Here's my edition of Top 10 links from around the Internet at 10:00 am today. We now have a Monday-Wednesday-Friday schedule for Top 10.

Bernard will be back with his version this Wednesday. We will have another guest posting on Friday.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz.

See all previous Top 10s here.

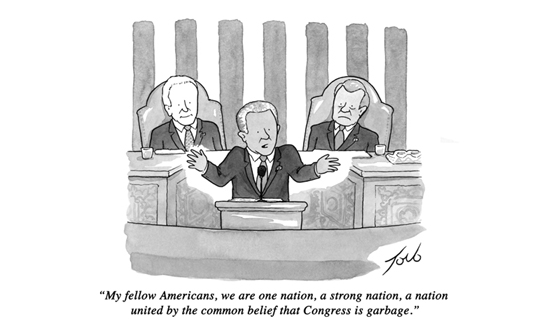

1. Giving bipartisanship a bad name

About the worst in American congressional politics gets revealed in their 'Farm Bill'. It's the gold standard in bad public policy. It's pork barrel politics, literally.

Until they find a way to break up enabling legislation like this, they will always be tarnished.

Plenty of very smart people have tried and over the past 50 years all have failed - which seems odd given nearly everyone is in agreement it is a terrible way to run a government. Ironically, there is bipartisan support that things need to change, and the latest bill got enacted with a bipartisan vote. But between those two objectives the 'doing' just got worse.

The Economist has a useful review.

While Congress was gridlocked it was easy to forget how ugly the smooth functioning of government can be. After a delay of two years, a reminder came on February 4th when the Senate passed the farm bill, a strange piece of legislation which costs nearly a trillion dollars. It mixes benefits that mostly go to the poor (food stamps) with agricultural subsidies that mostly go to the rich (crop subsidies for large farms). Given a blank slate, nobody with an interest in either alleviating poverty or improving farming would construct such a law. Yet here it is again.

The alignment of rural and urban interests, which dates from when the two bits of legislation were yoked together in the 1970s, had temporarily broken down, largely thanks to some House Republicans who wished to treat food stamps (which account for 80% of farm-bill spending) and agricultural subsidies separately. They were motivated by fiscal prudence and the belief that welfare discourages work.

2. Does China have 'special defenses'?

China's credit addiction and the guesses as to how it 'will end' is popular sport these days. It will end I am sure, but I am not sure whether it will be with a bang (as the apocalypse crowd seem to want) or whimper as it has in many other countries over the past century. A bang would hurt us, but a whimper would hurt them in the long run - although there is doubt about the real level of hurt places like Japan or Taiwan have actually suffered when they had theirs.

Still, as a spectator sport, we love a good credit crisis story.

Ruchir Sharma from Morgan Stanley has provided one in the FT:

Forget Argentina. The big story of 2014 in the emerging world is the black cloud of debt hanging over China.

Debate rages over how this tale will end. Most analysts believe that the Chinese economy will once again expand by more than 7 per cent this year, despite ballooning private sector debts. But the pessimistic minority has history on its side. Only five developing countries have had a credit boom nearly as big as China’s. All of them went on to suffer a credit crisis and a major economic slowdown.

3. 'It's getting too crowded'

Conservative mono-culturalists have a new slogan to hide behind - "it's getting too crowded". The issue is playing out in Switzerland because you can force a binding referendum on just about anything there. They are voting today. It is close and early reports show that the proposal will win. The BBC has a review of the issues:

He would like Switzerland to return to its earlier policy of hiring foreign workers on a temporary or seasonal basis, requiring them to come to Switzerland alone and to return home as soon the specific job they came to do is finished.

"With free movement now, we know that only 50% of the immigrants work here," he explains. "The rest are just families."

But Mr Haab's view is not shared by many Swiss employers, who claim their success is actually because of, rather than despite, free movement.

4. A Spaniard German in the works

Readers of interest.co.nz (who have a very good memory) will recall we reported last year on a German Constitutional Court review of the ability of Germany to participate in the ECB's 'whatever it takes' policy to prevent a euro meltdown. The ECB declared it would do its own QE if necessary. The German Bundesbank said that Mario Draghi didn't have the right to do so and tested the assertion in the courts (the German courts).

Well, on Saturday after EU markets closed, the court issued its decision - it agreed with the Bundesbank.

