Here's my Top 10 items from around the Internet over the last week or so. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read is #7 on the US$4.5 trillion of US dollar lending in Asia since the Lehman Crisis, and what might happen to it now the US may be about to raise rates.

1. 'Gold digger' tours - This Bloomberg piece on Chinese investors touring American cities in private jets and Rolls Royces on the hunt for property deals is a laugh.

It turns out there is quite a market for this and real estate website SouFun, which organises some of these tours, says it has organised tours to New Zealand (although the jets and cars aren't mentioned).

The detail about how decisions to invest are made and how overseas property is marketed is fascinating.

Some countries have responded with fresh limits on buying or taxes, including Canada, Singapore and Australia.

The Singaporean curbs have been particularly effectively, causing sales to drop 48% and prices to drop 4%, Bloomberg reported.

Here's the detail:

Some Chinese investors don’t need the support of international real-estate networks. Take Lynn Lin, 36, who said she first arrived in New York from China last year on a sightseeing tour. Then she met a Chinese-speaking broker, who showed her a three-bedroom, 2,152-square-foot (200-square-meter) condominium on Manhattan’s Upper East Side. Lin, who already owns three homes in Shanghai, bought it for $4 million -- in cash.

“People usually come to the U.S. shopping for luxury bags or expensive clothes, but I bought a home,” said Lin, who owns a petrochemical export business in the eastern Chinese province of Zhejiang. “Maybe I’m crazy and a bit impulsive, but it was a better deal than buying a similar type of home in downtown Shanghai. And I just really like the city. It’s as simple as that.”

2. No questions asked - Bloomberg Markets Mgazine reports here on the amazing story of St Kitts, which has turned itself around from being the third most indebted nation in the world with one of the world's highest murder rates into a Caribbean tax haven. It says a lot about the world right now.

It's all thanks to selling citizenship and one Swiss immigration consultant called Christian Kalin.

Thanks to Kalin, St. Kitts has become the world’s most popular place to buy a passport, offering citizenship for $250,000 with no requirement that applicants ever set foot on the island’s sun-kissed shores. Buyers get visa-free travel to 132 countries, limited disclosure of financial information, and no taxes on income or capital gains. The program became so successful that St. Kitts emerged from the global financial crisis far ahead of its neighbors in the Caribbean. “It’s been a complete transformation,” says Judith Gold, head of an International Monetary Fund mission to the country.

Soon, prime ministers from around the world were seeking Kalin’s advice, in the hope he could reproduce the magic of St. Kitts, where he effectively created a resource out of thin air for a nation that had few. Many countries allow wealthy foreigners to buy residency cards through what are called immigrant investor programs, but before the financial crisis, St. Kitts and another Caribbean island called Dominica were the only ones selling citizenship outright. Since then, another five countries have gotten into the game. More are coming.

The business Kalin pioneered has its share of critics, who say it gives the wealthy more room to avoid taxes and provides safe harbor to people who made their money illegally. “We’ve created over the past 50 years an entire shadow financial system that helps people hide money,” says Raymond Baker, president of the Washington-based advocacy group Global Financial Integrity. “This is a new wrinkle in that.”

I couldn't help but think about the Wolf of Wall St while reading this.

3. Falling Chinese prices - Prices on the factory floors of China are falling, the FT reports. This helps explain why China is frantically easing monetary policy and interest rates and prices are dropping around much of the developed and developing world.

China’s official producer price index fell 4.8 per cent last month from a year earlier, an accelerating decline from the 4.3 per cent drop in January and the worst result since October 2009.

The PPI, often regarded as a leading indicator for consumer prices, has now been in deflationary territory for three straight years thanks to sliding domestic demand and chronic overcapacity in many sectors.

4. Falling Chinese wages? - We know that China's economic growth is slowing as the construction sector slows to absorb all its surplus capacity, but could things be more serious than that?

It's fiendishly difficult to generalise or know anything with any great confidence given the variations in the economy and the lack of reliable data.

But this Shanghai Daily piece from a survey by recruitment portal Shaopin.com seems to suggest wages are now falling in the big cities. If that's true, then something more substantial is going on. And we shouldn't forget China is our largest trading partner and our second largest trading partner's largest trading partner.

