Here's my Top 10 items from around the Internet over the last week or so. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read is #1-8. Actually click through to the link and read all 61 pages. I dare you to. :)

1. Please read this - The OECD survey of New Zealand out today is a must read for anyone who wants to understand how our economy and society is performing and how to improve both.

It's essential argument is that New Zealand's economy and its collective wealth could be significantly improved by investing in ways to reduce the poverty and improve the health and skills of New Zealand's poorest people.

It suggests a whole range of perfectly conventional things to improve the situation of our poorest in a way that also makes the entire economy more productive and healthier.

The suggestions include increasing the amount of social housing (particularly in Auckland), increasing benefits, easing restrictions on building density in Auckland, introducing congestion charging, finding other ways for councils to pay for infrastructure and comprehensively attacking the obesity epidemic.

Perhaps not surprisingly, the Govenrment started doing some of these things in the Budget, including the benefit increases and the tentative moves towards actively intervening to build more social housing. There is a lot more to do.

Right at the heart of it are a large number of mostly young New Zealanders.

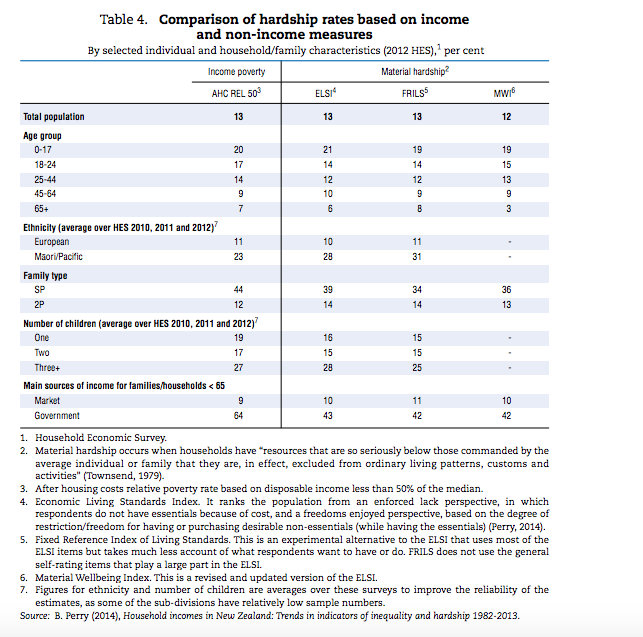

The scale of the gap between the young and the old is enormous, as this table showing the percentages of New Zealanders who are in poverty by a variety of measures. Anywhere from 14 to 20% of 0-24 year olds are living in poverty, while 3 to 7% of those over 65 are in poverty. The 3-7% is still too much, but the most resources need to be focused on the young.

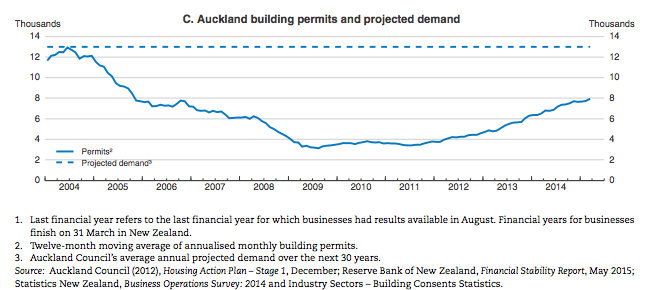

2. Mind the gap - The OECD makes a particular point of focusing on Auckland's housing crisis.

This chart showing just how far housebuilding is behind the curve implied by current population growth.

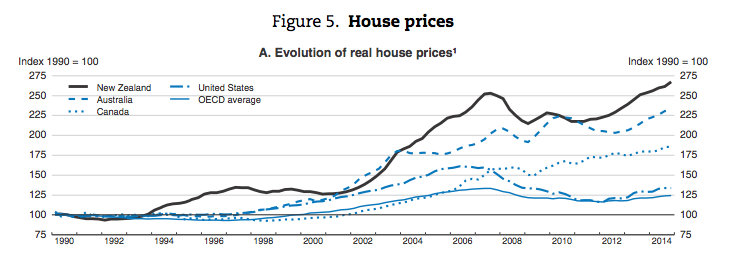

3. We're special - This OECD chart showing New Zealand with the best/worst performing real house prices in the OECD is startling. We're very special in a very good or very bad way, depending on how short/long you are on Auckland housing.