The eurozone doesn't have a banking union, a fiscal union or a political union, but at the very least it can claim to have a fully functioning monetary union. If the largest national central bank refuses to participate in an ECB program, that claim could be called into question, to the great dismay of investors. Here is Megan Greene of Bloomberg:

The German court has surprised many analysts by offering a “no, but” ruling: It thinks the bond-buying program violates German law, but recognizes that the European Court of Justice should determine whether the ECB is acting within its mandate. The European court must now investigate whether the program falls within the ECB’s mandate as a form of monetary rather than economic policy. This will take at least 18 months.

So what happens in the meantime if a country gets in trouble and the ECB wants to buy its bonds? One possibility is that the program will be put on hold until the European court deems it legal -- meaning that the central bank's most powerful policy tool will be completely defunct. This should worry Portugal, which is due to exit its bailout program later this year and is taking some comfort that there is a safety net if things go horribly wrong. Other financially challenged countries in Europe should be concerned as well: Both Greece and Italy have unstable governments that could collapse over the next 18 months, possibly triggering investor panic.

5. The case against performance reviews

Performance reviews are in the spotlight. It is doubtful that they work as intended. The problem with many great workers is they know how good they are. But the problem with many bad workers is they don't know how bad they are. Derek Thompson at The Atlantic has taken a look at the process and found many flaws.

It's bad enough that annual evaluations are outdated. It's problematic that they're susceptible to a plague of biases. It's worse that they tend to be pathetic motivators. But the coup de grace is that they're not even good at identifying the thing they're meant to identify: performance.

Research from Corporate Executive Board found that two-thirds of employees receiving the highest scores in a typical performance management system "are not actually the organization’s highest performers," Jena McGregor reported for the Washington Post.

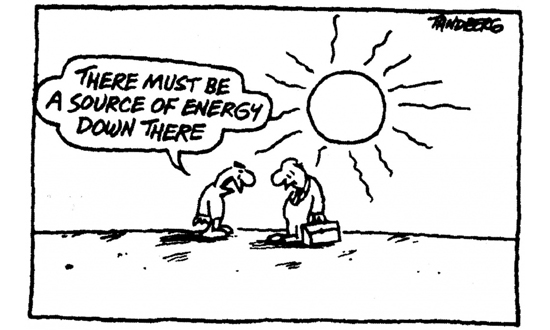

6. The time has come

I was taken by Rob Stock's Sunday Star-Times story about Vector's solar offer. It is not so much that it is a great deal - it may or may not be, I don't know - but it is the first I know of that makes it really easy to get photovoltaic cells generating usable and storable electricity on your house. For about $3,000 you can get a 5kW system installed and running, less if you need less.

I reckon Vector will be swamped, and these sorts of systems will now quickly go mainstream.

... with the installation cost of the Vector scheme being lower than the solar water heating systems, the company paying for maintenance, and the smart monitoring technology (Vector also monitors performance remotely), some of the big disincentives for solar are effectively removed.

Just how big can the scheme get?

Mackenzie expects the current 250 installations over the past ten months to grow substantially with much of that coming from the 30,000 or so new homes due to be built in Auckland each year.

It's another reason the Government needs to get right out of owning electricity companies. Big disruption is on the way.

7. More women in the workforce raises the jobless rate

My reading at the moment is of The Second Machine Age by two MIT professors Erik Brynjolfsson and Andrew McAfee. I am only about halfway through but am almost ready to declare it a 'must read'. (It's less than NZ$20 on a Kindle.) It's subtitle is 'Work, Progress, and Prosperity in a Time of Brilliant Technologies' and it raises some troubling questions about what we are all going to do to earn a living while explaining why we have a sudden burst of inequality. It is getting much praise and I can see why.

One thing it does explain is why labour force participation rates are under pressure. Unemployment rates may not be rising, but that is because participation rates are falling as people in the labour force can't or won't change fast enough in the face of changing demand for skills.

But here's a challenge for the authors: European unemployment remain very high (12%) because participation rates have remained high. In fact Europe's female participation rate has actually risen strongly since the onset of the 2009 recession. Older women are entering the workforce there fairly fast. Eduardo Porter has the details in a NY Times blog.

