Here's my Top 10 items from around the Internet over the last week or so. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must watch is #10 from John Oliver on Donald Trump. Useful and surprising information with lots of laughs. And please do visit Dilbert for the latest Uber series.

1. Roll baby, roll - Bank lending inside China has surged in recent months, thanks in part to a loosening of monetary policy by the central bank, which has reduced the reserve requirement. It did it again this week in a way that could boost lending by US$100 billion. In theory, it allows banks in China to pump more lending into construction, but a large chunk of the lending is simply going back to the companies so they can service previous borrowings, which are not covered by their lossmaking businesses.

Some would describe that as a type of ponzi scheme, but there you go.

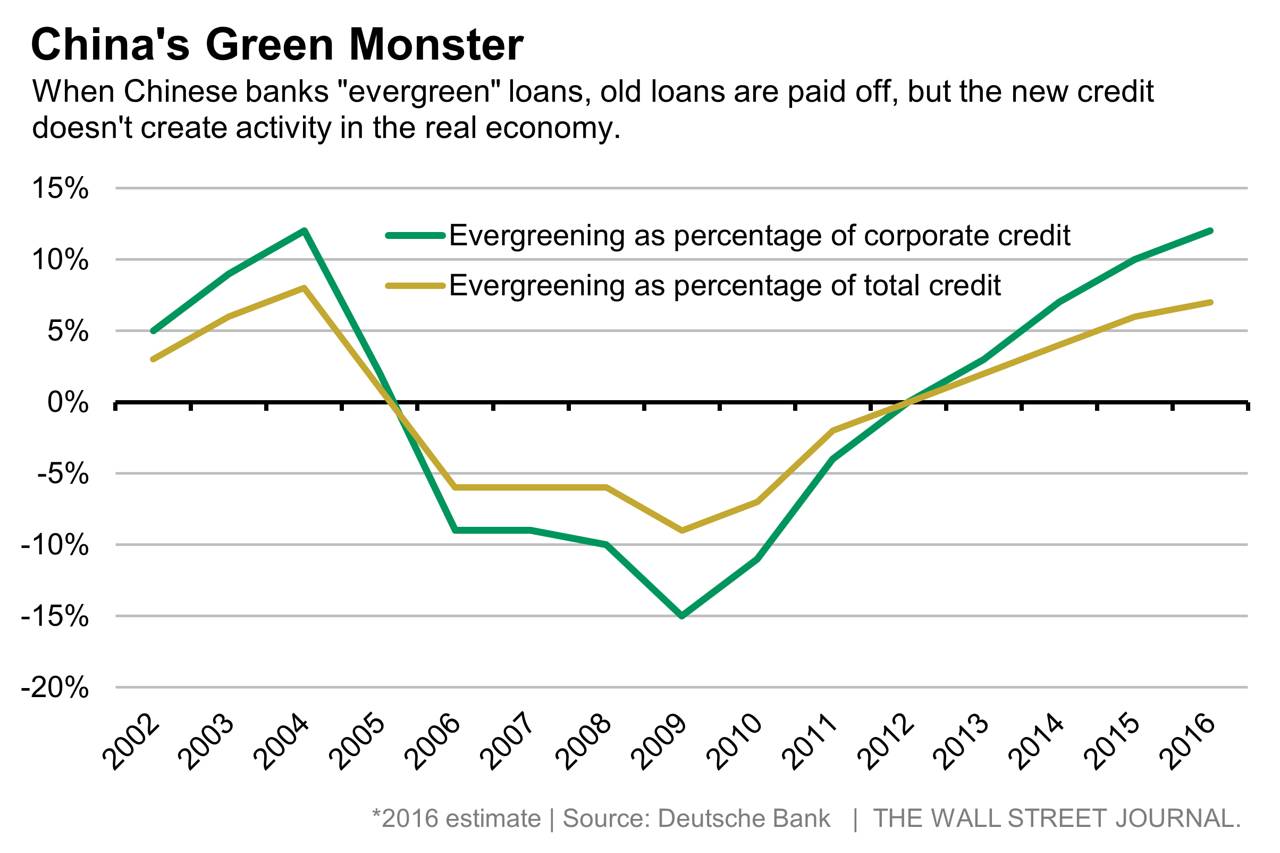

WSJ has the detail on how much of this 'ever-greening' (ie servicing old debt with new loans) is going on.

In reality, more credit in China isn’t all that stimulative. A concerted lending boom in theory could jump-start growth as it did in 2009 in the aftermath of the global financial crisis. Iron ore prices, for instance, have rallied sharply on expectations of renewed Chinese demand.

