Here's my Top 10 items from around the Internet over the last week or so. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read is #1 on the 'gig' economy. Number 7 is exellent too on the three gluts that shape our world: money, savings and oil.

1. The gig economy - This FT piece on how the shift to contract, freelance and consulting type work is changing the the worlds of workers is well worth a read.

It paints a more balanced picture.

There are pros as well as cons.

I'm part of this world now and I can see how it works very well for some, and not for others.

I'm not sure it's a good or a bad thing, but it's certainly a thing we need to understand and plan for. Whether it can be stopped or mutated by any sort of policy is a tougher matter.

The gig economy is only part of a shift in employment over the past three decades, unleashed by technology and global trade. It has created many winners and losers, both by outsourcing jobs from the west to Asia and Africa, and by changing the terms on which most people work. Financial and contractual risk that used to be borne by companies has been transferred to employees.

Yet this world of insecurity and risk is also one that many people seem to appreciate. More self-employed people in Europe and the US report enjoying their jobs than those who are employed. Many entrepreneurs, even those who run a tiny business that amounts to self-employment, like their freedom and self-reliance and the possibility that they could become wealthy.

2. Where do mortgage rates come from? - Local monetary policy matters, but this piece suggests US monetary policy is just as important to UK mortgage rates as UK rates.

That begs the question: how much impact might next month's long-fabled US rate hike have?

UK mortgage rates play an important role in the transmission mechanism of monetary policy, but are they home-grown? UK swap rates are a key component in determining UK mortgage rates. And UK swap rates are highly correlated with those in the US. Putting these pieces together, we show that UK mortgage rates increase by around 50bp on average in response to a 100bp increase in US swaps. This highlights one important channel through which global financial spillovers affect small open economies such as the UK.

3. What happens next with the New Zealand dollar? - Oppenheimer Funds says via this Bloomberg piece that the commodity currencies face a world of pain.

``Compared to the U.S. talk about raising rates and tightening policy, the commodity currencies are going in the exact opposite direction,'' Alessio de Longis, a money manager in the Global Multi-Asset Group at OppenheimerFunds, said from New York. ``These currencies are not cheap by any means.''

De Longis, whose company manages $233 billion, projected the Canadian dollar will weaken 14 percent in the next one to three years. He estimated the Aussie will fall in the same timeframe to 60 cents per U.S. dollar and the kiwi to drop to 50 cents.

4. A wholesale run for the low carbon doors? - The New Yorker looks at what the smart money is being advised to do about climate change. The short answer is sell oil and coal and buy renewable energy.

A perhaps counterintuitive finding of the analysis is that a two-degree Celsius rise over preindustrial times need not, according to the authors, “have negative return implications for long-term diversified investors at a total portfolio level.” This is not to say that assets wouldn’t need to be reallocated. Under such a scenario, the analysts expect gains in “infrastructure, emerging market equity, and low-carbon industry sectors,” which is another way of saying that limiting climate change to a two-degree Celsius rise would require such enormous investments in clean energy—Ceres has called for an annual investment of a “clean trillion”—that it would be hard not to profit as an intelligent first-mover in this market.

Losers like coal, the returns of which, according to the report, “could fall by anywhere between 18% and 74% over the next 35 years,” should be jettisoned to make room for new investments in renewables, which “could see average annual returns increase by between 6% and 54%” in the same period. Even if the world ends up exceeding the two-degree limit (a result that appears increasingly likely: according to the World Bank, we are already locked into a one-and-a-half-degree increase), the report’s authors expect, at some point, a wholesale run for the low-carbon doors, what Anthony Hobley, the C.E.O. of the nonprofit climate-and-finance think tank Carbon Tracker, described in an interview as an inevitable “come-to-Jesus moment.”

5. Delusions of competence - Paul Krugman has a good old spray here at politicians who assume that good economic times were due to their amazing decisions. China is his target.