Shanghai’s average monthly salary was 7,108 yuan (US$1,135) while Beijing was second with 6,585 yuan and Shenzhen with 6,285 yuan came in third, the survey covering job postings on the website after the Spring Festival found. But Zhaopin.com didn’t reveal the sample size of the survey yesterday, citing business reasons.

But the average salary in Shanghai fell from last year’s 7,214 yuan in line with the 6 percent decline from a year ago to 6,518 yuan in the four largest Chinese cities, the survey showed.

5. Data galore - Smartphones are transforming industries and economies as we speak. Here's Buzzfeed with one called Premise that could radically change the business of economic data collection, particularly of prices.

The picture below of Chinese food prices collected by Premise is certainly telling.

“A picture can be worth about 1,000 data points,” said David Soloff, co-founder and CEO at Premise, and with potentially “billions of photographers around the world,” the possibility for new, radically different ways of measuring economic activity are emerging.

6. Can kicking Chinese style - Bloomberg reports on a Chinese Government directive to local governments weighed down by US$3 trillion in debt. It says they should deal with it later.

The Finance Ministry issued a 1 trillion yuan ($160 billion) quota for local governments to convert maturing high-cost debt into lower-yielding municipal notes to be repaid at a future date, according to a March 8 statement. Questions left unanswered include whether investors will be forced into the swap, how much transparency there will be over assets involved and whether the liabilities will strain the nation’s finances.

Not so much laundering - Here's a fun chart showing what's happening in the money laundering part of China: buying of jewellry and gambling.

7. The biggest currency margin call in history - Tomorrow morning's FOMC statement is being closely watched for any signs the Fed will start hiking US short term interest rates from June. Just the talk of it has been enough to put a fire under the US dollar.

The combination of higher interest rates and a higher US dollar will make it much harder for those who borrowed in US dollars but are servicing it with another currency.

Ambrose Evans Pritchard uses a BIS paper to show how big an issue this is for emerging markets, given the three rounds of US Quantitative Easing flooded the world with cheap money and now it's flooding back to America. Asia is particularly vulnerable, it seems.

This abundance enticed Asian and Latin American companies to borrow like never before in dollars - at real rates near 1pc - storing up a reckoning for the day when the US monetary cycle should turn, as it is now doing with a vengeance.

Contrary to popular belief, the world is today more dollarized than ever before. Foreigners have borrowed $9 trillion in US currency outside American jurisdiction, and therefore without the protection of a lender-of-last-resort able to issue unlimited dollars in extremis. This is up from $2 trillion in 2000.

The emerging market share - mostly Asian - has doubled to $4.5 trillion since the Lehman crisis, including camouflaged lending through banks registered in London, Zurich or the Cayman Islands.

Although this chart below explains why long term bond interest rates are so low and why stock markets are at record highs. Central banks have been buying so much there's not much left to buy. Although one thing central banks haven't been buying is property, which might explain the elevated prices...

