By Bernard Hickey

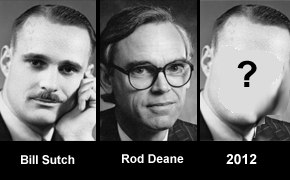

Where is the next Bill Sutch or Rod Deane hiding?

Maybe I've missed them and they're there in the background beavering away pushing for change, but I can't see them yet and New Zealand needs them to step up and start making a noise.

New Zealand has a great history of intellectuals and thinkers who roll up their sleeves and get involved in the messy and hard business of mashing those ideas into policy.

These bureaucrat/thinkers act like the halfback of the government's rugby team, driving the forwards of the bureaucracy around the paddock before spreading it wide for the glory boys (and girls) of politics in the backs to score the tries and win the votes of the public.

New Zealand has had two of these great great 'halfbacks' of public life in the last century.

Both were economists who played crucial roles in public life from somewhat behind the scenes at times of great and necessary change.

Bill Sutch began his life as a policy maker as an adviser to the then centre-right Minister of Finance Gordon Coates in 1933. He carried on in that office when Labour won the election and Walter Nash became Finance Minister.

Sutch generated much of the intellectual grunt for the great reforms of the 1930s that helped pull New Zealand out of the great depression and redevelop its economy and social system.

He went on to serve as as the Secretary for Industries and Commerce in 1958.

He was later wrongly accused of being a Russian spy and acquitted.

In the late 1970s and 1980s fellow economist Rod Deane played a similar role in first challenging the leaders of the time and then reshaping the nation when new leaders came in.

As first Chief Economist and Deputy Governor of the Reserve Bank in the early 1980s, Deane clashed with then Prime Minister Robert Muldoon over the country's economic direction.

He was at the vanguard of a generation of policy advisers and bureaucrats who radically reshaped New Zealand from 1984 onwards, liberalising and deregulating government and the economy.

Deane went on to become the State Services Commissioner that worked with then Finance Minister Roger Douglas to drive those reforms. It's unlikely he'll be accused of being a Soviet spy.

Both Sutch and Deane were part of the great world-wide intellectual movements of their time that were spawned by economic crisis - Sutch in the 1930s and Deane in the 1970s.

Fast forward another 40 years to the next great crisis. I look around the world and see a massive debate in Europe and the United States and Asia about how to respond and reform after the Global Financial Crisis.

Assumptions about banking, monetary policy, government spending, social policy, the environment and corporate structures are all being challenged.

Yet in New Zealand public life and inside the bowels of the Reserve Bank and Treasury I can't see the next Bill Sutch or Rod Deane.

Maybe I'm not looking hard enough or they aren't there yet, but I can't see the same intellectual energy and creativity in policy circles here that I see in Britain or America.

New Treasury Secretary Gabriel Makhlouf gave an interesting speech on November 1 about how Treasury wanted to be a hothouse for ideas and analysis, and how it was focused on improving living standards, not just the hard, dry targets of economic growth.

His speech was welcome, but I've yet to see the next Bill Sutch or Rod Deane.

---------------------------------------------------------------------

This piece was first published in the Herald on Sunday. It is used here with permission.

35 Comments

Good article, Bernard.

Yes, we need people with reasonable, rational, evidence-based ideas to deal with issues such as those set out in this article, an issue which affects us here also:

http://www.spiegel.de/international/business/playing-poker-with-trillio…

The more I think on it, the less happy I am with the laissez-faire 'leadership' as we have in NZ. The libertarians will disagree, of course, and go on about 'big government', the 'nanny state' and other catchphrases, but surely there is a middle way, which does not involve blowing the budget on social welfare in all its many forms, but does not also leave us open to the vagaries and herd behaviour of the market and currency fluctuation. As contributors to various other articles have been saying in the last few days, we also need a reasonable and calm discussion on what we want for NZ Inc. in the longer term -- immigration rates, national direction, industrial specialisations, export focus, retirement saving, city planning, population limits, ecological and sustainable policies, educational quality, defence, etc. These are all critical for quality of life of future generations.

In times of uncertainty, people look to leadership. You have to be careful what you wish for (e.g. Hitler, Mao in the later years), but hopefully in NZ we can find a middle way.

All the best to everyone,

JetLiner

Simple answer is they have moved overseas to maximise their personal potential properity and making great contributions elsewhere.

The fundamental problem with NZ is we are not patriotic. The minute NZer see potential more personal gain overseas we uproot and move there, particularly the smarter ones. Now you are wandering where are these young intellectuals.

