Here's my Top 10 links from around the Internet at 10 am in association with NZ Mint.

As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My apologies for no Top 10 on Friday. I was travelling. Back on track this week. My must read today is #7 from Martin Wolf on why banks are dangerous. They don't have enough equity. on the failure of government austerity in Britain and Europe. See the NZ bank leverage ratios here, courtesy of David.

1. Regional immigration policy - Massey University's Paul Spoonley makes some good points in this TVNZ interview about the apparently unquestioned assumption that Auckland should stick with its policy of welcoming all-comers.

Why can't we limit migration into Auckland to take some of the pressure off house prices and infrastructure?

Spoonley suggests that visas are only given to people wanting to live somewhere other than Auckland for the first 5 years.

That might limit overall migration, but is that such a bad thing?

There would be wrinkles aplenty though, particularly for ex-pats and family members of those already resident in Auckland.

Here's Spoonley:

The sociologist said that there are some instances of immigrants moving outside of the big cities.

"For example, in Southland, almost half of the dairy workers down there are Filipinos. Who would have thought that Southland would be a destination for a major group out of Asia?" he said.

2. The incorrigible Nigel Farage - It's worth getting to know the fringe politicians in Europe that are rapidly winning support as regular voters start to revolt at the austerity economics being driven from Brussels and Berlin.

Here's another taster of UK Independence Party Leader Nigel Farage, who is a euro-sceptic member of the European Parliament. He has a lot of fun upbrading euro-crats.

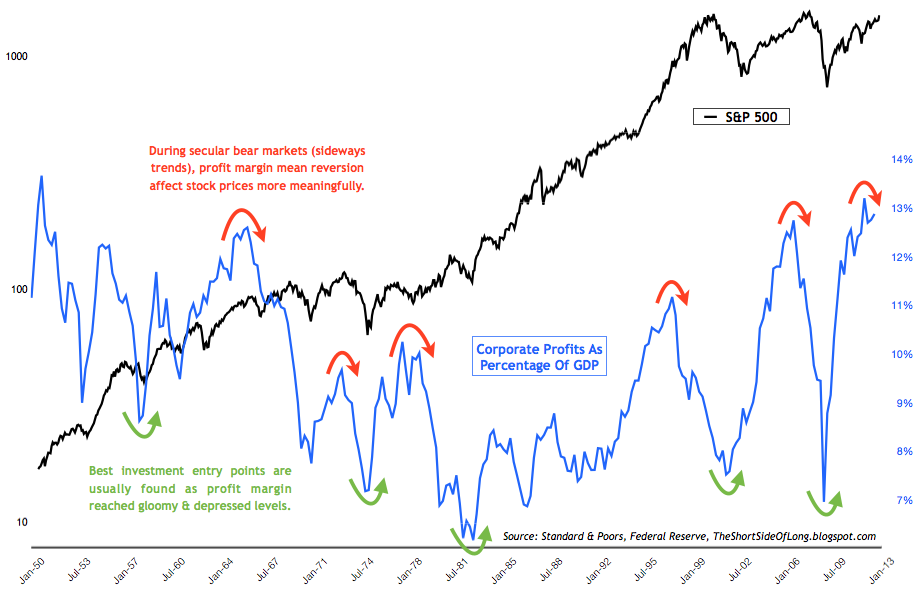

3. Maybe the stock market rally makes sense - This chart below (courtesy of the short side of long) shows how the corporate profit share in America has doubled to 13% of GDP since the early 1980s. It means capitalism doesn't have a socially sustainable future, but hey...

4. Europe is risking a bank run - So says the FT's Wolfgang Munchau in this excellent piece on Cyprus' extraordinary decision to renege on its deposit insurance promise to those with less than 100,000 euros in the bank so as not to hurt the Russian mobsters and European banks too much who have lent Cypriot banks much, much more.

The vote has been delayed overnight and Cyprus' banks will remain closed until Thursday to stop bank runs.

But will the runs spread contagion-like to other much bigger parts of Europe? Munchau reckons there's a risk.

If one wanted to feed the political mood of insurrection in southern Europe, this was the way to do it. The long-term political damage of this agreement is going to be huge. In the short term, the danger consists of a generalised bank run, not just in Cyprus. As in the case of Greece, the finance ministers said: “Don’t worry, this is a unique situation”. This is true only in a very narrow legal sense.