The problem is that China has reached an inflection point. A substantial chunk of new debt is increasingly going to pay old debt, creating less activity in the real economy aside from bankers’ fees and commissions. Like a patient with a headache who has already taken aspirin, more medicine won’t dull the pain much, but it may lead to complications.

A measurable effect is the so-called evergreening of credit, where lenders essentially roll loan maturities or provide credit simply to pay off old debt. Deutsche Bank measures this by estimating what’s owed each year by companies in terms of principal payments and interest expenses. It then assesses the resources to make those payments, namely operating cash flow, freshly raised equity and excess cash not earmarked for general expenses like salaries.

The result is a massive shortfall in the debt service compared with the sources of cash, to the tune of about 10% of corporate debt last year. That gap is filled with more borrowing. Five years ago, Chinese companies were generating excess cash to pay off debts, so new debt could be used to invest.

The most egregious evergreeners are state-owned companies in industries with massive overcapacity issues. Coal mining and metals, for instance, account for 30% of evergreening, according to Deutsche.

2. Parcelling up bad debt and selling it - Now where have we heard of this before? It seems banks in China are parcelling up non-performing loans into AA rated bonds....

Seen 'The Big Short' yet? Here's Bloomberg with an excellent piece called 'Smells like sub-prime' that explains how it's being done in China.

On Monday, Bloomberg News reported that China will allow domestic banks to issue as much as 50 billion yuan ($7.6 billion) of asset-backed securities that would be paid back using the proceeds from nonperforming loans. (Yes, you read that correctly.) The structure they're employing is similar to the method that was used to repackage subprime mortgages in the U.S. ahead of the global financial crisis.

But when bankers in America were bundling those low-doc mortgages into AAA-rated bonds, they still expected most of the loans would be repaid. In this case, the debt has already gone bad. Considering hardly any Chinese asset-backed securities have ever received a less than AA score from a local rating company to date, chances are these ones will be awarded the same grade. Of course, investors buying these bonds should be aware they're backed with debt that's already soured, regardless of its credit score. Yet, the move is worrying because it's the latest in a string of revivals in China of dangerous structures that were common in the West before being all but abandoned after 2008.Many of the instruments are helping banks disguise or unload their exposure to troubled companies in the same way issuance of asset-backed securities helped U.S. and British lenders mask their exposure to souring home payments as loans became delinquent.

3. What restructuring that debt looks like - China's problem is that many of the 'zombie' companies that owe all this debt need to be shut down. That means millions of job losses, as Reuters pointed out in this piece suggesting 5-6 million workers will need to be laid off over the next couple of years.

China aims to lay off 5-6 million state workers over the next two to three years as part of efforts to curb industrial overcapacity and pollution, two reliable sources said, Beijing's boldest retrenchment program in almost two decades.China's leadership, obsessed with maintaining stability and making sure redundancies do not lead to unrest, will spend nearly 150 billion yuan ($23 billion) to cover layoffs in just the coal and steel sectors in the next 2-3 years.

The overall figure is likely to rise as closures spread to other industries and even more funding will be required to handle the debt left behind by "zombie" state firms.

The term refers to companies that have shut down some of their operations but keep staff on their rolls since local governments are worried about the social and economic impact of bankruptcies and unemployment.

Shutting down "zombie firms" has been identified as one of the government's priorities this year, with China's Premier Li Keqiang promising in December that they would soon "go under the knife"..