Rod Deane's and older generations have made great contributions to becauses they choose to stick around and contribute. Generation Y are only self-centred and choose to maximise their personal gain. Blatant examples are these self-centred Gen Y who moan about having to pay for earlier generation superannuation - yet they forgot the fact that when they were born they inherited massive infrastructure already built by earlier generation. Yes, those generation who sticked around and contributed rather than like the Gen Y who buggering off to maximise their personal gain elsewhere.

People capabilities and intelligences do improve as human progress, so the lack of committed young intellectuals in the current generation in NZ is not the lack of capability, but rather it is the lack of will, characters and willingness to put the country interest before their own and sticking around to be counted upon.

Complete load of rot. The younger generation are wiser to leave. They have been completely dominated by the generation ahead.

The current under 25 generation will not be better off than their parents (one of the first generations that could be said in NZ). The simple reality is that very very few of these younger people have any real chance of making it here in NZ (I know that there are exceptions - but by in large as an ordinary kiwi they are going to be screwed).

For example - power generation, what has the been done in the last 25 years? Growth businesses? Property and infrastructure?

Another example is the massive government debt that has been accumulated over the last 35 years (how many surpluses have been run in this time?). The Cullen fund (you know when helen was running the place - we over spent 2011 more than the accumulated value of this fund).

Another example - older generation taking the super and still holding their job (holds promotion and job opportunities for the youth - bottom of the ladder).

Another example - student loans previous generations never had mortgages taken out on living costs (food and rent) whilst they studied). Don't argue personal benefit of education because we all know that only a small % of qualifications have any material/practical skills.

Another example - older generation freeing up finance (youth saddled with debt on crap like cars and electronics). Should never have been allowed. I know that freedom of choice - but we all know that there are sharks out there that feed on these younger people.

Feel for the younger generation - give them the same opportunities that you had. Remember that these people need to have children they need to have stability of homes. They need to be a part of community of kiwis. Aussie provides this better than NZ.

Another example. Greedy baby boomers buying more property than they will ever need to live off and thereby pushing up house prices so much the generations following them have to resort to borrowing silly levels of loans and in many cases getting assistance from parents to buy their first home. No wonder so many are going to Australia to get ahead and buy the home they could never buy in NZ.

...I'll gve you another. The over 65 years olds who refuse to retire and are holding onto their jobs whilst collecting National Super. No kids, no student loan, not mortgage...both working and both collectiong NS. Four incomes and beggar all outgoings. No wonder the youth are leaving..

I think your reply is simplistic and misses some important points,

1) Often youth lack the 40 or 50 years experience in doing a job....even 20 years makes a huge difference...Very few 20 year old can do my job....even 30 year olds. For instance if they are brighter than I am to make up for their lack of experience then they are likely to be few and command a far better salary than this job offers.

2) Many pensioners still work because their OAP isnt enough to live on.

3) Many OPAs still work because of the intelectual challenge.

So I look to my retirement and given the terrible economic outlook I expect at least 1 if not all three of my ex-pension schemes to never pay out. Certainly I will be gob smacked on one, it lost 22% in one year of 30 years savings in 2008 and we have not seen the big drop yet.

The youth leaving, well I suggest we ask them why...the bright lights, better pay...OE experience etc....many such things are simply not available in NZ.

regards

Steven, you must acknowledge that if the CEO holds onto their job then the vice misses out on a promotion, then the head misses out on his promotion, then the middle manager misses out, then the joe average misses out and of course the young guy just out of uni with a massive student loan can't get a job. Works at McDonalds for six months then thinks screw this I'll move to Aussie.

The 30%+ of unemployed under 25's sympathise greatly with your portfolio dropping in 2008. Probably was a property heavy portfolio which has rebounded by the fact that the same younger generation is taking on 8 x average wage size mortgage.

Sorry for the tone of this - but lots of my family are giving up on NZ. I really think that this is a massive shame that this country doesn't work for kiwi's.

I dont think you are thinking this through enough personally, or at least taking only 1 perspective.

This assumes that the replacement can do the job, as I said. Many middle managers will never be or can be CEOs. Also the workforce will be shrinking...so for some posts yes this could be true......but say there are 10 jobs of mine...allowing for me being an almost BB....then those 10 jobs whn left vacant by retireming BBS may ponly see 8 filled....so really some BBs can stay.

It also asumes that I will have an adequate pension, I wont so Im pretty certain I will be working part time, or I'll starve or lose my house. So sorry younger ppls IM not making way for you unless you make my pension high enough that I can.