But is it a short term trend to help the income of families under pressure? It won't last if Brynjolfsson and McAfee are right.

8. Priceless but worthless?

When S&P's cut Italy's credit rating two notches in 2012 to BBB+ the then prime minister Mario Monti called the downgrade as "a further problem as it makes certain investments impossible". The Italians weren't happy. Now they are looking at suing the credit ratings agency for failing to value its historical and cultural treasures. More from the British Guardian:

The latest Italian case may be the first time the powerful ratings agencies have been accused of culturally illiteracy, but they already faced charges of poor maths and dismal economic forecasting.

When the US saw its credit worthiness downgraded in 2012, the then Treasury secretary Tim Geithner accused the agencies of "a stunning lack of knowledge about basic US fiscal maths". The US government is pursuing a £5m lawsuit against S&P, accusing the agency of defrauding investors by pumping up the ratings of mortgage securities to win more business from large investment banks.

The ratings agencies also stand accused of failing to see the financial storm coming. In 2009 Moody's issued a report titled Investor Fears over Greek Government Liquidity Misplaced – just six months before Athens was forced to seek a bailout.

I think the Guardian in its zeal to report this case and focus on other credit agency failings are forgetting that to be included as an asset backing borrowings, the 'historical and cultural treasures' would need to be claimable in the event of a default - and then sold on. Firstly I very much doubt any lender could expect to take possession, and secondly in the unlikely event they did the selling process would swamp even the large international art market. I think Italy's 'treasures' are both priceless and worthless as far as borrowing against to pay pensions or garbage collections.

9. The BRICs wall

It is no longer news that emerging markets are suddenly doing it tough. They enjoyed an investment boom fueled by very cheap money that flowed from the US, Japan, China and to some extent Europe as the first world tried to stimulate growth. The flood of liquidity gave them an impressive growth spurt, but with the end of stimulus, the effect seems to be reversing.

It has lasted long enough though to not only build a middle class in many of these countries, but raise aspirations and along with it and new and powerful political voices and clout.

Without growth there is growing anger. Spiegel Online assesses the mood:

It isn't just the raw figures that are fueling concern among the governments of developing nations. From Beijing to New Delhi to Rio, the upswing has fostered a new self-awareness in people, creating a broad popular movement in the truest sense of the term. In recent years, impressive middle classes have taken shape in virtually all of the emerging economies.

Members of that middle class are now demanding a larger piece of the pie and higher wages. At the same time, they also want "good governance" -- meaning greater responsibility and accountability for their leaders -- and the right to increased democratic participation. Economic progress has served as catalyst for political demands. If that dream now suddenly ends, it could also slam the brakes on these emerging popular movements -- or at least stir emotions in dangerous ways.

10. Today's quote

"Most economic fallacies derive from the tendency to assume that there is a fixed pie, the one party can gain only at the expense of another." - Milton Friedman

28 Comments

#3: "it's getting too crowded" (in Switzerland)

Sounds quite relevant to NZ too...

#3 - 'Swiss Voters Narrowly Approve Curbs on Immigration'

BERLIN — A narrow majority of voters in Switzerland on Sunday approved proposals that would reintroduce restrictions on the number of foreigners who are allowed to live and work in the country, a move that could have far-reaching implications for Switzerland’s relations with the European Union.

http://www.nytimes.com/2014/02/10/world/europe/swiss-voters-narrowly-ap…

Re 4: FFS! Germany never ceases to do my head in. No wonder the EU is such a mess with them calling the shots.

Friedman should have been given one of those globe-of-the-world things as a kid. Might have saved him spouting drivel.

6 - as a long-term advocate of solar (not as long as Edison, but: httphttp://www.sierraclub.org/sierra/201301/create-rooftop-solar-revolution-295.aspx ) I've long pointed out that this is where we have to go.

It seems the insiders - Vector types - have thought it through. You either got on the bandwagon, or you're a dinosaur. 10 years down the track, personally (and 30 years if you count living on boats), i just say 'go for it'. Well done Vector. Going in the right direction.

But we are a stupid species. If all that panels go on new builds, we haven't solved anything. Just as '50% reduction in CO2 by 2050', is still adding to the problem every year. Seems most folk see the word 'reduction' and think were' going to be 'down to half the volume in the atmosphere'. What we need is tetro-fitting of existing housing, and a crash-reduction in population and a concurrent reduction in physical consumption per head.