Politicians who preside over economic booms often develop delusions of competence. You can see this domestically: Jeb Bush imagines that he knows the secrets of economic growth because he happened to be governor when Florida was experiencing a giant housing bubble, and he had the good luck to leave office just before it burst. We’ve seen it in many countries: I still remember the omniscience and omnipotence ascribed to Japanese bureaucrats in the 1980s, before the long stagnation set in.

This is the context in which you need to understand the strange goings-on in China’s stock market. In and of itself, the price of Chinese equities shouldn’t matter all that much. But the authorities have chosen to put their credibility on the line by trying to control that market — and are in the process of demonstrating that, China’s remarkable success over the past 25 years notwithstanding, the nation’s rulers have no idea what they’re doing.

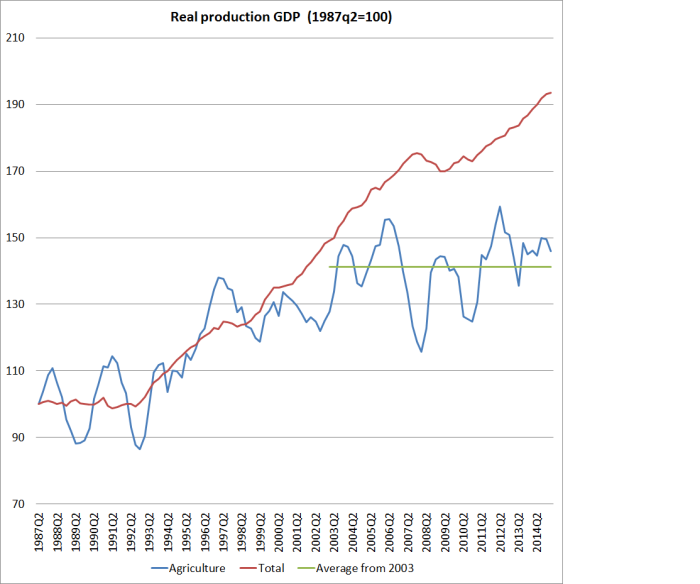

6.Reliance on dairy - Michael Reddell has been blogging up an excellent storm over at Croaking Cassandra. Today he's done a fantastic piece on long-run dairy prices and just how much extra real production has come from our farming sector. It has essentially stalled in real terms in recent years.

The chart is a cracker and he points to a reason why farmers might be increasing production despite the apparent weakness in prices.

In their paper “The intensification of the NZ Dairy Industry – Ferrari cows being run on two-stroke fuel on a road to nowhere?”, presented at an agricultural economics conference last year, Peter Fraser and two co-authors (Warren Anderson, an academic at Massey, and Barrie Ridler,a Principal at Grazing Systems Limited) argue that many New Zealand dairy farmers have been applying anything but the principle of producing until marginal revenue equals marginal cost. I spent quite a bit of time working with Peter during the 2008/09 dairy price crash – I knew about debt but he (at MAF) knew, and taught me, a lot about dairy. I have a lot of time for his (often-trenchantly-expressed) views.

Fraser et al argue that most of the farm models used by farmers and their advisors in New Zealand take an average cost approach rather than a marginal cost approach, which is inducing increases in production beyond the point of profit maximisation.

7.Like Uber but for dairy - Eric Crampton has also been blogging over at Offsetting Behaviour about dairy, but from a different point of view. He suggests a solution to the problem with Canadian dairy producers not wanting to take the up-front pain of relaxing import restrictions. He has a curious idea. He suggests a new tax on dairy in Canada to pay for bonds to buy quota off farmers.

I love it when libertarians propose new taxes ;) It's a clever idea.

8. Three gluts to shape the global economy - Jonathan Shapiro over at SMH has a good piece on the three gluts that will rock our worlds. The comments on a savings glut are fascinating.

From the folks who brought you the "new normal" and the "new neutral", welcome to the world of the "three gluts". That's the descriptive phrase of the global economy offered by global bond fund PIMCO and its newly appointed economic adviser Joachim Fels.

