Here's my Top 10 items from around the Internet over the last week or so. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read is #9 on how money is created.

See more Dilbert cartoons here. They're excellent.

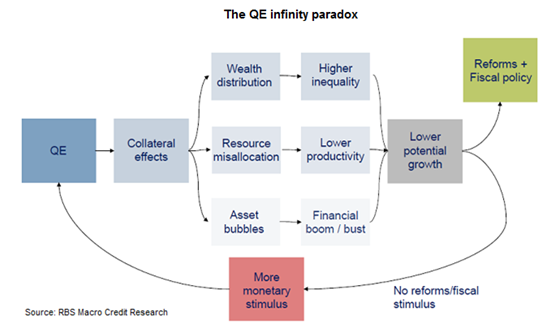

1. Chart of the year - I love this chart courtesy of RBS Macro Credit Research on how Quantitative Easing works (or doesn't). It's appropriate on the verge of the US Federal Reserve apparently beginning to take the punchbowl off the table. It will need a forklift.

I'll be surprised if the Fed hasn't reversed or at least stalled the tightening by this time next year.

There is no inflation coursing through the global economy, at least while the services sector globalises under a torrent of cloud computing apps and peer to peer networking.

The RBNZ, the Riksbank, the RBA and a bunch of others have tried to hike from record lows over the last five years and have had to reverse their tightenings every time.

Maybe this time is different, but, if anything, the deflationary forces are growing, particularly out of Europe and China.

2. The power of cities - This WSJ piece on how New York City is amassing data on all sorts of habits and activities gives you an idea of how incredible amounts of cloud computing power and some clever algorythmists can start to use assets more efficiently (and again reduce costs and inflation).

Researchers can analyze energy use, air quality, light pollution, heat, traffic and sleep patterns moment-to-moment, building-by-building, in one of the most densely populated cities on Earth. On a recent day, the camera spotted a plume of gases emerging from a skyscraper in Midtown, likely an improper pollution release.

It is one way that researchers, civic entrepreneurs and city managers are using New York for experiments in the emerging science of cities. Hundreds of aging cities have embraced digital technology, but few are moving as quickly as New York to link municipal computer networks, develop novel applications, make digital data public or install so many thousands of sensors to monitor urban life—from water quality, traffic and power use, to the sound of gunfire.

3. Where the property investment is coming from - One of the arguments put forward by the Government to downplay Chinese investment in Auckland property is to say that other foreign investors are much bigger investors proportionately. Our sketchy and incomplete data may say that, but it's certainly not the case in other markets where they do a much better job of recording who is buying what and where.

Here's a chart from Juwai at a Property Council function showing the proportions being bought by investors from China in some other big 'global' cities.

4. Selling out while they've got the chance - The highest profile 'buy-to-let' investors in Britain over recent years have been Fergus and Judith Wilson. The former maths teacher and his wife started buying rentals in 1986 and built up a portfolio of 900 houses. They've just sold them to a foreign consortium for 250 million pounds. Yes. You read right.

It may be coincidental, but the decision came after the Conservative British Government decided on July 8 to remove the ability for landlords to deduct interest costs for tax purposes. Our Treasury proposed something similar before the May Budget, but it was rejected. I doubt we've heard the last of this sort of thing. The Telegraph reckons it amounts to a 100% tax rate in some cases.

The mechanism of Mr Osborne’s tax attack is the removal of landlords’ ability to deduct the cost of their mortgage interest from their rental income when they calculate a profit on which to pay tax.

In effect, the Chancellor wants to tax landlords on their turnover rather than their profit, meaning that tax will be payable on nonexistent income. This explains why tax rates will, for some, exceed 100pc: landlords will have to pay all of their profit in tax, and then pay more tax still.

5. It's all about the batteries - Here's Nick Butler in an FT Blog (which means it's in front of the paywall) talking about fresh research on batteries, which are seen as crucial in this whole business of moving to a carbon neutral economy where fossil fuels can be replaced by renewably-generated electricity.

Two excellent recent research reports summarise the current state of the art in the field and offer some predictions. The first is from Lazards and is the latest in a series assessing trends in the costs of different mechanisms. The second is from Moody’s and concentrates on the advances being made in reducing the cost of batteries.

In discussing storage it is important to demolish two myths. First, the technological advances are not about to transform the energy system to the point where a major proportion of consumers defect from existing distribution systems. Second, it does not require a dramatic breakthrough for making it on a significant scale to become economic.

The key conclusion of the two reports is that storage is getting cheaper at a rate that is liable to challenge at least part of the existing energy system within five years. The conventional alternatives that are under threat from this sort of competition start with gas turbines but extend to expensive plans to upgrade transmission lines and distribution systems.

When serious and objective financial institutions start saying such things, investors and companies involved in the old energy economy would be foolish not to take notice.

6. 'We faked the data' - Surprise, surprise, but it seems some of the economic growth reported in China in recent years was faked by ambitious local officials. And that's official, according to this Xinhua report.