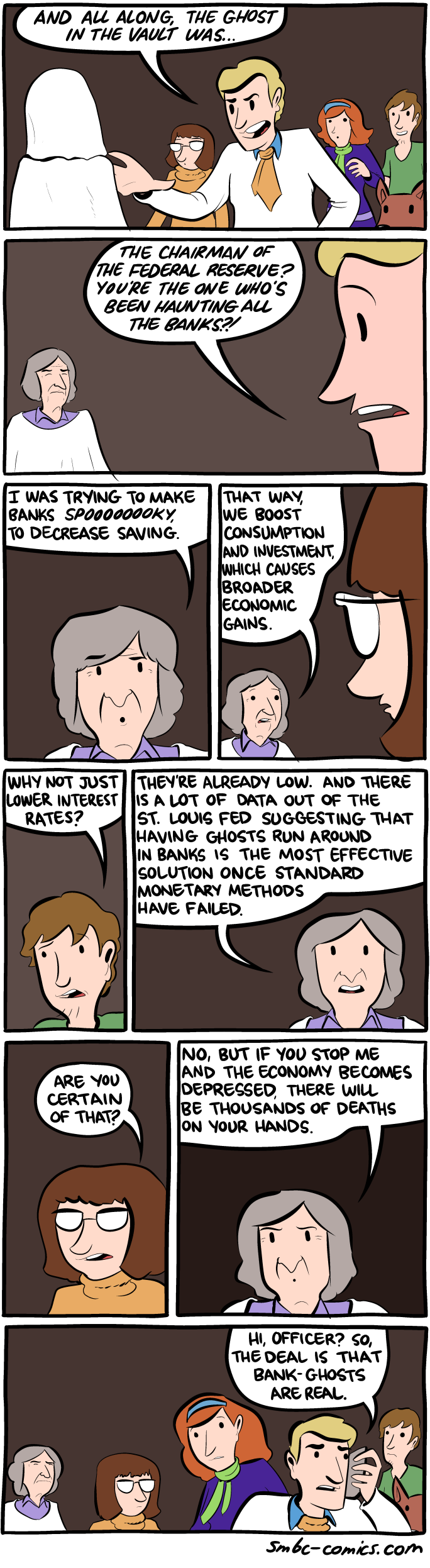

8. Scooby Doo and the Federal Reserve Governor - I couldn't resist it.

9. Australian superstars - It turns out Australians are the best in the world...at having more household debt to nominal GDP than anyone else, Barclays reckons.

The first chart tells the story with Australian household debt at 130% of nominal GDP. By the same measure, New Zealand is just under 80%. Same banks, by the way...

The second chart is also startling, showing how loans to landlords in New South Wales (which means Sydney) doubled to A$60 billion inside two years...

"With high levels of leverage by world standards, where debt is concentrated in the household sector, we see this as a vulnerability in the event of another global shock," Mr Davies said.

"However, we do not see this as a near-term issue for the economy as we expect leverage to reach new highs over 2015 on the back of lower interest rates."

10. Here's an older one from Clarke and Dawe on Quantitative Easing. Very apropo given #7 and most of the rest above and that 2015 will be the biggest year for QE since QE III in 2011. Big like a Bofors gun facing the window.

You gotta stand well back....

4 Comments

Re; #7 The combination of higher interest rates and a higher US dollar will make it much harder for those who borrowed in US dollars but are servicing it with another currency.

My lazy skim through the attached documents failed to note any currency hedging strategy comment attached to voluminous copy detailing increasing numbers of foreigners borrowing more USD.

Cross currency basis swap hedging techniques underpin the foreign funding aspect of extended loan to domestic deposit bank asset growth ratios in New Zealand. And while interest rate rollover risk is a potential unhedged problem currency exposure certainly is not.

The RBNZ Financial Stability Report page 20 of 60 goes to reasonable lengths to emphasise the fact. Are we the only clever clogs nation in the globe that recognises and mitigates foreign currency funding mismatch risk?

Could be SGD and RMB loans which will need to be paid off at highter cost...then these might liquidate assets, with a (small) knock-on effect in NZ?

Maybe some housing stock owned by non-residents will get sold off?

.

We'll see.

.

We've done CSWs in AUD, USD, NOK. None in Asian currencies, but then our trades could be BtBs

Someone talking to the AFR thinks Aussie and NZ interest rates will fall further and faster than markets are predicting.

AFR on Australian (and NZ) dollar values, and interest rates.

Mr Miller (of BlackRock) said he thought the local currency would continue to depreciate.

"In Australia, we still have significant headwinds to growth. I still look at those capital expenditure numbers from a couple of weeks ago and what they portend in the future is very challenging," Mr Miller said.

"The downside risks to growth are probably a little bigger than perhaps is commonly appreciated."

Mr Miller reckons the Australian dollar will be about US70¢ by the end of 2015 and may possibly push lower next year with consumer confidence, capex and commodity prices remaining weak.

"I think we'll have two further rate cuts this year, and if that's wrong I think it could be three, not one," Mr Miller said.

The market is currently pricing in a 35 per cent chance of a rate cut in April.

Capital Economics chief Australia economist Paul Dales said that any signs from the US Fed that it is close to raising rates will see the Australian dollar weaken, however not as dramatically as it did in 2013 when the US central bank flagged it would taper its QE program.

"But we think that any falls will be sustained. Indeed, our forecasts that the Reserve Bank of Australia and Reserve Bank of New Zealand will cut interest rates further than the markets expect are broadly consistent with both the Australian and New Zealand dollars falling below US70¢."

There are just over 7,000 NZ properties on the Chinese Real Estate site mentioned in the gold digger article.

Here http://www.juwai.com/NZproperty if you have Chrome you might be able to translate some of it.

A lot of the agents on there are NZ ones, Baileys, Barfoot etc. So when they say they’re unsure of how many foreign buyers are purchasing property in NZ, are they not full of it?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.