Here's my Top 10 links from around the Internet at 11.30 am today in association with NZ Mint.

As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must watch article today is #4 on 'how the eurozone is a cage for masochists.' My must watch video is #5 on the skateboarders of Ordos.

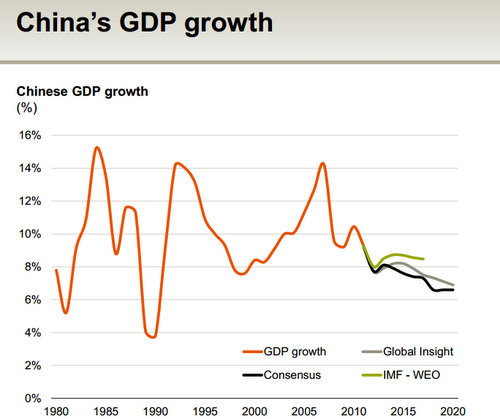

1. Watch what BHP says - BHP CEO Marius Kloppers gave a major speech yesterday on the outlook for China's growth and its demand for commodities.

He pointed out China's demand for steel (and the iron ore and coking coal used to produce it) would moderate as China's economy matured from one based on investment to one based on consumption. Could be good news for us as China switches from concrete to cheese.

The full speech is well worth a read because it shows the last decade of growth in China was exceptional (ie won't be repeated)

We (meaning Australia and New Zealand) can't rely on the same thing again to dig us out of the hole.

We will have to find other sources for growth.

Or get ready for the inevitable slowdown and asset price declines we missed out on in the last four or five years.

In the 10 years or so that have passed since China first came to the fore as a commodities demand force, two things have happened: First, steel intensity per unit of GDP in China surged as early stage infrastructure and construction was required. This has now peaked, and we expect it to progressively decline as we have seen in historical examples. Put simply, this is a lead indicator of the progression of the Chinese economy toward maturity. However, we will continue to see per capita consumption of steel growing, albeit at a slower rate, as steel intensity of GDP declines.

And secondly, as the industry matured it has progressively improved its ability to supply the volumes to meet demand. As a result, the ‘supply shortage’ has largely been filled, or is well advanced in being fulfilled. Therefore, what we are now witnessing is the rebalancing of supply and demand and a progressive recalibration of prices back to long term sustainable pricing levels. In effect, what this means is that the record prices we experienced over the past decade, driven by the ‘demand shock’, will not be there to support returns over the next 10 years.

What we can instead expect is demand growth at more predictable and sustainable levels and more moderated pricing. This ‘mean reversion’ in prices and returns is something we at BHP Billiton have anticipated for some time.

2. Hadn't thought of this angle - There's been a growing frustration and a dawning realisation that China either can't or won't fire up its economy again in the same way it did after the Lehman crisis in late 2008 and early 2009.

Here Bloomberg points out China doesn't need to when it looks at the growth in its labour force, which is slowing as its population begins to age and the effects of the one-child policy take hold.

The ruling Communist Party hasn’t rolled out a stronger monetary and fiscal policy response as officials watch for signs that the economy is stabilizing. While the government has this year described the labor market as “grim,” pressure for job creation is lessening as the one- child policy introduced in 1979 caps new entrants to the workforce.

As recently as 2010, Premier Wen Jiabao said that an 8 percent expansion was necessary for “basic stability of employment,” and anything lower will create “problems,” according to the party’s Qiushi magazine.

“With China’s shifting demographics, that benchmark should shift as well,” said Louis Kuijs, chief China economist for Royal Bank of Scotland Plc in Hong Kong, who previously worked for the World Bank in Beijing. Labor market resilience “reduces the perceived urgency of a major policy response,” he said.

The working-age population is growing at 0.5 percent a year now, one-third the pace of 10 years ago, Kuijs estimates. That means the benchmark growth rate may be 7 percent, he said.

3. 'A lasting depression for Europe' - The Telegraph reports George Soros has called on Germany to act urgently to stop Europe from falling into a lasting Depression.