My portfolio as you call it isnt up to much. And there you go jumping in assuming property. Funny that but Im one of the ppl in here who is highly anti-ponzi-scheme that is property right now. I expect a 60% drop in property, but then I expect a Greater Depression worse than the 19030s, hence Ive sold to cash what little shares etc I had.

How is the youth's training portfolio? If they are sitting on their butts expecting to be handed a well paying job? well they are going to have flat butts. Also I tend to find employers like to employ youth as they are cheaper....so its not all a one way street.

BTW, 30% un-employed youth in NZ? that surprises me....

NB Same problem in Aussie.

Family moving, sure the grass is always greener....I left the UK for NZ because literally I wanted more green....you can make choices....

regards

We are both bears - I agree that we have some bad (greater depression) days ahead of us. But NZ is trying to exist in wonderland. The real pain will be suffered by the youth (workers) simply put BB will be less and less able in the workforce the tax burden will fall on the younger generation.

The older generation grew up with great advantages (free education + medical + a job for life + fair priced houses + the list goes on). The reality is that the property 'game' is rigged against the younger generation - they have to take on crippling levels of debt (and you and I can see big drops in value).

When you type " IM not making way for you unless you make my pension high enough that I can [live adequately]" you are making very challenging statements. I know of many very very wealthy people who have great incomes and subsidise this with 'extra' super payments. Go to the airports see who's travelling (the disposible income is clear).

As I say we have a wonderland approach to life here in NZ. We have massive over expenditure by our government, balance of payments way out of whack and a run away debt bubble in property.

You can see that the pain is on its way. I can see the pain is on its way. Surely it's better for us as a country to acknowledge this (state our plan B as Bernard puts it). Highlight areas that will be trimmed when push comes to shove. It's only fair to everyone to be informed what will happen.

He (Deane) was at the vanguard of a generation of policy advisers and bureaucrats who radically reshaped New Zealand from 1984 onwards, liberalising and deregulating government and the economy.

An example drawn from Telecom’s 30 June 2001 Annual Report illustrates the deceptiveness of advertising techniques and financial manipulations. The Chairman’s Report in the glossy front section of Telecom’s Annual Report described as "splendid" Telecom’s investment in Southern Cross Cables Holdings, an associate company based in Bermuda (a tax haven). And splendid it seemed. Earlier, Telecom had invested $45 million in shares in three associated companies, one of which was Southern Cross. In 2001, Southern Cross paid Telecom a dividend of $263 million. Few share investments return such massive dividends, and this dividend increased Telecom’s reported after tax profits for 2001 by 52% or $221 million (total reported profit after reported tax expense for that year was $643 million. Without the dividend, it would have been $422 million).

Closer scrutiny of Telecom’s financial reports revealed that all three associate companies had incurred losses so great that Telecom’s portion of their losses exceeded its investment in their shares. In the same year that Telecom received the $263 million dividend from Southern Cross, Telecom also wrote down to zero its share investment in all three associate companies, including Southern Cross. This was because of the losses, but it had the effect of changing the accounting requirements between them and Telecom. It meant that all three became the New Zealand equivalents of Enron-style off-balance sheet entities. Our financial reporting standards require this!

With Southern Cross incurring such losses, how could it pay such a large dividend to Telecom? It could if it were a circular transaction. In other words, if Telecom passed the money to Southern Cross, Southern Cross would have the money to pass back to Telecom. Telecom’s 2001 Annual Report reveals that Telecom seemed to have paid to Southern Cross an amount close to the $263 million, recording it in Telecom’s reports as an asset, either as a shareholder’s advance or as an investment in "cable capacity". Southern Cross paid the $263 million to Telecom, and Telecom reported most of it as dividend revenue, thus artificially inflating its after tax profit by the $221 million. Read full article by Sue Newberry

There's more:

Telecom mobile history and Rod Deane's failing memory

Yeah, when I saw that name, I thought probably not the best example (lol). Not saying we didn't need reform at the time but it was the lack of measured consideration by these policy thinkers in government .. not to mention their capture by the BRT. Their failure to plan for failure of any of the policies was complete. And when all the signs of failure were obvious, the excuses about "had David Lange not decided to have a cup of tea... (and all that jazz about) ..."we didn't go far enough fast enough" as the principle excuses, just got tedious and tiring. Meanwhile, the welfare state grew due to the refusal to get their hands back on the tiller and advise Ministers accordingly!!! Quite the opposite.