4. 'Please someone tell Auckland's NIMBYs to allow more dense development' - When even the OECD is worried about what the old and the rich of Ponsonby, Grey Lynn, Mt Eden, Remuera and Parnell are doing to block more intense development you know the issue has gone mainstream.

As a large share of planned residential development in Auckland is to continue to occur within previous city limits, it will be important to find ways to increase community support for densification. A greater central role in dealing with local objections might take some pressure off municipal governments. Freeing up public land could also make way for further developments, particularly of affordable dwellings.

5. 'Tax the land bankers' - The OECD also goes into a lot of detail on how Councils (and it's mostly Auckland we're talking about) could get more money to invest in infrastructure such as water, roads and public transport.

With the central government concerned to reduce its debt, meeting these infrastructure needs will have to focus on diversifying funding sources. Local and national roads could make greater use of tolls, and Public-Private Partnerships could make more efficient use of resources. For core water infrastructure, long-run marginal cost pricing would ensure funding for capacity expansion and future upgrades but would require increasing water prices, which might be politically difficult.

Local councils could also consider greater use of debt financing of their infrastructure needs, since the benefits extend over several generations. However, this would require increasing debt-servicing capacity. Options that could be considered include: i) sharing in a revenue base linked to local economic activity; and ii) taxing the windfall gains that accrue to landowners from rezoning land for urban use.

6. Invest in trains and buses - The OECD also goes on to say some of the congestion charging money could be used to invest in rail and bus infrastructure.

While additional investments in road infrastructure will probably continue to provide net benefits (New Zealand Treasury, 2014b), there are ways to better manage demand. Charging higher road tolls at peak times could spread road use towards non-peak hours. Funding additional public transport infrastructure would provide other options for commuters, reduce road congestion and help lower greenhouse gas emissions.

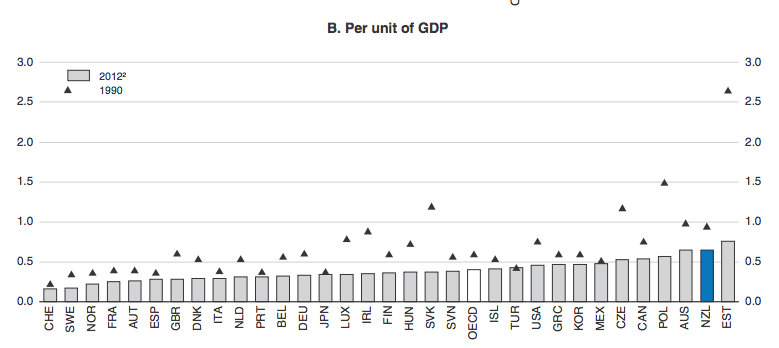

7. What a bunch of radicals - The OECD also goes on to spend a lot of time hammering New Zealand's record on carbon emissions and the risk of deteriorating water quality from the rise of dairying. Remember that this is the OECD, the arbiter of all things sensible in the world of economic policy makers.

It points out New Zealand is the second worst in the OECD when it comes to Greenhouse gas emissions per unit of GDP. We're the fith worst per capita.

