Here's my Top 10 items from around the Internet over the last week or so. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read is #4 on the thinking behind Grexit. It's illuminating on the joys of having your own currency and central bank. #6 on China's long game is fun too.

1. Debt forgiveness - The Greeks are hoping to catch a break at the moment with their plan for debt restructuring, but the idea of mass debt forgiveness, which is an ancient tradition, hasn't gotten a lot of traction as a public policy idea.

Except in Croatia.

The Government there this week started wiping the debts of its poorest 317,000 people who have debts that stop them from having a bank account.

It applies to people with debts of less than US$5,100 and a monthly income of below US$138. That makes it very targeted and only for the poorest, but a fascinating idea.

The Croats have done their sums and worked out that the financial freedom to earn and bank and spend will actually make the policy pay for itself.

It's extraordinary in quite a few ways.

And thought provoking. I'm not suggesting it for here, but it's worth thinking about around the issue of debt and poverty and, more broadly, economic growth.

Here's the details via the Washington Post:

Although the program is expected to cost between 210 million and 2.1 billion Croatian kuna ($31 million and $300 million), according to conflicting reports by Austrian press agency APA and Reuters, the Croatian government expects economic long-term benefits that will outweigh the short-term investment. Prime Minister Zoran Milanovic has convinced multiple cities, public and private companies, the country's major telecommunications providers, as well as nine banks to clear some of their citizens of their debt. The government will not refund the companies for their losses.

Overall, the debt of all Croats amounts to $4.11 billion -- and the debt that is about to be wiped out accounts for about 1 to 7 percent of that. However, for those who are eligible the agreement will make a significant difference by enabling them to gain access to their bank accounts. By reducing debt by less than 10 percent, Croatia frees nearly 20 percent of the country's debtors from their obligations.

2. What would retail sales and savings be? - If New Zealanders didn't gamble so much money away. This Economist chart showing New Zealanders are the fourth highest gamblers in the world after Australia, Singapore and Finland surprised me.

3. Yet more money printing - The Americans have just stopped, but the Europeans are just starting and the Japanese will never stop.

Now it's clear that China is getting ready to ease its monetary policy to pump more cash out into the world to offset a sharp slowdown in lending by the 'shadow banks'. The authorites have cracked down on these shadow banks over the last year, but now they're realising it has slowed money creation and economic activity.

So the People's Bank of China is expected to push hard on the pump. Here's the FT with the latest on China's shadow banks:

Data released last month by the People's Bank of China show that credit creation from all sources fell 6 per cent in 2014 from a year earlier, only the third annual decline since collection of data on “total social finance” started in 2002. This fall reflects the slowing growth of non-bank lending, analysts say.

The regulatory push against risky practices has set the stage for targeted monetary loosening, following GDP data showing China growing at its slowest pace in 24 years in 2014. The drive “should help provide [the PBoC] with more flexibility on future monetary policy with less concern on the potential negative ‘side effects’ if further easing is needed,” Richard Xu, China financials analyst at Morgan Stanley, wrote last month. Indeed, the central bank in January confirmed market rumours that it had recently injected fresh cash into the banking system via its newly created medium-term lending facility.

4. 'They should try 'Grexit' - So says Roger Bootle in this well argued piece. The Greeks themselves don't want 'Grexit', but they may get it anyway because the Germans think the eurozone is now safe from contagion. Good luck with that.

To prevent a banking collapse, the Bank of Greece would have to replace the euro with a new Greek national currency, call it the new drachma. Not only would this enable the Greek central bank to support the banking system but Greece would also, once again, have an exchange rate between its money and everyone else’s. And that exchange rate would undoubtedly drop considerably. “With one bound, he was free” etc, etc.

But not quite. Although coming out of the euro and letting its new currency fall dramatically on the exchanges would, in my view, give Greece a realistic chance of escaping from its current dreadful situation, in the first instance the effects of euro withdrawal could be decidedly unpleasant.

The point of having your own currency is to effect a change in domestic prices relative to prices abroad. The first element in the process bringing about this result is a rise in the price of imports, reflecting the weaker currency. If the new drachma fell by 30 or 40pc, which I think is fully plausible, then there would be a very substantial rise in the price level.

