Here's my Top 10 links from around the Internet at 10:00 am today in association with NZ Mint.

Bernard will be back with his version tomorrow.

As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

1. Subsidy folly

“The Australian automotive industry is under severe stress.” After more than $1 billion in subsidies, ostensibly given to help manufacturers transition to being economically sustainable, it looks like the end is near for some or all local manufacturers, including Ford. The Labor government came up with the subsidy scheme under pressure from their union support base to save jobs. It looks like that huge spending has just been featherbedding an inefficient industry. It's going to end in tears, and the plug may get pulled by the Labor government itself.

Ford will be gone as a manufacturer from 2016. The AFR has the sanitised story, but the Australian Government has got a court order preventing it from publishing all the gory detail. But this gives you the idea.

2. China Tea-Leaf index

What’s really going on in China’s economy? It depends where you look. Numbers abound, but good explanations are scarce. Take the country’s Gross Domestic Product: it showed year-on-year growth of 7.6 percent in the second quarter of 2012, a whisker above the official goal. Yet vice premier Li Keqiang famously referred to GDP as “man-made” and therefore unreliable, according to a cable published by Wikileaks. Many academics and economists agree. Reuters has taken a different approach - giving you a tool where you can work it out yourself. The result suggests things currently aren’t as bad as in the depths of the crisis in 2009. But they’re not far off.

To get a different perspective, Breakingviews has picked ten alternative indicators. Some, like bank lending and residential property, measure finance and investment. Steel output, rail freight and truck sales offer a gauge of industrial activity. Others are more subjective, like the quality of Beijing’s air, the share-price performance of Kweichow Moutai, a brewer of high-end liquor, and sales of Audis, the car beloved of Chinese officials. An increase in the last three suggests growth, but maybe not the right kind.

We have crunched the numbers into an interactive “Tea Leaf” index, which allows readers to choose and combine their favoured measures.

3. Republicans will be quite different after the election

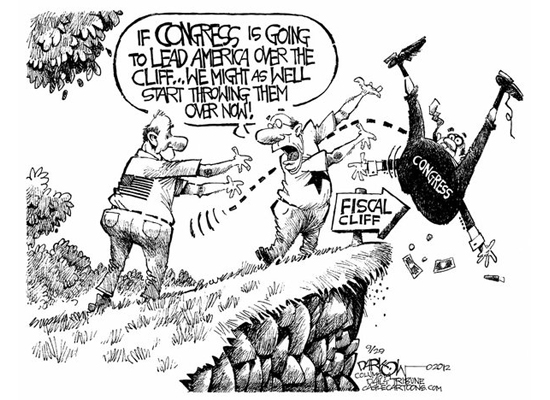

Either way. Don’t panic about the fiscal cliff says Anatole Kaletsky at Reuters. He notes that the US is on a very different path to Europe.

Given what fiscal austerity has done to Europe, the worries are understandable, but everyone should calm down. A drastic fiscal tightening is almost inconceivable after the election, because politics, economics and markets interact in Europe and America in opposite ways.

Let’s start with economic policy. The warnings from the Federal Reserve to U.S. politicians as the fiscal deadline approaches are all against allowing the legislated tax increases and spending cuts to take effect. Thus the Fed is giving politicians advice that is opposite that of the European Central Bank and the Bank of England.

Moreover, the Fed is now putting its money where its mouth is. By warning the U.S. government not to tighten fiscal policy, and simultaneously promising to buy bonds and to keep short-term interest rates at zero until the economy returns to full employment, the Fed is effectively offering to finance whatever deficit the U.S. government chooses to run at almost no cost.

In terms of economic philosophy, the Fed is now a clearly Keynesian institution. Bernanke sees unacceptable levels of unemployment and attributes them to an excess of saving over investment by the private sector. He therefore wants the government to keep borrowing until the private sector returns to normal levels of investment and spending – and promises to finance this borrowing with printed money. This policy is anathema in Europe, especially in Germany – so much so that EU treaties explicitly make “monetary financing of government” illegal.

4. Broken or just being tested?

Neuroscientists say they know how people compute value. Why won’t economists listen? Pompous gits or worthy contenders? Josh Fischman has been looking at the marketplace in your brain.

Neuroeconomics came into being around the turn of this century, growing out of a critique of the basic idea in economics that people are driven by rational attempts to maximize their own happiness. A new breed of behavioral economists had noted that in reality, individual definitions of "maximize" and "happiness" seemed to vary. Neuroeconomists added the idea that, by mapping parts of the brain doing the maximizing and the happiness-defining, they could better account for those actions.

Through experiments, researchers have shown that when people reject a low, unfairly priced offer, a part of the brain associated with disgust kicks in, but that when they view the offer as fair, a brain region linked to reasoning seems more active. Researchers have also tackled the puzzle of "overbidding," when people pay too much for something. An area called the striatum, associated with rewards, is more active when people bid high in an auction because they fear losing an item, but is not as active when they think they have a good chance of winning. So fear of losing may be key to things like overvalued stocks.

5. Greener on this side?

The housing market in Australia is decidedly dodgy, according to ANZ, and reported in the Sydney Morning Herald.

Home hunters are faced with purchasing in a market where prices have softened for the past two years and sellers are questioning whether it is the right time to put a hoarding out in front of the family residence.

A swag of reports released this week suggest Australia's residential property market is still vulnerable to global economic conditions and wary, downbeat consumers.

Buyer interest remains soft, sales activity is at historically low levels and the stock of unsold homes at near-record highs, the ANZ's Australian Property Outlook says.

High-profile business failures, insolvencies and job cuts have heightened concerns over job security in many areas, prompting households to focus on paying off debt, it says.