The bond haircut in Greece is indeed different to the depositor haircut in Cyprus. And when they repeat this elsewhere, it will be unique once more. Unless there is a last-minute reprieve for small savers, most Cypriot savers would act rationally if they withdrew the rest of their money simply to protect them from further haircuts or taxes. It would be equally rational for savers elsewhere in southern Europe to join them.

The experience of Cyprus tells them that the solvency of a deposit insurance scheme is only as good as that of the state. In view of Italy’s public sector debt ratio, or the combined public and private sector indebtedness of Spain and Portugal, there is no way that these governments can insure all banks deposits on their own.

5. 'I told you the tax wouldn't pass' - The Cypriot President has been forced to delay a vote on the deposit 'tax' and is starting with the 'I told you so's...'

Here's Ekathimerini with a report:

Anastasiades is also reported to have spoken to German MEP Elmar Brok, a member of Chancellor Angela Merkel’s CDU party who is close to the German leader.

According to Mega TV, Anastasiades is reported to have said to Rehn and Brok: “When I warned you that there would not be a parliamentary majority to pass the agreement, you didn’t want to listen. Give my regards to Mrs Merkel.”

6. And here's how the Daily Mail portrayed the Cypriot bank tax. Btw I never did fancy Downton Abbey's main man...

7. The bankers' new clothes - Here's Martin Wolf at the FT nailing the problem of modern banking: not nearly enough equity to act as a buffer because bankers want returns on equity (and therefore bonuses) that are too high. It's a review of this book. See the NZ bank leverage ratios here, courtesy of David.

The UK’s Independent Commission on Banking, of which I was a member, made a modest proposal: the proportion of the balance sheet of UK retail banks that has to be funded by equity, instead of debt, should be raised to 4 per cent. This would be just a percentage point above the figure suggested by the Basel Committee on Banking Supervision.

The government rejected this, because of lobbying by the banks. Why might even so tiny an increase in the equity-funded proportion of the balance sheet be objectionable? The answer is that what is small to everybody else is huge to bankers. To them, a one-third increase in equity means a 25 per cent decline in return on equity. To bankers, the ICB’s tiny step was a big reduction in prospective returns and so in their own rewards.

If you think that running banks with so little loss-absorbing equity is crazy, you are right. This book shows you why you are right. It is the most important to emerge from the crisis.

8. It was a Cypriot decision - The Germans had apparently told the Cypriots to spare the small depositors (under 100,000 euros) and ping the big ones (ie the Russian Mobsters). Maybe the Cypriot President was a little worried about his personal safety.

"It was the position of the German government and the International Monetary Fund that we must get a considerable part of the funds that are necessary for restructuring the banks from the banks owners and creditors - that means the investors," German Finance Minister Wolfgang Schaeuble told public broadcaster ARD in an interview.

"But we would obviously have respected the deposit guarantee for accounts up to 100,000," he said. "But those who did not want a bail-in were the Cypriot government, also the European Commission and the ECB, they decided on this solution and they now must explain this to the Cypriot people."

9. The seeds of the next crisis - Here's Australia's Gerard Minack with a good analysis via ABC.

Gerard Minack, one of the few who largely foresaw the global financial crisis, is warning that another and potentially worse economic storm is brewing. In his latest Downunder Daily note, Mr Minack warns that the very actions central bankers are taking now, that have done so much to inflate share markets and restore economic confidence, are sowing the seeds of the next crisis.

In response to a financial crisis which the Morgan Stanley global strategist argues was caused by loose monetary policy, mispricing of risk and a resultant sharp rise in debt, central banks around the world have saved the day by loosening monetary policy even further and ratcheting up debt even more. Mr Minack says these loose central bank policies go hand-in-hand with rising share prices for a while, as low interest rates persuade investors to park freshly minted money from the US Fed or Bank of Japan into equities because the return on cash is so low.

However, he warns that in trying so hard to win the battle against an economic downturn at the moment, central banks could be consigning themselves to defeat in the war against another global financial and economic meltdown. "Winning the battle isn't winning the war. If central bankers do win this round, the next downturn could be, in my view, an omnishambles," he wrote in the note.