In his first missive since joining the US-based bond fund in February, Mr Fels said global macroeconomic forces would be defined by the "the three gluts" – of money, savings and oil.

Cheap money and energy would spur an economic recovery but an abundance of savings would keep global interest rates in check, Mr Fels said in a note to clients.

"While the global savings glut is likely the main secular force behind the global environment of low growth, 'lowflation' and low interest rates, both the oil and the money glut should help lift demand growth, inflation and thus interest rates from their current depressed levels over the cyclical horizon," he said.

There were several reasons why the demand to save was greater than the demand to invest, Mr Fels said. They were: history, with consumers still scarred by the financial crisis; demography, with savers living longer; inequality, with the rich saving more than the poor; technology, with new companies able to expand with little investment; and necessity, with emerging market companies dealing with capital flight risks.

The savings glut had led to weak demand, which "for a long time slows potential growth and turns into permanent joblessness, while weak investment dents the growth of the capital stock", Mr Fels wrote.

He said if governments failed to fill the demand and if central banks could not force rates down enough, or into negative territory, "they have to resort to blowing pretty bubbles in the financial markets, in order to avoid worse outcomes".

9. Totally John Oliver on the state of Washington DC. He's always good for a laugh and some surprising knowledge.

10. Totally Clarke and Dawe are asking for a recount. Just plain funny.

34 Comments

Steven Joyce fits the "delusion of competence" mould perfectly...

You would have to be pretty deluded...

JJ, so then you can name exactly what Joyce or Key or English or Brownlee for that matter have done that improved the economy greater than what would have otherwise occurred given the economic recovery that was inevitable as interest rates fell (due purely to global financial market conditions) and the massive stimulus from earthquake reinsurance and insurance proceeds and of course the massive stimulus (purely causing an asset inflation bubble) due to Chinese foreign investment and of course the huge growth in stock prices again due to global growth in all stock markets.

You had better have a good list JJ, as I already have a rebuttal list of things they have done wrong which have harmed our economy that is pages long...

#6. "farmers and their advisors in New Zealand take an average cost approach rather than a marginal cost approach, which is inducing increases in production beyond the point of profit maximisation."

mmmh. Worth thinking about.

#8 Three gluts. Could add a 4th. People who have a lengthy education - but are still jobless.

Third world countries these days typically have masses of unemployed graduates. NZ?

Maybe the path to success is rather to ensure we own our enterprises, which often will be small, eg farms.

That will take some taming of the big corporates.

Gee you might have wanted to come up with that idea a decade or so back, but you are right

3 decades ago.....

Your education point is on the money.

I'll use accountancy as an example here. When you have 700 people graduating from Canterbury Uni with a basic Commerce degree (majoring in Accounting as an example) every year (plus all of the other tertiary institutions) competing with

a) lack of accountancy roles compared to graduates

b) competing with those who have completed honours, masters etc and competing with those accountants already working (and unlikely to retire at 65)

c) influx of graduates from overseas looking for work here

d) feeling or knowing that their only option is returning to study because all most of us young people are taught is 'go and complete secondary school, go to uni and graduate, we promise there'll be a job waiting for you (entitlement culture perhaps?)?

e) our primary and secondary school cultures encourages the search for employment rather than entrepreneurial skills, this ties in with point d

f) with our education system increasingly reliant on fees, the advertisements for students run more than ever before and the amount of worthless degrees that appear increases year after year (what's next, a diploma in Machine Operation???) which encourage students to borrow or spend money that could be better of used for shares, travel, property, business building etc.

Then no wonder people are jobless (or jobless in the field of study the paid or borrowed money for) after their education!

I am of the view it will get worse

view this - the need for fees is migrating down into primary and secondary schools now

http://aca.ninemsn.com.au/article/9013106/school-sell-off

The die is cast - when they can't take any more here - where do you think they will go

Lucky Auckland eh? And the bubble goes... Just a lil' bigger then perhaps?

you're not the only one thinking such

The risk of course is that it doesn't and I despair at the concept of my 19-year-old daughter enriching someone else with her bad timing and good intentions and having to work for decades just to make good on the mistake with no value to show for it at the end.