6. What can't they do?

Physicians and environmentalists alike could soon be using a new class of electronic devices: small, robust and high performance, yet also biocompatible and capable of dissolving completely in water - or in bodily fluids. Researchers in the US have demonstrated a new type of biodegradable electronics technology that could introduce new design paradigms for medical implants, environmental monitors and consumer devices - and spy devices.

"We refer to this type of technology as transient electronics," said the Professor who led the research team. "From the earliest days of the electronics industry, a key design goal has been to build devices that last forever - with completely stable performance. But if you think about the opposite possibility - devices that are engineered to physically disappear in a controlled and programmed manner - then other, completely different kinds of application opportunities open up."

7. Under our noses

Competing teams of scientists in Sydney have given Australia a significant lead in an increasingly intense international competition to build a working quantum computer. In an article that appeared on Thursday in the journal Nature, a team of Australian and British scientists, led from the University of New South Wales, reported that they had successfully constructed one of the basic building blocks of modern quantum computing by relying on manufacturing techniques now used by the modern semiconductor industry.

The team led by Dr. Dzurak uses conventional semiconductor techniques to implant a phosphorus atom just 10 to 15 nanometers below the surface of a silicon chip. That approach has the twin advantages of using industry standards and potentially extending the individual electron’s duration in a quantum state.

8. If you are a farmer ...

We have launched a new service for the rural community - New Zealand's first web app enabling you to get the latest prices from processor's schedules and saleyard results, nationwide. And its free. On any smartphone, just go to www.interest.co.nz/livestock It has the exact same data that we display on the Rural web pages of this site, only you can get at it when you are in the field.

9. Ten Labor Party rules

Lindsay Tanner is a politician from the left of the Australian Labor Party. Clearly he is an honest man. He has just published a book, Politics with Purpose, and in it he lists his ten 'laws'. They are:

1. Everyone in politics exaggerates everything all of the time.

2. No one ever complained about (lack of) consultation when they liked the outcome.

3. The further from responsibility you are, the more left wing you become.

4. When lobbyists think they have public opinion on their side, they talk about democracy; when they don't, they talk about leadership.

5. All editors, shock jocks and journalists are incredibly intelligent, witty and good-looking, and should be reminded of this fact regularly.

6. When you're a politician, you run into every person you've ever met in your entire life.

7. People who answer "yes" in opinion polls asking if they would be prepared to pay higher taxes for better government services are actually answering a different question. That is, should someone else pay more tax so I can get better services?

8. There are no options allowed in politics, only announcements. The media treats a politician's speculation about a possible policy approach as a commitment.

9. The most important thing for a politician is to look like you're doing something.

10. It is vital not to offend anyone who matters.

10. 'Release the hounds, Smithers!'

Really, thats what they actually said - well close enough. The British tax boss retired recently, and his retirement function was crashed by some activists who videoed their work. HT Plan B. (Yeah, I know. Bernard led with it one day last week. But it is too good not to repeat, for those who missed it.)

and another repeat, worth repeating ...

8 Comments

1. Classic robbing Peter to pay Paul...so instaed of starting the transition to some other work/sector its been propped up.....

It cant continue.

regards

No 1 - Subsidy folly of 1 Billion - Nice tab for the taxpayers in Australia to pick up !

No 4 - Well.... we should put this technology to good use and all those wannabe Politicians should have to undergo these neuro-science tests before standing for election.

We could go further and test all the bureaucrats as well !

George Soros has been on about human behaviour and economics for years - looks like his theory can be proven.

No 9.5 - Bernard and team have I told you lately how good-looking, incredibly intelligent and witty you all are.

No 9.8 - Well an example of this would be Hekia Parata's Education issue !

No 4 "Through experiments, researchers have shown that when people reject a low, unfairly priced offer, a part of the brain associated with disgust kicks in" - Yep my brain disgust mechanism kicks in everytime I hear COMPLIANCE - I know it's low, unfair and it's priced to cost me.

The global car industry is a very strange beast, Most countries one way or another have ways of governments paying for the privilage. So Australia pays a bit. It is very hard to know how competive or not the Oz car industry is because it is almost impossible to find out what is really going on. One thing that strikes me is that Japan must have the closest thing to what a real competitive car industry might look like- but they have wierd rules to keep the car market moving. They do have 7-8 domestic manufacturers still in Business which must be a modern record.

"...Japan must have the closest thing to what a real competitive car industry might look like"

I don't think so. I worked in a car factory in Japan after leaving school and they had Indonesians working for substandard pay, Brazilians for below-average, then Japanese on normal rates. I know we weren't on the books (but then we were doing 50hr weeks on 25hr visas) so how much of it is lax labour laws or just illegial I don't know, but it isn't real competition.

Chinese solar panel makers in a bad way.

http://peakoil.com/alternative-energy/china-bails-out-worlds-largest-ma…

10 - > we need heaps more of this sort of thing going on everywhere. This is what democracy looks like.

A winter of discontent?.. no...more like two or three decades of misery. Remind me...who was it came up with the idea to have the euro!

"The eurozone unemployment rate was 11.4pc in August, up from 10.2pc last year. Data from the EU statistics agency Eurostat estimated that 25.5m men and women were out of work over the period, 18.2m of whom were in the eurozone.

Compared with the previous month the number of unemployed people in the EU rose by 49,000 and in the eurozone by 34,000.

The overall unemployment rate in Spain has reached 25.1pc, while the latest data from Greece for June shows a figure of 24.4pc. The outlook is far more optimistic in Germany, however, where just 5.5pc of people are out of work."

http://www.telegraph.co.uk/finance/economics/9578762/Eurozone-unemployment-hits-record-high-and-reveals-two-speed-Europe.html

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.