Here's my Top 10 items from around the Internet over the last week or so. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read is #3 on the central bank-approved successor to bitcoin, and please do check more Dilbert over here.

1. The chilling maths of inequality - This Mark Buchanan piece on Bloomberg highlights the potentially chilling effect of inequality on global economic growth by looking at some fancy modelling of 'random exchange economies' by physicists.

What they find is troubling, although not all that surprising -- rising inequality tends to undermine exchange.

The reason is quite simple. As inequality gets more pronounced, a larger fraction of the population faces more stringent budget constraints, and the spectrum of possible economic interactions open to them narrows. Fewer people have the wherewithal to engage in economic activity. This mathematical economy actually demonstrates a sharp transition, akin to the abrupt freezing of a liquid, as the level of inequality exceeds a certain threshold. Worryingly, the wealth distribution in the U.S. over the past few decades has been moving ever closer to this critical edge.

2. Which would support Helicopter Money - Buchanan highlights one way to reverse this effect -- inject money at the bottom. Ready to fire up the helicopters?

This inequality mechanism has nothing to do with ordinary recessions and the usual business cycle. Significant changes in the distribution of wealth take place much more slowly -- an attribute consistent with what many economists have identified as the different and more profound nature of the current global slump. The concept of secular stagnation that Larry Summers has popularized could have a number of contributing causes, including rising inequality.

If so, the inequality diagnosis opens up interesting possibilities for policy solutions. The researchers found another interesting effect -- a “trickle up” flow of wealth quite different from the usual “trickle down” picture of supply-side economics. In an economy with appreciable inequality, capital tends to flow from those with less to those with more, generating a cascade of transactions along the way. Hence, policy interventions aiming to spur economic activity should work better if they inject money into the system at the lower end, rather than from the top.

3. Just imagine a new cypto-currency - Now that bitcoin has burnt itself out, the focus on the area of crypto-currencies is shifting to how more established and credible institutions could use blockchain technology to save everyone money and solve a few monetary and financial stability issues at the same time.

Computer scientists have devised a digital crypto-currency in league with the Bank of England that could pose a devastating threat to large tranches of the financial industry, and profoundly change the management of monetary policy.

The proto-currency known as RSCoin has vastly greater scope than Bitcoin, used for peer-to-peer transactions by libertarians across the world, and beyond the control of any political authority.

The purpose would be turned upside down. RSCoin would be a tool of state control, allowing the central bank to keep a tight grip on the money supply and respond to crises. It would erode the exorbitant privilege of commercial banks of creating money out of thin air under a fractional reserve financial system.

4. The official successor to bitcoin - Pritchard explains why RSCoin would succeed where bitcoin has failed.

The RSCoin is deemed more likely to gain to mass acceptance than Bitcoin since the ledger would remain exclusively in the hands of the central bank, with the 'trust' factor of state authority. It would have the incumbency benefits of an established currency behind it.

"It seems very unlikely that, to any significant extent, we'll ever be paying for things in Bitcoins, rather than pounds, dollars, or euros," said Ben Broadbent, the Bank of England's Deputy Governor. There were an estimated $5bn of Bitcoin transactions in the US last year, a remarkable phenomenon but a trivial sum in the greater scheme of things.

Mr Broadbent said the attraction is the settlement mechanism used by Bitcoin, the so-called 'distributed ledger'. "The function goes right to the heart of what central banks do," he said in a speech earlier this month.