5. Big problems in big China - The Australians just cut their cash rate because of a slump in demand for iron ore and coal from China, which is due to a sharp slow down in construction, which is in turn because of signs of over-supply and falling prices in the apartment market, particularly in the smaller cities.

That means there's a bunch of property developers are either about to go bust or are now going bust, whether it's quietly or loudly.

Here's Josh Noble with the tale of Kaisa's demise. It's one of the biggest apartment developers in China:

Kaisa said on Sunday that, because of its “distressed debt position and financial difficulties”, the proceeds from the sales would be used to increase cash flow and “secure the company’s daily operations”. Kaisa has about $2.5bn of offshore debt outstanding.

Kaisa’s troubles began at the start of December when the local government imposed a sales ban at some of the company’s projects in Shenzhen.

The departure of the chairman and biggest shareholder Kwok Ying-shing soon after then triggered a bank loan repayment, which the company missed. Kaisa subsequently failed to pay a coupon on its offshore bonds, prompting local creditors to ask the courts for freeze its assets across China.

A number of other developers have since announced they too are the subject of sales bans at some projects in Shenzhen.

The rapid escalation of problems at Kaisa has rattled Asian bond markets, cutting off a vital funding route for many of China’s highly indebted property companies.

6. Speaking of China - New Zealand takes a very benign view of China's ambitions, as has much of the world since Nixon 'opened up' China to the world in the 1970s.

A new book from a Mandarin speaking US foreign policy expert that says China is playing a long game to take over the world looks like a fascinating read. It could be a hawkish call to arms for the Americans, but it seems to have lots of new details from behind the scenes.

For more than four decades, Chinese leaders lulled presidents, cabinet secretaries, and other government analysts and policymakers into falsely assessing China as a benign power deserving of U.S. support, says Michael Pillsbury, the Mandarin-speaking analyst who has worked on China policy and intelligence issues for every U.S. administration since Richard Nixon.

The secret strategy, based on ancient Chinese statecraft, produced a large-scale transfer of cash, technology, and expertise that bolstered military and Communist Party “superhawks” in China who are now taking steps to catch up to and ultimately surpass the United States, Pillsbury concludes in a book published this week.

The Chinese strategic deception program was launched by Mao Zedong in 1955 and put forth the widespread misbelief that China is a poor, backward, inward-looking country. “And therefore the United States has to help them, and give away things to them, to make sure they stay friendly,” Pillsbury said in an interview. “This is totally wrong.”

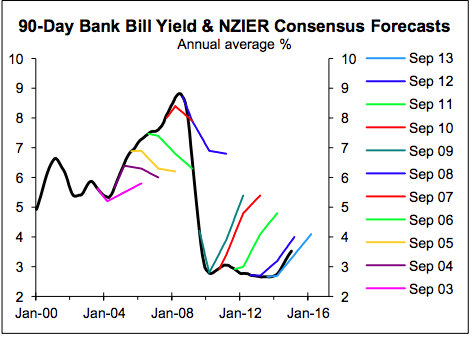

7. Wrong again - The surprisingly weak inflation and now talk of rate cuts here is again raising questions about all the economists who predicted fast rising interest rates, and therefore said fixing for long terms was a good idea. To be fair they were wrong the other way around from 2002 to 2008.

Rodney Dickens has an excellent paper of his own on the issue of forecasting interest rates and fixing.

This chart tells the story of how economists were surprised by how much and how high interest rates rose from 2002 to 2008 and then how little they rose after 2008.

I'm sure people will throw my 30% house price fall prediction back at me (fair enough), but I've consistently thought for the last four years since all the money printing started that interest rates would stay lower for longer than many thought.

When central banks and Governments bailed out banks and started printing money to offset endemic deflation, this changed the equation on both interest rates (low and falling) and asset prices (high and rising). That willingness to ignore moral hazard and conventional monetary thinking certainly blew my 30% prediction out of the water. Just imagine if the central banks and Governments had not acted in the way they did from 2008 until now.