Several local officials in China's Northeast region sought to explain dramatic economic dropsin their areas by admitting they had faked economic data in the past few years to show highgrowth when the real numbers were much lower, Xinhua News Agency reported on Friday.

"If the past data had not been inflated, the current growth figures would not show such aprecipitous fall," one official was quoted as saying.

The report cited several officials in the region who acknowledged they had significantlyoverstated data ranging from fiscal revenue and household income to GDP.

Three years ago Liaoning province's GDP growth was reported at 9.5 percent, but its currentfigure-over the first three quarters of this year-is just 2.7 percent. Jilin's growth wasreported at 12 percent three years ago, but its current rate is 6.3 percent in the same period.

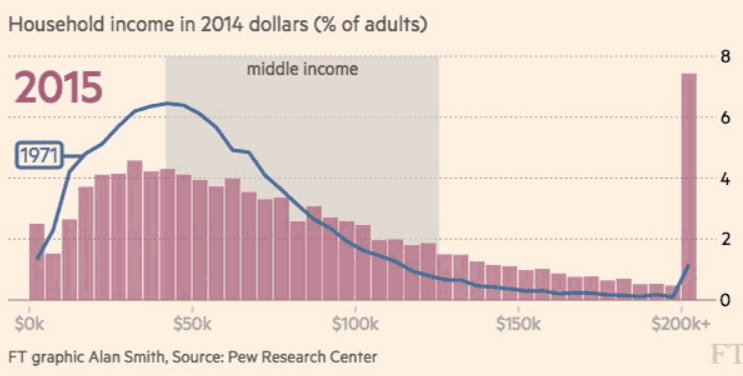

7. America's middle class meltdown - This week the FT produced a fascinating series of reports with Pew Research on the decline of the US middle class since the early 1970s.

It was based around this chart below.

America’s middle class has shrunk to just half the population for the first time in at least four decades as the forces of technological change and globalisation drive a wedge between the winners and losers in a splintering US society.

The ranks of the middle class are now narrowly outnumbered by those in lower and upper income strata combined for the first time since at least the early 1970s, according to the definitions by the Pew Research Center, a non-partisan think-tank in research shared with the Financial Times.

The sense of polarisation in US society is underscored by the rapid growth seen at the extreme rich and poor ends of the spectrum. “The distribution of adults by income is thinning in the middle and bulking up at the edges,” says Pew’s report. Households above the middle class are on the cusp of holding more income than all other households combined, suggesting earnings are getting concentrated in fewer hands.

Upper income Americans more than doubled their wealth gap against the middle from three times as much to seven times, according to the report.

8. So how about a Universal Basic Income? - Finland is trying one out. Here's a factcoexist piece explaining the plans.

The Finnish government likes the concept, and it's putting serious resources behind a national experiment. Starting in 2017, up to 100,000 Finns could get up to 1,000 euros a month, in lieu of other benefits. These lucky souls won't have to work. They won't have to prove they're in poverty to get the money. For two years, they'll get a fixed amount to do with what they will.

The idea of giving away public money, no strings attached, sounds crazy at first. But basic income has been attracting a lot of interest of late. Cities in the Netherlands and Canada are planning pilots. Politicians from Spain to Greece have announced their support. And, here in the U.S., the concept has drawn fans from across the political spectrum, and particularly in Silicon Valley. Basic income is seen as a way of putting a floor under the poorest, and minimizing inefficiencies in current welfare systems.

9. Switzerland's amazing vote on money creation - Another thing that's snuck up on everyone is an upcoming Swiss referendum on whether the Swiss National Bank should be the only entity with the right to create money, given private banks (everywhere) currently also have that ability. (Don't take my word for it. Just read the Bank of England explainer here)

The date hasn't been set yet, but it's firing up the debate about who gets to create money and lend it.

Here's Leonid Bershidsky at Bloomberg View on the issue:

A Swiss initiative to ban private banks from creating money has gathered enough signatures to put the matter to a referendum. This looks like another cranky economic idea that Swiss voters will throw out, as they did last year's proposal to require the country's central bank to keep at least a fifth of its balance sheet in gold. Yet perhaps such an experiment needs to be held somewhere to put to rest all the theoretical arguments about 100 percent reserve banking.

In the current financial system, private lenders create most of the money in circulation: Every time they issue a loan, they set up a matching deposit in the borrower's name, and since banks are only required to hold some 10 percent reserves against such claims, 90 percent of the deposits constitute new money. Central banks only influence the process through regulation. What the authors of the Swiss initiative want is a situation in which the Swiss National Bank becomes the sole creator of money.

Under such a system, private banks would only serve as intermediaries for citizens and businesses, in effect keeping current accounts with the central bank.

It's a variation on the so-called Chicago Plan developed by Henry Simons and supported by Irving Fisher in the 1930s. That plan amounted to making banks hold 100 percent reserves against all demand deposits, from which customers can withdraw money. That should make it impossible for bankers to inflate bubbles with risky lending, while making bailouts and other nasty consequences of financial crises obsolete. Banks would survive on the commissions they made for basic payment services -- the way PayPal does.