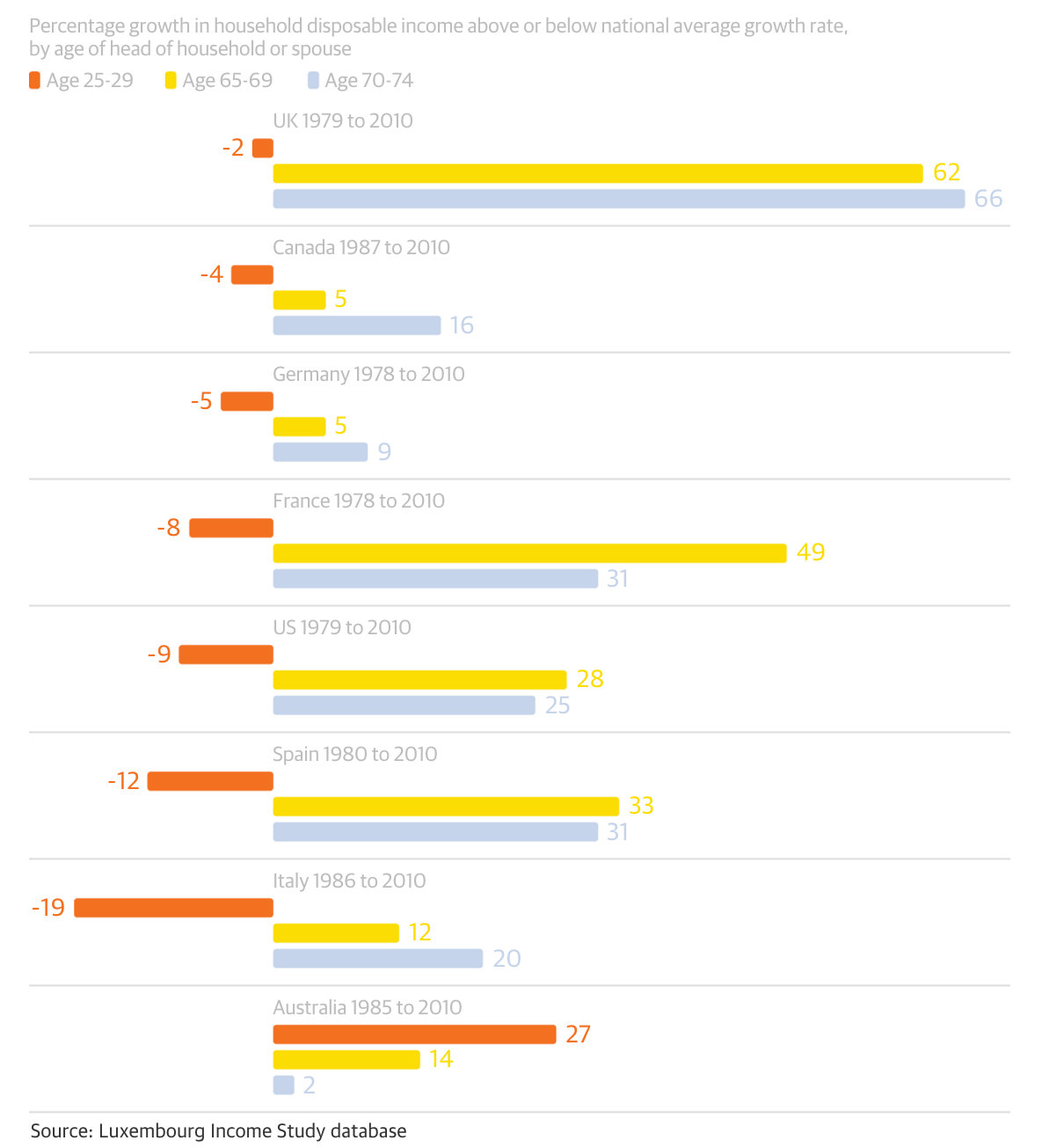

5. The problem for millenials - This Guardian Op-Ed piece on the plight of millenials vs the ever-growing incomes and wealth of the elderly is eye-opening, at least for the developed countries of the Northern Hemisphere. The chart below tells the story, as does this summary:

A combination of debt, joblessness, globalisation, demographics and rising house prices is depressing the incomes and prospects of millions of young people across the developed world, resulting in unprecedented inequality between generations.

A Guardian investigation into the prospects of millennials – those born between 1980 and the mid-90s, and often otherwise known as Generation Y – has found they are increasingly being cut out of the wealth generated in western societies.

Where 30 years ago young adults used to earn more than national averages, now in many countries they have slumped to earning as much as 20% below their average compatriot. Pensioners by comparison have seen income soar.

6. Social cohesion to family formation - The Guardian describes the possible implications for the Northern Hemisphere countries, although does it really matter when they won't vote?. Here's the Guardian's full series.

In seven major economies in North America and Europe, the growth in income of the average young couple and families in their 20s has lagged dramatically behind national averages over the past 30 years.

In two of these countries – the US and Italy – disposable incomes for millennials are scarcely higher in real terms than they were 30 years ago, while the rest of the population has experienced handsome gains.

It is likely to be the first time in industrialised history, save for periods of war or natural disaster, that the incomes of young adults have fallen so far when compared with the rest of society.

Experts are warning that this unfair settlement will have grave implications for everything from social cohesion to family formation.