Hands off, hands off - they cried incessantly - such that almost no institutional learning in "hands on" could be found in the corridors of power for a 2-3 decade period. But boy, under NPM did the salaries of the 'elite' core of senior government servants rise!!! Such that now, they have pretty much surpassed salaried non-executive management in the private sector. And the best of the plumb jobs in the private sector are consulting back in to government. Re-regulation has been like pulling hen's teeth - and when they do it to correct the errors of past neoliberal bright ideas (e.g. relaxation of building regulations and standards) they make a complete balls up of it on most occasions.

As to whether the NZ reforms included any 'unique' NZ thinking - well, not alot. It (the policy presented to the incoming 1984 Labour Government) reads like a parrot of the analytical models and ideas coming out of the US movement and the Chicago School. So, not really homegrown kiwi ingenuity there. Some good legislation, but take the RMA, a product of that regulation making period - how many times has it been amended so far .. probabaly something like twice yearly since 1991? And still no one is happy, aside perhaps the legal profession and the plethora of 'experts' one has to hire to navigate ones way through even the simplest of development proposals.

The Treasury movers and shakers of the Deane era were all obviously well above average intellligence but in my opinion they largely lost the plot in becoming economic evangelists as opposed to measured, considered policy analysts. I reckon this tainted the value of their true potential contribution and most will not be remembered fondly in the economic history books.

"This view happens to be shared by other researchers and advocates around the world too".

Rear-view mirror-gazing and vested-interest-pushing, are not 'research'.

"Evolutionary change is preferable to "crash change".

Then why are you advocating not just more of the same, but even more of the same?

How about looking ahead?

"The rapid growth in global urban land cover is likely to continue as long as urban

populations continue to grow, as long as incomes continue to rise, and as long as urban

transport remains relatively cheap and affordable.

Indeed a rear view mirror Hugh......

I assume its based on this pdf,

https://www.lincolninst.edu/pubs/download-thankyou.asp?doc_id=1171&logi…

So I dont really have to pay for a book to know yu are cherry picking what it says...

The key is cheap urban transport....followed by rising incomes which are both based on ever expanding enrgy availability.

Which there wont be.

In terms of Luddites. they rejected machines which were really the embodiment of maths, physics and energy....neither PDK or I abhor these three, we recognise we live by them, as do we all. Indeed Im a Beng honours qualified engineer with (at the time) an interest in thermodynamics and energy efficiency....

So what have machines done for us? Well I just bought myself a Bosch saw...instaed of cutting a 4x2 by hand which takes minutes, the saw is precise I can cut a perfect angle and length in 2 seconds....trouble is it uses a 1650watt motor to do it. If I ran that for an hour it would cost me about 40cents....my productivity and quality is hugely improved.

Those sort of gains are done, the low hanging fruit.

regards

Hughey - with the greatest of respect, he may be a 'Prof', but it's not of a discipline which deals with reality. What is it, economics?

Stand on a street corner at rus hour, or indeed any time of the day, Hughey. See anything not delivered by, made of, made by the use of, or burning as it passes you - not oil-based?

You seriously think we can not only continue BAU (85million barrels per day tickover) plus expand, plus service the increasing rate-of-decay of the never-bigger global infrastructure?

There will indeed be a push - globally - to re-ignite 'growth', and housing is the only conventional end-game capable of absorbing (on paper) momentum on that scale.

There isn't the energy underwrite, is the problem. You really should take a year out to study physics (I suggest Energy Studies, at Otago Uni, you could stay with me for free, there are no energy costs at my place, and less than 50% food costs so I could carry you.

You won't, though. Haven't bothered to take up the offer to visit/learn about cheaper housing forms, either, have you?

And the difference between you avoidance, and chosen ignorance is?

:)

PDK, how does a knowledge of physics convert one to being a Malthusian Luddite?

I studied physics (to a higher level than you I suspect - 400 Level) and am the exact opposite! You forget that humans are adaptable, all matter is energy and that the earth is bathed in bounteous free and unending solar energy (for our long term) every day.

Failing that, how about pedal power buses...

How do we collect that solar energy?

Conversion, well in Hugh's mind anything is possible, even a non-physics universe can and does exist in his head, its a problem he shares with a high % of ppl. This looks to be one of the dis-advantages of fossil energy. It took us out of our annual solar energy hard limit and we've forgotten what that means.

I dont know what you studied in physics but if you believe we can adapt then you must have not understood. You certainly seem to not want to understand the expotential function in maths. Maybe in your case its a case of a little knowledge is dangerious....