8. More currency wars - Further to the theme of unending central bank money printing and currency wars, the Danish central bank disclosed overnight it had intervened heavily to keep the kroner down amid capital flight out of the Euro zone into anything nearby that isn't falling..

The Swiss gave up in the end. Let's see how long the Danes last, and everyone else for that matter once the Europeans and Chinese get going again.

9. Differing perspectives - American Sniper is packing out movie theatres everywhere, but this account by another American sniper in Salon is a sobering antidote.

When I heard of the bigoted reaction some Americans had after watching the film, I was disgusted, but not surprised. Audience members are mistaking Chris Kyle’s view of the war as “the” story about the war. No wonder someone tweeted that the movie made them “want to go kill some ragheads.” It’s sad that such a nearsighted portrayal of Iraqis has caused more people to fear Arabs and glorify violence against them.

10. Totally Clarke and Dawe on Tony Abbott's knighthood for Prince Phillip, which may turn out to be a career ending decision. And not for Prince Phillip.

38 Comments

I don't see the Greeks have anything to look forward to. Greek debt GDP now is about 175%, the IMF in 2010 was forcasting a peak of 149% in 2012-2013. Even the worst case scenario from the IMF had debt peaking at 178% but not until 2020. Trying to solve a debt crisis by adding more debt, is batshit crazy.

They are getting ready for the Grexit, don't listen to the talk, look at the situation objectively and understand that they have no future in the Euro without massive default, which they have already tried and it didn't work then, wont work now. In addition Spain is watching carefully, with a new government later this year. The Euro can't handle the number four economy demanding a default, which they will if Greek gets one. That kind of loss will destroy the equity of too many banks.

The Grexit will be sudden, they can't afford to pre-annouce the descision, or give any hint. Just like the swiss had no choice but to make a surprise announcement effective immediatley.

Of course they could fold and go back to being the Troika's puppet, but thats not the mandate they promised, and I expect that to end worse then a Grexit.

from the bloke himself

the bbc newsnight makes you wish for Paxman, here is how he did the Iceland situation (similar)

https://www.youtube.com/watch?v=e2VuElk5_Bg

and then looking back

http://www.telegraph.co.uk/news/uknews/10799634/Jeremy-Paxmans-top-five-moments.html

Interesting, and they were promsing an eternity in purgatory for Iceland, now they seem to be doing quite well.

Another issue for China, smog - http://www.theguardian.com/world/2015/jan/28/beijing-smog-unliveable-ma…

Even former Greenpeace exec. finally sees sense on GM crops. Even admitting Golden Rice is a good GM crop. I wonder what new scare story is being cooked up to keep the money rolling into the coffers?

Genetically modified crops: Time to move on from theological dispute.

http://centreforeuropeanreform.blogspot.co.uk/2015/01/genetically-modif…

Need more research I think, vested interests and all that.

"On the downside, GM can also produce crops which are able to grow with more pesticide being sprayed on them without being damaged. This trait is less desirable than pest resistance because it might lead to greater use of pesticide: farmers would not need to worry about the chemicals damaging the crops. Increased pesticide use is of benefit to the agrochemical industry but not necessarily to wider society, and certainly not to wildlife. GM crops should be treated as a series of proposed technological changes, to be assessed and regulated on a case-by-case basis."

Only 2 million deaths and 1/2 a million children blinded from vitamin A deficiency so no hurry eh? What is the vested interest and all that with golden rice? Its free for anyone to grow it. The only vested interest I can think of is the "green" scare industry.

I'm sure the 1/2 million blind children this year will give a toss about pontifications like "might lead to greater use of pesticide". "Might" vs dead or blind. Tough call.

Go ahead and release Golden Corn, I am not arguing against that if the research is so conclusive. But are you suggesting lifting the ban on all GMO? I hope not ...!?

37 Million Bees Found Dead in Canada After Large GMO Crop Planting

While many scientists are still unconvinced that “colony collapse disorder” (CCD) is caused by neonicotinoids, there has been a consecutive die-off of bees in the U.S. for seven years now – directly correlated to higher insecticide spraying.

I agree the former Greenpeace chap case by case basis. In this case the benefits far outweigh any perceived risks.