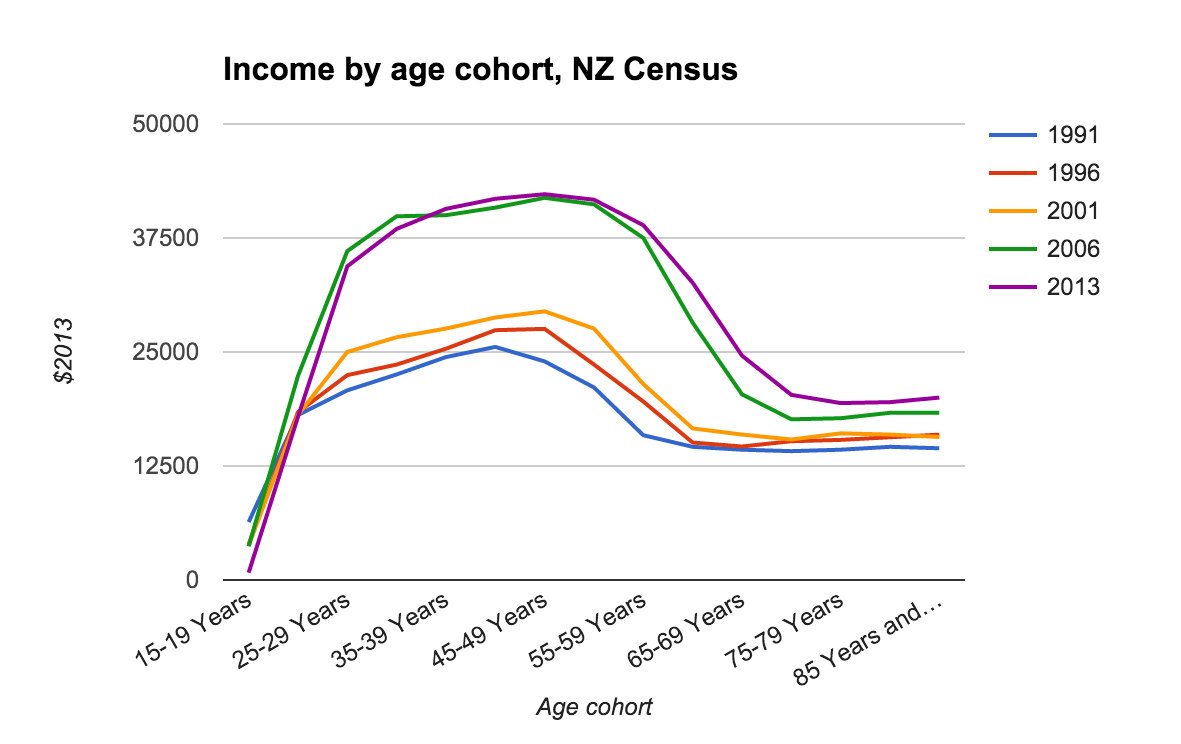

7. 'But it's different here' - In response, Eric Crampton from the NZ Initiative crunched the numbers on the New Zealand income data to point out it's a different picture in New Zealand, although he rightly points out the specific issue of housing costs does make life more difficult for the millenials. The chart also shows the gap betwen the old and young did actually widen a bit between 2006 and 2013.

New Zealand isn't doing too badly compared to the international experience. But the international experience isn't good. And New Zealand has a bad habit of just assuming that whatever's reported in the Guardian about the US or UK is also true here. Youths locked out of housing by the Auckland gerontocracy could be excused for not noticing their very real growth in real incomes as compared to the 1990s; it's all being eaten up by housing costs.

My worry is that imported narratives of stagnant wages (again, note the substantial increases 2013-2015 in NZ Income Survey data, contrary to the international experience) fuel demand for bad policy. The narratives are appealing here because it is easy to think back to the houses your parents could afford, and conclude you're worse off. But adults in their early thirties have real median incomes more than $16,000 higher than they had in 1991.

It's a problem with housing.

8. China's Tobin Tax - Capitalism with Chinese characteristics cannot be ignored, so China's decision to at least draft a Tobin Tax on currency transactions is a fascinating and big thing.

Here's Bloomberg on the topic:

Obscured in the conversation is how the move shows again that the world’s No. 2 economy isn’t content with acceding to a global financial system crafted by No. 1.

No major economy has implemented a Tobin tax, a move that backers say would curb currency speculation that distorts exchange-rate values. The rules still need central government approval and it’s not clear how quickly they can be implemented, according to people familiar with the matter. The initial levy would be kept at zero to allow authorities time to refine the rules, and it wouldn’t be designed to disrupt hedging and other foreign-exchange transactions undertaken by companies, they said.

One hope: a Tobin tax could help curb an outflow of funds from China that last year reached a record $1 trillion. The idea follows China’s use of its leadership of the Group of 20 to examine proposals that would reduce the dollar’s dominance. Other evidence of China’s desire to revamp global financial architecture has been seen in its launch of development banks to rival established lenders such as the World Bank.