It's not much fun losing money you have, but it does matter if our children lose money they don't have, and spend their lives paying for it; that's a whole new level of long-term slavery and dissatisfaction I cannot imagine.........

Read more: http://www.smh.com.au/money/investing/heres-how-to-cast-off-the-chains-…

Follow us: @smh on Twitter | sydneymorningherald on Facebook

Don't do it. It cant be done again.

It was the same when I graduated in 1991, that was the end of there being a shortage of graduates in NZ, five years earlier the graduates had an entirely different market..and run the roost now. They had it very easy.

When i came a director in a consultancy in the late 90s we marvel how much talent we could choose from via graduate recruitment and how cheap it was.

Then the next ten years everyone outsourced everything to graduates in third world countries behind the scenes.

Technology has changed the professions in the last ten years that the only way to make it is accounting or law firms today in NZ is have freakish specialist skill or great network. For most this means a hand me down client base from a family member in an existing firm.

I hate the false expectations for graduates..it is heartbreaking to see. The middle class parents believe education is the gateway...it may well have been for them..times certainly have changed.. the odds are closing in to be similar now to professional sport people in finding a way to make it.

At which point we will see the destruction of neoclassical economic's mantra of 'no physical limits to growth'.

At the point when mankind runs out of ideas?

I hope not - rather a point where failed ideology is dumped so alternative ideas can be tested.

So how many ideas have you had Profile?

That Croaking Cassandra link is a cracker. Mike Joy has espoused the view for some time that dairy has become a capital gains machine and this comment supports that:

''Critically, this can also explain why more resources are flowing into the dairy industry: farmers are willing to borrow (and banks willing to lend) in order to accumulate assets (and potentially realise [untaxed] capital gains, especially if converting a dry stock farm into a dairy farm, as this is akin to property development).''

what untaxed gains?

#1 this was happening in the UK in the 1990s, in engineering. I ended up contracting trouble is I had to work all over the UK, had huge expenses from travel and accommodation yet had periods of no work, one of the main reasons I left.

Krugman isn't looking to China for after dinner speaking engagements then....

#4 ignores EROEI and ppls ability to pay. I have said if before so i guess its groundhog day many financial ppl seem disconnected from reality / main street.

Bound to end well for them, or maybe like Kunstler suspects....not.

#1 only works well if one can factor in holidays, ACC levies, GST, and other costs and still get the work. Trouble is employers are using this model to force employees onto the poverty line. It an unscrupulous way to increase profits, screwing workers with little accountability. Never thought I was a lefty but I have seen business owners gloating and flaunting big and growing profits while their workers, the ones who produced it for them, got sweet FA. Not a fan. Should only be allowed where the need is temporary.

not employers murray.

many employers are struggling to meet all those costs which are _forced_ on them. They would _love_ to pay their employees more...but where do you think that magic money is coming from sunshine??

The rest of your babbling just shows you have never run a small business nor have the slightest bloody idea what you're talking about. Get some clue before you open your rude little trap.

Sick of unintelligent morons pointing fingers at the few people working to fix the problem. Where's the fix -murray-. Who's gunna be paying the bigger wages you want - oh yeah the people you accuse of not paying up, ie the guys paying the wages.

Go point your finger at the parasitic government and all their services. As an employer you spend half your working life working for the government for free and/or paying others to do it for you. say "thank you" murray. You want pay rises go demand government reduce the costs they pass to employers (AND employees).

Actually have run a business, and do understand the costs imposed. So "The rest of your babbling just shows you have never run a small business nor have the slightest bloody idea what you're talking about. Get some clue before you open your rude little trap." suggests this has hit close to home? If you want to run a business there are costs that must be tracked. If you read my comment and pay attention to the words and not your paradigms, you might have got the living the lifestyle with all the toys suggestion while telling the workers he can't afford a pay rise to match inflation. No I don't wear that BS. I do know there are good employers who do well and try look after their staff, but to make someone a self employed contractor who has to wear all the costs of that employment themselves, with the remaining being less than the minimum wage, for a permanent position is unethical, and immoral!