Nobody is stopping those countries that need it from growing it. Do we need it in NZ? Not at all. It's hard to see why you are freaking out.

He's pushing his agenda. Watch out for the context and small print, he usually distorts the "truth" to say the least.

Put away the tinfoil hat. Get a tad bored commenting on Auckland housing that's all.

Ample evidence of your distortions, lies, mis-quoting and out of context in your posts.

Steven I take issue with this comment. I am not a liar nor do I have and political or vested interests. I simply disagree with your malthusian world view. Get over it.

In all your "ample evidence" can you provide a single example of when I have not provided a link when asked by you or anyone else.

I enjoy you calling me names as in most cases that's all you've got but calling me a liar is not cricket.

Lots of your posts repeatedly link to obsolete articles despite being pointed out as such and you take comments of others out fo context frequently.

Link well lets see I dont have to go far, I one above. I didnt say you didnt link I said as per my first sentence above.

Second, I didnt mention vested interest above, you did.

third, politically you do not agree with my "malthusian" views since your view isnt based on math or science what is it based on?

So you can't justify your smear that I am a liar. Thought as much.

The article I posted above has a link - what on earth are you talking about? Here I'll post it again for you in case you missed it. Let me guess you commented on a link without bothering to read it first.

http://centreforeuropeanreform.blogspot.co.uk/2015/01/genetically-modif…

PS I have no problem with you disagreeing, what I do take exception to is how you justify it.

Maybe he's withdrawn his money from shale oil companies now they're going bust and moved it to Monsanto! :-P

Considering that our brand differenctiation was quality food and green image, and our customers are all saying they don't want GE or GMO products I think that's pretty clear.

And other countries have their own evironment and sovereign right to do things how they need to. Personally I think Vitamin A tablets aren't expensive to make and distribute easily - once your people stop killing each other, and the official stop stuffing the money in their own/each others pockets.

Agree.

If tablets were such a great idea we wouldn't see million of people dying of Vitamin A deficiency annually. Rice on the other hand is free to distribute by peasant farmers themselves rather than relying on "officials".

NZ's market image is a different kettle of fish.

Except there is concern that we may end up with no bees and no food, cause related to GM crops.

Gambling chart is probably nonsense. Singapore heavily restricts entry to local citizens, $100 dollar fee per visit just to get in - Id required etc.

The number probably reflects non resident gambling which is probably huge in Singapore

Re 1: Debt forgiveness, but only for the poor. What an amazing idea. That will surely increase money velocity and stimulate the economy much more than US style QE stimulus. On the other hand the top 1% won't like it at all. Investors in harmoney in NZ wouldn't like it either!

creates moral hazard and no actual change to circumstances.

Why not just give them a few new TV, DVD's and Fastfood vouchers and cut out the middle man.

For sustained effect you need to alter the conditions to one which favours positive change to a better environment. eg When we final got the message through to the councils to tell farmers that effluent was a good quality free spreadable fertiliser, in 2 years many farmers had brought the gear to get the free fertiliser and trying to work out how to best use it. Councils had been bullying and threatening for 15 years to do the same effort and meeting only resistance - resistance because the expense couldn't be justified...but free fertiliser justifies it.

The moral hazard only exists if the population sees the debt forgiveness coming, which probably wasn't the case there.

Cut out the middleman, why not just give the money directly to the Goldman sax, the bankers, and the top 1%. We saw how that worked. Organically stimulating a debt saturated economy from the bottom up is a worthwhile approach, and one which probably won't drive up already overpriced assets.

I take your point with the cow poo analogy, structural reform towards efficiency is always good.

"debt forgiveness coming"

"a worthwhile approach"

as per Steve Keen.

It is going to come IMHO, aka 19th century style and their economies didnt collapse ie moral hazard from it from what I can see.

agree.

you are incorrect regarding the moral hazard. do you testing properly - you are so wrong that your comments lose integrity.

re:middleman Because that isn't cutting out the middle man, that reducing the velocity of money which is what tax and interest do.