Ain't gonna happen.

PDK, do you know of anyone is doing the same in Christchurch as Vector is doing in Auckland? Am busy saving up for some photovoltaic panels but they seem to be very expensive - well for me - with not a great return. Is it effective to add more panels as you get the money?

Sorry for speaking for PDK.

Consider reduction first!

Then identify, do you want off grid or on grid.

off grid is the big saver but harder.

Off grid you need batteries, all your batteries should be the same age... or at least within 9-12months window of purchase otherwise the age affects their voltage.

Consider where you're going to put the cells...I planned for 4 panels, ended up with 8, which sticks out from the house (all panels must have _very_ similar orientation in connected to the same circuit).

Most electronic gear and wall warts prefer Pure Sine Inverters. They're twice the price but worth it for delicate stuff, motors and chargers. I have found a 2kW modified sine wave inverter will NOT drive a standard Kettle :(

Consider what circuits you would/can change over. I'd love to do my fridge and freezer, but don't want a couple of cloudy days to cost me a fortune in defrosted food! (or worse unknowingly refrozen rotting food!).

Personally I have gone for : radio/stereo change over. lights (LED), computer/TV. That's three circuits. All off grid.

If you're going on-grid then the size of you special inverter is the most important factor as you don't want to be buying/installing more than one! If using on-grid co-generation consider that the rules for electricity charges are changing - very soon I can see co-generators (eg on grid solar) will be paying the "Transport Charge" so you'll only save the "unit charge" this could be a big decider in which system to use in NZ.

Later when my wet/float batteries die I will replace them with current generation AGM/Gel cells which should double my storage capacity.

MPPT chargers are the way to go especially over 300Watts total.

"For about $3,000 you can get a 5kW system installed and running,"

Please provide link to the installer David.

For $3,000 you'll get a pure sine wave converter for a 5kW system and that's about it. (inc GST).

Panels individually are about $2/1W still. Buying bulk containers to get the price down on 5kW doesn't count, neither does buying cheap nasty chinese brands.

$3k with get 6 Trojan Solar-recommended Wet Deep cycle batterys, or 3 "Gel Cell"/AGW ones. That's 9kWh, or about 4.5kWh recommended.

A 45Amp charger (max 48v) max about 2kW will set you back about $800 for a reputable brand, not bells and whistles.

Doesn't encluding enclosures, cabling, monitoring panels, $50-$150 per DC Circuit Breaker. And not mentioning railing or mounting or qualified installer (for the 230v "low voltage" circuits). And no panel tracking or radio links or automatic waterers!

Or RMA/building consents should your area need it (mine are in the back lawn next to the North facing house wall).

Doing the labour, enclosures and wiring myself, a decent 2kW off grid system like the one running this computer 24x7 is about $10k. (8xTrojan 12v batterys, 2KW QCell panels, 2x 45A Morningstar MPPT, Victronix Pure Sine 800W Inverter) $500,$500,$750,$1200 respectively. Cabling about $400 more.

The link is in the item. It is

http://vector.co.nz/solar/service-offering-and-pricing

Note that Vector is offering a lease. They own all the gear and maintain it. You pay a monthly fee (in lieu of having to buy it or maintain it). You also pay the one-off installation cost (up to $3,000). All the details are in the link above.

Suggest you edit your article pronto then.

Huge difference between you can get a "5kW solar system installed" for $3,000

and

you can pay $3,000 to install a 5kW system which you have to rent for $115 per month.

$115 buys a lot of grid kWh.

especially considering that you don't end up owning the system at any stage (ie - it breaks you're still going to be paying that 115 whether the system is going or not!)

I'm a bit sceptical on this one having looked through the details. If you do the calculations for the smallest installation, $2k + $70 per month for 12.5 years, that's a little over $10k. You don't own the equipment at the end of the contract, but you do have to insure the installation for $35k. Seems a bit like renting vs buying.

Personally, I'm keen on solar energy, but it's not quite cost effective for me yet. At current prices, and compared to my electricity usage, it would never pay for itself.

Queensland tried this solar residential approach and it turned into an entirely predictable disaster.