Under various versions of the scheme, commercial banks would also be allowed to accept time deposits, which are considered investments and would not be covered by the 100 percent reserves, and to borrow from the central bank to make loans. That wouldn't represent a return to the current system: The central bank would still be in full control of the amount of money created.

The 2008 financial crisis has brought the 1930s proposal back to life. Martin Wolf entertained it in a Financial Times column last year, and a 2012 International Monetary Fund working paper -- cited on the Swiss campaign's site as a supporting document -- found it workable, after testing it on a modern model of the U.S. economy. That paper also provided a detailed description of how the banking system would be reformed under a modern-day Chicago Plan. Greatly simplified, the idea is that the central bank would provide private banks with 100 percent reserves against their deposits, in return taking over most of the banks' loans, such as mortgages and consumer debt. This would result in a separation of the banks' basic payment and deposit keeping functions on one side, from risky lending on the other.

It seems the idea is unlikely to fly, but it's certainly getting people thinking about alternatives to the current leveraged and fractional banking system we have now.

"The idea that the National Bank or any other government authority could determine the optimal quantity of money fully objectively and without any political influence is unrealistic," the pro-business think tank Avenir Suisse pointed out in response to the initiative.

The fall of Communism completely discredited the idea of a planned economy; even in the Soviet Union for about two decades before its collapse, few believed state planning could work. Somehow, the idea that governments are less evil and better at making financial decisions than private banks has survived that disaster. It's mainly the banks' fault: They have been flagrantly irresponsible. A state monopoly on money could test the theory, and Switzerland, where the central bank is disinclined to do crazy things and democratic institutions are more powerful than in most other places, could be an ideal proving ground.

It's conceivable that the Swiss National Bank wouldn't cause hyperinflation by printing tons of new money. It's possible, too, that non-bank companies would pick up the slack in mortgage and small business financing. Mutual lending -- a fashionable business now that technological platforms such as Lending Club have proven their viability -- could get a boost. There's no need to kill off entire financial markets to keep demand deposits and the payment system safe: It might be enough to move them outside the banking sector.

For the rest of the world, at least, it's a shame that the Swiss, reasonable and conservative as they are, will probably vote down the proposal. No other country is likely even to contemplate such a momentous reform and the debates raging among economists will keep going, without much real-world evidence to support the theories.

10. Totally Clarke and Dawe - Copernicus was, it seems, an insurance assessor.

12 Comments

#2

Google 'trillion sensors movement" to get insight into how - er - trillions of tiny, cheap, single-purpose sensors will be a Next Big Thang.

Combine that with the revolution in analytics (Microsoft has folded R and Hadoop into SQL Server as one small example) and real, statistically valid data will increasingly drive decisions.

Maybe.

If the pollies' grubby hands are kept off the dials and levers...(intentionally anachronistic metaphor in play, here).

Which is why open source / transparency pay dividends, so whenever a pollie plays we see that and its effect.

to remove the ability for landlords to deduct interest costs for tax purposes. Our Treasury proposed something similar before the May Budget, but it was rejected. I doubt we've heard the last of this sort of thing.

with vested interests I.E a lot of MPs rental investors this is like trying to push a pebble uphill with your little toe.

once the composition of parliment changes maybe it will change or once they realise the bill to come in future years from accommodation supplement to house MOST of their voting citizens being paid to a smaller number of voters and the backlash that will create

.

.

#8 crazy idea. Basically helicopter money distribution. Everyone will rush to spend all their money creating hyperinflation, as people realise cash has no value.

It's not "free" money - it is paid for by the tax system like NZ Super. Its just a fairer and more efficient way to distribute benefits. It also makes individuals responsible for their own lives rather than being dictated to by government departments.

It is free for the ones who decide not to work? If you don't have to apply for a benefit less people will want to work work? And the ones that do will pay high taxes to pay for the scheme.

not necessarily the extra money being spent would provide many jobs which would need to be filled and you would find most people would want to work, also for some it would make your choice of occupation more likely to be something you really want to do rather than something you do to earn the best income.

as a boss told me a long time ago "work to live don't live to work" and I am a lucky one that's gets to take a lower paying job because its something I enjoy

you will always get a percentage that does not want to work, that's why most welfare economies call 5% unemployment as full employment.

#4.... you can be sure that the consortium that bought the property portfolio used debt...and that the interest on that debt is tax deductible...

I think Osborne is simply attacking the small investor.... and hes' totally munted them with this...

If he is going to disallow interest as a deductible expense.... it should across the board... ie. ALL interest on ALL loans..... ( This would , in a very simple way... lead to the unwinding, the deleveraging, of debt in the UK )

He would never have the bollocks to do this... to take on big business.

All he is doing is driving the small investor out of the property mkt.... like a Bully

he cant do that as the amount of Debt in the UK is titanic, maybe this is the a baby step on that path but i doubt it he knows who pays for him to get elected

The RBNZ nativity play has been cancelled due to a lack of suitable people to play.....

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.