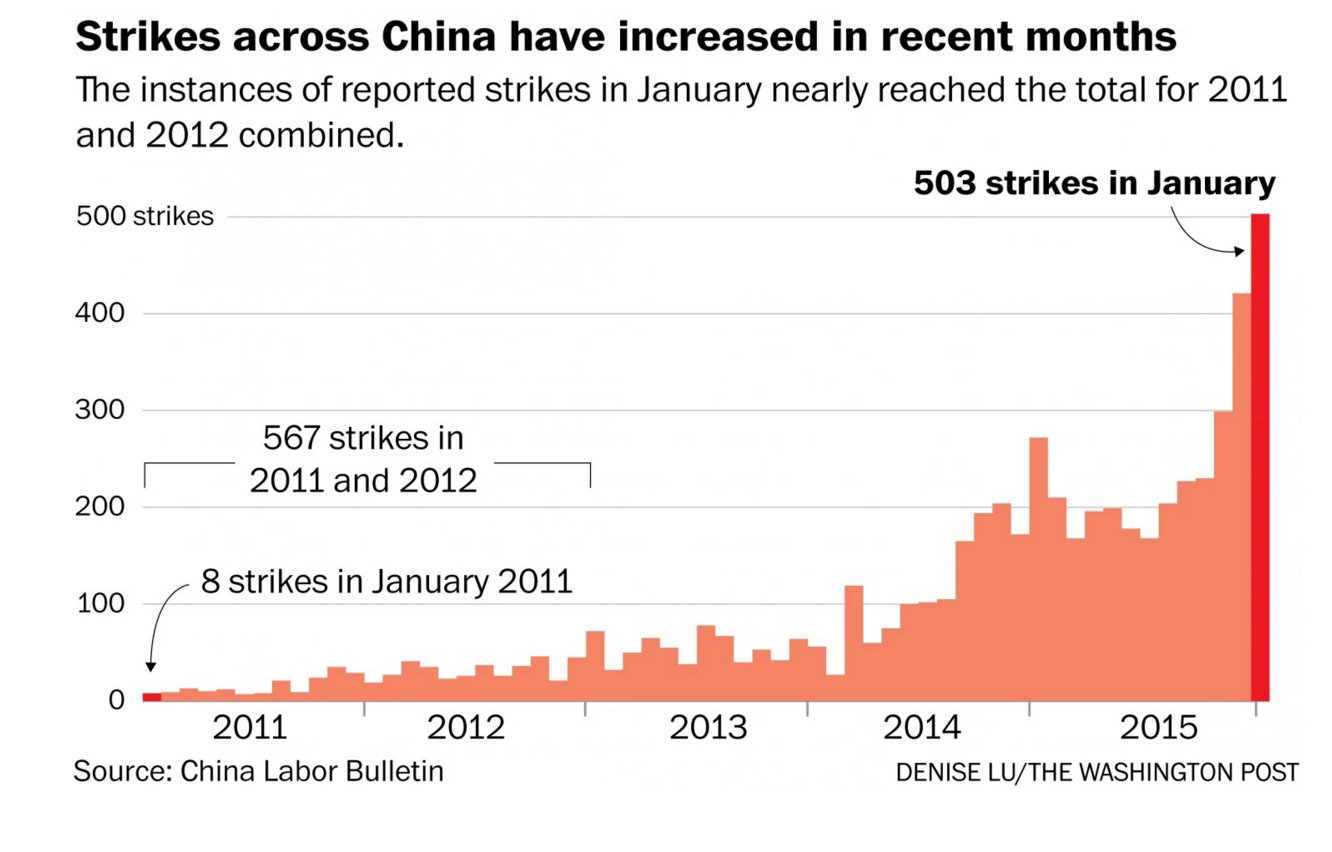

4. Social unrest - The Washington Post looks here at growing social unrest in China, which is one of the risks for the Chinese Government as they put the zombies 'under the knife'.

In the Chinese region nicknamed “the world’s factory,” many workers are angry and disillusioned.

Strikes and other labor protests have spiked across the country as manufacturing plants lay off workers and reduce wages in the face of mounting economic head winds. But the unrest is particularly intense in the southern province of Guangdong, the vast urban sprawl bordering Hong Kong that is the heart of China’s export industry — and its economic success story.

The upsurge in industrial action represents a challenge for a Communist Party that bases much of its legitimacy on its ability to manage the economy. Experts say it is not about to threaten the party’s vice-like grip on power, but it will ring alarm bells for local officials whose careers often depend on their ability to stamp out stirrings of social unrest.

5. Shutting down the underground banks - China is battling to control capital outflows via non-official channels. Here's Bloomberg with the latest:

China said it cracked the nation’s biggest “underground bank,” which handled 410 billion yuan ($64 billion) of illegal foreign-exchange transactions, as the authorities try to combat corruption and rein in capital outflows that have hit records this year.

More than 370 people have been arrested or face lawsuits or other punishment in the case centered in eastern Zhejiang province, the official People’s Daily reported on Friday, citing police officials. The case brought the total for underground banking and money-laundering activities to 800 billion yuan since April, the newspaper said.

The probe began in September last year and the police took almost a year to sort through more than 1.3 million suspicious transactions, the state-run Xinhua News Agency reported separately. The authorities froze more than 3,000 bank accounts, Xinhua said.

ial channels. Here's Bloomberg with the latest.

6. First there was Zirp. Then Nirp. - Now there's Hirp. The old idea of 'helicpopter money' -- where central banks just pay big dollops of cash to every citizen -- is getting a lot of air time lately. Matthew Lynn has the story.