Consider - because line charges are variable ( crazy but true ) as demand falls a user pays less - but the costs are still there so they over time are spread over a reduced user base. The line costs are for sure sunk and cannot be recovered so someone has to pay.

The regulator allows cost recovery - so prices rise making solar even more attractive so more switch and Vector end up in a death spiral.

If you stay grid connected - you should pay the full fixed line costs or end up in the mess that QLD now find themselves. Why on earth would Contact offer buy backs at more than they can source off the market. This model will not work and QLD demonstrates what happens when you go down that path. It is in the long run not sustainable.

Possibly wrong, and for "predictibility" well Im sure your hindsight is 20/20

Germany for instance shows it can work the Q is why did Queensland fail.

You are somewhat mixed up in what you are saying....

Line charges are confusing here, I wish they would simply charge a per day and be done with it, hopefully this is an area the Green's will "attack".

You also have to allow for cost recovery which is resiliance, ie standby plant/ spare capacity.

Contact buying, well simple because the Govn writes the regulations.

regards

Solar

It's another reason the Government needs to get right out of owning electricity companies. Big disruption is on the way.

Not really correct at all. Sorry, It could also be a real reason for Government to stay in Hydro.

BTW, How come Doug gets to keep his job when over 900 million have been wiped off the shareprice? At what point will he loose his job- answer- never- why because the market is not really operating, if it was then there would be no excuse that could let him keep his job, he would be gone and someone else would have a go at making money for shareholders.

Actually its a reasong for a Govn to own it, as the Govn has to ensure a reliable and resiliant supply.

Its not looking to be profitable though thats for sure.

regards

Hmmmmmmm

Patricia - you can buy PV in Waitati (Otago) for $1.12 a Watt. That's $1,120 a kilowatt, not installed.

Cowboy - not bad, but the simple story dodges all the tech stuff. All that most folk need to do, is feed their solar straight at a dual element in their water cylinders. No grid-tie, no phase-locking, no dealing with Companies.

Malfunction - you need to look ahead. There's been an ocean of ink expended explaining where energy demand is going. The 'price' today is not what it will be tomorrow, that's guaranteed. All work which currently uses fossil fuels, either has to switch to renewables (solar)

JB - (that's with a 'de' in the middle, right? :) Too biased. Queensland has no 'battery', we do. It's called our hydro lakes. Vector have seen it coming, presumably, nad have a bob the other way. Smart. And sorry, but nuclear - that's what you're about, yes? - is unsustainable in resource-supply, unsustainable in disposal terms, and unacceptable in hushed-up-Fukushima terms.

PlanB - nothing wrong with us all owning it. Better than an overseas monopoly.

Rigt now, you could install say 2 kw of panels, wire it straight to your HW cylinder, and do nothing else. Unlike shares or a bank account both of which can vanish - you have your wealth and it will work for you for the rest of your tenure.

Thanks everybody.

PDK, are they difficult to install? I presume I would need an electrician.

I had a quote last year for a "grid tied solar roof mounted installation North aspect. JCM 25024bv, Renesolar Virtus II PV modules (silver frame), an ensolar inverter with a hopergy mounting system. A 1.5kw system 6x PV modules $6965.11 for an estimated annual generation of 2005KW/year." Whatever all that means.

He said 10m2 of roof area is required. I wonder if Bunnings have them.

They are quite a system to install. 1.5kw sounds a bit small for $7k, really I think 3kw that can be expanded to 4.5kw would be the swet spot.

yes you would need an electrican, and a specialist one.

regards

If you're aiming at HW, the modern evaporated tube based systems are more efficient for solarthermal heating. IMO. although the dual element does give best of both worlds, even if it means making sure you have your showers in the morning.

I listed the tech stuff because it's a mine field. Things like (*) enclosures* for the batteries and chargers don't show up in price lists. And it's easy to forget that a circuit breaker/isolator is needed for PV array, Battery side of charger, and to inverter. Circuit breakers for high current DC electricity is quite expensive. Larger arrays might need several.

Well worth the effort though for the reasons you've given.

Done correctly a PV setup is wealth. Is freedom to use and schedule your electricity how you feel, with no extra costs or payments to anyone. And for a long long time.

Also I hope that as they become more common they're less likely to get stolen or vandalised.

* must be separate for wet batteries!