10. Totally Jon Stewart on cuts for Kindergartens.

8 Comments

Bernard

The $NZ is too high and the need to raise interest rates?

Think again

http://www.investopedia.com/articles/forex/06/centralbanks.asp

The one factor that is sure to move the currency markets is interest rates. Interest rates give international investors a reason to shift money from one country to another in search of the highest and safest yields. For years now, growing interest rate spreads between countries have been the main focus of professional investors, but what most individual traders do not know is that the absolute value of interest rates is not what's important - what really matters are the expectations of where interest rates are headed in the future.

Examples

Take the performance of the NZD/JPY currency pair between 2002 and 2005, for example. During that time, the central bank of New Zealand increased interest rates from 4.75% to 7.25%. Japan, on the other hand, kept its interest rates at 0%, which meant that the interest rate spread between the New Zealand dollar and the Japanese yen widened a full 250 basis points. This contributed to the NZD/JPY's 58% rally during the same period.

On the flip side, we see that throughout 2005, the British pound fell more than 8% against the U.S. dollar. Even though the United Kingdom had higher interest rates than the United States throughout those 12 months, the pound suffered as the interest rate spread narrowed from 250 basis points in the pound's favor to a premium of a mere 25 basis points. This confirms that it is the future direction of interest rates that matters most, not which country has a higher interest rate.

#3

My opinion (for what it is worth) is that we are experiencing a massive oversupply of investment dollars.

I expect the DOW to be be volitile but would not be suprised if it hit over 15k this year.

Of course it will eventually crash, but who cares, lots more super funds out there to screw.

The U.S. can no longer be decribed as having capitalism as its economic system. It is now crony-capitalism, there is a huge difference.

#4

I dont blame low interest rates. I blame the gross corupt way Central banks have spent all there money printing. Bailing out the banksters for one.

The fire is being fuled that QE dosnt work when in fact it is the distribution of QE thats at fault.

People should realise that central bankers are as corrupt as other bankers.

As long as corruption rules the end will come with a great big thud

Europe is still in the grips of a war for control of its future. Both are bad.

One is for a European economic zone where the capitalists can more jobs throughout Europe playing one government and its labour and tax laws against anothers.

The other is led by the Socialists who want a complet fiscal union so they can restrict the 1%'s control

I thought the Socialist would have won by now but it looks like this war is far from over. Neither side is prepared to give in and it will end in disaster.

The bloating of Auckland can be kept to a minimum with a jafa charge applied to all jafa property on top of the Len Brown Tax...plus gst of course. That way any migrants will think twice and move south......and the thieving govt will get extra loot to waste on make work schemes and fatter 'consultant fees' for working group mates.

#2 - Why do you describe Nigel Farage (UKIP) as a fringe politician? From Wikipedia:

"In the 2009 election to the European Parliament, UKIP obtained 13 seats with 16.5% of the vote, coming second behind the Conservative Party, overtaking the Labour Party in terms of votes"

When Bush and Blair waxed seriously about invading Iraq I thought they were kidding. To think it was the right thing to do required a suspension of reality of galactic proportions.

I was naive enought to think they must have had a cunning plan.

The "Cypriotic" bank heist is just as lunatic and fraught.

On the other hand, our immoral and amoral financial system, ably abetted by politicians and apathetic and ignorant voters, have been doing EXACTLY the same thing to all of our bank accounts and even stashes under the mattress for generations.

It's called inflation.

I remember when inflation was running close to 20% and I was getting less than 5% on bank deposits. Makes the Cyprus plan a better deal.

:)

#1 Ego driven meglomania from a succession of mayors, councils and self interested business groups. Bigger is better.

Also a government who's only economic plan is more immigration, more government borrowing and encouraging another mortgage/consumer credit binge.

Immigration has become a new taboo in politics. Labour and National are committed to it to support property and the banks and the Greens don't want refugee numbers cut. NZ First are written off as old codgers and xenophobes. Last time I looked NZ was a couple of islands in the middle of a large and hostile ocean. Limiting immigration is the easiest thing any government could do.

Where is the evidence that more than 2 million people in Auckland will benefit the economy or the liveability of the city, especially for us who are already here. Where's the regional development plans for the rest of New Zealand?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.