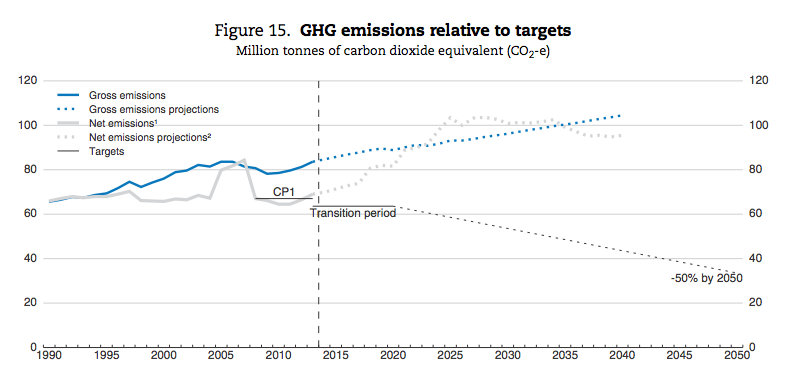

8. Mind the gap II - This chart showing the projected gap between New Zealand's projected greenhouse gas emissions and the necessary reductions is an indictment of previous policy.

Given the scale of agricultural emissions in New Zealand and the existence of some, albeit limited, abatement possibilities, as evidenced by the wide range of emission intensities among producers in each subsector (Ministry of Agriculture and Forestry, 2006; Boston and Chapman, 2007), the government should develop a strategy to cut agricultural GHG emissions efficiently (taking into account administrative costs) through some combination of pricing, regulation and R&D.

10. Totally Clarke and Dawe - Leslie Miserables has a few things to say. Mostly questions.

15 Comments

wow, have aliens invaded and the ppl at the OECD have been totally replaced? ie what happened to their free market mantra?

They have been taken over by the Social Justice Warror's, like most NGO's.

Don't be fooled Steven. They say Public Private Partnerships (privatise the profit socialise the debt). Toll roads, privatise water and put up the charges, congestion charges, etc etc etc.

They are a wolf in sheeps cloths. The extra benafit is to pay for these extra privatised charges.

You're giving us too much homework, Mr Hickey.

...and in countries that have actual poverty - the less than $5/day type poverty rather than some politicised term of "poverty" - things are on the improve.

"Workers in poor countries have never had it so good."

http://www.economist.com/blogs/graphicdetail/2014/05/daily-chart-18

which workers?

Oh dear cherry picking again. If you earn $5 a day and it costs you $4 to live you are a rich man/woman. If you earn $30,000 a year and it costs $30,000 to live you are penniless.

As it says "most new jobs in the developing world are likely to be of sufficient quality to allow workers and their families to live above the equivalent of the poverty line in the United States"

On top of that those jobs being created offshore make home employment worse pushing ppl on to benefits, hardly a quality lifestyle.

Yes the 3 billion people represented on the chart were a "cherry pick". You got me. Well done.

Going by your logic better we keep those people on $2/day so kiwis don't have to go on welfare? Most likely all those jobs created off shore increase the demand for fridges and milk benefiting NZ.

#4: I have noticed that David Seymour is quite vocal about reducing the pressures on housing in Auckland by releasing greenfield sites on the margins. He has been noticeably quieter about making it easier to increase densification in Epsom. Selective libertarianism, these Act MPs practice!

Inflation......bigger bureaucracy.....increase in personal bankruptcies, higher interest rates......less efficiency in the economy, increase in people in lower income bracket......history always repeats!!!

Recall 1929? that wasnt inflationary.

People have to keep borrowing to keep inflation going because it's the bank lending out most it's deposits that creates the money supply. If people stop borrowing the system fails and the wealth vanishes. In 1929 people lost confidence in the system and i have read that property dropped about 50% . If interest rates have to keep dropping towards zero to get people to borrow, it may explain why there is deflation in the world, because individuals are near their debt limit, and if borrowing slows could the money supply be rapidly depleting and is this why some countries are having to keep printing.It's the confidence in the system and our ability to keep borrowing that creates the money supply , does the Auckland property market give us the confidence to borrow? (obviously there are enough believers) Personally I think it is a threat to our financial stability and makes me nervous.

"Exploitation of the underclass is justified by the self-congratulatory pronouncements from the upper class of how much better off their victims are now than they were before these exploitations. By this measure the upper class can ignore the issue of how all people ought to be treated if one were being truly fair, rather than merely making a horrible situation a tiny bit better - and profiting obscenely in the bargain."

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.