First we had Zirp. Then Nirp. The language of central bankers sounds increasingly like the formal medical term for a nasty rash. We have already grown used to a zero interest rate policy over the past year. Over the past few months we have been gradually softened up for a negative interest rate policy.

Both now appear to have run out of road. Zero interest rates are not doing enough to stimulate flagging economies, while negative rates, by destroying the profitability of the banking system, may well do more harm than good. But don’t assume that will stop central banks trying to stimulate demand and raise inflation. The next likely option is “Hirp” – or helicopter money.

7. 'Banks rarely verified payslips' - This AFR piece last week on research by economist Jonathan Tepper and hedge fund manager John Hempton really caused a stir across the Tasman. It alleged 'Big Short' style activities in the west of Sydney. The banks and brokers denied there was a problem.

It was like a scene from the film The Big Short. A hedge-fund manager and an economist pose as a gay couple on a combined income of $125,000 and tour Sydney's western suburbs viewing housing developments and meeting mortgage brokers for research to determine if there's a housing bubble.

The conclusion is it's worse than they thought.

"The further west I went, the more irrational it felt. Lots and lots of supply and prices that bore no resemblance to construction cost and income of people around there," says John Hempton, Bronte Capital's chief investment officer.

He joined with Jonathan Tepper, an economist and founder of Variant Perception, and toured suburbs across north-west and south-west Sydney and met 20 mortgage brokers three weeks ago.

What they discovered repeatedly was that mortgage brokers were advising them to lie on loan application documents about the deposit for a house and about income.

As Tepper has written in a report, "we asked if the bank would call our employer, and both reputable and disreputable brokers said banks rarely verified payslips".

Hempton says they were also told the checking of documents was sometimes done by Indian call centres. What also concerned Hempton was that on loan applications low-income earners were often offered discounts on the advertised mortgage rate of up to a 1 percentage point, increasing the vulnerability of the banks if there were a correction.

8. The only way out – When even former Bank of England Governor Mervyn King says that the only way out of Europe’s mess is the break-up of the euro and debt forgiveness for the south then it’s clear there’s some serious problems. He cites Keynes’ comments after the the First World War about not pushing people too hard. He was ignored. It didn’t end well.

If the members of the euro decide to hang together, the burden of servicing external debts may become too great to remain consistent with political stability.

As John Maynard Keynes wrote in 1922, “It is foolish… to suppose that any means exist by which one modern nation can exact from another an annual tribute continuing over many years.” It would be desirable, therefore, to create a mechanism by which international sovereign debts could be restructured within a framework supported by the expertise and neutrality of the IMF, so avoiding, at least in part, the animosity and humiliation that accompanied the 2015 agreement on debt between Greece and the rest of the euro area.

It is only too likely that a sovereign debt restructuring mechanism will be needed in the foreseeable future. Without one, an ad hoc international debt conference to sort out the external sovereign debts that have built up may be needed.

9. Food is virtual water – Speaking of ‘The Big Short’, one of the key players was Michael Burry, who is played by Christian Bale in the movie.

Now he’s betting that water will become the new scarce resource that people will have to pay ever more for. But he’s being careful.

Rather than invest in water rights, he’s investing in assets with access to plentiful water that can be turned into food. That’s because food is virtual water. Here’s a good Reveal piece on food as ‘virtual water’.

It’s a phenomenon happening around the world as investors and governments looking to secure adequate food supplies become more focused on freshwater. The organizers of the world’s largest agricultural investment conference have made it the focus of this year’s event in New York in April, telling attendees, “Water risks pose a growing threat to the food sector, and are causing real financial impacts for companies.”

The threat to the world’s freshwater largely is driven by three factors: pollution, growing demand and climate change. Politicians might debate the merits of at least two of those factors, but investors don’t.

In August, a group of 60 investors collectively managing $2.6 trillion in assets sent some of the world’s largest food companies open letters demanding that they take immediate action to better manage threats to the world’s freshwater supply because, if they didn’t, companies such as Hormel Foods Corp. and Tyson Foods Inc. could suffer severe financial damages as their ability to produce food plummets.

10. Totally John Oliver on Donald Trump - You'll laugh. And wince a little. And be surprised.

20 Comments

#6. HIRP - great, I have an acronym to work with. I think I'll call my proposal HIRPYO - Helicopter Interest Rate Policy [for] Youth Only.

Must be between 17-21 years of age, can only collect HIRPYO for a maximum of three years during that age period and must work in environmental restoration projects full time (DOC administered) to qualify.

HIRPYO salary, three times the minimum wage.