He even suggests Germany should leave if it doesn't want to put up its dosh.

"There is a real danger of the euro destroying the European Union. The way to escape it is for Germany to accept ... greater commitment to helping not only its interests but the interests of the debtor countries, and playing the role of the benevolent hegemon," he said at a luncheon hosted by the National Association for Business Economics

Germany should act as the leader of the union such as the United States was for the free world after the Second World War, Mr Soros said.

The influential fund manager floated another solution to the crisis that has gone on for more than two years: Germany could leave the euro, "and the problem would disappear in thin air," as the value of the euro declines and yields on the bonds of debtor countries adjust.

I wish John Key would read Mr Wolf's fine prose.

It is no secret why growth is slowing in high-income countries: this is due to fiscal tightening, weak financial systems and powerful uncertainty. This toxic combination is particularly threatening inside the eurozone, where, again no surprise, countries reliant on exports are affected by the shrinking economies of big trading partners. As the latest Global Financial Stability Report shows, cumulative capital flight from peripheral eurozone economies is more than 10 per cent of gross domestic product.

Indeed, without support, principally from the European Central Bank, peripheral economies would have had to impose exchange controls. They might even have left the eurozone. The fear of break-up remains pervasive: it is always hard to make masochism a credible strategy.

5. Ordos is back - Remember the ghost city in China where buildings were built but no-one came?

HT to Leith van Onselen at Macrobusiness.com.au for pointing me to this latest skating video set in Ordos.

While the skating is worth watching in itself, the bigger takeaway is that Ordos – a shiny city built to house one million residents – remains almost completely empty three years after Aljazeera’s first ground-breaking report.

These kind of malinvestments – projects that cost billions of dollars but provide next to no economic return – have the potential to become a millstone for China’s banks and economy going forward, subtracting from its growth potential.

With the real estate market accounting for around 10% of China’s GDP growth, and affecting many related industries, there also remains the concern that construction and sales could grind to a halt, crimping local government land sale receipts and dragging China into a sharp recession.

6. And now the price - Ambrose Evans Pritchard reports at The Telegraph about the price the Germans are demanding for Greece's latest bailout and the triggering of the Big Bazooka.

Tonight's summit of Eurozone leaders could be entertaining in a bad way.

There must be an EU “currency commissioner” with sweeping powers to strike down national budgets; a “large step towards fiscal union”; and yet another EU treaty.

Finance minister Wolfgang Schaeuble dropped his bombshell in talks with German journalists on a flight from Asia, and apparently had the blessing of Angela Merkel, the chancellor. “When I put forward such proposals, you can take it as a given that the chancellor agrees,” he said.

Officials in Brussels reacted with horror. “If that is the demand, they are not going to get it. Nobody in the Council wants a new treaty right now,” said one EU diplomat. “We’ve got the fiscal compact and quite enough fiscal discipline. Not even the Dutch want a commissioner telling them how to tax and spend,” he said.

The new demands risk another stormy summit in Brussels on Thursday, pitting Germany against the Latin bloc. The last summit in June ended with an acrimonious deal in the small hours on a banking union that began to unravel within days.

7. Would Romney call off Quantitative Easing? - Now the US Presidential election race is tightening up people are starting to to wonder what a President Romney would do to economic policy.

Former White House economist Bruce Bartlett looks at the possibility that the Fed's QE Infinity would be called off. Oy Vey. Romney has already said he would not reappoint Bernanke late next year.

That would unnerve markets, to say the least...

At a minimum, it is doubtful that the Fed will continue to maintain its present policy of being highly accommodative. A key element of this policy has been the Fed’s “forward guidance” that it will continue being accommodative at least through 2015 – well past the point when Mr Romney will have had the opportunity to appoint a new Fed chairman and one or more new members of the board. (It is highly unlikely that Mr Bernanke would continue to serve on the board if he is not reappointed chairman.)

At a minimum, the ability of the Fed to credibly make promises about future policy is threatened by potential changes in party control of the White House and the wide divergence in the monetary views of the two parties. If policy is quickly reversed, it will call into question the ability of the Fed to use forward guidance as a policy tool again in the future.