Stimulating an economy from the bottom up does work. Ejecting effluent nutrients into subsoil only toxifies the soil via anaeroic bacterial action ... ie only the elements that already harvest in that environment will flourish, because they are the ones adapted to that environment. You will just empower poor consumerism, enable addicts and timewasters so the only thing that will flourish is those that are already setup to prey on such activity.... as a poor landlord with cheaper holdings I'm not entirely adverse to the suggestion, and my psychic side foresees rent rises (and rising house prices) in the near future....

In some ways that's what councils are doing by over subsidising that lifestle of people who don't want to pay for what they consume....just allows them to consume elsewhere, distorting the market in favour of not payers and supporting not-paying-wage situations.

To change it, the whole fertility for the situation must be address. The pH in the market which encourages some invasive weeds (banks), and foreign parasitic action, must be adjusted so that the preferred growth can survive. If the conditions exist life will eventually take root - if the conditions are toxic, only those that are toxic will thrive. No matter how much chemical and artifical support is artifically supplied.

BTW, My dairy farm was only just starting to get effected by the drought. We have shifted to "drought maintenance" for 3 days before the rains hit. This is because I use pasture mixes and systems which honour good moisture retention and reduce undesirable loss. It never looks like the best performer, nor the worst, but it is the most self sustaining.

nope, I dont see it. With regard to the Croatians 5K of forgiven debt. You'll have to explain to me where the moral hazard existed.

As per Steve Keen I think Debt jubilee's will make a come back.

I even like the idea of how he suggests its done, ie you give everyone $100k but that has to first pay off mortgage debt after that you can spend it.

So creditors get their cash (if devalued a bit) a one off spending boost into the economy (aka USA style tax rebates) debt is cleared and the system is no longer in risk of collapse.

yes I totally agree. The oligarchs might even tolerate this as a last resort, if the alternative is unpalatable.

Nah you'll just go bankrupt and those with good credit, or cash will buy your assets on the cheap. As per Greece. Long term I don't see the government having the ability to fund a debt jubilee or the political power to enforce one on the banks.

Systems based solutions rarely work in real life. Outcomes based solutions are more effective. Prudent financial education and tighter lending criteria would prevent the situation where people have too much debt in the first place.

When its a few, yes, when it becomes a substantial part of the voter base I am not so sure.

Funding it is easy they just "print" the few billions needed and hand it out as a "tax rebate".

The Govn can force anything it wants on the banks including nationalising them. Frankly the debt jubilee I am taking about will be after OBR/ bank bankruptcies anyway so I suspect we the NZ govn will own their sorry asses lock stock and barrel.

'too much debt" we are passed that, long past.

System based ideas would work if they targetted the nature of the problem.

Outcome based solutions appear to work because they act directly on the KPI markers involved...eg debts would drop, spending would be up. But it would be like the councils when they went to capital vs land rating, it meant they're cashflow outcome was immediately solved. They coul dhave gone to a system based solution and targetted specific ratings towards wealthier areas of revenue... But the real problem is simply that they are spending more than their community can afford - so until _that_ is changed everything else is can kicking at best.

Put 100k of all mortgages, you've just created a security boost for more property bidding. And only those whom have mortgages would have benefitted, so now you've removed their risk and proven that it's a "too big to fail" bonus earner.

You want to inject funds (1) work out which areas will create sustainable payback, because you'll the payback plus increase to (2) work out where the future cost recovery is coming from. You can bet that as many smaart investors as possible will be leaving (2) by droves or positioning to pass on the costs - and we have created a current system that thrives on passing on costs, because our costs that need to passed on are so significant that to not do so is financial suicide.

"Debt forgiveness, but only for the poor. What an amazing idea. That will surely increase money velocity and stimulate the economy much more than US style QE stimulus. On the other hand the top 1% won't like it at all. "

Therefore, chances of that happening ... nil.

We have not as yet got to such a desperate point that such ideas will have any traction.

Give it 2 or 3 years of the "Great Shrink" and I think it will pass.

actually 1% would love it - they know the money would all be back in their hands within 5 yrs, and they'd be charging the government (via interest or tax write-offs) for every cent.

Actually I believe the US runs a variant of that called the "FED"

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.