Its really simple, to grow our world economy at 4% needs about 2.5% more energy, that means that 85mbpd crude oil had to get to 170mbpd in 28 years. Yet we peaked in 2006 and in 6 years there has been no meaningful increase.

regards

Bravo Snippy.

Bernard, i give you full marks for your efforts in driving for these things. Mybe you will end up being that person.

My thoughts too.

By pure default Bernard is the closest candidate available. If Mulddon was still running things he would have scooped Bernard into one of his many "Think Tanks" - just to tame him.

On the very first day though - Bernard would need a little re-education re housing afforability. Sad but true.

A new 1970 home was on average 120 sq metres - with no garage included

No garage or wood shed

No fences

No driveway

No paths

No letter box

No clothesline

No landscaping

And by law - 1/3 minimum deposit required

And wages were still moving forward - before they stopped dead (inflation adjusted) about 1980.

No wonder three annual salaries would buy a house in 1970. Mainly possible because all that you got was a house on a weed infested section.

Come on Bernard - take the above on board - and ingratiate yourself into the John Key "Think Tank".

A Tip. Never fly. Drive everywhere. Keep your feet-on-the-ground

Buy yourself a Suzuki Swift - and drive. Fun and middle-class community education all at the same time. Amazing and shocking.

The 2012 middle class problem is low wages!

They are trying to get a decent paying job here, so they can save up in Kiwisaver to get a subsidy to buy their first home with loans from the banks...

they are all involved in the rental property market and because of the returns they are on world tours .

see ya soon

Bernard, I'm quite glad we don't have the policy creativity you admire in Britain and the USA. And Sutch (I followed his trial quite closely) was a communist sympathiser at best, spying suspicions being around him from the 1930's. He did have clandestine meetings with Russian agents. I think it is telling that the debase the currency and show us the free money clique, have now adopted men like Sutch as heroes.

Oh dear, 20 years after the collapse of communism, and you're still frightened of the bogeyman.

Do you refer to the Soviet Union?

What about China?

China is communist? Pretty odd communists they are.

... this is 21st Century communism, not 1950`s communism.

But make no mistake, they are definitely communist...

Authoritarian, yes. Followers of the doctrine of Marx, no.

very true....

regards

You have been back in new zealand too long Bernard. Once you have been around for a while your blood thins out, you get a touch of the sun, the moisture in the air allows the ultra-violet rays to burn you, or it's something they put in the drinking water. Eventually you stop seeing the good side and only see the dark side.

It's all a matter of perspective, Bernard. People wanting to immigrate to new zealand don't seem to share your concern. Moneyed people coming out of Singapore and Hong Kong and China can't get enough of new zealand. And sky-city cant get them in fast enough. You really should check out what's happening in Australia. Things aren't going too good over there at the moment, but, boy, the boat people coming from iraq, iran, sri lanka, and afghanistan think the place is fantastic, and they keep coming by the boatload. Nearly 50,000 per annum at current rates.

I wouldn't wish anyone to be run over by a bus, but the Prime Minister is correct in saying that NZ would be a better place if that happened to him (that is what he meant, right? *chuckle*)

http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=10848054

Interesting illustration Bernard, Sutch and Deane, left v. right (social v. neo liberal), no?

Reminds me of Chile. In 1973 they had a socialist president (apparently communist) threatening social reform and wealth redistribution but suprise suprise there was a military coup and Augustine Pinochet assumed power for the next 20 odd years. Shortly afterwards, Henry Kissinger became a frequent visitor to Chile, and a few times Milton Friedman. Economic policy in Chile was directed by the 'Chicag School' and laissez faire reigned supreme (within confines of exisiting chilean social culture which is possibly stronger). All public utilities and infrastructure has been privatised, and majority foreign owned. No wealth distribution took place, standard of living may have increased, social unrest starting to ferment.

Does anyone know where Rod Deane got his economic inspiration from. Was it the Chicago School by chance?

Well, the great thinkers are not going to come from this lot of contributors Bernard.

Patricia, please confirm you are qualified to know.

Not sure on Sutch but Rod Deane didnt strike me as up to much....

All he did was protect Telecom's monoply at NZers expense.

For instance a business friend of mine was forced to pay over $2400 a month for 2 x DDS (128k) link from telecom, plus data....no wonder they fought tooth and nail to not promote ADSL it gutted their monopoly....

More successes like that we dont need.

regards

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.