8. This is a bit off the beaten track - FT.com's Simon Kuper has written a lovely, wistful ode to forty-something men, which struck a few nerves for me. HT @samfromwgtn

Frantic busyness has its upsides. Nowhere in my peer group have I witnessed a textbook midlife crisis. Nobody has the time. Anyway, my “Generation X” was never much given to fantasy. Our teenage soundtrack featured gloom merchants like The Smiths, we came of political age after all utopias had collapsed, and then graduated into recession. The dream among my peers isn’t a Ferrari and a 22-year-old model.

Rather, the dream now is of a cafè latte alone: a small victory in the struggle to preserve fragments of what Orwell called “ownlife” amid the onslaught of mortgage, toddlers, in-laws and physical decline.

36 Comments

hedge fund soros must think that there is a dollar to be made with his suggestions or else why would he make them.

it wouldn't be to help his fellow citizen that is for sure.

You've said you are not interested in spending a dollar on anyone.

So you wouldnt have a problem with anyone else being mean spirited would you?

Anything by Waits, Cohen, Dylan is worth seeing - they felt the malaise in the early 90's, turned it into art, and tried to warn us all. That's one of Kurt Vonnegut's notions of the purpose of artists - canaries in coal mines.

Try Waits' 'Black Rider', Cohen's 'The Future', or Dylan's 'World Gone Wrong' - all riffing on the same bad smell.

Swamp Gas....

Waymad

Cheers. I'll try to include these guys more regularly in Top 10.

Need all the light relief we can get

cheers

Bernard

I listed Vongut's quote of the week on Monday Bernard.....didn't raise an eyebrow..

it was....We are on here Earth here to fart around, and don't let anybody tell you any different.

Waymad aside from the good old reliable mainstays the late eighties, nineties produced some stunning social conscience writers...

Marshall Mathers...Kurt Cobain..Bad religion....System of a down ...sublime commentary.

Funny enough , I always thought M and M's intro to Lose Yourself would be a fabulous theme loop for Bernards Top Ten.

Give it a listen...!

So somebody gets real close to bombing the Fed and he can't even make the Top Ten...?...I'm getting out of terrorism, just no exposure in it anymore......anybody want a slightly used Camel...?

How much for your camel?

Hadn't though on price yet Tony.....as long as I can recover the cost of the case of Luscious Lashes from Maybeline we should be able to work something out.

She's got some issues though, like you can't approach her from behind n stuff.

Ordos looks like a skaters paradise!! Some cool architecture too.

Maybe it was a case of "if you build it they will come".

Hugh, it sounds like solutions to Auckland's housing affordability issues will be postponed at least another 3-4 years given Alex's article

Hugh - this little riposte should have been on the Press site seven hours ago, but it's probably sitting on some Moderatorizers inbox because it has no sound bites...and the reference to Birds of Prey may not've hepled either.

For your delectation:

Bob Jones noted this, oh, about 12 months ago. His view then (IIRC) was that the cost of acquisition of land, remediation once bought, new Building codes and layers of expensive Greenwash, would fairly much rule out the CBD from ordinary commerce because of the floor rental rates that would have to be sought to cover all of this

Which has indeed started to come to pass: the first tenants of the new CBD will be Government (Justice, Health, etc) and their private sector appendages (legal eagles and other Birds of Prey).

So the apparent lack of provision for affordable housing is not exactly unforeseeable, given That prediction.

And the unaffordability of housing in greater Christchurch is the wider point. The median multiple (house prices divided by household income) is a Severely Unaffordable 6 point something (a reasonable MM is around 3). See Demographia for the background to all this.

And the reasons for this unafforbability are many, mixed, and terribly hard to fix: a sampling -

- land zoning and urban limits which restrict Supply of land, hence prices rise.