The problem really is the excess energy, you either have to sell it or yes HW, really batteries dont cut it.

regards

in environmental clean arvesting, the excess isn't so important.

Selling requires demand elsewhere and thus logisitics of delivery - current market prices, to sell a kWh @ market, will equal the transmission price per kWh...

Problem with HW, is that if there isn't enough energy...cold water. If cylinder is already hot then you're back to square one,

It's a bit like an old boss of mine that was going to use solarthermal for space heating. Problem with his plan (using water piping) is that when there's plenty of thermalsolar you don't want space heating :) That's why PV should be pushed for those with AirCon.

PDK, what do you think of this

https://www.kickstarter.com/projects/1132758406/heatworks-model-1-your-…

Well I'd say Im 99% its a scam, or mutton dressed up as lamb maybe. Best I can say from what little info is provided is, its an instant water heater of some resistive form with a fancy control system costing maybe $1 oh big deal. So fundimentally put 1kw of power in get 1 kw of hot water out. Assume its 100% efficient which it wont quite be. It waffles on a bit here and there, classic signs of "scam merchant" for me.

regards

It's just a inline water heater. Like the gas based Infinity series.

Check out about 75% down the page under the heading "Autosenses Voltage". notice this baby can draw 13.3kW ! or 48 Amps. that's huge!

I'm betting the insides will be carbon tech elements (or even simons effect heat delivering semiconductors - kind of the reverse to what is used in high computer heat sinks to suck heat out of the CPU/graphics card. In this case it pumps heat in). And it'll warm up what would be a bunch of baffles like in a heat exchanger, as the water is drawn through it will come up to within about 3-5degrees of the graphite (teflon?) plates. Having plates creates a tortorous path that makes the water stay in contact for longer, giving the heat energy time to transfer to the water. Wide enough plates means you won't lose too much pressure.

The major efficiencies are two fold. The biggest is that the units can be placed closed to the distribution point. No longer do you heat tens of linear meters worth of water that is just going to side in the pipe and go cold - this is also in the "instant hot water" claim - short distance means no waiting for the hot water to (a) warm the pipes enough and (2) push all of the old cooled water out of the way.

The second is that you only heat slightly more water than you need. and it doesn't sit around hot. There is also likelihood that this cylinder won't need to heat *all* of the 150-400 litres of water to sterilisation temperature (55degrees? to kill legionella etc.) It probably only holds 5 - 10 litres. much cheaper and easier to heat flush itself at least once a day. But best of that is you don't have that energy just sitting there waiting...seeping away. Even the best insulated cyliners still lose heat to the water pipes connections and expansion system.

The downside. Cold water in power cuts. Wiring will be expensive. _45 Amps_. (there are ones on the market that do 18-25A, but they struggle to get 50degrees in full flow)

US I think? so 110v?

60deg c for legionella.

David,

It's another reason the Government needs to get right out of owning electricity companies. Big disruption is on the way.

This in my view is an understandable but simplistic assumption, that seems worth challenging.

For selling:

Possible disruption of solar, and more efficient lighting, insulation etc. (And by the by, I've had installed my own solar system).

Possible loss of Aluminium smelter.

Dodgy arguments on private sector being more efficient than SOEs, even with the same, albeit more highly paid Boards.

Against selling:

Increased population demand.

Transfer from fossil fuels to electricity. E.g.Plug in cars becoming mainstream.

Hydro generators are cash cows with close to nil marginal cost of production, and should always be so. Cash returns much higher than profits.

All New Zealanders owned them; now a few do; along with a good number of foreigners.

Capital flows of foreign sale feed back to the current account through the exchange rate, and then dividends, making foreign sales a free gift to foreigners from a net NZ Inc point of view.

Likely retention of aluminium smelter (Chinese pollution, and critical shortage of water means they will want to outsource basic production like smelters). Loss of this customer is likely priced in to the sale of Meridian already.

Strategic long term assets.

Some pricing control.

On balance, in my view the case for not selling the power companies far outweighs the case for selling them.

I seriously looked at Vector's offer, and the numbers simply don't add up for me. I would be paying more per kW with Vector, not less. Mileage may vary, but I'm afraid most people who buy this system cannot add.

My brief look, agrees with you.

regards

6. Need to see the nuts and bolts of the costs (edit).

Its the first though....there will be more I think.

regards

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.