather than default outright on them because they need the votes. The banking system (lead by the Fed) will monetise the entire debt, just who do you think it can sell that debt to? It's trapped. The crisis with the euro has only provided a temporary break, the real elephant in the room is the US.

2. Gambling is buying 'paper gold' that doesn't exist. Or holding wealth as money in the bank when you believe a deflationary collapse is just around the corner. Yes - this is not so much about making money as saving your wealth, the making money bit will come later, when you've protected your wealth in sound money and can pick up bargins at fractions of a previous price. Those holding gold assets will be again the venture capitalists of tomorrow (just like after the 1930s great depression).

3. 'No one will lend at any rate' - well why do entities buy US treasuries - the mother of all bubbles and get basically no interest rate - or actually a negative interest rate (because they can borrow from the Fed at even less rates)... in essense enabling yet another defacto wealth transfer to the banks... The Fed can create unlimited amounts of money at no cost (and practically has - lending to Harley Davison, McDonalds, etc...just last year) to lend out...

As Max Keiser has put it - the remonetisation of gold is the solution to the GFC, it deals with both the solvency issue and the liquidity one and puts us back on an asset based monetary system rather than a debt based one. That day will come, and once again he who actually has the gold will make the rules. But the crisis isn't bad enough yet to move this debate to the forefront.

This is it... How are you going to squeeze out growth when the world faces such energy/resource constraints, let alone the worn out infrastructure and manufacturing base in the US. They can try and create wage parity with China, but they'll have to run the US into the ground to do it...

I think they will....(run the USA into the ground) but not on purpose....they have no oil left, at least enough to be self-supporting, minerals are seriously degarded/used up...and the financial morons think they can build encalves and live comfortably....you just have to look at South Africa to see how that worked out...

Why I think NZ's future is brighter than most is its low population, excess food production, good land, some raw materials left and we are too small and too far to be a target...unless we are stupid enough to ship it out.....oh wait......we are.....

regards

Subject: ALERTS TO THREATS IN 2011 EUROPE : BY JOHN CLEESE

ALERTS TO THREATS IN 2011 EUROPE : BY JOHN CLEESEThe English are feeling the pinch in relation to recent events in Syria and have therefore raised their security level from "Miffed" to "Peeved." Soon, though, security levels may be raised yet again to "Irritated" or even "A Bit Cross." The English have not been "A Bit Cross" since the blitz in 1940 when tea supplies nearly ran out. Terrorists have been re-categorized from "Tiresome" to "A Bloody Nuisance." The last time the British issued a "Bloody Nuisance" warning level was in 1588, when threatened by the Spanish Armada.

The Scots have raised their threat level from "Pissed Off" to "Let's get the Bastards." They don't have any other levels. This is the reason they have been used on the front line of the British army for the last 300 years.

The French government announced yesterday that it has raised its terror alert level from "Run" to "Hide." The only two higher levels in France are "Collaborate" and "Surrender." The rise was precipitated by a recent fire that destroyed France 's white flag factory, effectively paralyzing the country's military capability.

Italy has increased the alert level from "Shout Loudly and Excitedly" to "Elaborate Military Posturing." Two more levels remain: "Ineffective Combat Operations" and "Change Sides."

The Germans have increased their alert state from "Disdainful Arrogance" to "Dress in Uniform and Sing Marching Songs." They also have two higher levels: "Invade a Neighbor" and "Lose."

Belgians, on the other hand, are all on holiday as usual; the only threat they are worried about is NATO pulling out of Brussels .

The Spanish are all excited to see their new submarines ready to deploy. These beautifully designed subs have glass bottoms so the new Spanish navy can get a really good look at the old Spanish navy.

Australia, meanwhile, has raised its security level from "No worries" to "She'll be alright, Mate." Two more escalation levels remain: "Crikey! I think we'll need to cancel the barbie this weekend!" and "The barbie is cancelled." So far no situation has ever warranted use of the last final escalation level.

John Cleese - British writer, actor and tall person

A final thought -“ Greece is collapsing, the Iranians are getting aggressive, and Rome is in disarray. Welcome back to 430 BC”.

Chuckle. Thanks AJ. :)

Love it....

1. Except you cant grow GDP without using more fossil fuels....therefore GDP will decline and debt increase....so yes this time it is different me thinks....

regards

#6 Those graph lines especially for Italy and Spain are alarming. Is that institutional money fleeing? How far does it have to go before it becomes a full on systemic bank run.

i would have said money has mostly exited the EU its in US treasuries at pathetic interest.

regards

I Think you are right steven...I lost the link but it was a report that money is flooding out of Spain..Italy..Portugal..and France...likely also Ireland...the smuggling of euro is now huge so it would seem.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.