- Council levies on development which can add around $70K per section

- Land banking by owners who anticipate large capital gains thereby

- Licensing of builders, OSH requirements about Elfin Safety (Brent Merrick - Stonewood - estimated this years' crop of regulatory impost from OSH alone at $3K per house), and that's on top of Fencing, Scaffolding, Certification of every electrical tool, and a host of small but in aggregate onerous costs, paid for by Guess Who.

- cheap credit availability from banks, with no Loan-To-Value mandates, thus throwing petrol on the house-price fire

The net result is that the lowest rungs on the housing ladder have been chopped away.

Still, what cannot go on, won't.

I regard it as a basic human right to build your own shelter. At some point, all of the craziness around Housing is gonna get ignored or thrown in the trash-can of History, and we will have ourselves a self-directed Rebuild.

Hey, I can Hope!

Hugh

I'm 99% sure the outcome will be that the Auckland Unitary Plan will be "fast tracked" - 3 to 4 years rather than say the truly silly 8-10 years+ that District Plans often take to become operative. Of course, that 'fast tracking' is still far too slow.

If this happens we have the scenario where Govt promised solutions to Auckland housing in 2008, but they might not be operative until 2017 - nearly 10 years

As you say, if this is the outcome then NZ might as well become a rest home.

Hugh I have no faith whatsover in English and this govt - if you do then I applaud you.

Sadly, yes.

I suspect that the bubble will inflate and inflate, until it bursts, then NZ will be truly in shit creek.

It seems like our esteemed "leaders" have paid no attention to the devastation that has followed the bursting of multitudes of housing bubbles across the world these past few years.

I will find no satisfaction in looking back and saying "told you so"

Come on Hughey, it gets tedious.

No matter what they do, your precious multiple thingys are not going to come back.

They know this; why do you think they have to divvy up the energy co's? No longer the ability to increase - or even maintain - total incomes, is why. So they are backing a small clique at the expense of the majority, in a zero-sum game.

"It was the quickest pace of groundbreaking since July 2008, though data on starts is volatile and subject to substantial revisions."

8><-----

"Housing remains hampered by a glut of unsold homes, and the housing starts rate is still about 60 percent below its January 2006 peak...."

Lets not count chicken before they are hatched...there is a lot of contradictory things in there, the Q is why(s).

One interesting thing,

"pushed interest rates on 30-year mortgages to all-time lows. Last week, fixed 30-year mortgage rates rose 1 basis point to average 3.57 percent"

wow what a rate....now if I could get that at say 10 years....maybe even 8...

regards

Hugh, about $60K. pdk should be congratulated for his export business.

http://www.clickorlando.com/news/Disaster-shelter-offers-full-kitchen-f…

Hugh, actually you are the Luddite because you askew maths, engineering, geology and physics, the basis for tools, engines and automation.

A malthusian is merely someone who understands basic maths, ie you cannot infinitly divide the finite, even my eldest has long understood that and he hasnt finished school yet. I assume you failed in school, clearly you do not get it, or want to.

regards

Not looking good.

http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=10840853

Hey Bernard , just for a bit of a lark , could you overlay that chart of China's GDP growth with that of New Zealand's ? ........

.... or should I say , " underlay it " ......

Whose country is it that's seriously been going nowhere !

yeah...GBH...but is Bernard a ..bit of a lark kinda guy...? or is he the guy that stops scruntching the popcorn during Cardasian love scenes for fear of offence.

We are becalmed GBH, but our great sail will soon be unfurled revealing it's Logo

N.Z. Assets.

And whooosh! we'll be cranking , you'll see, look back at that helm and tell me you don't see a voyage hardened skipper in John Boy...

Actually, it's just possible Bernard understands what 'Off a Low Base' means, and has some journlistic standards - obligations to truth, stuff like that.

When you start from a pasant economy, you have just a little more room to move. Odd, that.

That was either a foolish suggestion, or a disingenuous one. I think the question has to be, Christov, who is backing the prolonged attack, and why?

Usiually those type of comments come from either vested-interest folk who see themselves as 'winners', or those losers who would like to think they'll be 'winners' sometime.....