Government then exists the student loan business (and cans student allowances) for all persons under 30 years.. In other words, if you want a tertiary education, either seek private sector scholarship funding, or save during your three-year stint in HIRPYO.

Makes a whole lot more sense than helicoptering everyone a small amount in a one-off payment.

So you expect the youngsters who didnt make the environmental mess to clean it up? Why not the ppl who made the mess? How is DOC paid to admin this? How are the accommodated, transported and fed? how will the youngsters feel being impressed into this work? ie maybe it would be counter-productive?

Common"sense" often isnt IMHO, a simple one off debt jubilee (Steve Keen's idea I think) on the other hand to clear debt would seem to have some potential.

All the blockers you raise are poor apologies for inertia, by these seemingly impassable notions how do any of us leave the couch, ever? As for the Jubilee, In order that those who have been deliberately profligate in their habits are forgiven, rewarded and encouraged to greater feats of debt are grossly advantaged over those who have not?

Aside from the semantics of how it is achieved, the suggestion is to lay at the feet of the young an evenly allocated and fair opportunity to enrich themselves through their own efforts, free from the predatory grasping of the incumbents. If their effort was to get them a living allowance and also accumulate education credits, how would this be a bad thing?

Agree with the sentiment, thanks, Spinach. But my idea is make the pay high enough such that those that take up the opportunity can not only feed, house and transport themselves, but they can also SAVE for their own future. Hence, a set multiple of min wage where the salary is around $80,000 (in today's terms). It would go up as the min wage rose. That's why the opportunity is only available for a maximum three year period - and every young person can choose to take it up or not.

Come on, those are the party years! What kind of nerd would save money when they can blow it all on a good time?

The "dont complain option"

One could say the option is there - accept it or reject it - your choice - but don't come back and complain later on

I like it - got a lot going for it - better than doing nothing

a simple one off debt jubilee (Steve Keen's idea I think) on the other hand to clear debt would seem to have some potential.

I tend to agree.... Thou I sometimes wonder on the most equitable way to do so.... ???

(I've had enuf of the wrong entities/ people getting the bailouts...the handouts...gifts )

Most equitable way i can think of is "helicopter" money in the form of a Universal Basic wage...BUT..that money first has to be used to pay down debt....SO... the indebted don't really see the money AND the unindebted are free to spend that money as they please....

equitable and fair.... ...a way of monetizing some of the debt, reducing debt.... from the bottom up..

took us 50 yrs to get this deep in debt..... we can take a few yrs to get out of it..

Universal Basic wage would be a far better way to grow Money supply than the current way of the private Banking system of growing money supply.... creating credit as debt....

Sadly the planet is already overexploited and giving people more cash to waste on stuff they don't need, and doesn't work, is just going accelerate the damage. At current rates, there will be more plastic, than fish in the oceans by 2050. The list of ways that we as a species, are destroying the biosphere, is incredibly long, and growing.

How is all this bad news getting out of China?

are the top guys losing control, could we start to see more top level replacments in the coming weeks

Good piece.It is getting increasingly messy in China. OPEC lost control of the oil market and now the Chinese Govt. are fumbling to maintain control. It is just a matter of time before it all implodes imo.

Always like your articles Bernard. Could you

Do a piece on the "big short" of New Zealand

Lending? - either farming debt or housing???

A cynic might say he can't afford to bit the hand that feeds. But Aussie is a good proxy.

I expect the Chinese Goverment at some stage will clamp down on the banks that have facilitated movement of illegal funds offshore in the same way the US Govt have. I see that HSBC have been mentioned in some articles.

Trump is winning, John Oliver's Video is junk.

Of no use now, they are points every one knows, He is just pandering to his audience. At times I felt he is worse than Trump in his style of talking.

John Oliver will never be President, but Trump has a good shot at it.

Trump sure is winning, but the video isnt bad at all.

How Kunstler see's Trumps chances,

He is right, America seems to be staggering to some great tragedy in the glare of the whole world.

Kunstler's always interesting. His 'Long Emergency' was the book that made me realise just what a trap we're in as a society.

#5 The Chinese have insisted they wont devalue, and it's because they are implementing total capital controls. Soros is going to have to suck on a lemon. Capital flight will be impossible, hence no reason to devalue. Some Chinese have already sent money abroad, and parked it in things like property. What good is that going to do them now?

The trouble with helicopter money is that, although it can stimulate parts of an economy, it doesn't actually make any economy more efficient. The problem of debt is kicked down the road a little further and ultimately magnified. It would be better for a government to invest in certain public works with the potential to help production of goods and services and make the economy more competitive.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.