"There’s a growing sense that China is leading the thinking in terms of questioning the value of unsettled capital flows," said Tim Condon, head of Asian research at ING Groep NV in Singapore. "Some kinds of flows probably need to be restricted. I don’t think China will be the only one."

9. Totally John Oliver on the issue of encryption - Topical in the wake of proposals for a big security shake-up planned for New Zealand.

10. Totally Clarke and Dawe on an Australian election in July. - 'If you wait long enough everything will go away.'

15 Comments

#1and#2. Helicopter and injecting money. The taxpayer doesn't have to be a player, it could just be a referee and achieve the same much more sensibly.

Why not break the power of the big corps and give good prices to people. All of us. Rich, poor and businesses. I'm talking energy, banks, communications, building materials (not excluding government services a local govtment who current have their foot on our throats.

Imagine what the extra cash and spending power in people's pockets could do for them and the nation.

One calculation I saw said banks took out of New Zealand $25 each week for each person.

So for the single mum with two kids that's $75 per week. Magic for them and magic business activity if that was retained.

For small business a huge boon, and lots more cash in the economy. Round and round.

Bit sad for the monopolies tho.

like everything our banks were sold overseas and now the profits flow offshore.

why does that surprise anyone yet we keep selling and scratching our heads ten years down the track with lack of foresight.

been going on for decades and will keep happening especially with the TPPA where they don't need OIO approval

The inequality stuff is chilling; puts the shape on the train wreck that is coming. The question is, is it too late to do anything to stop it? The power players, the wealthy, politicians, multi-national conglomerates may resist, but they have the most to lose in any re-adjustment.

Helicopter money just finds it way to the top eventually, there needs to be regulation to stop the greed fleecing the rest as well.

I can't see putting a one off payment of $1000 in everybody's bank account will achieve anything - that was tried in Australia with little effect - BUT if a weekly payment of $100.00 was put in everybody's account for say 5 years that would make a real difference to the economy.

I went to a talk by Joseph Stiglitz a few years ago. He said that the research showed that the $1,000 payment to everyone in Australia was one of the most effective actions taken post GFC.

Re #7. Something doesn't smell right.

That graph looks mighty dodgy, it shows the average (or is it median) income for the working age 25 to 60 year cohort rising from about 27K to about 43k in the 5 years from 2001 to 2006.Extraordinary ! That is over 10% per year and, supposedly, in constant (2013) dollars. Can we please have a link to the source of this data.

I had a quick look at the income figures in NZ Stat. It reports weekly median and average incomes. The working age average weekly income in 2001 was $467 (roughly 24K/yr) and rose to $583 in 2005 (roughly $30k). Medians were $352 and $452 for the same years.

Unfortunately this includes 15-25 year olds and 60+ as well so isn't directly comparable, and I couldn't figure out a simple way to just get one set for 25-60 year olds, so the graph might be close.

Inequality - would have liked to see a bit more on the "But will they start voting because of it" point.

If they don't vote then they should STFU.

#6 Does it really matter if they don't vote? Jesus Wept! Is this a symptom of overdosing on electioneering, or what? Is voting the only thing that actually matters?

#8. Tobin tax to deal with unsettled capital flows has merit.

(And here in China I can't access the link. I don't think China likes Bloomberg.

#2: Zed says that GST is great for big business but really bad for low income earners:

http://www.smh.com.au/federal-politics/political-news/gst-hike-to-hit-p…

Reduce or abolish GST (think of the reduction in compliance costs). Make the big corporates and those known to be avoiding it pay their taxes (Google; Apple; Facebook; Starbucks to name a few). To be sure to be sure to be sure...

At least those on higher incomes find it harder to avoid GST than income tax. Abolish GST? Not likely!

Restructure and balance is all that is needed for a fairer system where it is to no benefit that profits are shifted offshore, this can be done by tax on income as it is collected rather than profit after losses. Raise the tax free threshold on personal income to $50k, then 10% from there. Company tax reduced to whatever is suitable, maybe 15%. GST set @ 20% would have about the same net effect on most but means the company tax take is largely collected at time of purchase not after losses can be calculated, just like income tax. Then they may do as they please with their income. My guess is all the corporate boxes and other lifestyle providing writedowns will be much less appealing as they just come straight off the bottom line.

NZ Initiative does the werst charts. Are we supposed to believe that real income jumped $12,500 or 50% between 2001 and 2006. They are constantly churning out charts where the data has been tortured beyond recognition to produce a predifined result. Which is pretty cool, because obviously the morans who pay for their services are either promoting an agenda (which makes NZI an advertising agencey) or are the type of sheeple who blindly follow.

RSCoin doesn't seem much better than the status quo. Money can still be magic'd out of thin air by central banks.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.