I know which I think this one is..... :)

Well said...

regards

Aw jeez Stevo ...a bit a fun is all....you a funny guy sometimes too..!!

hehehe.

regards

I believe a good dose of Valium could assist steven and PDK at this point

Prolonged attack...? ease up there PDK....just funnin wit the guy, his integrity largely goes unquestioned .......by me anyways... We love you Bernard and don't let anybody tell you any different..!!!

The one thing GBH has with Bernard is a relationship, or history if you like...in person........so I 'd be guessing Bernard knows a wind up when he sees one.....or maybe I don't.

Vested interests...? yes everybody got some kind in something or other, trying to get the monkey off the back or downsize the monkey at least...

Winners Losers....?dunno.....winning can be sooooo fleeting..ask Charlie Sheen...you can be losing while your winning...ya just don't know it yet is all.

Don't much care for the term losers.....but you'd expect that from not having enjoyed the experience........I'd always prefer to have lost than be a DNF....

how's that invention coming along anyways....?

I work on occams razor myself....simplest explanation wins, and GBH is very simple, we know that.

;]

I do find it interesting on the amount of and degree of shoot the messenger that seems to go on. That for me is dismal, if you cant argue your point(s) on a sound basis and using good logic, well lets discredit the oposition....

Kind of worried that this really is stopping the corrections that have to take place and will make them bigger and more painful. However reading on all past civilisations decline it seems this has always been the case.

Pity that after 10,000 odd years we are no better.....even with so much excess energy to allow us the freedom to look and think, it will never be repeated I think......not for a few hundred million years anyway.

Just think, say 500 million years from now something could be staring at our fossilised remains and wondering why we went extinct...

regards

well lets discredit the oposition....

Kind of worried that this really is stopping the corrections that have to take place and will make them bigger and more painful.

Stevo....inadvertenly you have confirmed PDK's suspicion...that was a mouthful of exposure to a desire you hold......I'm completely ok with the basis of any number of your arguments....I just know whether it be simple math or Quantum physics...the Human condition will always become the contradiction to the rule.

I'll never leave this place wondering why we became extinct...it's in our DNA.... the tide will still come in and go out... the Sun , up and down...kinda comforting to know.

".kinda comforting to know."

indeed....

regards

re #1 Kloppers CEO BHP

Is he saying it because he believes it?

Or is he saying it to convince the Oz govt that mining should have a favourable tax regime, as the good times are about to end at any moment?

It's not that I don't distrust these captains of industry or any words of wisdom they might share with us, of course...

"Nobody really knows what will work to get the economy back on course. And nobody-in fact, no central bank anywhere on the planet-has the experience of successfully navigating a return home from the place in which we now find ourselves. No central bank-not, at least, the Federal Reserve-has ever been on this cruise before."

http://www.marketoracle.co.uk/Article37076.html

Where to start on this....

1) We cannot ever get back on the course of expotential and infinite growth.

2) No one, yes but we have a lesser example of teh 1930s Great Depression. However as keynes said we will get out of this we have the resources.....see 1 for the big issue this time.

3) One wonders where the "brilliant" "market forces" are in this....uh no where.....to busy fiddling like Rome burns.

regards

Don't have to look too far ... market forces have provided this forum for you to write endlessly, ..... saves quite a few forests I suspect.

HEHEHE...."Rather, the dream now is of a cafè latte alone: a small victory in the struggle to preserve fragments of what Orwell called “ownlife” amid the onslaught of mortgage, toddlers, in-laws and physical decline."

Generation Jones has already or is there (as I sit here with my second latte my crazy rabbit for company, yes he's a cafine head as well)....except toddlers are now becoming teenagers and even more pain, and physical decline, well arthritis is well set in. The good news is god awful in-laws have either learned to get along a bit better or keep well clear of each other...

regards

#6, really I dont think they (the Germans) get it....if they really think Greece etc will spend 20 or 30 years is poverty so Germans can continue on as normal they are day dreaming.

regards

#5 and #10

Top vids and what a line...

"Hallelujah! We've found the one honest man in America. And hes' a Donkey #%$#$#"

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.