Agree with your final sentence but would remind you that for many small businesses the legal hurdle and responsibilities are far too lengthy and risky to content with, and there is always that fear that IRD will declare a contractor or sub-contractor to be an employee (and thus the employer is liable for not having employment contact, not filing PAYE records or paying PAYE, not doing Kiwisaver, not tracking hours or holidays).

The IRD "tried it on" with my Relief Milker. Declaring her to be "an employee" even though it was "by OTC request" that she worked, had no written contract with me, was free to refuse custom (and had), set her own price. She used the motorbikes I provided for everyones convenience (helmets supplied by me), I supplied wet weather gear (it reduces wet clothing and increases my biosecurity).....

But IRD's sticking point was she was an employee because she milked the cows in my dairy (used my equipment) rather than take the cows to her dairy for milking.....

Many small business people, who are price followers and not price setters, and haven't got IPO's or savings from rich parents or lucrative professional careers truly struggle to make the numbers meet and do not deserve the "fat employers with the toys" finger that is pointed at them. They do over a hundred hours a week without break, put up with employee drama's, sacrifice family, all while employees do their 8 to 5 for a solid pay check. No begging at the bank manager for another months worth of pain for them, in the hope to keep everyone employed just a little longer. And if it goes tits up? An the owner loses their house or gets saddled with a massive loan/bankruptcy.... what's their hiring prospects? What certification or career path have they been developing with their burnout, and the hatred of their partner and kids?

Yes it has hit close to home, to someone who did their damn best and now has near nothing for the pain.

I sympathise Cowboy. That chap who faced of the IRD and won (and is again in trouble with them and bankrupt I think) said that when the IRD come knocking, be afraid, be very afraid. When it is for temporary workers self employment can fit quite well, but I see the forcing or permanent employees into a "self employment" model at the same total rates they were paid when an employee occurring occasionally, and Talleys now forcing their work force into IEAs because they don't like unions and don't want to pay a fair wage as unethical and unscrupulous. Any business owner must manage costs

and some of the rules and regs we face are ludicrous, but that is making Government accountable for the way they look after them selves, but make every one else pay. This site is one way of increasing awareness, and stimulating robust debate. I am currently a Quality specialist in a Government Department and the level of BS is unbelievable, and I cannot believe the amount of Teflon (non-stick)around. Bugger all leadership and integrity.

#1 is about working for an end-client for a limited amount of time in a specialised field. If you get in to contracting or consulting as a 1 man band, you stand to make a LOT of money. The UK is particularly lucrative in the IT/banking areas. Even with tax, unpaid holiday and the rest it is a hell of a lot more than you would make in a perm role. You take the risk of going without work for a few months if things are quiet but the good times more than make up for the bad and all projects I have worked on start out as 3 month contracts that end up going for about 18 months to 2 years of constant work. It's popular with clients because they pay for a specific service, get what they need at a set price, don't have to pay anything more - and if they don't like you or you don't do a good job, they can replace you easily.

more often those who don't fall on to the gravy train end up getting low paid work elsewhere and lose track of certification (its too expensive) or skillset/projects are too old (out of the loop). This seriously skews the results of such observations.

Employers are leeches that have no concept of a fair wage for a fair days pay.

yeah thats why I used to hire people above minimum wage (min $12-$13) and only get the equivalent of $3.20 an hour, Mark.

You think you can do better, why you not setup your own business.

Because you can't handle it. that's why. easy to point finger when you're a clueless employee or socialist parasite.

#5 And this from the guy who has been pontificating about the miracles induced by deficit financed government investment to rescue the world from capitalist crisis. What a flake.

I've been freelancing for a few years now. I don't think I could ever go back to being a wage slave.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.